Financial or Accounting Ratios is an important chapter for the syllabus of both RBI Grade B as well SEBI Grade A Exam. Therefore, we have come up with this free pdf for your basic understanding of Financial Ratios. Download the Free eBook from the link given below.

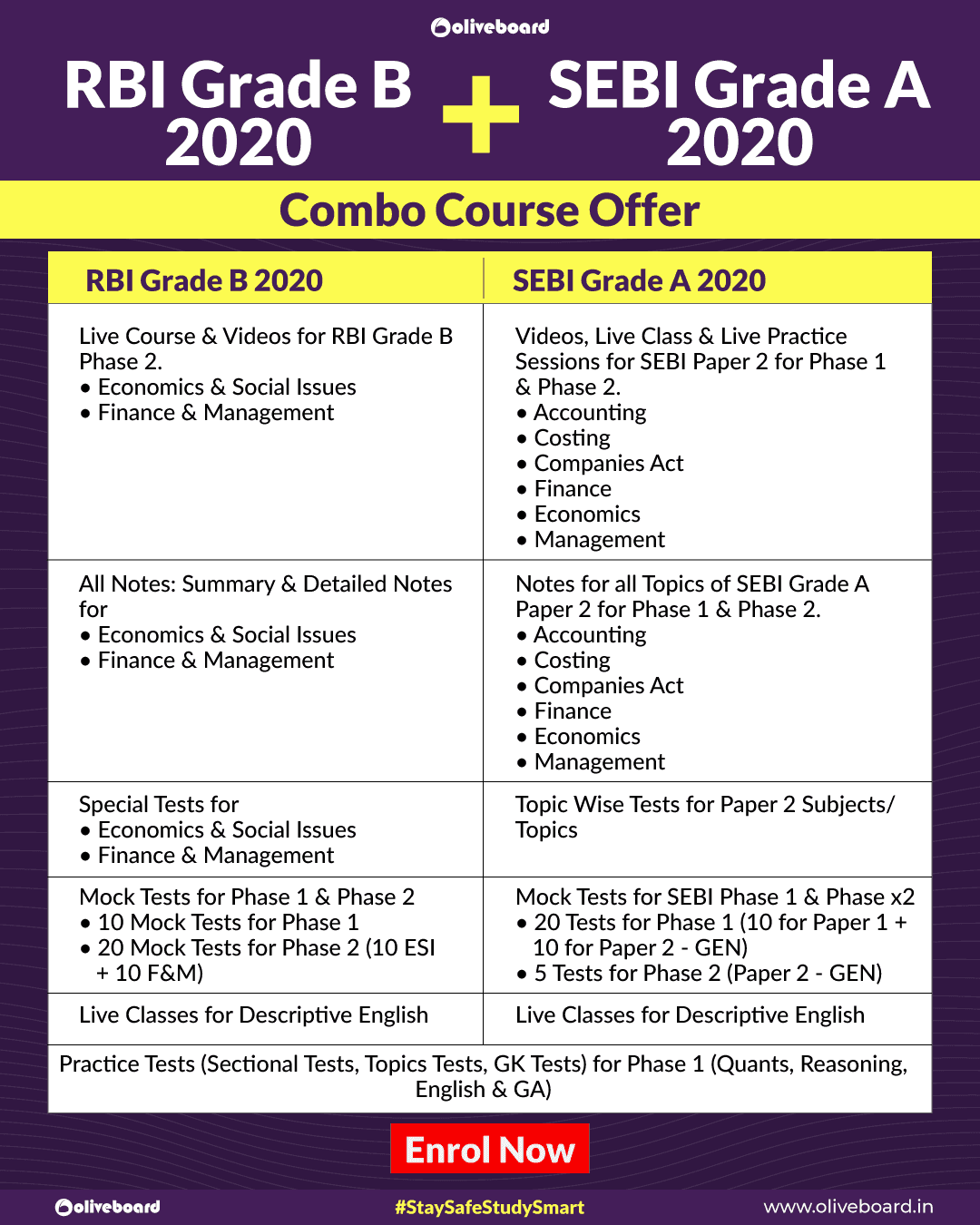

Have a look at the provisions of the Online Course 2020

Financial Ratios PDF Download – For RBI Grade B & SEBI Grade A

Financial Analyst’s world depends on financial statements for the performance of the companies but if one compares other entities alongside the size of the statements it poses a problem.

Then Financial or Accounting Ratios come to their rescue. The ratio is a mathematical relationship between two numbers.

Accounting Ratios can be divided into categories

- Liquidity Ratios

- Leverage Ratios

- Turnover Ratios

- Profitability Ratios

- Valuation Ratios

Enrol for SEBI Grade A 2020 Online Course Here

Steps to download the Free eBook:

a. Sign in or log in using the ‘Download’ button given above.

b. As you log in, click on the “SEBI Free Videos” tab.

c. Find the eBook and download it for free.

More eBooks:

- SEBI Grade A Officer Question Paper PDF

- Introduction to Costing

- Financial/Securities Markets

- Basics of Derivatives

- List of Sustainable Development Goals 2030

- Alternate Sources of Finance

Sample Questions:

Q.1 Liquidity ratios are expressed in

a. Pure ratio form

b. Percentage

c. Rate or time

d. None of the above

Answer: (a)

Q.2. Which of the following is not included in current assets?

a. Debtors

b. Stock

c. Cash at bank

d. Cash in hand

Answer: (b)

Q. 3. Quick ratio is 1.8:1, the current ratio is 2.7:1 and current liabilities are Rs 60,000. Determine the value of the stock.

a. Rs 54,000

b. Rs 60,000

c. Rs 1,62,000

d. None of the above

Solution:

Quick Ratio =Quick assets /Current liabilities

1.8 = Quick assets /Current liabilities

1.8 = Quick assets/60000

Quick assets = 60000*1.8

Current Ratio = Current Assets / Current Liabilities.

2.7= Current assets/60000

Current assets =60000*2.7

Quick Assets are current assets without inventories as inventories are least liquid in current assets.

Hence quick assets =Current assets – stock

Stock= Current assets-quick assets

Stock = 60000*2.7 – 60000*1.8

=60000*0.9= 54000

These ratios form the most important part of the syllabus of the Numericals in the phase 2 Exam and hence these need to be studied in totality and not each ratio as a separate entity. Try to find the relation between ratios as problems are often asked in a combination of ratios.

This is all from us. Let us look into the provisions of SEBI Grade A & RBI Grade B Courses.

SEBI Grade A Online Course

For your Complete Phase 1 and Phase 2 Preparations

SEBI Grade A Cracker is a course designed to cover all the subjects under Phase I and Phase II exams.

- For Paper 1 of Phase I exam all essential subjects like Quantitative Aptitude, Reasoning, and English will be covered through video lectures.

- For Paper 2 of both Phase 1 and Phase 2, the complete syllabus will be covered through video lessons, and notes.

- The course will also have strategy sessions and past year paper discussions.

- This course has been designed in such a way that it can be covered well before the examination.

Enrol for SEBI Grade A 2020 Online Course Here

1. Course Features

| Phase 1 | Phase 2 |

| Videos on Important Topics of Quantitative Aptitude, Reasoning, English (Paper 1) | Video Lessons + Notes for all the sections of Paper 2: |

| 10 Full-Length Mock Tests for Paper 1 | Commerce & Accountancy, Management, Finance, Costing, Companies Act, Economics |

| BOLT magazine covering the GA section for Paper 1 | Live Classes for Revision of the chapters and Guidance |

| 10 Full-Length Mock Tests for Paper 2 | Live Practice Sessions for all the components |

| Video Lessons + Notes for all the sections of Paper 2 | Live Classes for the Descriptive English (Paper 1) |

| Commerce & Accountancy, Management, Finance, Costing, Companies Act, Economics | 5 Full-Length Mock Tests for Paper 2 |

2. How to enrol for the SEBI Grade A Online Course 2020?

Step 1 – Login/Sign in SEBI Grade A Exam Page.

Step 2 – After your login/sign in, click on “Edge (Live Class) on the top left corner.

Step 3 – As you click you will be redirected to the page where you would find the SEBI Grade A Cracker Course 2020.

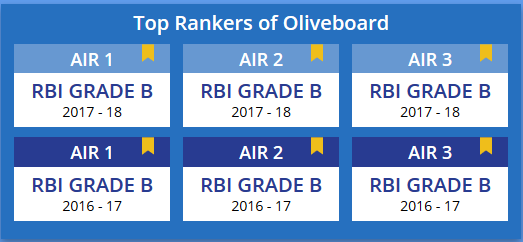

Study material for RBI Grade B 2020 by Oliveboard

Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

| Phase I | Phase II |

|

|

1.2. How to enrol for the RBI Grade B Online Course 2020?

Step 1 – Login/Sign in RBI Grade B Exam Page.

Step 2 – After your login/sign in, click on “Edge (Live Class) on the top left corner.

Step 3 – As you click you will be redirected to the page where you would find the RBI Grade B Cracker Course 2020.

Now that you are aware of the RBI Grade B Online Classes, why wait?

Subscribe & Join the RBI Grade B 2020 Online Coaching here.

I enjoy creating SEO-friendly, information-rich marketing content. Cooking is therapeutic! I like to cook and eat it too!

Oliveboard Live Courses & Mock Test Series