The Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) is a public charitable trust created by the Government of India. The PM CARES Fund was launched on 28th March 2020, at the height of the COVID-19 pandemic.

It was established to deal with emergencies, calamities, or distress situations, whether natural, man-made, or public health-related. The Fund provides quick and organized financial relief for disaster management, healthcare, research, and welfare activities.

The fund was set up after widespread public demand for a dedicated national relief fund during the pandemic. Its ability to accept even micro-donations makes it inclusive, allowing citizens from all walks of life to contribute.

Why was the PM CARES Fund Created?

The COVID-19 pandemic in 2020 highlighted the urgent need for a flexible, transparent, and responsive national relief fund. While the Prime Minister’s National Relief Fund (PMNRF) already existed, PM CARES was launched with specific objectives:

- To support healthcare infrastructure and research.

- To provide immediate financial aid in emergencies.

- To allow corporate social responsibility (CSR) contributions.

- To enable foreign donations for relief measures.

How is the PM CARES Fund Structured?

The PM CARES Fund is registered as a Public Charitable Trust under the Registration Act, 1908. The key features of this fund are as follows:

- Chairperson (Ex-officio): The Prime Minister of India.

- Trustees (Ex-officio): Minister of Defence, Minister of Home Affairs, and Minister of Finance.

- Nominated Trustees: The Prime Minister can appoint three eminent persons from fields such as health, science, law, social work, public administration, or philanthropy.

- Pro bono nature: All trustees serve in a voluntary, unpaid capacity.

- Administrative support: Provided by the Prime Minister’s Office (PMO).

What are the Objectives of the PM CARES Fund?

The objectives are broad yet focused on emergency assistance and long-term capacity building:

- Relief during emergencies

- Support healthcare infrastructure

- Fund research

- Provide financial aid

- Undertake related activities

How is the PM CARES Fund Financed?

The PM CARES Fund is unique because it does not rely on government budgetary support. Instead, it is entirely financed through voluntary contributions.

| Category | Details |

| Sources of Funding | – Individuals & organizations (India) – Corporate donations (CSR) – Foreign contributions (FCRA) – Small micro-donations |

| Tax & CSR Benefits | – 100% tax exemption under Section 80G (Income Tax Act, 1961) – Counted as CSR expenditure (Companies Act, 2013) |

Get ready to crack government job exams with leading educators

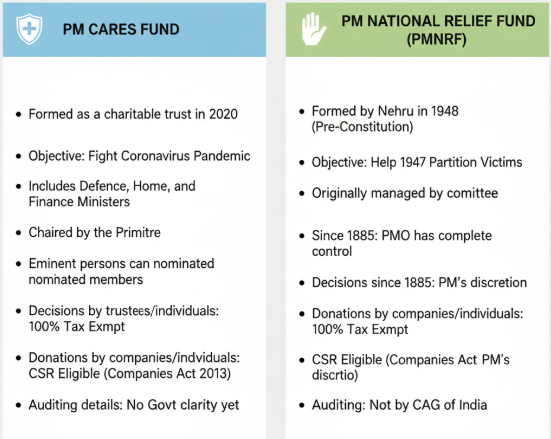

How does PM CARES Differ from the Prime Minister’s National Relief Fund (PMNRF)?

The PM CARES Fund is often compared with the PMNRF, created in 1948. While both serve similar purposes, there are key differences:

| Feature | PM CARES Fund | PMNRF |

| Establishment | March 28, 2020 (COVID-19 pandemic) | 1948 (Partition refugee crisis) |

| Audit | Independent auditor chosen by trustees | Comptroller and Auditor General (CAG) |

| Transparency | Not covered under RTI | Audited and monitored by CAG |

| Foreign Donations | Allowed (FCRA exemption granted) | Allowed since 2011 |

| Purpose | Any emergency or calamity, including health crises | Natural disasters, medical treatments, etc. |

What is the PM CARES for Children Scheme?

On 29th May 2021, the government launched the PM CARES for Children Scheme to support children orphaned during the COVID-19 pandemic.

| Benefit | Details |

| Financial Corpus | Rs. 10 lakh corpus for each child at age 23. |

| Monthly Stipend | Monthly stipend provided from age 18 to 23. |

| Health Insurance | Rs. 5 lakh coverage under Ayushman Bharat till age 18. |

| Education Support | – Schooling through Kendriya Vidyalayas or private schools – Scholarships and loans for higher education |

| Total Beneficiaries | Around 1.47 lakh children (orphans, abandoned, or those who lost one/both parents to COVID-19). |

What is the Legal Framework of PM CARES?

The PM CARES Fund operates as a public charitable trust. Its trust deed was registered under the Registration Act, 1908, on 27th March 2020.

It is not established under the Constitution of India or a specific parliamentary law, which has raised legal and transparency-related questions. Nevertheless, its registration gives it full legal recognition as a charitable trust.

What are the Issues and Criticisms of PM CARES Fund?

Despite its noble objectives, the PM CARES Fund has faced criticism from opposition parties, civil society groups, and analysts.

- Need for a new fund: Critics question why PM CARES was created when PMNRF already exists.

- Transparency: Since the Fund is not under the RTI Act or audited by CAG, accountability is questioned.

- Use of official symbols: Critics argue about the use of “Prime Minister,” the emblem, and the gov.in domain for a non-statutory trust.

- Foreign donations: The acceptance of international contributions contradicts past government stances.

- Audit independence: The auditor is appointed by trustees, not by a constitutional body.

How can Donations Be Made to PM CARES?

Domestic and international donations are accepted through:

- Online banking portals (SBI and others).

- Credit/debit cards, UPI, and net banking.

- NEFT/RTGS transfers.

- Cheques/demand drafts sent to the PMO.

- Dedicated websites: pmcares.gov.in and pmindia.gov.in.

No transaction charges are levied by the Fund itself, though banks may charge service fees.

Key Takeaway

| Aspect | Details |

| Full Form | Prime Minister’s Citizen Assistance and Relief in Emergency Situations |

| Established | 28th March 2020 |

| Legal Status | Public Charitable Trust (Registered under Registration Act, 1908) |

| Chairperson | Prime Minister of India |

| Trustees | Defence, Home Affairs, Finance Ministers (ex-officio) |

| Funding Sources | Voluntary contributions, CSR, foreign donations |

| Tax Benefits | 100% exemption under Section 80G, CSR eligibility |

| Auditing | Independent auditor (not CAG) |

| Key Scheme | PM CARES for Children (2021) |

| Controversies | Transparency, RTI exclusion, duplication with PMNRF |

Also Read:

Multiple Choice Questions Based on PM CARES Fund

Q1. When was the PM CARES Fund established?

a) January 2020

b) March 28, 2020

c) April 1, 2021

d) August 2019

e) March 27, 2020

Correct Answer: b) March 28, 2020

Q2. Under which Act was the PM CARES Fund registered?

a) Indian Trusts Act, 1882

b) Companies Act, 2013

c) Registration Act, 1908

d) Income Tax Act, 1961

e) Charitable Trust Act, 1920

Correct Answer: c) Registration Act, 1908

Q3. Who is the ex-officio Chairman of the PM CARES Fund?

a) President of India

b) Prime Minister of India

c) Finance Minister

d) Home Minister

e) Vice President of India

Correct Answer: b) Prime Minister of India

Q4. Which ministers are ex-officio trustees of the PM CARES Fund?

a) Finance, Defence, Education

b) Defence, Home Affairs, Finance

c) Home Affairs, Railways, Health

d) Defence, External Affairs, Finance

e) None of the above

Correct Answer: b) Defence, Home Affairs, Finance

Q5. Which of the following benefits do PM CARES donors get?

a) 50% tax exemption under Section 80G

b) 100% tax exemption under Section 80G

c) No tax exemption

d) Tax exemption under GST Act

e) Exemption only for corporates

Correct Answer: b) 100% tax exemption under Section 80G

Q6. Which scheme under PM CARES supports children orphaned by COVID-19?

a) Bal Swaraj Scheme

b) PM CARES for Children Scheme

c) Ayushman Bharat Yuva

d) PM Jan Kalyan Scheme

e) PM Vikas Yojana

Correct Answer: b) PM CARES for Children Scheme

Q7. How much corpus is given to each child under PM CARES for Children?

a) Rs. 5 lakh

b) Rs. 7 lakh

c) Rs. 10 lakh

d) Rs. 15 lakh

e) Rs. 20 lakh

Correct Answer: c) Rs. 10 lakh

Q8. Which of the following funds existed before PM CARES?

a) PMNRF

b) CM Relief Fund

c) NDRF

d) All of the above

e) None

Correct Answer: d) All of the above

Q9. Who audits the PM CARES Fund?

a) CAG of India

b) Parliament’s Public Accounts Committee

c) Independent auditor appointed by trustees

d) RBI

e) Ministry of Finance

Correct Answer: c) Independent auditor appointed by trustees

Q10. Which of the following is NOT a criticism of PM CARES Fund?

a) Not under RTI Act

b) Not audited by CAG

c) Cannot accept foreign donations

d) Duplication of PMNRF

e) Transparency concerns

Correct Answer: c) Cannot accept foreign donations

- How Some Aspirants Clear Multiple Government Exams: Strategy, Discipline & Exam Psychology

- Crop Diversification Program, Transforming Indian Agriculture

- Government Schemes for NABARD Grade A 2026

- National Dairy Plan Phase 1 and Phase 2, Boosting India’s Dairy Sector

- Mera Gaon Mera Gaurav Scheme, Bridging Lab to Land

- Farmers First Initiative, Empowering Farmers Through Innovation

Hi, I’m Aditi. I work as a Content Writer at Oliveboard, where I have been simplifying exam-related content for the past 4 years. I create clear and easy-to-understand guides for JAIIB, CAIIB, and UGC exams. My work includes breaking down notifications, admit cards, and exam updates, as well as preparing study plans and subject-wise strategies.

My goal is to support working professionals in managing their exam preparation alongside a full-time job and to help them achieve career growth.