Karnataka Bank PO Expected Interview Questions 2025: The Karnataka Bank PO Interview stands between you and you becoming a Karnataka bank PO at this point. Don’t let anything get in the way of your success; certainly, the interview process is a little unsettling, but that shouldn’t bother you. Expected Karnataka Bank PO Interview Questions are provided to you as a confidence booster in this blog.

Karnataka Bank PO Expected Interview Questions 2025

You can expect banking related questions in your Karnataka bank PO interview, unlike any other bank interview. Here are some topics and possible questions about banking so that you can be prepared for the Karnataka bank PO interview. Before diving into banking questions, Do you know anything about the bank you want to work for?

1. What is 1st Quarter Report of Karnataka Bank?

- Net Profit: The bank reported a net profit of ₹400.33 crore for Q1 FY25, marking an 8% year-on-year (YoY) increase from ₹370.70 crore in the same quarter of the previous fiscal year.

- Operating Profit: The operating profit stood at ₹558.59 crore, compared to ₹601 crore in Q1 FY24. This decline is attributed to a 19% increase in expenses against a 12% rise in total income.

- Net Interest Income (NII): NII increased by 10.89% YoY to ₹903.36 crore, up from ₹814.68 crore in Q1 FY24.

- Gross Non-Performing Assets (GNPAs): GNPAs declined to 3.21% in Q1 FY25 from 3.54% in the previous quarter, indicating an improvement in asset quality.

- Net NPAs: Net NPAs decreased to 1.46% at the end of Q1 FY25 from 1.66% in the previous quarter, reflecting better credit management.

2. What do you know about Karnataka Bank?

- Leadership-

- Chairman: Mr. Pradeep Kumar Panja continues to serve as the Non-Executive Part-Time Chairman of Karnataka Bank.

- CEO: Mr. Mahabaleshwara M. S. serves as the Managing Director & CEO of the bank.

- Foundation: Established on 18 February 1924, Karnataka Bank has a long-standing history in the Indian banking sector.

- Headquarters: The bank is headquartered in Mangaluru, Karnataka.

- Recent Initiatives and Achievements:

- In December 2024, Karnataka Bank launched a Retail Assets Centre aimed at expanding its retail assets business and delivering an enhanced customer experience.

- The bank introduced the ‘KBL Peak Education Loan’ and ‘KBL Genius’ integrated savings account to empower students with innovative financial solutions.

- Karnataka Bank partnered with FISDOM to enhance its digital offerings, reflecting its commitment to adopting fintech solutions.

- The bank has been recognized for its technological advancements, winning the Indian Banks’ Association (IBA) Technology Award.

- Tagline: Karnataka Bank operates under the tagline ‘Your Family Bank Across India,’ emphasizing its commitment to serving families nationwide.

3. What is a Bank?

Ans- As per section 5(b) of Banking Regulation Act, 1949

- “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise

- Bank is a financial organization which accepts deposits and provides loans.

4. How does Banks Generate Profit?

Ans- Deposits of Customers with the bank are assets of the customer and liability of the bank. Loans borrowed by the customer from the bank are the assets of the Bank and the liability of the customer.

Other Banking Related Questions

- What is CRR, SLR, Repo Rate, Reverse Repo Rate, Bank Rate, NPA etc.(other banking related terms)?

- What are the reasons for rising inflation in India?

- What do you know about Share market?

- What is fintech?

- What is e-commerce?

- Is bank-merger a good option?

- What do you understand about NPA?

- How does a bank generate revenue?

- What is the difference between CRR and SLR?

- What is NABARD?

- What are scheduled banks?

- What is the difference between Inflation and Deflation?

- What do you mean by FDI?

- Tell us some current events at the international level?

- Can you name ASEAN countries?

- What is the difference between REPO and reverse REPO?

- What do you mean by CTS?

- What is known as MICR?

- What do you mean by KYC and what are the documents considered for the purpose of address proof and identity proof as per KYC?

- What are the eligibility conditions for a minor opening a bank account?

What questions to expect in the Karnataka Bank PO Interview ?

Preparing for a banking interview requires a comprehensive understanding of both your personal qualifications and the banking industry. Below are key areas to focus on, along with strategies to effectively address common interview questions:

1. Discussing Your Current Role

If you’re presently employed, anticipate inquiries about your current job responsibilities. Clearly articulate your role, emphasizing tasks that align with the banking position you’re applying for. Highlight relevant skills and achievements that demonstrate your suitability for the new role.

2. Explaining Your Interest in the Banking Industry

Be prepared to answer why you’re pursuing a career in banking. Convey a genuine interest in the sector, discussing aspects such as its dynamic nature, opportunities for growth, and your passion for financial services. Avoid suggesting that the position is a fallback option; instead, express enthusiasm for the contributions you can make.

3. Staying Informed About Current Affairs

Given the banking sector’s close ties to economic and global events, interviewers often assess your awareness of current affairs. Regularly read reputable newspapers and financial publications to stay updated. Before the interview, review recent developments in the banking industry to demonstrate your informed perspective.

4. Understanding Basic Banking and Financial Concepts

Expect questions testing your knowledge of fundamental banking principles. Familiarize yourself with topics like interest rates, financial regulations, and banking products. If uncertain about a question during the interview, it’s acceptable to acknowledge this politely, indicating your willingness to learn.

5. Reflecting on Your Educational Background

For recent graduates, interviewers may explore subjects related to your academic studies. Review key topics from your coursework, especially those pertinent to banking, to showcase your foundational knowledge and its applicability to the role.

6. Knowing Your Personal History

Be ready to discuss your place of birth and the various locations you’ve lived. Understanding the cultural and economic aspects of these areas can provide context to your experiences and demonstrate your awareness of different markets.

7. Discussing Hobbies and Interests

Interviewers might inquire about your hobbies to gauge your personality and cultural fit. Ensure that any interests listed on your resume are genuine, as you may be asked to elaborate on them. Authenticity in your responses helps build rapport and credibility.

Topics to Cover – Karnataka Bank PO Interview

Karnataka Bank PO Interview Questions: It is essential for bankers to be aware of banking awareness topics since these topics will definitely be asked at the interview. You can check a few important banking awareness topics below.

| Guidelines on Regulation of Payment Aggregators and Payment Gateways | Restriction on Storage of Actual Card Data: Tokenization |

| RBI Innovation Hub | National Bank for Financing Infrastructure and development |

| NARCL | IDRCL |

| Importance of CASA | Monetary Policy Rates |

| Privatization | CPI and WPI |

| Profit of Banks Bank NBFC difference | Payment Systems AIFI |

| NPA | Cheques |

| Financial Markets |

Karnataka Bank PO Expected Interview Questions 2025 – Current Affairs

As you prepare for the Karnataka Bank PO Interview for the fiscal year 2024-25, it’s essential to stay informed about current global and national developments impacting the banking sector. Interviewers may inquire about these issues to assess your awareness and analytical skills. Key topics to focus on include:

1. Global Economic Trends

- Geopolitical Tensions: Ongoing conflicts, such as the situation in Ukraine, continue to influence global markets and economic stability. Understanding these dynamics is essential.

- Inflation and Monetary Policies: Global inflation is projected to decline steadily, from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025. Central banks’ policy adjustments to combat inflation significantly impact economic activity.

- Economic Growth Projections: The global economy is expected to grow by 2.7% in 2024, indicating a stable yet modest expansion.

2. Indian Economic Outlook

- Robust Growth: India’s economy is set to grow at 6.6% in 2025, maintaining its position as a major driver of global growth.

- Fiscal Deficit: A projected decline in fiscal deficit from 6.4% to 5.9% of GDP in FY24 will stabilize public debt at around 83% of GDP—a promising indicator of fiscal health.

3. Indian Banking Sector Developments

- Asset Quality Concerns: Indian private banks are experiencing rising bad loans, particularly in personal loans and micro-credit sectors, signaling potential stress in asset quality. The Reserve Bank of India forecasts an increase in the gross Non-Performing Assets (NPA) ratio to 3% by March 2026 from 2.6% in September 2024.

- Technological Advancements: The banking sector is embracing trends like Generative AI, Open Banking, and Banking-as-a-Service (BaaS) to enhance customer experience and operational efficiency.

4. Socio-Economic Issues

- Healthcare Tax Exemptions: Biocon Ltd has urged the Indian government to exempt cancer and rare-disease drugs from taxes in the upcoming budget to alleviate patient expenses.

- Infrastructure Development: India plans to prioritize spending on railway modernization in its upcoming federal budget, shifting focus from road transport to enhance connectivity and economic growth.

Karnataka Bank PO Expected Interview Questions 2025 – Banking Topics

Preparing for the Karnataka Bank PO Interview requires a solid understanding of key banking concepts and current developments in the financial sector. Below is an updated list of important topics to review:

1. Banks and Non-Banking Financial Companies (NBFCs):

- Role of DICGC: Understand the Deposit Insurance and Credit Guarantee Corporation’s function in insuring deposits.

- Types of Banks: Familiarize yourself with various banks, including commercial, cooperative, and regional rural banks.

2. Types of Bank Accounts:

- Basic Accounts: Savings, current, and fixed deposit accounts.

- Advanced Accounts: Recurring deposits, demat accounts, and NRI accounts.

3. Types of Banking Services:

- Retail Banking: Services offered to individual customers.

- Corporate Banking: Services tailored for businesses and corporations.

- Digital Banking: Online and mobile banking services.

4. Collateral and Types of ATMs:

- Collateral: Assets pledged by a borrower to secure a loan.

- Types of ATMs: On-site, off-site, white-label, and brown-label ATMs.

5. Negotiable Instruments and Types of Cheques:

- Negotiable Instruments: Documents guaranteeing the payment of a specific amount, such as promissory notes, bills of exchange, and cheques.

- Types of Cheques: Bearer, order, crossed, and electronic cheques.

6. Payment Systems:

- NEFT (National Electronic Funds Transfer): A nationwide payment system facilitating one-to-one funds transfer.

- RTGS (Real-Time Gross Settlement): Continuous and real-time settlement of fund transfers.

- IMPS (Immediate Payment Service): Instant interbank electronic fund transfer service.

- UPI (Unified Payments Interface): A system that powers multiple bank accounts into a single mobile application.

- USSD (Unstructured Supplementary Service Data): A banking service that works without internet connectivity.

7. Inflation:

- Causes: Demand-pull, cost-push, and built-in inflation.

- Types: Creeping, walking, galloping, and hyperinflation.

8. Reserve Bank of India (RBI):

- History and Functions: The central bank’s role in monetary policy, currency issuance, and regulation of financial institutions.

- Monetary Policy Committee (MPC): The body responsible for setting interest rates to control inflation.

- Priority Sector Lending (PSL): Mandated lending to specific sectors like agriculture and small-scale industries.

9. Non-Performing Assets (NPAs):

- Explanation: Loans or advances where the principal or interest payment remains overdue for a period of 90 days.

- Categories: Substandard, doubtful, and loss assets.

10. Recent Updates in the Banking Sector:

- Technological Advancements: Adoption of artificial intelligence, blockchain, and fintech collaborations.

- Regulatory Changes: New guidelines from RBI and other regulatory bodies.

- Economic Developments: Impact of global events on the Indian banking sector.

Thoroughly understanding these topics will help you confidently address questions during your interview and demonstrate your preparedness for a role in the banking sector.

- Karnataka Bank PO Interview Candidate Experience, Check here

- Karnataka Bank PO Expected Interview Questions 2025

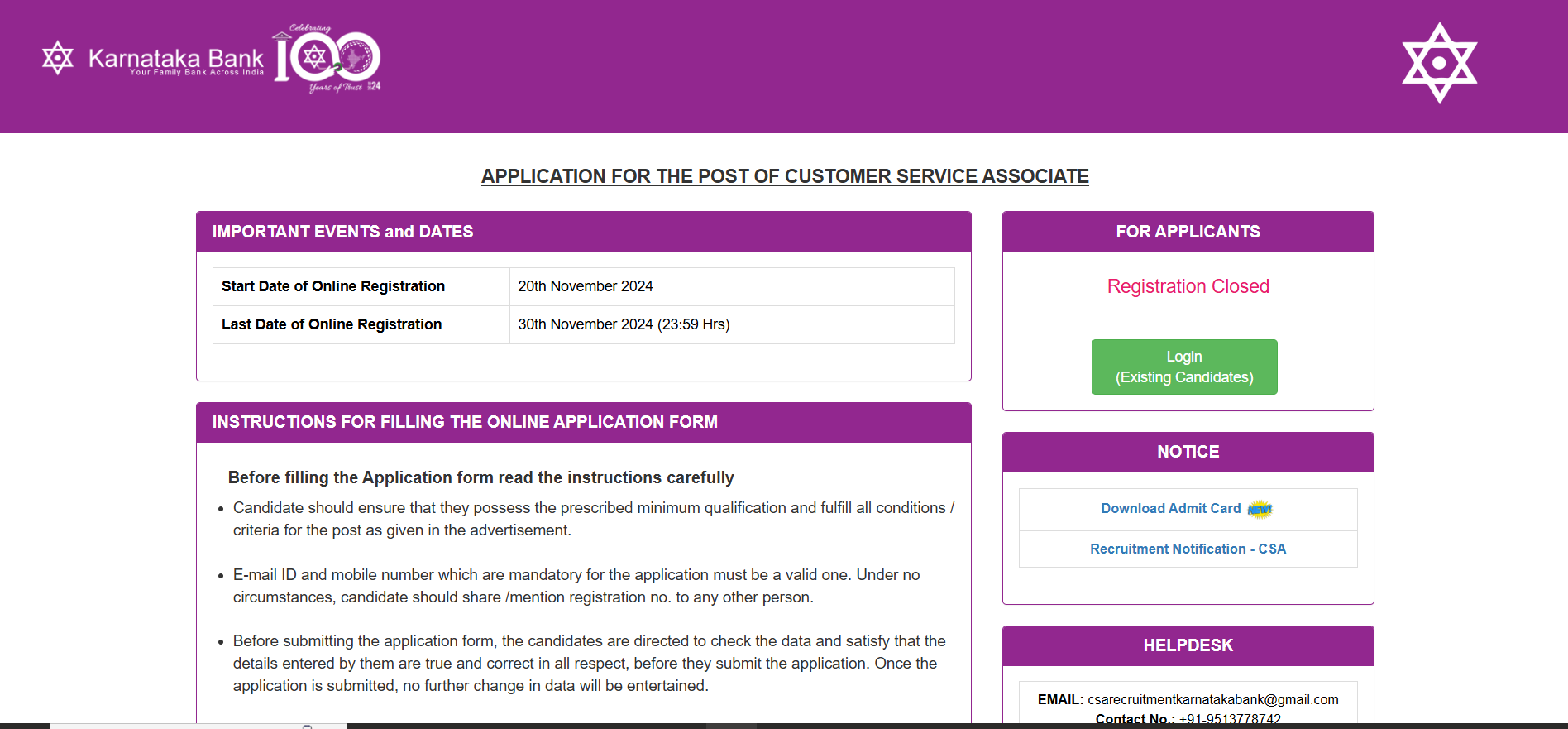

- Karnataka Bank Clerk CSA 2024, Exam Date, Admit Card Link

- Karnataka Bank Clerk Admit Card 2024 Out, CSA Call Letter Link

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.