Departure of Karnam Sekar

Karnam Sekar, the Chairman of the National Asset Reconstruction Company of India (NARCL), has stepped down from his position due to disagreements over the institution’s structure and operations. This decision comes in the wake of a proposal to merge NARCL with the India Debt Resolution Company Ltd (IDRCL), which has ignited a debate about the most suitable arrangement for these financial entities.

The Origins of the Merger Idea

The merger proposal between NARCL and IDRCL was initiated by IDRCL, led by Diwakar Gupta, former Managing Director of the State Bank of India. This proposal, presented to the Finance Ministry, aimed to capitalize on business opportunities and reduce costs through consolidation.

Currently, NARCL acts as the ‘principal entity,’ responsible for acquiring and aggregating bad loan accounts from banks, while IDRCL operates as a resolution agent, focusing on the loan resolution process. The merger could potentially redefine these roles, prompting discussions and concerns about the optimal structure for these entities.

National Asset Reconstruction Company of India (NARCL)

NARCL is registered with the Reserve Bank of India as an Asset Reconstruction Company under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. Its primary goal is to address and resolve stressed loan assets exceeding ₹500 crore each, with a total value of approximately ₹2 lakh crore.

Understanding the Concept of a Bad Bank

A ‘bad bank’ is a financial institution established with the purpose of acquiring Non-Performing Assets (NPAs) or Bad Loans from banks. Its primary objective is to relieve banks of the burden of bad loans, allowing them to resume lending to customers without hindrance. After acquiring a bad loan, the bad bank may attempt to restructure and market the NPA to potential investors interested in its acquisition.

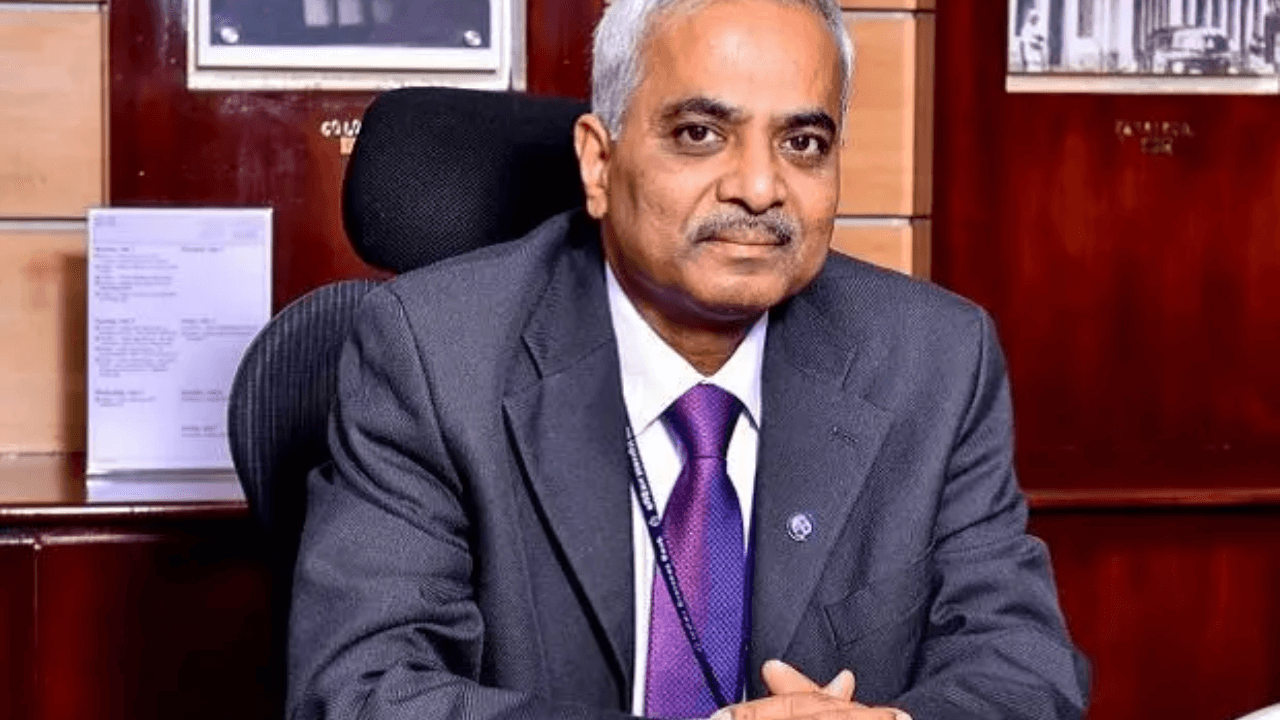

Karnam Sekar: Accomplished Banking Professional

Karnam Sekar’s resignation represents a significant development in the ongoing discussions surrounding the merger proposal between NARCL and IDRCL. Sekar, an accomplished banking professional, began his career as a Probationary Officer with State Bank of India in 1983. Over the years, he held various senior roles in the Indian banking sector, culminating in his appointment as Deputy Managing Director. From 2018 to 2019, he served as the Managing Director of Dena Bank, followed by his role as the Managing Director of Indian Overseas Bank from 2019 to 2020.