3 January Current Affairs 2024

3 January Current Affairs 2024 refers to the latest news and events happening worldwide and are relevant to our daily lives. Staying updated with the 3 January Current Affairs 2024 is essential for students who are preparing for exams, especially competitive exams, as it forms an important part of the syllabus. The importance of the 3 January Current Affairs 2024 lies in its ability to help students enhance their general knowledge, improve their reading and comprehension skills, and develop their critical thinking abilities.

3 January Current Affairs 2024 also provides students with insights into issues such as politics, economics, and social issues that are important for their overall development as informed citizens. Regularly reading and analyzing the 3 January Current Affairs 2024 not only helps students ace their exams but also prepares them for their future roles as responsible and well-informed citizens of society.

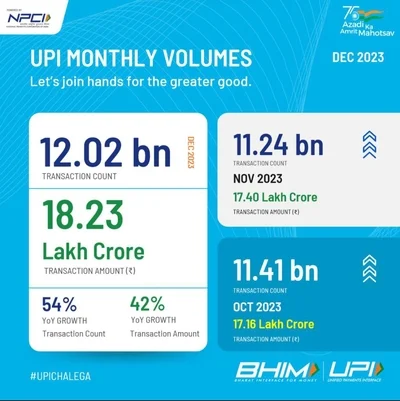

UPI transactions hit a new record with ₹18.23 lakh crore in Dec; 54% higher

The volume of UPI (Unified Payments Interface) transactions continues to rise month after month as the total monthly transaction amount touched ₹18.23 lakh crore in Dec last year, 54 percent higher than the corresponding data of 2022.

In terms of the number of transactions, the figure reached 12.02 billion, witnessing 42 percent higher than the previous year’s figure.

HDFC Bank goes live with NPCI-developed UPI in the secondary market platform

HDFC Bank has executed transactions via the NPCI’s UPI payments app as part of the ‘UPI for secondary market’ facility, which went live.

The move follows markets regulator Sebi allowing the facility through the UPI app developed by the National Payment Corporation of India (NPCI).

UPI transactions cross the 100-billion mark in 2023

Transactions through the unified payments interface (UPI) platform crossed the 100 billion mark in the calendar year 2023 to close at around 118 billion, as per the data shared by the National Payments Corporation of India (NPCI).

This marks a 60 percent growth as compared to 74 billion UPI transactions recorded in 2022.

Visa, the world’s largest card network, processes an average of 750 mn. transactions/day.

RBI proposes banks with less than 6% net NPAs to declare dividends

The Reserve Bank of India proposed allowing banks having a net non-performing assets (NPAs) ratio of less than 6% to declare dividends.

As per the prevailing norms last updated in 2005, banks need to have an NNPA ratio of up to 7% to become eligible for the declaration of dividends.

RBI has proposed that the new guidelines should come into effect from FY25 onwards.

Reserve Bank of India cancels the license of The Faiz Mercantile Cooperative Bank Ltd., Nashik, Maharashtra

The Reserve Bank of India (RBI), canceled the license of “The Faiz Mercantile Cooperative Bank Ltd., Nashik, Maharashtra.

The bank does not have adequate capital and earning prospects. As such, it does not comply with the provisions of Section 11(1) and Section 22 (3) (d) read with Section 56 of the Banking Regulation Act, 1949.

RBI enhances bulk deposit limit for large UCBs 6.66 times to ₹1 cr and above

The Reserve Bank of India (RBI) has decided to enhance the bulk deposit limit for large urban co-operative banks (UCBs) to ₹1 crore and above from the current ₹15 lakh and above.

Specifically, the new bulk deposit limit applies to UCBs in Tier 3 (with deposits more than ₹1,000 crores and up to ₹10,000 crores) and Tier 4 (with deposits more than ₹10,000 crores) categories.

Australian batter David Warner announces retirement from One Day International cricket

Australian batter David Warner has announced his retirement from One Day Internationals (ODIs). The 2 time ODI World Cup Winner had previously announced that he would be ending his Test career after Australia’s upcoming Test against Pakistan in Sydney. However, the opener has said that he will keep himself available for selection in the Champions Trophy in 2025.

37 more products brought under the Simplified Certification Scheme

The Telecommunication Engineering Centre TEC of the Department of Telecommunications DoT has brought 37 more products under the Simplified Certification Scheme SCS.

These products include media gateway, IP security equipment, IP terminals, optical fiber or cable, transmission terminal equipment, etc. With this, the total products under SCS have now gone up to 49 from 12.

Chaudhary Charan Singh Haryana Agricultural University’s Vice Chancellor Prof B R Kamboj honoured with the M S Swaminathan Award

Chaudhary Charan Singh Haryana Agricultural University’s Vice Chancellor Prof. B.R. Kamboj has been honoured with the prestigious M.S. Swaminathan Award in recognition of his contributions as a scientist and extension specialist in the field of agronomy. Thawar Chand Gehlot, the Governor of Karnataka, presented him with this award.

CCI approves the acquisition of 100% shareholding of GVK Power (Goindwal Sahib) Limited by Punjab State Power Corporation Ltd.

The Competition Commission of India (CCI) has approved the proposed acquisition of 100% shareholding of GVK Power (Goindwal Sahib) Limited by Punjab State Power Corporation Ltd. The PSPCL, a fully owned entity of the Punjab government, is set to acquire 100% shareholding of the power generation company.

India Ratings revises PNB Housing Finance NCD ratings from AA to AA+

PNB Housing Finance, a housing finance company, said that India Ratings and Research (Ind-Ra) has upgraded the rating of the company’s non-convertible debentures (NCDs) to ‘IND AA+’ from ‘IND AA’ with a stable outlook. Further, Ind-Ra said that the NCDs limit has been split into bank loans and NCDs, and an ‘IND AA+’ rating has been assigned to the bank loans.

J&K becomes first UT to implement PM Vishwakarma Yojana

Jammu and Kashmir has become the first Union Territory (UT) to implement the PM Vishwakarma Yojana (PMVY), an initiative that aims to empower and enhance the skills of the craftsman community, officials said. The inauguration of the training program for the first batch of 30 trainees (Viswakarmas) in ‘Darzi Craft’ was virtually conducted.

- SSC CGL Full Form, All You Need to Know About SSC CGL

- SBI CBO Admit Card 2025 Out, Exam Date 20th July

- SSC CHSL 2025 Vacancies Released for 3131 Posts, Complete Details

- SSC JE Vacancies 2025, Check Post Wise Vacancy List

- Important Percentage Questions for SSC Exam Preparation, Solved

- SSC CGL Application Correction Form Starts from 9th to 11th July

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.