The Primary Market is the foundation of the capital market where new securities are issued and sold to investors for the very first time. It acts as a direct channel between issuers (companies or governments) and investors, enabling organisations to raise funds for growth, expansion, or debt repayment. Unlike the secondary market, where existing securities are traded among investors, the primary market ensures fresh capital enters the financial system.

What is Primary Market?

The primary market (or new issue market) is the first place an issuer company or government offers securities to raise fresh capital. In this market the issuer receives the proceeds directly; investors buy from the issuer, not from other investors. A typical example is an Initial Public Offering (IPO), where a private company sells shares to the public for the first time. The key participants of Primary Markets are:

- Issuer: Company or government issuing securities.

- Investors: Retail investors, institutional investors (mutual funds, insurance companies), and high-net-worth individuals.

- Intermediaries: Merchant bankers/lead managers, underwriters, registrars, brokers, and SEBI (regulator).

If you are preparing for the LIC AAO Exam 2025 then make sure to read about Primary Market and it’s importance.

Importance of Primary Market for Banking Aspirants

Understanding the primary market helps aspirants answer questions on capital markets, securities, and regulation common topics in banking exams. Questions often test definitions, types of issues (IPO, rights, private placement, QIP), regulatory bodies and issuance procedures; familiarity with these topics improves performance in both objective and descriptive sections.

Why it appears frequently in exams

- Links to financial awareness and macro-finance topics.

- SEBI procedures, IPO types and allotment methods are repeatable factual topics.

- Case examples (major IPOs) and terms (DRHP, book-building, underwriting) are commonly tested.

Instruments of Primary Market

Primary securities include equity, debt and government instruments issued fresh to investors. Below are the main kinds of primary market instruments and how they are used to raise capital.

- Equity (Shares) — Issued via IPOs/FPOs to raise permanent capital. New shareholders gain ownership.

- Debentures and Corporate Bonds — Companies borrow from investors by issuing bonds; principal plus interest repaid later.

- Government Securities (G-secs) & Treasury Bills — Issued by the government (often through central bank auctions) to fund public spending. T-Bills are short-term; G-secs are longer-term.

- Initial Public Offering (IPO) / Follow-on Public Offer (FPO) — IPO for first-time public issue; FPO when an already-listed company issues new shares.

- Rights Issue — Existing shareholders are offered the right to buy new shares, usually at a discount, preserving ownership proportion.

- Bonus Issue — Free additional shares issued to existing shareholders from company reserves; no fresh cash inflow.

- Private Placement — Securities issued to a small set of investors (institutions or HNIs); quicker and less public.

- Preferential Allotment — Shares issued to a select group at a negotiated price, often for strategic investors.

- Qualified Institutional Placement (QIP) — Listed company issues shares/debentures to Qualified Institutional Buyers (QIBs) to raise funds with simplified procedures.

Functions of Primary Market

The primary market performs essential roles for issuers, investors and the economy.

Beyond raising money, it sets the stage for price discovery and capital formation needed for growth.

- Capital mobilization: Channels savings into productive investment by companies and the government.

- Financing new projects/expansion: Firms raise funds for expansion, R&D, debt restructuring etc.

- Underwriting and risk absorption: Underwriters help ensure issue success; they may buy unsubscribed securities.

- Price-setting (initial): Issue price is fixed (fixed-price) or discovered (book-building) before listing.

- Distribution mechanism: Prospectus, RHP and bankers ensure securities reach investors in an orderly way.

- Strengthening financial markets: Provides primary supply of securities that later enable secondary market trading and liquidity.

Also Read: Money Market Meaning, Types, and Its Instruments in Details

How a Company Issues Shares: Step-by-Step (IPO Process)

Issuing shares involves a sequence of regulatory and market steps; knowing these steps is helpful for exams. Below is a simplified flow of an IPO process in India (generalized, exam-relevant).

- Board decision & appointment of lead managers (merchant bankers): Company decides to go public and appoints intermediaries.

- Due diligence & draft prospectus (DRHP): Merchant bankers prepare a Draft Red Herring Prospectus and conduct checks on financials, promoters and business plan.

- Filing with SEBI & regulatory review: DRHP is filed with SEBI; SEBI may ask for clarifications before approval.

- Marketing / roadshows: Company and bankers present the issue to potential investors (institutions and anchor investors) to create demand.

- Price discovery – Book-building or Fixed Price: Two common methods: book-building (bids collected within a price band) or fixed-price offering (price fixed in advance).

- Allotment & refund: If oversubscribed, allotment is done (lottery/priority rules); unsuccessful applicants receive refunds.

- Listing on exchanges: Shares begin trading on stock exchanges; listing date often witnesses price discovery between issue price and market price.

- Post-listing compliance & lock-in: Promoters and pre-IPO investors may have a lock-in period; company adheres to disclosure norms.

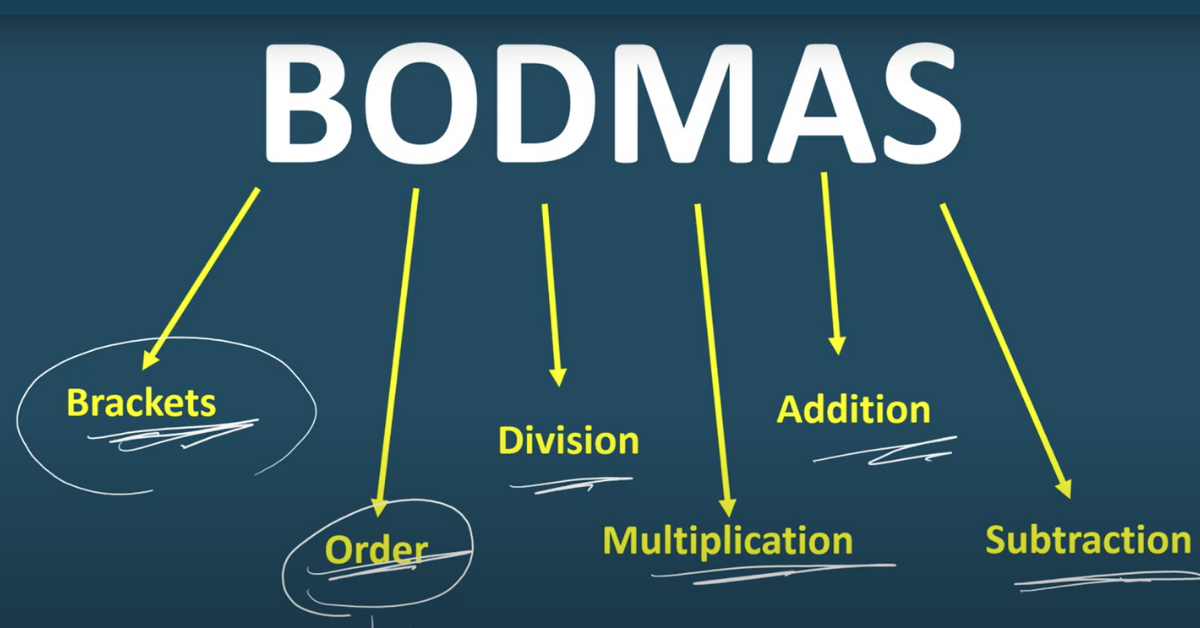

Methods of Pricing: Book-building vs Fixed-price

Issuance price can be fixed beforehand or discovered through investor bids. Both methods are used in India and you should be able to state the difference concisely in exams.

- Fixed-price issue: Issuer sets a price; investors apply at that price. Simpler and used for smaller issues.

- Book-building: Price band is announced; investors (especially institutional) bid quantity & price; final issue price is set from bids. Book-building is common for larger IPOs and helps reveal market demand.

Role of Underwriters and Merchant Bankers

Underwriters and merchant bankers are central to a smooth issue. Understanding their duties is important for conceptual questions.

- Merchant bankers / Lead managers: Manage the entire IPO process — due diligence, documentation, marketing, filing and coordination with SEBI.

- Underwriters: Commit to purchasing unsubscribed shares or arrange a syndicate to guarantee the issue. Types include firm commitment (guarantee) and best-efforts underwriting (no guaranteed sale).

- Registrar & transfer agents: Handle allotment, refunds and investor records.

Allotment, Oversubscription and Refunds

Allotment rules determine who gets shares when demand exceeds supply. Exams ask about oversubscription and the retail allotment process — know the typical outcomes.

- Oversubscription: When demand exceeds available securities, allotment can be via pro-rata distribution, lottery for retail investors, or specific allocation norms set for institutional/retail segments.

- Refunds and allotment letters: Unsuccessful applications are refunded and allotment advice is dispatched.

- Dematerialization: Most issues now require shares to be allotted in electronic (demat) form; physical share certificates are rare.

Listing and Post-Listing Behavior

Listing connects primary issues to the secondary market where liquidity and daily price discovery occur. The listing day often sees volatility — a stock may list at a premium, discount or at par to the issue price.

- Listing gains/losses are common on the first trading day — influenced by market sentiment and demand.

- Lock-in periods are applied to promoter holdings and sometimes to pre-IPO investors to ensure stability.

- Continuous disclosure obligations kick in after listing — quarterly results, corporate actions, etc.

Also Read: Financial Instruments & Markets for LIC AAO

Advantages and Disadvantages of Primary Market

Primary market activity has clear pros and cons — both are often asked in exams.

Advantages

- Direct capital to issuers for growth and project finance.

- Mobilises public savings into productive channels.

- Prevents price manipulation at issuance since prices are fixed/discovered before trading.

- Diversity of financing methods (IPO, QIP, private placement, rights issue).

Disadvantages

- Information asymmetry for new companies (limited past data).

- Risk for investors due to uncertainty about future performance.

- Allocation challenges in oversubscribed issues — small investors may get little or none.

- Regulatory compliance cost and time for issuers.

Also Read: Important Financial Institutions for LIC AAO Exam

Quick Revision: Important Terms to Memorize

- IPO / FPO / DRHP / RHP

- Book-building / Fixed-price

- Underwriter / Merchant banker / Registrar

- QIB / NII / RII (investor categories)

- Allotment, Oversubscription, Listing, Lock-in

Exam Tips for LIC AAO & Banking Exams

- Learn clear one-line definitions for IPO, QIP, private placement, rights and bonus issues.

- Memorize participants and the IPO sequence (board decision → DRHP → SEBI filing → marketing → price discovery → allotment → listing).

- Practice MCQs on differences (primary vs secondary), underwriting, and issuance methods.

- Keep a couple of example IPOs in mind (large, widely-known offerings) to answer contextual questions.

- Use short bullet notes for quick revision the week before the exam.

FAQs

The primary market is where new securities like shares, bonds, or debentures are issued by companies or governments to raise fresh capital.

The primary market issues instruments such as equity shares (IPO/FPO), debentures, bonds, treasury bills, rights issues, bonus issues, and private placements.

In the primary market, issuers raise funds by selling new securities, while in the secondary market, investors trade existing securities among themselves.

The primary market is a key topic in financial awareness for LIC AAO, RBI, SEBI, and IBPS exams, as questions on IPOs, SEBI regulations, and issue methods are frequently asked.

SEBI regulates the primary market by approving prospectuses, ensuring transparency, protecting investor interests, and monitoring IPOs and other issue processes.

- Simplification Questions For Bank Exams, Live Quiz, FREE PDF

- IBPS Clerk Final Vacancy 2025-26: Check State-wise List

- RBI Office Attendant Exam Analysis 2026, 1st March, All Shifts

- SBI Clerk Mains Answer Key 2026 Response Sheet Date

- Bihar State Cooperative Bank Clerk Final Result 2025 Out

- SBI Clerk Document Verification, List of Documents Required

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.