The IIBF CAIIB exam is one of the most important career growth exam for banking professionals who want to enhance their knowledge and skills in banking operations. One of the key papers in CAIIB is BFM (Bank Financial Management). With limited time before the exam, it is essential to focus on the most important topics and units to maximize marks and secure success.

In this blog, we have provided details about the important topics of CAIIB BFM, along with the module-wise important topics for the BFM paper.

CAIIB BFM Module Wise Important Topics

The CAIIB BFM (Bank Financial Management) paper is one of the most crucial papers for banking professionals. To score well, it is important to focus on high-weightage topics across all modules (A, B, C, and D). The details of the important topics are as follows:

Module A

Module A focuses on foreign exchange, letters of credit, and export-import procedures. It forms a major part of the BFM paper and carries a high weightage, making it essential to revise all topics carefully.

| Topic | Key Points |

| Exchange Rate & Forex Business | Spot rate, cash rate, forward rate; Participants in forex market; RBI and Federal Reserve guidelines; Arithmetic and regulatory aspects of forex transactions |

| Liberalised Remittance Scheme (LRS) | Limits on money transfer abroad; Guidelines for outward and inward remittances |

| Capital Account Transactions | Rules and schedules (Schedule I, II, III); Banking services for forex – with or without accounts |

| Letter of Credit (LC) | Types, definitions, and involved parties; Framework and regulatory guidelines |

| Uniform Customs & Practices (UCP) | Current trends, key articles, and practical applications |

| Export Data Processing & Monetary System | Guidelines for exporters and importers; Trade credit definitions and operational guidelines |

Also Check: CAIIB Exam Date 2025

Module B

Module B focuses on risk management, Basel norms, and treasury operations. This module is critical for understanding both theory and practical aspects of banking risk and treasury management.

| Topic | Key Points |

| Risk Management | Types of risks: credit, operational, market; Risk management frameworks and Basel norms; Measurement & management of credit risk via loan review; Liquidity risk management & overseas guidelines |

| Basel III Norms | LCR (Liquidity Coverage Ratio) and NSFR (Net Stable Funding Ratio); Pillars I, II, III – capital guidelines and framework |

| Treasury Management & Products | Money market and forex market operations; International equity and debt products, GDR rules; Treasury risk management (VaR, derivatives); ALM concepts and guidelines |

Module C & D

Modules C & D focus on balance sheet management, asset-liability management, and banking risks. These modules cover operational and financial management concepts and include important case studies.

| Topic | Key Points |

| Balance Sheet Management & ALM | Source of funds vs. application of funds; NPA classification, insolvency, IBC code basics; Interest rate risk management techniques; Case studies on operational & financial risk management |

| Treasury & Risk in Banking | Repeat concepts of derivatives, VaR, and liquidity management; Practical application in case studies |

Also Check: CAIIB Syllabus

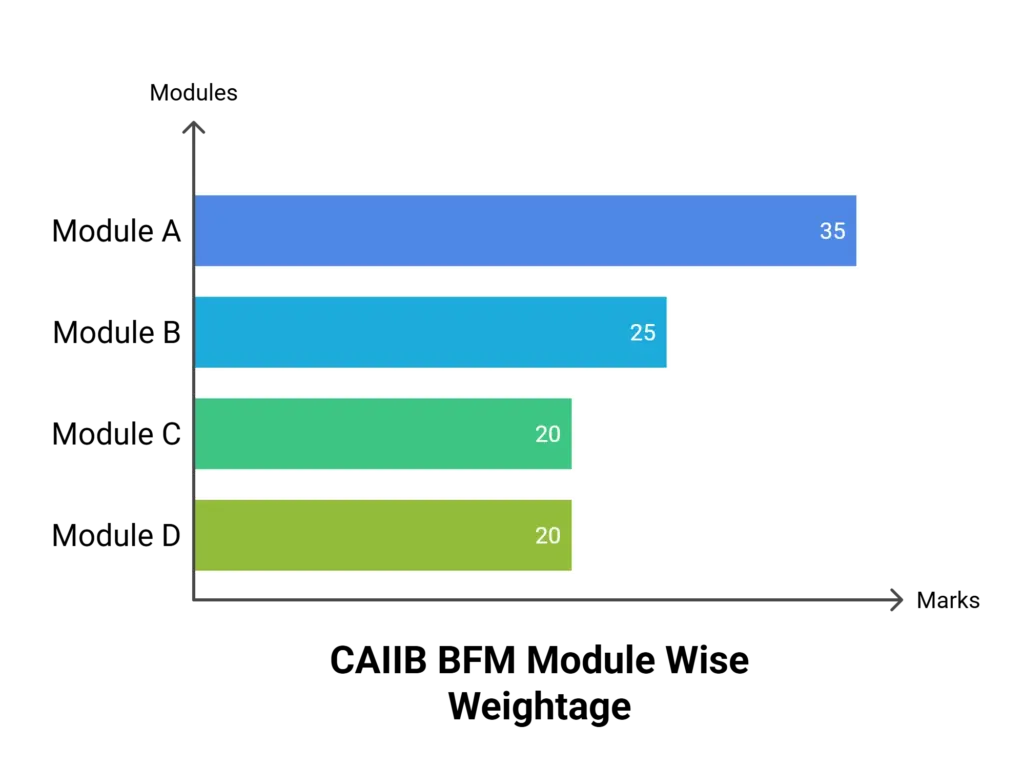

Module wise Weightage of CAIIB BFM Paper

For the CAIIB BFM exam, the highest priority modules are Module A and Module B, as they together contribute around 60 marks.

Module C and Module D are of medium priority, contributing around 40 marks. Additionally, case studies and numericals appear across all modules, so it is crucial to practice them along with theory to ensure comprehensive preparation.

As per the previous year exam:

CAIIB BFM Paper Exam Structure

The CAIIB 2025 exam has five papers in total. Four are compulsory ABM, BFM, ABFM, and BRBL, and one is an elective chosen by the candidate based on role or interest. Each paper has 100 questions for 100 marks with a 2-hour duration.

The exam is held online by IIBF and includes MCQs, case studies, and numerical problems to check both knowledge and practical skills.

| Feature | Details |

| Total Questions | 100 objective-type multiple-choice questions |

| Total Marks | 100 marks |

| Case-Based Questions | Includes case studies and case lets |

| Numerical Input Questions | Some subjects include numerical questions requiring direct input (no options provided) |

| Exam Mode | Online (Computer-Based Test only) |

| Negative Marking | No negative marking for wrong answers |

| Exam Language | Can be attempted either in Hindi or in English |

Preparation Strategy for CAIIB BFM

The CAIIB BFM (Bank Financial Management) paper is a critical exam for banking professionals looking to advance their career. Efficient preparation requires prioritizing high-weightage modules, practicing real-world scenarios, and revising key concepts consistently.

- Prioritize Modules A & B – These modules cover approximately 60% of the marks and include foreign exchange, letters of credit, risk management, Basel norms, and treasury operations. Focus on these first.

- Practice Case Studies and Numericals – Theory alone is not sufficient. Regular practice ensures accuracy and helps in applying concepts to practical scenarios.

- Use Updated Class Notes – Stick to concise, reliable notes rather than referring to multiple books. This saves time and ensures focused preparation.

- Daily Revision of Key Topics – Focus on high-priority topics such as:

- Forex & Exchange Rates

- Liberalised Remittance Scheme (LRS) & Capital Account Transactions

- Letters of Credit & UCP Guidelines

- Treasury Products & Asset-Liability Management (ALM)

- Risk Management Frameworks & Basel Norms

- Attempt Mock Tests Regularly – Mock tests improve speed, accuracy, and time management, and highlight areas needing further revision.

- Understand Practical Application – Ensure comprehension of rules, guidelines, and frameworks in real banking operations. This is essential for solving case studies effectively.

FAQs

Module A and Module B carry the highest weightage, contributing around 60% of marks.

Focus on these after completing Modules A and B, as they contribute around 40% of marks.

Yes, case studies are essential and appear across all modules.

Forex & exchange rates, LRS, capital account transactions, LC & UCP, treasury products, ALM, and risk management frameworks.

Understanding practical application helps solve case studies and apply theoretical concepts effectively.

- Attempt CAIIB HRM Important MCQs and Download PDF

- 50 Most Repetitive Questions for the CAIIB HRM Paper, Download PDF

- 50 Most Repetitive Questions for CAIIB ABM 2026, Download PDF

- 50 Most Repetitive Questions for CAIIB BFM 2026, Download PDF

- 50 Most Repetitive Questions for CAIIB BRBL 2026, Download PDF

- Attempt CAIIB ABM Important MCQs and Download PDF

Hi, I’m Aditi. I work as a Content Writer at Oliveboard, where I have been simplifying exam-related content for the past 4 years. I create clear and easy-to-understand guides for JAIIB, CAIIB, and UGC exams. My work includes breaking down notifications, admit cards, and exam updates, as well as preparing study plans and subject-wise strategies.

My goal is to support working professionals in managing their exam preparation alongside a full-time job and to help them achieve career growth.