In banking and finance, secure money transfer is essential for both individuals and businesses. A Demand Draft (DD) is one of the most reliable instruments used to transfer funds safely from one bank to another. Unlike personal cheques, demand drafts are prepaid and provide guaranteed payment, making them useful for high-value transactions, educational fees, and business dealings. Understanding demand drafts is crucial for banking exam aspirants, as it is frequently asked in exams like IBPS, SBI, and RBI recruitment.

What is a demand draft?

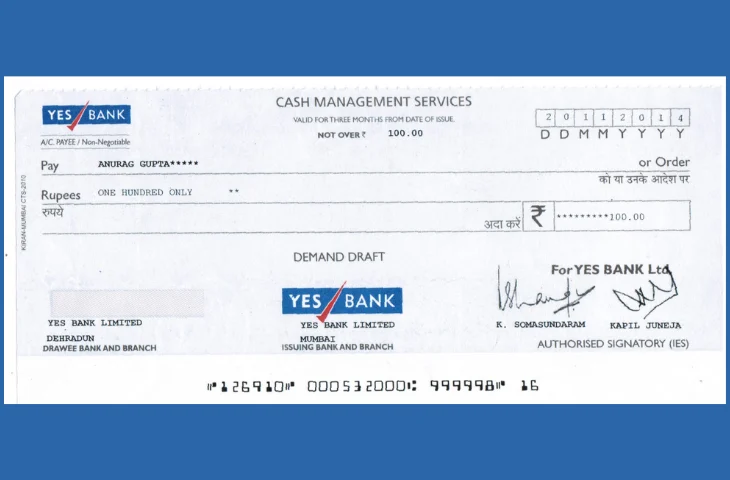

A Demand Draft (DD) is a prepaid negotiable instrument issued by a bank to facilitate the transfer of funds from one place to another. The key feature of a DD is that the amount is deducted from the drawer’s account at the time of issuance, ensuring that the payee receives the money without the risk of insufficient funds. The key features of a demand draft are:

- Prepaid payment instrument.

- Payment guaranteed by the issuing bank.

- Can be issued to any person, even if they do not have an account with the bank.

- Non-cancellable once delivered to the payee (except under specific bank procedures).

- Useful for large transactions where cheque bounce risk exists.

Use of Demand Draft in the Banking Sector

Demand drafts play a significant role in banking and financial transactions. They provide a secure and reliable way to transfer funds and are particularly useful when guaranteed payment is required.

- Educational Payments: Universities and educational institutions often prefer DDs for fee collection, as they guarantee the full amount without the risk of bouncing.

- Business Transactions: Companies use demand drafts to pay suppliers, vendors, or service providers. The bank guarantees the payment, making it safer than cheques.

- Property and Real Estate Deals: For property purchases or legal transactions, DDs ensure that the payment is secure and traceable.

- Government and Tax Payments: Many government departments accept DDs for payment of taxes, deposits, or fees because they are prepaid and verifiable.

- Personal Transfers: High-value personal payments can be safely made via DDs when physical cash is not practical.

Types of Demand Draft

Demand drafts are generally classified into two main types based on the time of encashment:

| Type of Demand Draft | Description |

| Sight Demand Draft | Can be encashed immediately upon presentation to the drawee bank. Used when the payee requires instant payment. |

| Time Demand Draft | Payable after a specified period (maturity date). The bank issues it, and payment is made only when the DD matures. Often used for scheduled transactions or contractual payments. |

Explanation:

- Sight DD is preferred for urgent payments, where the recipient needs immediate funds.

- Time DD is useful in commercial agreements where payment is due at a later date, providing flexibility while still offering bank-guaranteed security.

How to Obtain a Demand Draft?

Obtaining a demand draft is a straightforward process but requires proper documentation.

Steps to Get a DD:

- Choose a Bank – Decide the bank where the DD will be issued.

- Submit Request – Fill a DD application form at the bank or via net banking.

- Provide Details – Payee name, amount in figures and words, purpose of payment, and drawee branch details.

- Submit KYC Documents – Identification and address proof if required.

- Pay the Amount and Charges – Amount to be transferred plus bank charges.

- Collect DD Receipt – The DD contains a unique number for tracking and verification.

Online Option: Many banks now allow issuing DDs through net banking. Applicants must fill out online forms and choose branch and payee details, and the DD is either couriered or collected in person.

Demand Draft vs. Other Payment Instruments

Understanding the differences between DDs and other payment methods like cheques, NEFT, and RTGS is essential for banking aspirants.

- Demand drafts are prepaid instruments issued by banks, guaranteeing payment, while cheques depend on the drawer’s account balance.

- Electronic transfers like NEFT or RTGS are faster but require account details and online processing. DDs, being physical instruments, are slower but more reliable in high-value or formal transactions.

- DDs do not require signatures from the drawer, unlike cheques, reducing chances of fraud or errors.

| Feature | Demand Draft (DD) | National Electronic Funds Transfer (NEFT) | Cheque |

| Issuer | Bank | Bank | Account Holder |

| Payment Guarantee | Yes, prepaid | Depends on account balance | Not guaranteed, may bounce |

| Speed | 2–5 working days | Usually same day | 2–3 days to clear |

| Signature Required | No | Not applicable | Yes |

| Cancellation | Can be canceled with bank procedure | Can stop transfer if not processed | Can be stopped before clearance |

| Security | High | Moderate | Low if “Account Payee” not specified |

| Usage | Large and secure transactions | Day-to-day transfers | Low to medium transactions |

Validity of Demand Draft

A demand draft is valid for three months from the date of issuance, after which it becomes invalid. This structured validity ensures accountability and reduces the risk of unclaimed or fraudulent drafts.

- Initial Validity: The standard validity period ensures that payees encash the draft promptly.

- Revalidation Process: If the DD is not used within three months, the drawer can apply to the issuing bank for revalidation. The bank may extend the validity for another three months after verification.

- Non-Encashment Risk: If neither encashment nor revalidation occurs, the DD cannot be used further. The bank may require a fresh DD for the transaction.

Fees and Charges

Banks charge fees for issuing a demand draft. Charges vary based on bank and DD amount:

| Bank | DD Amount | Charges |

| SBI | Up to ₹5,000 | ₹25 |

| SBI | ₹5,001–₹10,000 | ₹50 |

| SBI | ₹10,001–₹1 lakh | 0.5% of DD amount (Min ₹60) |

| SBI | Above ₹1 lakh | 0.4% of DD amount (Min ₹600) |

| HDFC | Up to ₹5,000 | ₹75 (₹50 via phone banking) |

How to Cancel a Demand Draft?

A DD can be canceled before it is delivered to the payee. If a DD is lost or stolen, the bank must be contacted immediately to block it and issue a replacement. The steps to cancel a DD are:

- Inform the issuing bank immediately.

- Submit a written application with the DD number, amount, and payee details.

- Pay any applicable cancellation charges.

- The bank may verify details before refunding the amount.

Advantages of Using Demand Draft

Demand Drafts offer several advantages over other payment methods, especially in formal banking and business contexts.

- Secure and Prepaid: The amount is prepaid by the drawer, ensuring that the payee receives the full sum. Unlike cheques, there is no risk of insufficient funds.

- Widely Accepted: DDs are recognized across banks, institutions, and government offices, making them suitable for official or high-value transactions.

- High-Value Transactions: DDs are ideal for large payments, such as property purchases, education fees, or business settlements, where security and proof of payment are essential.

- Bank Guarantee: Since the bank issues the draft, the payment is backed by the bank, reducing counterparty risk.

- Convenience: A DD can be issued even by someone who does not have an account with the bank. Online banking also allows for easy issuance.

- Traceability: Every DD has a unique number and receipt, which allows both the drawer and payee to track the payment status.

FAQs

A Demand Draft is a prepaid negotiable instrument issued by a bank to transfer funds from one place to another. The bank guarantees payment to the payee, and the amount is deducted from the drawer’s account at the time of issuance.

Only banks and authorized financial institutions can issue a Demand Draft. Individuals or businesses cannot issue DDs themselves; they must request the bank to issue one on their behalf.

There are two main types:

Sight DD: Payable immediately upon presentation.

Time DD: Payable after a specific period or on maturity.

Unlike a cheque, a DD is prepaid and guaranteed by the bank, so it cannot bounce due to insufficient funds. Cheques are issued by account holders and depend on account balance. DDs also do not require the drawer’s signature.

Yes, a DD can be canceled before it is delivered to the payee. The drawer must submit a written request to the issuing bank and may have to pay a cancellation fee. Once delivered, cancellation is generally not possible.

A DD is typically valid for 3 months from the date of issuance. If not encashed, the drawer can apply for revalidation, usually for another 3 months. After this, the DD becomes invalid.

To get a DD, a drawer generally needs:

Identification proof (like Aadhaar, PAN, Passport)

Address proof (if required)

Payee details, amount in figures and words

Purpose of payment

Account details if applicable

Banks charge a nominal fee based on the DD amount. The fee structure varies between banks and may include additional charges for courier delivery. Fees are generally higher for high-value DDs.

Immediately inform the issuing bank with the DD details. Submit a written request and supporting documents. The bank may block the draft and issue a duplicate after verification.

DDs are preferred when:

Secure and guaranteed payment is required

Large-value transactions are involved

Payment proof is needed for official or business purposes

Cheques are risky due to potential bounce or fraud

- IBPS RRB Clerk Prelims Scorecard 2026 Out, Office Assistant Marks

- IBPS RRB PO Mains Scorecard 2026 Out for Scale 2 & 3, Download Link

- OICL Assistant Cut Off 2026 Out, Prelims & Mains Category-wise Marks

- IBPS RRB PO Interview Shift Timings 2025, Check the Schedule

- IBPS RRB PO Interview Marks 2025-26, Detailed Mark Calculations

- IBPS RRB PO Interview Date 2025-26, Check Complete Schedule

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railways, and state exams.