The topic “Different Types of Borrowers” is an important part of the JAIIB PPB 2026 syllabus. In banking, borrowers are the key parties who take loans, advances, or credit facilities from banks. They can be individuals, partnership firms, companies, trusts, or other organizations. Each type of borrower has unique legal requirements, operational powers, and liabilities, which a banker must understand before granting credit.

For JAIIB aspirants, this knowledge is crucial not only for exams but also for practical banking operations. In this blog, we provide a complete blog about the different types of borrowers, the JAIIB PPB syllabus, exam dates, and a direct link to download the PDF for easy reference.

Download the JAIIB PPB “Types of Borrowers” eBook

The link to download the “Types of Borrowers” eBook is provided below. Aspirants can download the PDF through the direct link.

What are the details covered under the topic Types of Borrowers?

The JAIIB PPB topic Types of Borrowers explains all borrower categories a banker deals with, covering their legal status, operational powers, liabilities, and special rules. It helps bankers understand who can borrow, how accounts are managed, and the responsibilities of both parties. Main categories include individuals, partnership firms, HUFs, companies, statutory corporations, trusts, and clubs & societies, with key rights, duties, and limitations for each.

| Type of Borrower | Key Details |

| Individuals | – Legal capacity to contract: minors, persons of unsound mind, and disqualified persons cannot contract. – Guardians can manage minor’s accounts and have authority as per law. |

| Partnership Firms | – Governed by Indian Partnership Act, 1932. – Minimum 2 and maximum 10 partners for banking; max 20 for other businesses. – Eligibility: individuals or businesses; ineligible: minors, insolvents, unsound persons. – Partner’s liability: joint and unlimited. – Operational powers: all partners involved; changes require consent. – Effect of insolvency/death: operations adjusted; bank approval needed for transactions. |

| Hindu Undivided Family (HUF) | – Senior member (Karta) manages accounts. – Karta has powers to administer property, operate accounts, and make financial decisions. – Co-parceners have limited liability. – Operational rules: Karta can delegate authority; co-parceners cannot stop payments. |

| Companies | – Governed by Companies Act, 2013. – Incorporation via Memorandum of Association (MoA) and Articles of Association (AoA). – Statutory corporations: legal entity, state-owned, financially autonomous, accountable to legislature. – Operational rules defined in MoA/AoA. |

| Trusts | – Governed by Indian Trust Act, 1882 (private trusts) and state laws (public trusts). – Trustees manage operational authority and account activities. – Loans only allowed if permitted under the Trust Deed. – Death or insolvency of trustee does not affect trust property; bank can honor cheques issued earlier. |

| Clubs & Societies | – Governed by Societies Registration Act or Co-operative Societies Act. – Required documents: registration certificate, byelaws, committee resolution. – Operational authority: Managing Committee decides; rules for cheque handling and stop payment. |

In which JAIIB module is the “Types of Borrowers” topic covered?

The topic “Types of Borrowers” is part of the JAIIB PPB Paper, Module B, which covers core banking operations and credit functions. The Types of Borrowers section explains different borrower categories, their legal status, operational powers, and liabilities, making it vital for both exam preparation and practical banking knowledge.

| Field | Details |

| Paper / Module | Principles & Practices of Banking (PPB) – Module B |

| Focus Areas | Core banking operations and credit functions |

| Topics Covered | – Principles of lending – Loan appraisal and documentation – Types of securities – Non-Performing Assets (NPA) management – Banking laws- Retail loans, priority sector lending – MSME and agricultural finance – Government schemes and self-help groups – Types of Borrowers |

| Exam Dates 2026 | May Cycle: 9th May 2026 November Cycle: 22nd Nov 2026 |

What do you mean by the term individual borrowers and their legal requirements?

Individual borrowers are people who take loans from banks for personal, business, or investment purposes. The banker must ensure that the individual is legally competent to contract. Certain individuals, such as minors, persons of unsound mind, or those barred by law, cannot borrow money. Guardians play an important role when lending to minors, and their authority must be verified. Understanding these rules helps avoid legal disputes and ensures proper recovery of loans.

Also Check: JAIIB Complete 2026 Exam Schedule

Who cannot legally borrow from a bank?

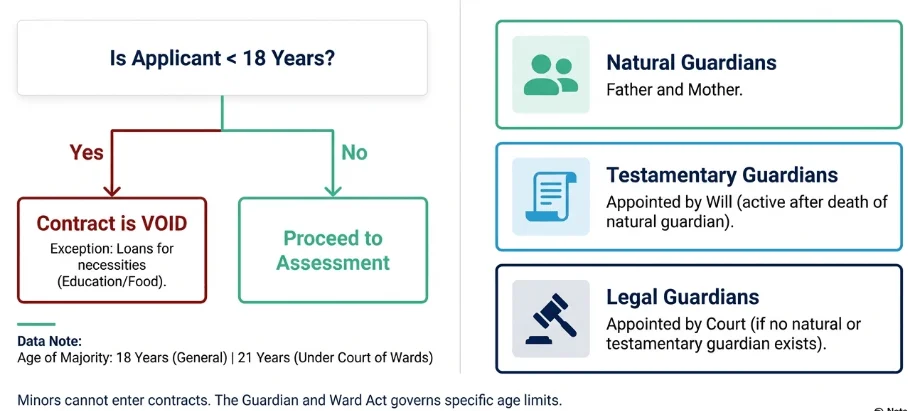

Not everyone can legally borrow money from a bank. Certain individuals lack the legal capacity to enter into a contract, while others may be restricted by law. For bankers, it is important to identify such persons before sanctioning loans to avoid legal complications and ensure the loan is enforceable. This includes minors, persons of unsound mind, and those disqualified by legislation.

- Minors: Persons under 18 years (or 20 under Guardian and Ward Act) cannot enter into contracts. Any contract is void ab initio.

- Representatives for Minors

- Natural Guardians: Father and mother.

- Testamentary Guardians: Appointed by a will to act after death of natural guardian.

- Legal Guardians: Appointed by the court if no natural or testamentary guardian exists.

- Representatives for Minors

- Persons of Unsound Mind: Cannot legally contract. Transactions with such persons are invalid.

- Legally Disqualified Persons: Barred by law from borrowing or contracting.

What are partnership firm borrowers and their key rules?

A partnership firm is formed when two or more persons agree to carry on a business with shared profits and liabilities. The Indian Partnership Act, 1932 governs these firms. Bankers must check the firm’s registration, understand each partner’s authority, and know the legal implications of partner actions. Partnerships are common in small to medium businesses, and lending to them requires knowledge of liability, operational authority, and changes like insolvency or death of a partner.

Legal status of a partnership

Partnership firms are governed by the Indian Partnership Act, 1932, which defines their formation, operation, and dissolution. Banks must know a firm’s legal status before lending because it affects partners’ rights, liabilities, and authority.

- Governed by Indian Partnership Act, 1932 – This act provides rules for forming, managing, and dissolving partnerships. It also explains partners’ authority and responsibilities.

- Registration is optional – Firms may choose to register or remain unregistered. Unregistered firms cannot sue to recover debts, but others can sue them. Registration offers legal protection but is not mandatory.

- Section 19 & 22 – Section 19 defines each partner’s authority to act on behalf of the firm. Section 22 explains the process for executing actions that legally bind the firm.

- Minimum 2 partners – At least 2 partners are needed to form a partnership; one person alone cannot legally form a firm.

- Maximum 10 partners for banking firms – A partnership engaged in banking can have a maximum of 10 partners to ensure proper control over sensitive banking operations.

- Maximum 20 partners for other businesses – Partnerships in trading, manufacturing, or service sectors can have up to 20 partners, allowing flexibility for management.

Who is eligible to become a partner in a firm?

Not everyone can become a partner in a firm. Eligibility is based on legal capacity, age, and financial standing.

- Eligible partners – Individuals, other partnerships, and limited companies can become partners if they meet legal requirements.

- Not eligible partners – Minors, insolvent individuals, and persons of unsound mind cannot become partners, as they cannot legally contract.

- Minors and profit sharing – A minor cannot act as a partner but can claim a share in the firm’s profits earned during the partnership.

- HUFs and trusts – Hindu Undivided Families and trusts cannot be partners because they are not legal entities capable of contractual obligations.

What is a partner’s liability in a partnership?

Partners are responsible for the firm’s obligations. Liability rules protect both the firm and outsiders, including banks.

- Joint and several liability – Each partner is jointly and individually responsible for all debts and obligations of the partnership. If one partner cannot pay, others must cover it.

- Checks issued by insolvent partners – If a partner becomes insolvent, all previously issued checks must still be honored if confirmed, ensuring banking transactions are protected.

How is operational authority managed in a partnership?

Operational authority defines how a partnership’s accounts are managed and who can make decisions.

- All partners can operate accounts – Every partner has the authority to operate the firm’s bank accounts. Any changes in this authority require approval of all partners.

- No delegation allowed – Partners cannot delegate their authority to outsiders; only partners can act on behalf of the firm.

- Sleeping partners and cheque payments – Even non-active (sleeping) partners can halt cheque payments, but revocation or approval of cheques must follow operational rules.

What happens in case of the death or insolvency of a partner?

The death or insolvency of a partner affects the firm’s operations and banking relationships.

- Death dissolves the firm – When a partner dies, the firm is dissolved for banking purposes. Banks must stop transactions in running credit facilities and open separate accounts to maintain smooth operations.

- Cheques signed by deceased/insolvent partners – Any cheques signed before the partner’s death or insolvency require approval from remaining partners.

- Credit vs debit accounts – If the firm’s account is in credit, operations can continue for closure purposes. If the account is in debit, all operations are halted to protect the obligations of the deceased/insolvent partner or their estate.

Also Attempt

| Test Name | Link |

| JAIIB IE and IFS Mock Test | Attempt Now |

| JAIIB PPB Mock Test | Attempt Now |

| JAIIB AFM Mock Test | Attempt Now |

| JAIIB RBWM Mock Test | Attempt Now |

What are Hindu undivided family (HUF) borrowers and their powers?

HUF is a family unit borrowing through its senior-most member called the Karta. HUF is not a legal entity, and membership arises by birth or adoption. The Karta manages HUF property, exercises operational authority, and can delegate authority to other coparceners or third parties. Co-parceners’ liability is limited to their shares. Banks must verify Karta’s authority and proper consent from all adult members.

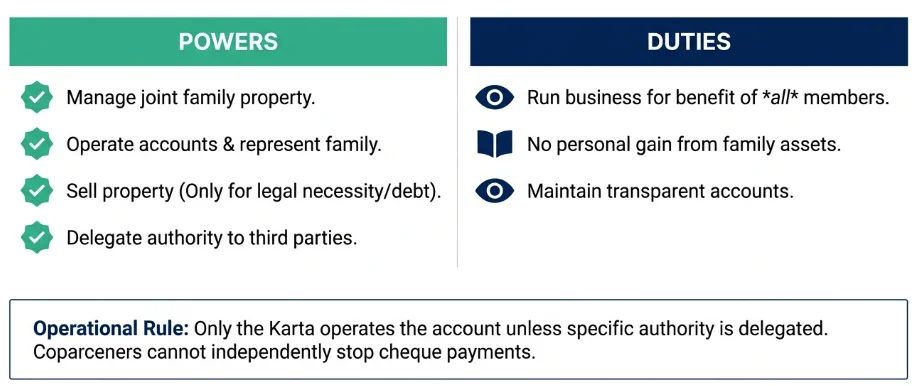

What are the powers of a Karta?

The Karta, as the senior member of a Hindu Undivided Family (HUF), has the authority to manage the family’s property and affairs. His powers allow him to operate, represent, and make decisions on behalf of all family members.

- Manage and administer joint family property – The Karta can handle, operate, and make decisions regarding family property and business, such as collecting rent or maintaining assets.

- Right to revenue share from family property – He can allocate or use the income from family assets to meet the needs of the family members.

- Represent the family in transactions – The Karta is the legal representative for banking and business dealings of the HUF; other members cannot enter contracts independently.

- Sell joint family property for specific reasons – Property can be sold by the Karta only for lawful purposes like debt repayment, business needs, or family welfare.

What are the duties of a Karta?

Along with powers, the Karta has responsibilities to ensure the proper running of the family business and the fair management of assets.

- Run the family business for benefit of all members – He must operate the family business to serve the interest of all members, not for personal gain.

- Ensure accountability for revenue and property – Proper records must be maintained for all assets, income, and transactions to ensure transparency.

What are the operational rules for HUF accounts?

The banking operations of an HUF account are strictly regulated to prevent misuse and ensure proper management under the Karta’s supervision.

- Only Karta operates HUF account – No other family member can operate the bank account unless delegated by the Karta.

- Karta can delegate authority; co-parceners cannot halt cheque payments – While the Karta may authorize someone to manage transactions, co-parceners do not have independent authority to stop payments.

- Supreme Court ruling: HUF cannot be a partner in a partnership firm – A Hindu Undivided Family cannot join a partnership firm as it is not a separate legal entity capable of entering contracts.

Also Check:

| Study Material | Study Material |

| JAIIB IE and IFS Important Questions PDF | JAIIB PPB Important Questions PDF |

| JAIIB AFM Important Questions PDF | JAIIB RBWM Important Questions PDF |

What are company borrowers and their incorporation requirements?

Companies are formal legal entities that can borrow money from banks for business operations. Governed by the Companies Act 2013 (previously 1956), companies must be incorporated through a Memorandum of Association (MOA) and Articles of Association (AOA). MOA defines the company’s objectives, capital, and liabilities, while AOA sets internal management rules like directors, borrowing powers, and share transfer procedures.

- Minimum 7 members for incorporation.

- MOA: Name, registered office, authorized capital, shareholders’ liability, business purpose.

- AOA: Rules for internal management, directors, borrowing powers, and share transfer.

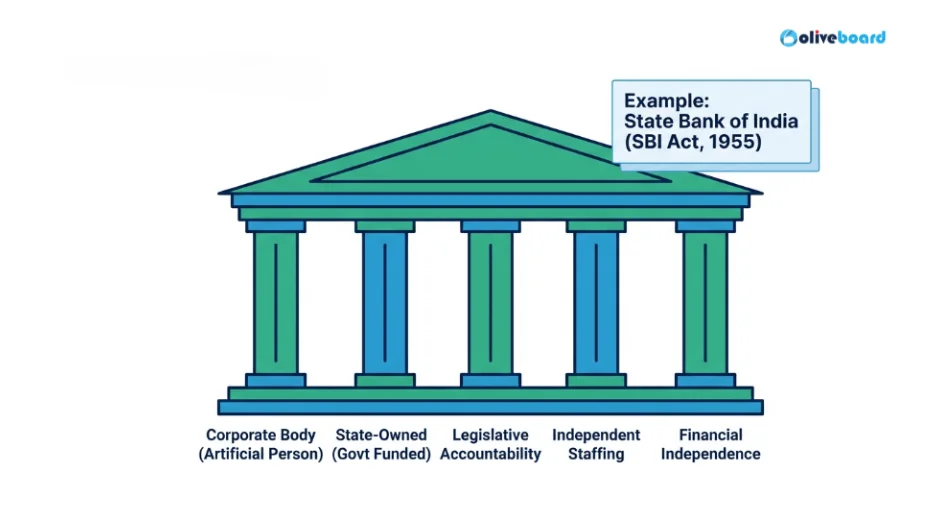

What are statutory corporations and their key features?

Statutory corporations are legal entities created by a special Act of Parliament or State Legislature. Examples: State Bank of India under State Bank Act, 1955. They are state-owned but operate independently, with full authority to manage finances, hire staff, and enter into contracts. Banks must know their powers, autonomy, and financial independence before lending.

What are the features of statutory corporations?

Statutory corporations are organizations created by a special Act of Parliament or a state legislature. They enjoy legal recognition, financial autonomy, and defined responsibilities, while remaining accountable to the government.

- Corporate Body – A statutory corporation is a legal entity and an artificial person created by law. It can enter into contracts, own property, and conduct business in its own name, independent of its members or government officials.

- State-Owned – The government either fully or partially funds the corporation, making it publicly owned. This ensures that the corporation can serve public purposes while enjoying government support.

- Answerable to Legislature – While the corporation must report on its performance to the Parliament or state assembly that established it, the legislature cannot interfere in day-to-day operations. Policy and oversight are limited to general guidance and accountability.

- Own Staffing System – Employees of a statutory corporation are not considered government employees. The corporation independently hires, pays, and manages staff according to its internal rules and policies.

- Financial Independence – Statutory corporations can raise funds through borrowing or other means without being subject to standard government budget, audit, or accounting control. This allows them operational and financial flexibility.

How do trusts borrow and operate bank accounts?

Trusts are governed by the Indian Trust Act, 1882. Banks must check the trust deed to verify trustee authority and ensure loans benefit the trust. Trusts may be private (specific beneficiaries) or public (general public). Trustees’ authority is limited to the deed and cannot be delegated. Death or insolvency of a trustee does not affect trust property; banks can honor cheques issued prior to death.

- Trustees manage accounts as per trust deed.

- Private trusts: specific beneficiaries; Public trusts: general public.

- Trustee’s death or insolvency does not affect property; court appoints new trustee if needed.

- Loans approved only if permissible under deed and for trust benefit.

Also Check:

| Study Plan | Study Plan |

| JAIIB IE And IFS Study Plan | JAIIB PPB Study Plan |

| JAIIB AFM Study Plan | JAIIB RBWM Study Plan |

What are clubs, societies, and non-commercial organization borrowers?

Clubs, schools, and societies are non-commercial organizations usually governed by the Societies Registration Act or Co-operative Societies Act. Banks require registration certificates, byelaws, and committee approvals to open accounts. Operational authority, stop payments, and cheque rules are defined by the managing committee. Following proper procedures prevents unauthorized transactions and ensures accountability.

What are the operational rules for Clubs & Societies?

Clubs, societies, and non-commercial organizations must follow certain legal and operational procedures when dealing with banks. Their operations are guided by the Societies Registration Act or Co-operative Societies Act, and the bank ensures compliance before opening accounts or processing transactions.

- Certificate of Registration and Byelaws – To open an account, the club or society must provide a valid registration certificate and a copy of its byelaws. These documents establish the organization’s legal existence and internal rules.

- Committee Decides Operational Authority – The Managing or Executive Committee of the club/society determines who has the authority to operate the bank account. Any changes to operational authority must also be approved by the committee.

- Stop Payment or Reversal – The committee has the power to issue stop payment instructions or revoke them, ensuring control over the account’s transactions.

- Cheque Signing – Cheques signed by authorized office-bearers such as the treasurer, secretary, or president are valid and honored by the bank, even if the signatory is no longer in office.

FAQs

Borrowers are individuals, firms, companies, or organizations that take loans or credit from banks.

The topic is covered under Principles & Practices of Banking (PPB), Module B.

Minors, persons of unsound mind, and those disqualified by law cannot legally borrow.

It is governed by the Indian Partnership Act, 1932, with defined partners, liabilities, and operational rules.

A government-created entity with legal status, financial autonomy, and accountable to Parliament/state legislature.

- JAIIB PPB Syllabus 2026, Module Wise Syllabus & Exam Pattern

- Priority Sector Advances, Important for JAIIB PPB 2026

- Different Types of Borrowers, JAIIB 2026, Download PDF

- JAIIB 2025 Previous Year Papers, Download Free PDF

- 3 Common Mistakes to Avoid While Preparing for JAIIB Exam

- How to Crack JAIIB 2026 in Your 1st Attempt, Tips and Tricks

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.