Government securities (G-Secs) are debt instruments issued by the central or state government to raise funds from the public. They are considered risk-free investments because repayment is guaranteed by the government. The debt market, also called the fixed-income market, is where government securities, corporate bonds, and other debt instruments are issued, traded, and managed.

For bank and insurance exam aspirants, including SBI PO, IBPS PO/Clerk, RRB, and LIC AAO, understanding government securities and the debt market is important. Questions often cover types of securities, interest rates, RBI operations, and market functions, making this a high-value topic for exams.

What are Government Securities?

Government securities are financial instruments issued by the central or state government to borrow money from investors. They provide a fixed or floating interest rate and are repaid on maturity.

Key points:

- Issued by central or state governments to meet fiscal needs.

- Considered risk-free since the government guarantees repayment.

- Can be purchased by banks, mutual funds, financial institutions, and retail investors.

- Helps the government finance budget deficits and public expenditure.

Why Government Securities & Debt Market Is Necessary for LIC AAO Aspirants?

Government securities and the debt market are critical for LIC AAO and other exam aspirants for several reasons:

- Questions on financial instruments, debt markets, and investment options are common in insurance and banking exams.

- Understanding primary and secondary markets, types of G-Secs, and RBI’s role helps in both objective and descriptive sections.

- Knowledge of government securities’ features and advantages is tested in reasoning, awareness, and financial literacy sections.

- Helps aspirants understand monetary policy tools, liquidity management, and SLR requirements, which are important for LIC AAO, SBI PO, and IBPS exams.

Features of Government Securities

Government securities have distinct features that make them one of the safest and most widely used financial instruments in India. Understanding these features is essential for bank and insurance exams.

- Issuer: Government securities are issued by the central government (Union Government) or state governments (State Development Loans) to raise funds for public expenditure and fiscal deficits.

- Risk-free Nature: Since these securities are backed by the government, they are considered risk-free, meaning there is minimal chance of default. This is a major advantage for conservative investors.

- Tenure: G-Secs can have short-term (less than 1 year), medium-term (1–5 years), or long-term (more than 5 years) maturities. Treasury bills are usually short-term, while government bonds can have tenures up to 30 years.

- Interest: They offer fixed or floating interest rates. Fixed interest (coupon) bonds pay a fixed amount at regular intervals, while floating rate bonds adjust based on market conditions or inflation.

- Tradability: Most government securities are tradable in the secondary market, allowing investors to sell them before maturity, which adds liquidity to the investment.

- Denomination and Accessibility: They are available in varied denominations, making them accessible to retail investors, banks, mutual funds, and financial institutions.

- Purpose: The primary purpose is to finance government expenditures, manage public debt, and stabilize financial markets. They also play a role in monetary policy operations conducted by RBI.

Types of Government Securities

Government securities are classified based on maturity, interest, and the issuing authority. Each type has its own features, purpose, and investor base.

- Treasury Bills (T-Bills):

- Short-term securities are issued for up to 1 year.

- Issued at a discount (sold below face value) and redeemed at par on maturity.

- Mostly used by banks and institutional investors for liquidity management.

- Example: 91-day, 182-day, or 364-day T-Bills.

- Government Bonds:

- Long-term securities with fixed or floating interest rates.

- Tenure ranges from 1 year to 30 years.

- Investors receive periodic interest (coupons) and principal at maturity.

- Example: 10-year government bond issued by RBI.

- Cash Management Bills (CMBs):

- Short-term instruments issued to meet temporary cash needs of the government.

- Tenure is usually less than 91 days.

- Primarily issued to adjust short-term liquidity in the economy.

- Example: 14-day or 30-day CMBs.

- State Development Loans (SDLs):

- Issued by state governments to fund their budgetary requirements.

- Interest is paid periodically, and principal is returned at maturity.

- Example: Maharashtra SDL, Tamil Nadu SDL.

- Inflation-Indexed Bonds (IIBs):

- The principal amount is linked to inflation, protecting investors from inflation risk.

- Interest is paid on the adjusted principal.

- Example: RBI Inflation-Indexed Bonds.

- Special Securities:

- Occasionally, the government issues securities for specific purposes, such as infrastructure development or to refinance old debt.

- These securities may have unique features like longer tenure, floating interest, or tax benefits.

Understanding these types helps aspirants answer questions on tenure, interest structure, purpose, and examples in exams like LIC AAO, IBPS, and SBI PO.

RBI’s Role in Government Securities

The Reserve Bank of India (RBI) plays a critical role in the issuance, management, and regulation of government securities. Aspirants should note the following points for banking and insurance exams:

- Debt Manager: RBI acts as the debt manager for both central and state governments. It conducts auctions, manages repayments, and ensures smooth functioning of the debt market.

- Issuance and Auctions: RBI manages primary issuance of T-Bills, bonds, SDLs, and other government securities. Auctions are conducted to allocate securities to banks, financial institutions, and retail investors.

- Secondary Market Operations: RBI oversees trading in the secondary market, ensuring liquidity, fair pricing, and transparency.

- Monetary Policy Implementation: Government securities are used by RBI as tools for monetary policy. By buying or selling securities, RBI can influence money supply, liquidity, and interest rates. For example:

- Open Market Operations (OMO): Buying G-Secs injects liquidity; selling G-Secs absorbs liquidity.

- Repo and Reverse Repo: G-Secs are used as collateral in short-term borrowing/lending operations.

- SLR Requirement: Banks are required to maintain a Statutory Liquidity Ratio (SLR) in the form of approved government securities. RBI monitors compliance with these requirements.

- Investor Education and Regulation: RBI ensures that government securities markets are safe, regulated, and accessible to institutional and retail investors.

Practice Questions on Government Securities & Debt Market for Bank Exams

- What are government securities, and who issues them?

- What is the primary difference between T-Bills and government bonds?

- Name one benefit and one limitation of investing in G-Secs.

- What are State Development Loans (SDLs)?

- Which platform allows retail investors to directly buy government securities?

- How does RBI use government securities to implement monetary policy?

- What is the difference between primary and secondary debt markets?

- What is an inflation-indexed government bond?

- Can banks invest in G-Secs to meet statutory requirements?

- Why is knowledge of government securities important for LIC AAO aspirants?

Answer Key:

- Debt instruments issued by central or state governments.

- T-Bills are short-term and issued at a discount; government bonds are long-term with fixed/floating interest.

- Benefit: Safe investment; Limitation: Lower returns.

- Debt securities issued by state governments to fund budgetary needs.

- RBI Retail Direct platform.

- By buying/selling G-Secs to control money supply and liquidity.

- Primary market is for new issues; secondary market is for trading existing securities.

- Bonds where principal is linked to inflation to protect investors.

- Yes, for statutory liquidity ratio (SLR) and investment purposes.

- Helps LIC AAO aspirants understand financial instruments, debt market operations, and RBI’s role in monetary policy.

FAQs

Ans: Government securities are debt instruments issued by the central or state government to raise funds. They are considered risk-free investments.

Ans: The main types include Treasury Bills (T-Bills), Government Bonds, Cash Management Bills (CMBs), State Development Loans (SDLs), and Inflation-Indexed Bonds.

Ans: They provide safe and stable returns, are highly liquid, help in portfolio diversification, and are widely accepted for SLR requirements by banks.

Ans: RBI acts as the debt manager, conducts primary auctions, monitors the secondary market, implements monetary policy, and ensures banks meet SLR norms.

Ans: Questions on types, features, RBI role, primary and secondary markets are frequently asked in LIC AAO, SBI PO, IBPS, RRB, and other banking exams.

- SBI PO vs. IBPS PO vs. IBPS RRB PO: Which Exam is Better?

- RBI Assistant Reasoning Preparation 2026: Complete Strategy

- OICL AO Mains Result 2026, Check Your Result Here

- OICL AO Cut Off 2025-26: Check Expected Marks

- IBPS Clerk Reserve List 2025-26, CSA Provisional Allotment

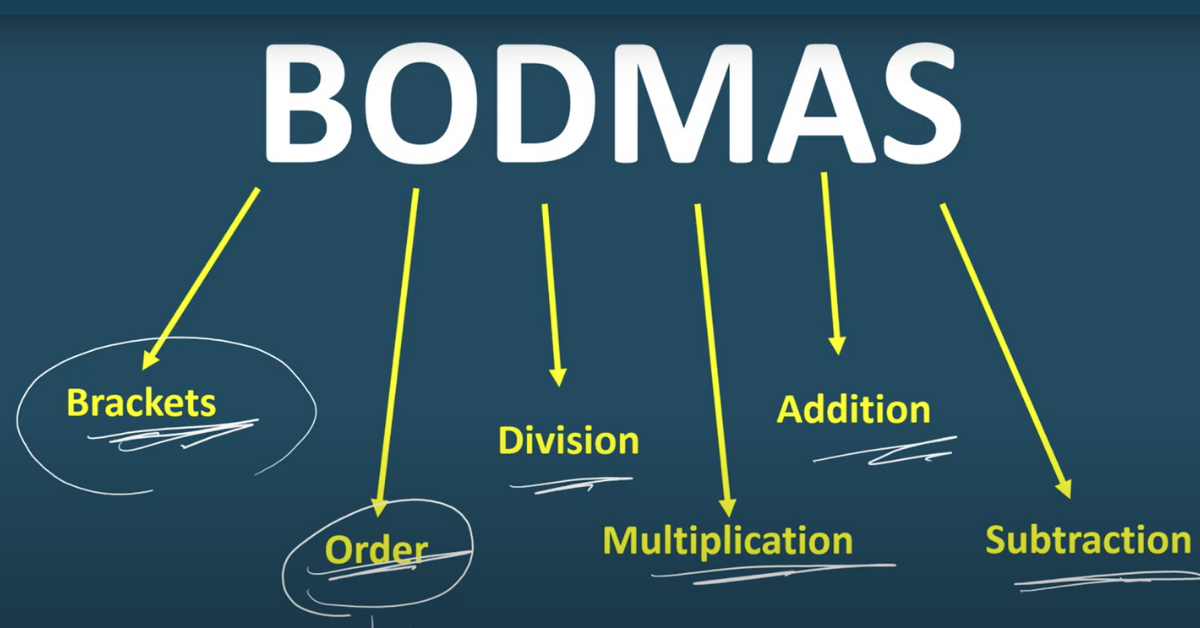

- Simplification Questions For Bank Exams, Live Quiz, FREE PDF

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.