The IBPS PO Interview Experience provides valuable insights for aspirants preparing for the final stage of the IBPS PO selection process. With thousands competing for a limited number of vacancies, the interview round plays a decisive role in determining the successful candidates. This article features detailed experiences from two previously selected candidates, shedding light on the interview environment, types of questions asked, and strategies they employed to impress the panel.

IBPS PO Interview Experience From Previously Selected Candidates

These real-life experiences will help candidates understand what to expect and how to prepare effectively for the IBPS PO interview. From technical and behavioral questions to situational problem-solving, the key takeaways outlined here can significantly boost your confidence and readiness for this crucial step.

February 11, 2024

Reporting and Initial Formalities

The interview was held at the Punjab National Bank’s local head office in Chandigarh, with a reporting time of 1:30 PM. Candidates arrived early and were allowed into the venue at the scheduled time.

Document verification began immediately, but an issue arose for one candidate due to discrepancies in the Aadhaar card, which omitted the father’s surname. This was resolved by preparing an affidavit, though it delayed the interview sequence for the affected candidate.

Interview Panel and Environment

The interview started around 5:30 PM. The panel consisted of five members, including one female. The candidate appeared slightly nervous, which the panel initially mistook for anxiety. After clarifying it was due to the cold weather, the atmosphere became more relaxed, and the candidate was offered water before proceeding with the interview.

Key Questions and Responses

- Banking Concepts:

- Components of a balance sheet.

- Differences between profit and loss accounts, shares, and debentures.

- Understanding of fixed deposits (FDs) and recurring deposits (RDs).

- Rules for obtaining funds from premature FD withdrawals.

- Situational Question:

The female panelist asked why the candidate believed they were better suited for the role than a male colleague. The candidate provided a diplomatic response, emphasizing that dedication and commitment transcend gender. - General Awareness:

The panel also inquired about banking current affairs and problem-solving in hypothetical scenarios, testing the candidate’s confidence and preparation.

Outcome

The overall experience was positive, despite initial challenges with documentation. The candidate’s confidence, adaptability, and in-depth responses left a strong impression on the panel.

February 16, 2024

Reporting and Document Verification

The second interview was conducted at Syndicate Bank’s regional office, also in Chandigarh, with a reporting time of 1:00 PM. Candidates were asked to arrive 15 minutes early, and the process began promptly.

Document verification was smooth, and the candidates were divided into groups of 10. The interview process commenced soon after.

Interaction with the Panel

The panel for this session also comprised five members, including a senior female member. The candidate entered with a composed demeanor and greeted the panel.

Core Questions and Areas Explored

- Educational Background:

The candidate was questioned about their academic journey and how it related to their interest in banking. - Technical Questions:

- Differences between NBFCs and banks.

- The role of NABARD in rural banking.

- How CRR and SLR impact the economy.

- Behavioral and Situational Questions:

The panel explored hypothetical workplace scenarios, such as how the candidate would handle pressure or deal with an irate customer. The responses showcased problem-solving skills and customer-centric thinking. - Current Affairs and Banking Awareness:

The panel asked questions about the repo rate and the global banking system, testing the candidate’s awareness of current trends. The responses demonstrated thorough preparation.

Final Impressions

The panel commended the candidate for their clarity and confidence. The interaction ended on a positive note, with the panel expressing appreciation for the well-thought-out responses.

Conclusion

The IBPS PO Interview Experience 2025 highlights the importance of preparation, adaptability, and confidence in the interview process. By focusing on technical knowledge, banking awareness, and effective communication, aspirants can stand out in this competitive stage. These experiences underline that success in the IBPS PO interview is achievable with the right approach and mindset.

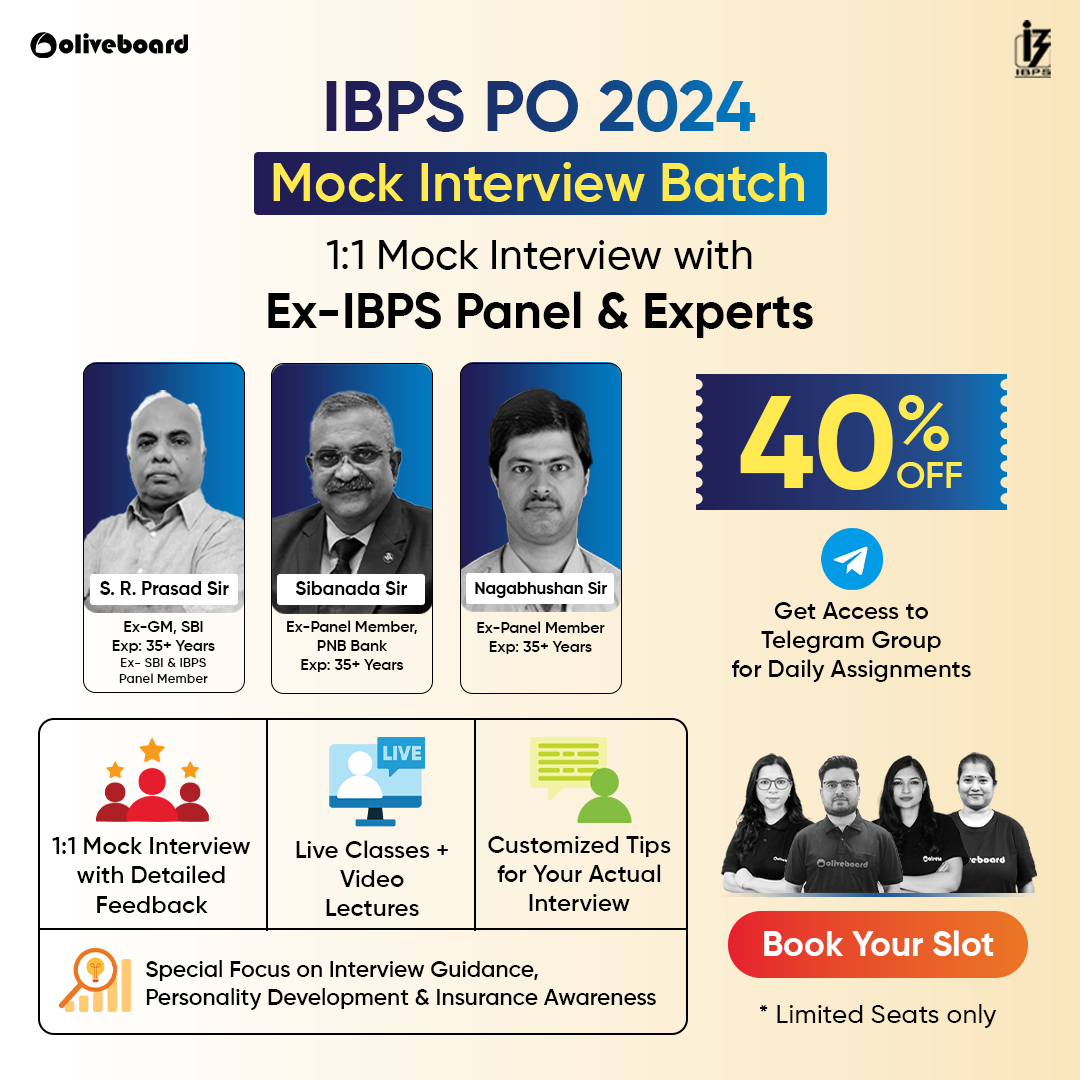

- IBPS PO Interview Questions 2025, Expected Questions to Prepare

- IBPS PO Interview Date 2025 Out, Interview Starts 11th Feb 2025

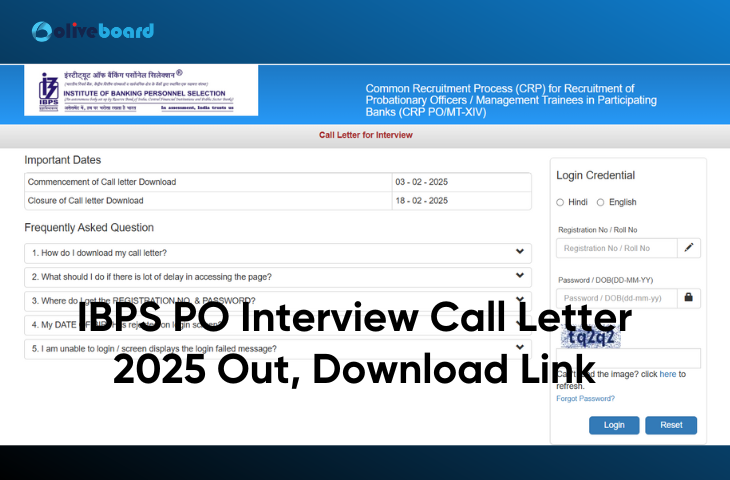

- IBPS PO Interview Call Letter 2025 Out, Download Link

- How to Explain a Gap Year in the IBPS PO Interview?

- How to Prepare for IBPS PO Interview 2025? IBPS PO Interview Strategy

- IBPS PO Interview Marks, Check the Marking Scheme

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in