IIBF CCP Exam 2025: The Certified Credit Professional (CCP) course is a specialized certification program offered by the Indian Institute of Banking and Finance (IIBF). This course is designed to equip banking and finance professionals with the skills and knowledge required to handle various aspects of credit management effectively. The CCP course focuses on areas such as Working Capital Management, Credit Appraisal, Loan Policy, Project Finance, and more. It is an essential certification for those working in the credit departments of banks or aspiring to become credit officers.

Objective of the CCP Course

The primary objective of the CCP course is to develop competent credit officers who can proficiently manage credit functions within a bank. The course aims to:

- Enhance Credit Management Skills: Train professionals to handle complex credit-related issues, including risk assessment and loan monitoring.

- Improve Decision-Making: Equip bankers with the ability to make informed decisions regarding loan approvals, creditworthiness assessments, and managing impaired assets.

- Foster Compliance: Ensure that credit professionals are well-versed in regulatory compliance and credit policies.

- Risk Mitigation: Enable professionals to predict and manage risks associated with lending, thereby reducing the incidence of bad debts.

Eligibility Criteria for IIBF CCP Exam 2025

To enroll in the CCP course, candidates must meet the following eligibility criteria:

- Educational Qualification: Candidates should have passed the 12th standard from a recognized board or have an equivalent qualification. Both IIBF members and non-members are eligible to apply.

- Work Experience: While not mandatory, it is beneficial for candidates to have some experience in banking or finance, especially in credit-related roles.

Certified Credit Professional Preparation Batch 2025

Join our Certified Credit Professional Certification Exam Preparation Batch today and take a step forward in your banking career. This program offers 65+ recorded sessions to cover the complete syllabus, 500+ chapter-wise MCQs for practice and revision, and detailed coverage of all modules based on the latest exam pattern. You’ll also get 65+ downloadable PDF notes for easy learning and quick review. With structured sessions, including conceptual learning, MCQ practice, and class notes, this course is designed to help you succeed. Enroll now and start your preparation.

Certified Credit Professional Preparation Batch 2025 – Click here

Key Components of the IIBF CCP Exam 2025

The CCP course is comprehensive, covering various critical aspects of credit management. The curriculum includes:

- Loan Policy: Understanding the bank’s loan policy, including the guidelines for approving and disbursing loans.

- Credit Appraisal: Techniques for assessing the creditworthiness of borrowers and analyzing their financial health.

- Analysis of Financial Statements: Learning to interpret and evaluate financial statements to make informed lending decisions.

- Project Finance: Knowledge of financing large-scale projects, including risk assessment and funding strategies.

- Working Capital Management: Managing the short-term financial needs of businesses, including the assessment of working capital requirements.

- Export Credits: Understanding the credit facilities available for exporters, including pre-shipment and post-shipment finance.

- Credit Monitoring: Techniques for monitoring the performance of loans and ensuring timely repayments.

- Management of Impaired Assets: Strategies for managing non-performing assets and reducing bad debt exposure.

Importance of the CCP Course

The CCP course is crucial for banking professionals specializing in credit management. It provides a robust foundation in credit-related concepts and practices, enabling professionals to:

- Improve Career Prospects: Achieving CCP certification can lead to career advancement and new opportunities within the banking sector.

- Build Expertise: Gain in-depth knowledge of credit management, which is essential for handling the complexities of lending and credit risk.

- Enhance Professional Credibility: Being certified as a Credit Professional by a reputable institution like IIBF adds significant value to one’s professional profile.

How to Prepare for the CCP Exam?

- Understand the Syllabus: Familiarize yourself with the entire syllabus, ensuring you cover all key topics in credit management.

- Study Material: Utilize IIBF-provided study materials along with additional resources such as textbooks and online courses.

- Practice with Mock Tests: Regularly take mock tests to assess your understanding and improve your exam-taking skills.

- Join Study Groups: Engage with peers in study groups to discuss difficult topics and share knowledge.

- Stay Informed: Keep yourself updated on the latest developments in banking and finance, as these may be relevant to the exam.

Also Read,

| Related Article | Link |

| Important IIBF Certifications | Click Here |

| IIBF CCP Apply Online 2025 | Click Here |

| IIBF CCP Syllabus 2025 | Click Here |

| IIBF CCP Registration Process | Click Here |

| IIBF Certificate Exam 2025 Schedule | Click Here |

Conclusion

The Certified Credit Professional (CCP) course by IIBF is a vital certification for those seeking to excel in the field of credit management. With a comprehensive curriculum and a focus on practical skills, the CCP course prepares banking professionals to tackle the challenges of credit assessment, risk management, and regulatory compliance effectively. By becoming a Certified Credit Professional, individuals not only enhance their knowledge and skills but also significantly boost their career prospects in the banking industry.

- SBI CBO Admit Card 2025 Out, Exam Date 20th July

- 40 Geometry Formulas PDF – Download Here

- Caselet DI Questions for SBI PO Exam 2025 With Solutions

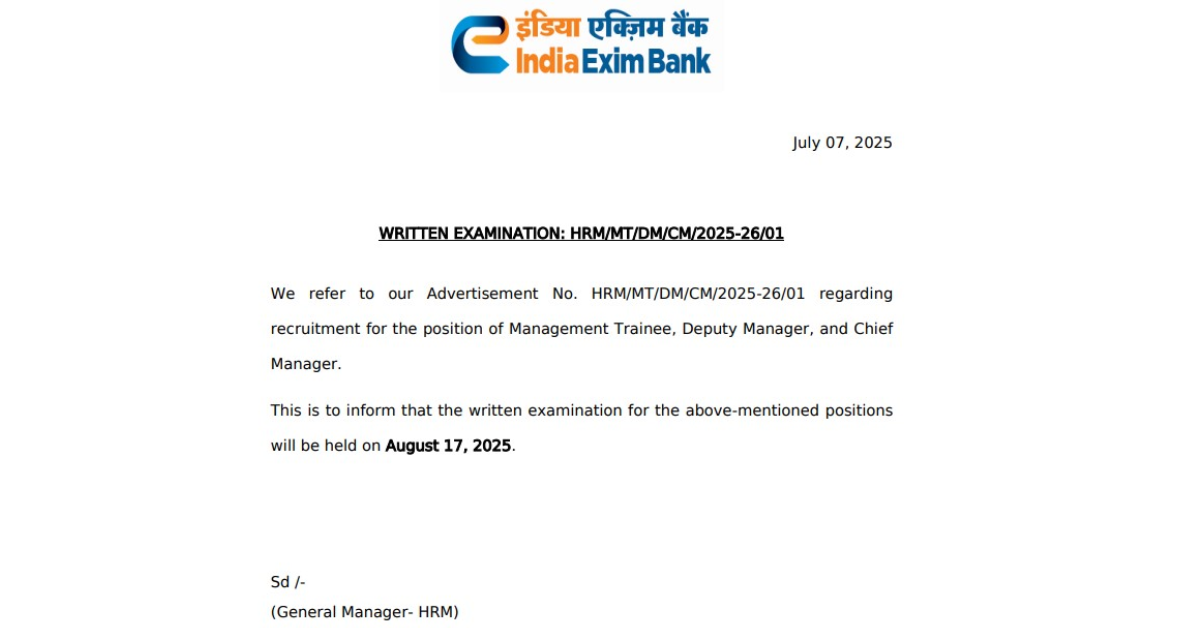

- Exim Bank Exam Date 2025 Out, Check Schedule, and Admit Card

- Arithmetic Questions for SBI PO Exam 2025 With Solutions

- Fillers Questions for SBI PO Exam, Practice with Solutions

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!