Pradhan Mantri Jan Dhan Yojana (PMJDY)

In August 2014, the Prime Minister launched a program called Pradhan Mantri Jan Dhan Yojana (PMJDY) across the country. Its aim was to ensure that everyone gets involved in banking. PMJDY offers banking services to households without bank accounts, focusing on those who haven’t had access to banking before. The Pradhan Mantri Jan Dhan Yojana (PMJDY) program was extended beyond August 14, 2018, with a new emphasis on opening accounts for adults who don’t have bank accounts yet.

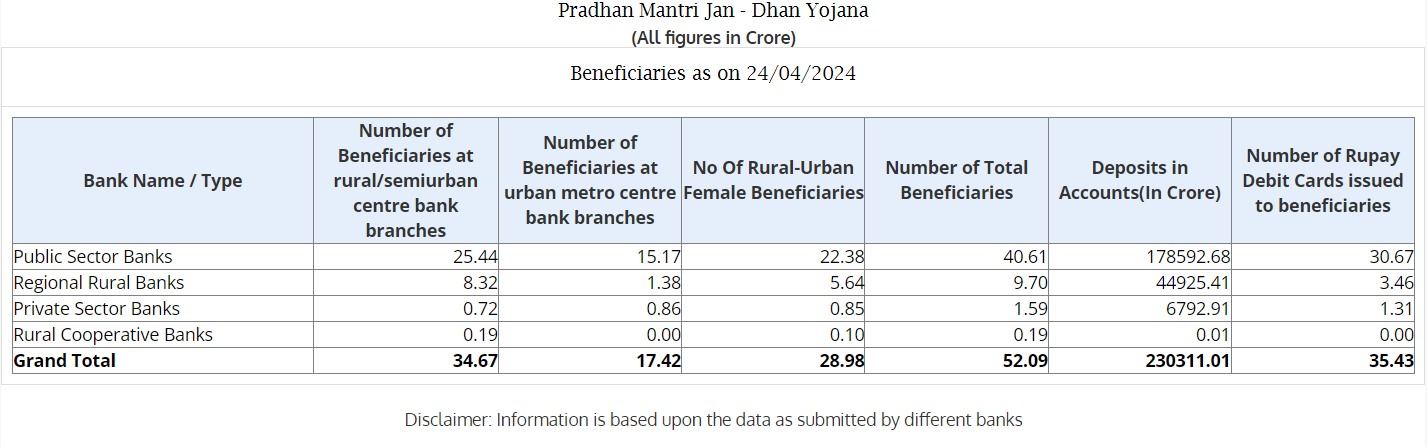

Overview Table of Pradhan Mantri Jan-Dhan Yojana (PMJDY)

| Aspecs | Details |

| Name of Scheme | Pradhan Mantri Jan-Dhan Yojana |

| Launch Date | 28th August 2014 |

| Ministry | Ministry of Finance |

| Interest Rate | What interest the bank is offering for a savings account |

| Minimum Required Balance | Zero Balance Account if Check facility not availed |

| Provision for Overdraft Facility | Available |

| Amount of Accidental Insurance Cover | Under Rupay Scheme, Rs.1,00,000/- for accounts opened before 28th August 2018, and Rs.2,00,000/- for those opened on or after that date |

A PMJDY account is eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha BimaYojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

What Is Pradhan Mantri Jan Dhan Scheme?

Launched in August 2014, the National Mission for Financial Inclusion (NMFI), also known as Pradhan Mantri Jan Dhan Yojana (PMJDY), aims to boost citizens’ engagement in financial activities. PMJDY provides banking services to unbanked households, emphasizing reaching the financially underserved and neglected areas.

The scheme was extended beyond August 14, 2018, focusing on unbanked adults. Recent enhancements include raising the overdraft limit to Rs. 10,000/- and doubling accidental insurance cover to Rs. 2 lakhs for RuPay cardholders.

PMJDY has significantly increased banking access and financial inclusion nationwide, offering essential services like savings accounts, tailored credit, remittances, and insurance to marginalized groups.

प्रधानमंत्री जन धन योजना (पीएमजेडीवाई)

प्रधानमंत्री जन धन योजना (पीएमजेडीवाई) भारतीय सरकार की एक महत्वपूर्ण वित्तीय समावेशन योजना है जो 2014 में लॉन्च की गई थी। इसका उद्देश्य है वित्तीय समावेशन में सुधार करना और गरीब और कम आय वाले व्यक्तियों को वित्तीय सेवाओं तक पहुंचना। यह योजना भारतीय नागरिकों को बेंकिंग सेवाओं का अधिक उपयोग करने की सुविधा प्रदान करती है और उन्हें बेंकिंग सिस्टम से जोड़ती है। इसके माध्यम से सरकार कम वित्तीय समावेशित वर्गों को बेहतर वित्तीय सेवाओं का लाभ दिलाने का प्रयास कर रही है।

PM Jan Dhan Yojana Benefits

The list of special PM Jan Dhan Yojana Benefits are provided in the following:

- Interest on deposit in the savings account.

- Accidental insurance cover of Rs.1,00,000/-.

- No minimum balance is required.

(A minimum balance should be maintained to avail the cheque facility)

- For cash withdrawal from any ATM using Rupay Card, some balance is required to be kept in the account.

- Rs.30,000/- Life Insurance Cover.

- Easy money transfers to any part of the country.

- The Beneficiaries of Govt. Schemes will receive direct Benefit Transfers in these accounts.

- An overdraft facility will be given, provided that the account holder maintains the account in a good manner for six months.

- Access to Pension and insurance products

- For the Accidental Insurance Cover, RuPay Debit Card should be used at least once in forty-five days.

- Overdraft facility up to Rs.5000/- will be available in only one account per household. Preference will be given to the female account holders.

- Account-holders can check their account balance using the mobile banking app.

- It ensures to provide on CBS(Core Banking System) along with mobile banking using the USSD facilities. Call centre facility and a toll-free number is available nationwide.

PM Jan Dhan Yojana Achievements

Over 52.09 Crore beneficiaries have been banked thus far, with a substantial balance of ₹230,311.01 Crore in beneficiary accounts as on 1st May, 2024.

This extensive reach is facilitated by 11.59 lakh Bank Mitras who provide branchless banking services across the country.

Public sector banks lead in serving beneficiaries, with 40.61 million in rural/semi-urban and 15.17 million in urban branches as on 24th April, 2024.

Regional rural banks follow, with 9.70 million beneficiaries. Private sector banks serve 1.59 million.

In total, 52.09 million beneficiaries are banked, with ₹230,311.01 Crore in deposits. RuPay debit cards issued amount to 35.43 million.

Pradhan Mantri Jan Dhan Yojana Eligibility

Following is the eligibility criteria for opening a PMJDY account:

- Be a citizen of India

- Be 10 years of age or above

- Should not be a bank account holder

PM Jan Dhan Yojana Application Process

Step 1 – Visit the official PMJDY portal.

Step 2 – Navigate to the “e-documents” section where you’ll find active links for the “Account Opening Form” available in both English and Hindi. Choose your preferred language.

Step 3 – Download the form in PDF format and print it out.

Step 4 – Complete the form manually with all required bank and personal details, such as bank branch, location, Aadhaar number, profession, income, Kisan credit card details, etc.

Step 5 – After filling out the form, visit your nearest bank branch and submit it.

During submission, ensure you have the necessary documents and provide your mobile number or email ID to be eligible for the Jan Dhan Yojana.

PM Jan Dhan Yojana Documents Required

1. AADHAAR

2. Government ID proofs (Voter Card/PAN Card/Ration card)

3. Permanent Address proof (Passport/Driving License/Electricity Bill/Telephone Bill/Water Bill)

4. Passport size photograph

5. Filled and Signed PMJDY Account opening form

6. Any other document as notified by the Central Government in consultation with the Regulator.

Conclusion

Launched in August 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to boost financial inclusion by providing banking services to all citizens. With benefits like zero balance accounts and increased insurance coverage, PMJDY has significantly improved banking access, serving over 52.09 Crore beneficiaries with ₹230,311.01 Crore in deposits.

Frequently Asked Questions

Ans: The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched on 28th August, 2014.

Ans: The amount of accidental insurance cover under the Rupay Scheme is Rs.1,00,000/- for accounts opened before 28th August 2018, and Rs.2,00,000/- for those opened on or after that date

Ans: Benefits include interest on savings, accidental insurance cover, zero minimum balance requirement, easy money transfers, access to government schemes, overdraft facility, and more.

Ans: PMJDY, launched in 2014, is a government program to bring banking services to everyone, especially those who didn’t have them before. It offers benefits like no minimum balance, interest on savings, insurance, and access to loans. It’s helped more people get access to banking across India.

- GA Questions Asked In SBI PO Mains 2025, 5th May Analysis

- Pradhan Mantri Suraksha Bima Yojana 2024 Overview & Benefits

- Central Government Schemes 2024, List of Schemes under Every Ministries

- Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) 2024

- Pradhan Mantri Gramodaya Yojana 2024 Features & Benefits

- Pradhan Mantri Van Dhan Yojana 2024, Features, Components & Stages

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3 years of experience in content and SEO optimization, I have led content for popular exams like SSC, Banking, Railways, and State Exams.