The LIC AAO (Assistant Administrative Officer) exam requires candidates to have a strong understanding of the Indian financial system, including the money market. This topic is a frequent part of the General Awareness section, where questions test aspirants’ knowledge of short-term financial instruments, their features, and regulatory aspects.

The money market plays a crucial role in providing liquidity, meeting short-term funding requirements, and ensuring smooth functioning of the economy. In this article, we will cover the money market for the LIC AAO exam with clear explanations, examples, and exam relevance.

What is the Money Market?

The money market is a segment of the Financial Market where short-term financial instruments with high liquidity and maturities of up to one year are traded. It acts as a source of short-term borrowing and lending for governments, banks, and corporations. In simple words: The money market is like a marketplace for short-term loans and investments that ensures liquidity in the economy. The key characteristics of the money market are

- Deals with short-term debt instruments

- Ensures liquidity for businesses and governments

- Provides safety with low risk

- Acts as a platform for RBI to regulate liquidity

Importance of Money Market and Its Instruments for Banking Aspirants

For aspirants preparing for LIC AAO, IBPS, RBI, SBI PO, and other banking exams, the money market is an essential topic. Exam questions often test the knowledge of instruments, their features, and their importance in the financial system.

Why Banking Aspirants Should Focus on Money Market:

- Helps in understanding how RBI regulates liquidity and inflation

- Frequently asked in General/Banking Awareness sections

- Explains the functioning of safe short-term investment instruments

- Builds conceptual clarity on financial stability and liquidity management

What Are Money Market Instruments?

Money Market Instruments are short-term financial tools that allow borrowing and lending of funds for a period of up to one year. They are highly liquid, safe, and widely used by governments, banks, and companies to manage short-term money needs.

These instruments are traded in the money market, which is a part of the financial market that deals only with short-term funds (less than 1 year). Unlike the capital market (where long-term securities like shares and bonds are traded), the money market focuses on liquidity and quick funding.

Key Features of Money Market Instruments:

- Short-term maturity (generally from 1 day to 1 year).

- High liquidity (easy to buy and sell).

- Low risk (since many are backed by the government or banks).

- Lower returns compared to long-term securities.

- Widely used by RBI to regulate liquidity in the economy.

Examples of Money Market Instruments:

- Treasury Bills (T-Bills)

- Commercial Papers (CP)

- Certificates of Deposit (CD)

- Call and Notice Money

- Commercial Bills

- Repo and Reverse Repo Agreements

- Collateralized Borrowing and Lending Obligations (CBLO)

Types of Money Market Instruments

Several instruments are traded in the money market, each serving a specific purpose. Understanding these will give you a solid foundation in financial markets.

1. Treasury Bills (T-Bills)

Treasury Bills are a popular and secure money market instrument. They are short-term debt securities issued by the central government of a country, in India’s case, the Government of India, to meet its temporary funding needs. T-Bills are known for their high degree of safety as they are backed by the government.

Key Features of T-Bills:

- Zero-Coupon Instruments: T-Bills do not pay any interest. Instead, they are issued at a discount to their face value and redeemed at the face value upon maturity. The difference between the issue price and the face value is the return for the investor.

- Maturity Periods: In India, T-Bills are issued with maturities of 91 days, 182 days, and 364 days.

- Auction-Based Issuance: The Reserve Bank of India (RBI) conducts weekly auctions to issue T-Bills on behalf of the government.

- Negligible Risk: Since they are backed by the government, the risk of default is almost non-existent.

Types of T-Bills in India:

| Type | Maturity Period |

| 91-Day T-Bills | 91 days |

| 182-Day T-Bills | 182 days |

| 364-Day T-Bills | 364 days |

2. Commercial Paper (CP)

Commercial Paper is an unsecured promissory note issued by corporations to raise short-term funds. It is a popular tool for highly-rated companies to meet their working capital requirements or bridge short-term cash deficits. CPs are an alternative to bank loans, offering corporations a flexible and often cheaper source of finance.

- Unsecured Nature: CPs are not backed by any collateral. Therefore, only companies with a high credit rating can issue them, as the risk of default is a key consideration for investors.

- Maturity: The maturity period of a CP can range from 7 days to a maximum of one year.

- Issuance: CPs are issued at a discount to their face value, similar to T-Bills. The return is the difference between the discounted issue price and the face value received at maturity.

- Regulatory Body: The Reserve Bank of India (RBI) provides the guidelines for issuing CPs in India.

3. Certificate of Deposit (CD)

A Certificate of Deposit is a negotiable, short-term debt instrument issued by commercial banks and financial institutions. It is essentially a receipt for a deposit of funds, promising to repay the deposited amount with interest after a specified period. CDs are a way for banks to raise funds, and for investors, they offer a low-risk, fixed-income investment.

- Issuers: CDs can be issued by Scheduled Commercial Banks and select All-India Financial Institutions (FIs).

- Maturity: The maturity period for CDs issued by banks ranges from 7 days to one year, and for FIs, it is typically between 1 and 3 years.

- Negotiable: A key feature of a CD is its negotiability, meaning it can be traded in the secondary market before its maturity date.

- Risk: CDs are generally low-risk, especially if issued by a well-established bank. Deposits in a bank up to a certain limit are also often protected by deposit insurance schemes (e.g., DICGC in India).

4. Commercial Bills (CBs)

Commercial Bills, also known as trade bills, are instruments used to finance the trade of goods. A commercial bill is a bill of exchange that arises out of a genuine trade transaction. For example, when a seller of goods (drawer) sells to a buyer (drawee) on credit, the seller can draw a bill of exchange on the buyer, who accepts it. This accepted bill becomes a commercial bill.

- Purpose: Used for financing business transactions, especially those involving credit sales.

- Maturity: Typically have a short maturity period, often around 90 days.

- Discounting: A holder of a commercial bill can “discount” it with a bank before its maturity to get immediate funds. The bank purchases the bill at a discounted price and collects the full amount from the buyer on the maturity date. This provides liquidity to the seller.

5. Call/Notice Money Market

The Call/Notice Money Market is a highly liquid segment of the money market where banks and financial institutions lend and borrow funds from each other for very short durations to meet their cash reserve requirements (CRR) and statutory liquidity requirements (SLR).

- Call Money: Refers to borrowing and lending for a single day. The funds are repaid on the next working day.

- Notice Money: Refers to borrowing and lending for a period of 2 to 14 days. A notice is required to be given for repayment.

- Participants: Primarily banks and other financial institutions that require immediate funds to maintain their statutory reserves. The interest rate in this market is highly volatile and is a key indicator of liquidity in the banking system.

6. Collateralised Borrowing and Lending Obligation (CBLO)

CBLO is a money market instrument introduced by the Clearing Corporation of India Ltd. (CCIL). It allows market participants to borrow and lend funds against government securities as collateral. It was developed as an alternative to the Call/Notice Money Market, offering a secured and regulated platform for overnight lending and borrowing.

- Collateral-Backed: Unlike call money, CBLO transactions are backed by government securities, making them a more secure option.

- Maturity: Typically for an overnight period, but can extend up to a year.

- Role of CCIL: The CCIL acts as a central counterparty, guaranteeing the settlement of all CBLO transactions. This eliminates counterparty risk for participants.

- Participants: Banks, financial institutions, mutual funds, and other entities with eligible government securities.

Why is a Strong Money Market Important?

A well-developed money market is crucial for a healthy and stable financial system. Here’s why:

- Liquidity Management: It helps banks and corporations manage their short-term liquidity needs, ensuring they have the cash to meet their immediate obligations.

- Monetary Policy Transmission: The interest rates in the money market are a direct reflection of the central bank’s monetary policy. The RBI uses these rates to influence lending and borrowing in the broader economy.

- Government Financing: It provides a reliable and low-cost source of short-term funds for the government to manage its fiscal deficit.

- Promoting Economic Growth: By facilitating the efficient movement of funds, the money market helps in the optimal allocation of resources, which is vital for economic growth.

Comparative Table of Money Market Instruments

This table helps you quickly compare who issues, tenor, form, and risk handy for MCQs and quick revisions.

| Instrument | Issuer / Market | Typical Tenor | Issue Form | Security | Typical Users | Key Risk |

| T-Bills | Govt. of India (via RBI auctions) | 91/182/364 days; CMBs as needed | Discount (zero-coupon) | Sovereign | Banks, MFs, insurers | Interest-rate risk if sold early |

| CP | Companies/NBFCs/AIFIs | 7–365 days | Discount, demat | Unsecured | Banks, MFs, insurers, treasuries | Credit risk of issuer |

| CD | Banks & AIFIs | 7–365 days | Demat receipt | Issuer credit | Banks, MFs, insurers | Rate/market risk on sale |

| Commercial Bills / BAs | Trade counterparties; bank-accepted bills carry bank guarantee | Usually weeks to a few months | Discount/acceptance | Bank guarantee (for BA) | Banks, MFs (via bill funds), corporates | Trade/operational risk |

| Call/Notice Money | Inter-bank/PD market | 1 day (Call); 2–14 days (Notice) | Loans | Unsecured | Banks, PDs | Rate volatility |

| CBLO → TREPS | (Legacy) CBLO by CCIL; Now TREPS triparty repo by CCIL | Typically overnight | Repo (secured) | Collateralised by G-secs/T-Bills | Banks, MFs, PDs | Collateral/settlement rules |

FAQs

The money market is a part of the financial market where short-term funds (up to one year) are borrowed and lent. It ensures liquidity and smooth functioning of the economy.

The key instruments include Treasury Bills, Commercial Papers, Certificates of Deposit, Commercial Bills, Call/Notice Money, and CBLO/TREPS.

It is frequently asked in exams like IBPS, SBI, RBI, LIC AAO, etc., and builds clarity on liquidity management and monetary policy tools.

The money market deals with short-term funds and safe instruments, while the capital market deals with long-term investments like shares and bonds.

The Reserve Bank of India (RBI) regulates the money market, ensuring stability, transparency, and smooth flow of funds.

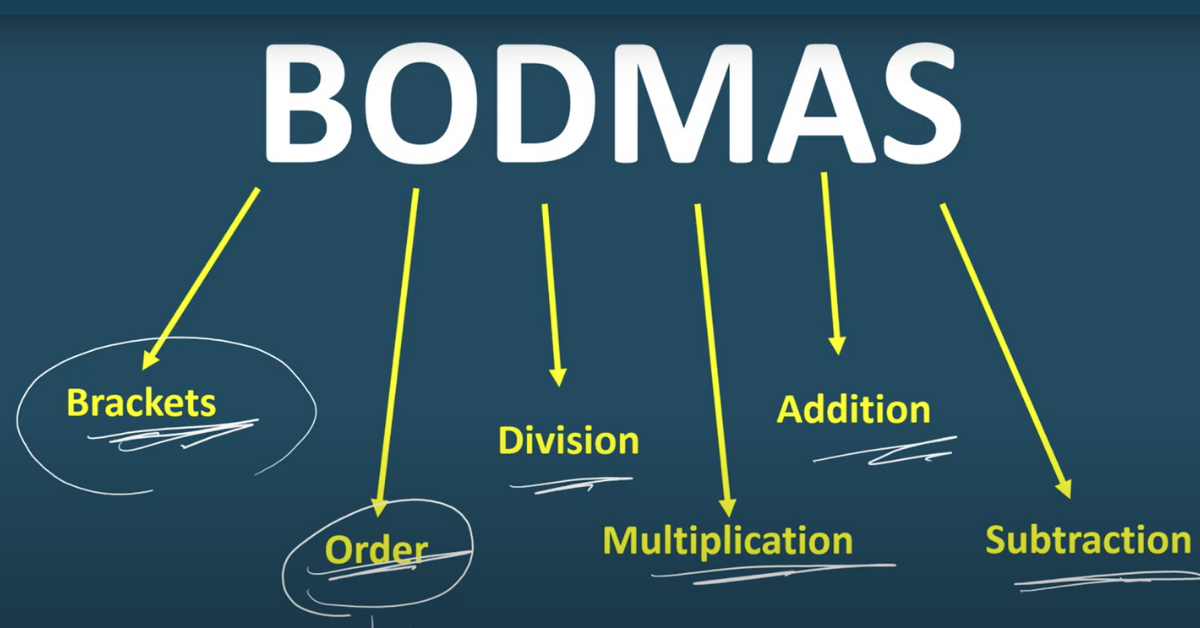

- Simplification Questions For Bank Exams, Live Quiz, FREE PDF

- IBPS Clerk Final Vacancy 2025-26: Check State-wise List

- RBI Office Attendant Exam Analysis 2026, 1st March, All Shifts

- SBI Clerk Mains Answer Key 2026 Response Sheet Date

- Bihar State Cooperative Bank Clerk Final Result 2025 Out

- SBI Clerk Document Verification, List of Documents Required

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.