What is the Global Financial Stability Report (GFSR)?

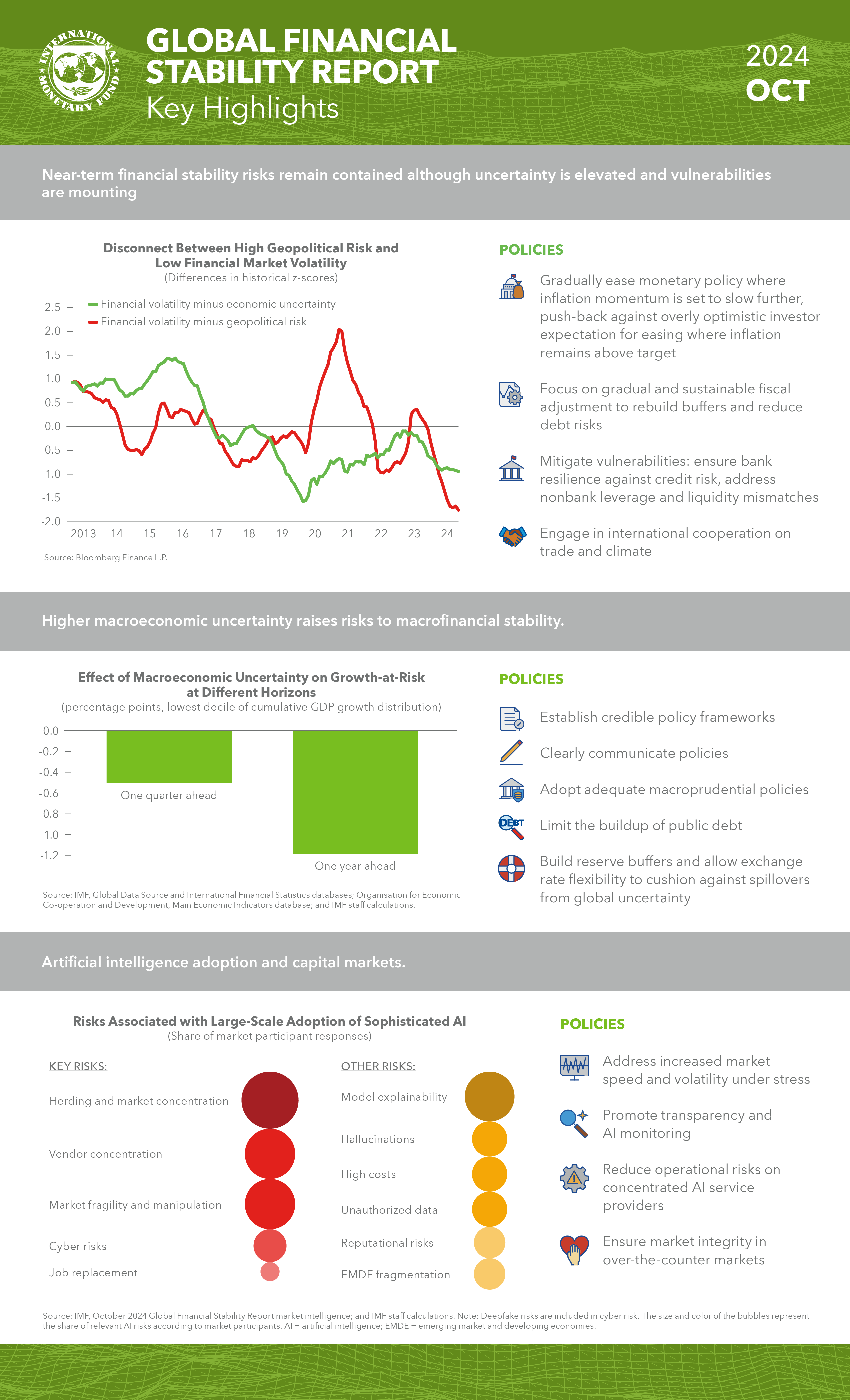

The Global Financial Stability Report (GFSR) is a semi-annual flagship publication of the International Monetary Fund (IMF), released typically in April and October. It offers a comprehensive and authoritative assessment of where global financial stability stands—identifying emerging risks, trends in financial markets, vulnerabilities among financial actors, and policy recommendations to uphold systemic resilience. The report draws on a rich mix of data, charts, stress-testing frameworks, and analysis by IMF experts to deliver forward-looking insights.

In the April 2025 issue, titled “Enhancing Resilience amid Uncertainty”, the GFSR clearly states that global financial stability risks have risen sharply, owing to tighter global financial conditions and heightened geopolitical and trade uncertainties IMF. By spotlighting top vulnerabilities, the report sets the agenda for policymakers, regulators, and exam-preparing candidates.

Global Financial Stability Reports

To make your preparation easier, here is a year-wise and issue-wise list of Global Financial Stability Reports (GFSR) released by the IMF. You can directly access the official reports by clicking on the links below. These reports are published twice a year (April and October) and provide key insights on global financial risks, stability, and policy measures.

| Year | Issued month | Theme | Direct link |

| 2025 | April | Enhancing Resilience amid Uncertainty (latest) | Click Here |

| 2024 | October | Steadying the Course: Uncertainty, Artificial Intelligence, and Financial Stability | Click Here |

| 2024 | April | The Last Mile: Financial Vulnerabilities and Risks | Click Here |

| 2023 | October | Financial and Climate Policies for a High-Interest-Rate Era | Click Here |

| 2023 | April | Safeguarding Financial Stability amid High Inflation and Geopolitical Risks | Click Here |

| 2022 | October | Navigating the high-inflation environment | Click Here |

| 2022 | April | Shockwaves from the War in Ukraine Test the Financial System’s Resilience | Click Here |

| 2021 | October | COVID-19, Crypto, and Climate: Navigating Challenging Transitions | Click Here |

| 2021 | April | Preempting a Legacy of Vulnerabilities | Click Here |

| 2020 | October | Bridge to Recovery | Click Here |

| 2020 | June | Financial Conditions Have Eased, but Insolvencies Loom Large | Click Here |

| 2020 | April | Markets in the Time of COVID-19 | Click Here |

| 2019 | October | Lower for Longer | Click Here |

| 2019 | April | Vulnerabilities in a Maturing Credit Cycle | Click Here |

| 2018 | October | A Decade after the Global Financial Crisis: Are We Safer? | Click Here |

| 2018 | April | A Bumpy Road Ahead | Click Here |

| 2017 | October | Is Growth at Risk? | Click Here |

| 2017 | April | Getting the Policy Mix Right | Click Here |

| 2016 | October | Fostering Stability in a Low-Growth, Low-Rate Era | Click Here |

| 2016 | April | Potent Policies for a Successful Normalization | Click Here |

| 2015 | October | Vulnerabilities, Legacies, and Policy Challenges | Click Here |

| 2015 | April | Navigating Monetary Policy Challenges and Managing Risks | Click Here |

| 2014 | October | Risk Taking, Liquidity, and Shadow Banking: Curbing Excess While Promoting Growth | Click Here |

| 2014 | April | Moving from Liquidity- to Growth-Driven Markets | Click Here |

| 2013 | October | Transition Challenges to Stability | Click Here |

| 2013 | April | Old Risks, New Challenges | Click Here |

| 2012 | October | Restoring Confidence and Progressing on Reforms | Click Here |

| 2012 | April | The Quest for Lasting Stability | Click Here |

| 2011 | September | Grappling with Crisis Legacies | Click Here |

| 2011 | April | Durable Financial Stability: Getting There from Here | Click Here |

| 2010 | October | Sovereigns, Funding, and Systemic Liquidity | Click Here |

| 2010 | April | Meeting New Challenges to Stability and Building a Safer System | Click Here |

| 2009 | October | Navigating the Financial Challenges Ahead | Click Here |

| 2009 | April | Responding to the Financial Crisis and Measuring Systemic Risks | Click Here |

| 2008 | October | Financial Stress and Deleveraging Macro-Financial Implications and Policy | Click Here |

| 2008 | April | Containing Systemic Risks and Restoring Financial Soundness | Click Here |

| 2007 | September | Financial Market Turbulence: Causes, Consequences, and Policies | Click Here |

| 2007 | April | Market Developments and Issues | Click Here |

| 2006 | September | Market Developments and Issues | Click Here |

| 2006 | April | Market Developments and Issues | Click Here |

| 2005 | September | Market Developments and Issues | Click Here |

| 2004 | April | Market Developments and Issues | Click Here |

| 2003 | September | Market Developments and Issues | Click Here |

| 2003 | March | Market Developments and Issues | Click Here |

| 2002 | December | Market Developments and Issues | Click Here |

| 2002 | September | Market Developments and Issues | Click Here |

| 2002 | June | A Quarterly Report on Market Developments and Issues | Click Here |

| 2002 | March | A Quarterly Report on Market Developments and Issues | Click Here |

Highlights of the Latest Global Financial Stability Report 2025

The April 2025 GFSR, titled “Enhancing Resilience amid Uncertainty,” underscores that global financial stability risks have risen sharply due to a mix of tighter financial conditions and escalating geopolitical tensions.

Key takeaways:

- Overvalued Asset Prices

Many markets including equities and corporate bonds are priced above historical norms. A sudden correction could cascade through leveraged sectors and fuel broader instability. - Leverage and Connectedness in Non-Bank Financial Intermediaries (NBFIs)

Shadow banks are increasingly interlinked with traditional banking systems. Their leverage and liquidity mismatches amplify the risk of contagion they can transmit shocks rapidly to the broader financial system. - Sovereign Vulnerabilities in Emerging Markets

With higher refinancing costs and weaker fiscal positions, emerging economies are more exposed. Souring global conditions can push up bond yields, increasing debt servicing pressures.

Important Themes from Previous Editions

Understanding how the Global Financial Stability Report (GFSR) has evolved over time helps you assess the shifting landscape of financial vulnerabilities and equips you with strong comparative analysis for exams. Below is a detailed look at the most recent editions (2022–2024), each with its key theme, exam-ready summary, and visual suggestion.

October 2024 – Steadying the Course: Uncertainty, Artificial Intelligence, and Financial Stability

Core theme: While near-term financial risks may appear contained, rising economic and geopolitical uncertainty could amplify structural vulnerabilities such as those exposed during a “macro-market disconnect” (when volatility is low despite elevated uncertainty).

Highlights:

- Macro-market disconnect: Markets were calm, but underlying risks like rising debt and complacent volatility could worsen shocks.

- AI in capital markets:

- Heightened market speed and volatility during stress, especially if AI-driven strategies respond uniformly to shocks

- Greater complexity and reduced transparency as AI shifts activity toward less-regulated non-bank intermediaries (NBFIs), making oversight more difficult

- Operational risks from reliance on key AI service providers, which dominate computational and large language model infrastructure

- Cyber and manipulation vulnerabilities, such as advanced phishing, disinformation, or automated fraud using AI tools

April 2022 – Shockwaves from the War in Ukraine: Financial System’s Resilience Tested

Core theme: The war in Ukraine triggered multidimensional threats to financial stability commodity shocks, sovereign-bank feedback loops, and fintech disruption in an unstable global context.

Highlights:

- Geopolitical–monetary dilemma: Rising commodity prices challenged central banks’ dual mandate tame inflation without choking growth. Emerging markets, particularly fragile, experienced acute stress.

- Sovereign-bank nexus risk: In many emerging economies, banks’ rising holdings of domestic sovereign debt created dangerous feedback loops that could precipitate financial instability.

- Fintech and DeFi risks: The rapid growth of fintech and DeFi introduced new vulnerabilities requiring proportional regulation for both incumbents and disruptors

Why the GFSR is Important for Exam Preparation?

The GFSR stands apart as a core resource for anyone preparing for competitive exams in economics, finance, or public policy (like UPSC, RBI Grade B, SEBI, and similar). Here’s why:

- Authority & Credibility

It’s published by the IMF widely accepted as a global standard in monitoring financial health. Referencing the GFSR gives your answers weight and reliability. - Current Data & Examples

Its charts (like Growth-at-Risk, asset valuation tension, sovereign spreads) and real-world cases are extremely useful for exams especially for data-driven or application-focused questions. - Sharply Focused Language

Executive Summaries are crafted to capture key messages in concise sentences perfect for beginning your answers with clarity and purpose. - Policy Insight

Each edition ends with recommendations (e.g., bolster capital buffers, strengthen NBFI oversight, enhance liquidity facilities). These are vital to demonstrate analytical and forward-thinking answers in exam scenarios.

Check out our latest video on Global Financial Stability Report with detailed explanation

FAQs

The GFSR is a semi-annual flagship publication of the International Monetary Fund (IMF), released in April and October. It assesses global financial stability, highlights risks, and provides policy recommendations to strengthen resilience.

The IMF publishes the GFSR twice a year — in April and October.

The April 2025 edition is titled “Enhancing Resilience amid Uncertainty.” It warns of rising financial stability risks due to tighter global financial conditions and geopolitical tensions.

For exams like UPSC, RBI Grade B, and SEBI, the GFSR is a trusted source of global financial data, charts, and analysis. It provides case studies and examples that can be directly quoted in answers.

October 2024: “Steadying the Course: Uncertainty, AI, and Financial Stability” – focused on AI risks and macro-market disconnect.

April 2022: “Shockwaves from the War in Ukraine” – examined geopolitical-financial linkages and sovereign-bank risks.

October 2021: “COVID-19, Crypto, and Climate” – discussed pandemic recovery, crypto markets, and climate challenges.

- SEBI IT Officer Syllabus 2026, Exam Pattern, Download PDF

- SEBI Law Officer Recruitment 2026, Download Notification PDF

- SEBI IT Officer Recruitment 2026 Notification, Download PDF

- SEBI Legal Officer Syllabus 2026 & Exam Pattern, Download PDF

- ESI & ARD Practice Questions for NABARD Grade A 2026

- RBI Grade B 2026 Practice Quiz, Download Free PDF

Priti Palit, is an accomplished edtech writer with 4+ years of experience in Regulatory Exams and other multiple government exams. With a passion for education and a keen eye for detail, she has contributed significantly to the field of online learning. Priti’s expertise and dedication continue to empower aspiring individuals in their pursuit of success in government examinations.