Banking Awareness for IBPS PO

Banking Awareness for IBPS PO: If we look at last year’s Main exams of IBPS RRB Officer Scale-I, SBI Clerk, and IBPS RRB Office Assistant, we find that a good number of questions came from Current Affairs of the last 5-6 months. Some questions tested static general knowledge and awareness. Very few questions were from banking awareness. Candidates can easily score more than 35 marks in the Banking Awareness section if they prepare well. The time given to attempt this section is 35 minutes, which is a good amount of time.

Banking Awareness for IBPS PO – Exam Pattern

Let us have a look at the Mains Exam Structure.

| TESTS (Not by Sequence) | No. of Questions | Maximum Marks | Time for each test |

| Reasoning & Computer Aptitude | 45 | 60 | 60 min |

| General/Economy/Banking Awareness | 40 | 40 | 35 min |

| English Language | 35 | 40 | 40 min |

| Data Analysis & Interpretation | 35 | 60 | 45 min |

Out of a total of 155 Questions, General awareness carries 40 marks translating to slightly more than one-fourth of the weightage in the exam.

Banking Awareness:

Banking Awareness consists of a vast list of topics and needless to say, it is dynamic, in the sense, what was the law of land yesterday, could be changed today. To understand the dynamic part of Banking Awareness we need to first master the static concepts that drive the field. The following are the list of important topics for Banking Awareness for IBPS PO Mains.

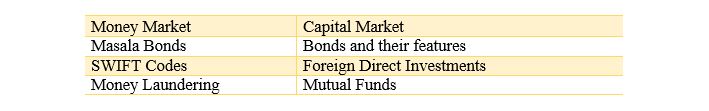

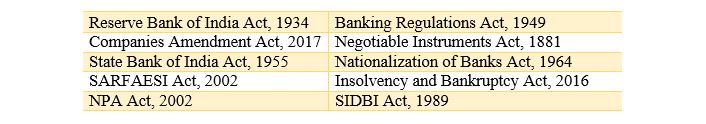

FINANCE SYSTEMS: (Indian and International)

FINANCE CONCEPTS

BANKING IN INDIA

BANKING & FINANCE ACTS

Banking Awareness for IBPS PO – How to Cover Topics

The preparation of Banking Awareness for IBPS PO Mains demands only a basic understanding of the above-said topics. The knowledge gained through these static topics should be applied to banking news that are read in newspapers, magazines, etc., If any particular topic has been widely covered in the news, prior to the month before the mains exam, it gains importance and should be given more importance.

Take a free mock test for IBPS PO- Click here

Where do I prepare from?

- Newspapers for Concepts and Current Affairs: There are many endless sources to prepare these topics from. Starting with standard newspapers such as Business Standard and/or Live Mint could help you with Banking Current Affairs along with the concept behind the same.

- Can books help in exam? Reading books is not generally encouraged for the preparation of Banking Awareness for IBPS PO Mains, one for they could go outdated in the course of time, two it could take a lot of time to finish a book.

- Let’s Go Online! Other online sources such as RBI Websites, SEBI, CIBIL websites can actually help you understand the basic concept.

To get all the important topics in one place refer to Oliveboard’s FREE e-books which includes topics such as Types of Banking, Important Abbreviations, Banking Terms, Banking Apps, Regulations & BASEL Accords, Financial Awareness, etc.,

Since, only basic knowledge is required for Banking Awareness for IBPS PO Mains, the above sources could be followed to ace the prestigious exam.

Tips for Preparation

- Practice Questions – After understanding the concept, make sure to attempt many quizzes to test your understanding. Practicing questions can really help score high in this section, as it does not consume a lot of time.

- Notes for Banking Awareness – You can prepare notes on the important concepts of Banking Awareness and revise it. Keep it beside while reading the newspaper. Refer the concept whenever a banking news comes up. It will definitely help you to retain the endless information that keeps coming up every day.

Also, learn important sections of Acts related to Banking, as Questions could be asked on them as well.

Banking Awareness for IBPS PO – PDF Download

Candidates can now download the IBPS PO Banking Awareness PDF to get a headstart on their preparation for IBPS PO Mains Banking Awareness.

How to Download the IBPS PO Banking Awareness Question PDF

Step 1: Click on the download link. You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the free pdf.

Step 3: After Logging in, you will be able to download the free e-book.

A Quote by Hartley Withers gains attention here. “Good Banking is produced not by good laws but by good bankers”. Best of Luck for your journey towards being a ‘good banker’!

Take a free mock test for IBPS PO- Click here

Hope this blog helped you in your preparation. If you have any queries feel free to post it below.

- IBPS PO Vacancy 2025 Out, 5208 Vacancies Released, Latest Update

- IBPS PO Interview Questions 2025, Expected Questions to Prepare

- New Essay Topics For IBPS PO Mains 2025 | Burning Hot Topics

- Descriptive Writing For Bank Exams, A Complete Guide

- GA Questions Asked in IBPS PO Exams in Previous Years

- How is Life After Cracking IBPS PO? The Journey Ahead

Banking Awareness for IBPS PO – FAQs

Ans. Out of a total of 155 Questions, General awareness carries 40 marks translating to slightly more than one-fourth of the weightage in the exam.

Ans. You can check the above blog for the resources for the preparation of IBPS PO banking awareness.

Ans. No, the IBPS PO is not that much hard. With proper strategy it is possible to clear any exam.

Ans. Candidates should start preparing for the General Awareness section of the IBPS PO exam at least 6 months prior to the exam date.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!