CAIIB Practice Questions ABM

The Indian Institute of Banking and Finance (IIBF) is conducting CAIIB 2023 on the 26th of November, 3rd, 9th,10th, and 17th of December, 2023. IIBF Conducts its flagship exams JAIIB & CAIIB twice every year. To qualify exams like JAIIB-CAIIB one must solve as many questions as possible. So to help you qualify this exam, we are providing you with the top 100 CAIIB Practice Questions ABM free ebook. Know how to download the ebook here and have a sneak peek at the ebook below.

Download Top 150 CAIIB Practice Questions ABM E-Book

Download Top 150 CAIIB Practice Questions ABM free e-book

How to Download Top 150 CAIIB Practice Questions ABM E-book for CAIIB?

Step 1: Click on the download link. You will be redirected to Oliveboard’s FREE E-Books Page.

Step 2: Create a free Oliveboard account or login using your existing Oliveboard account details

Step 3: Download the book by clicking on the link presented on the page.

CAIIB Practice Questions

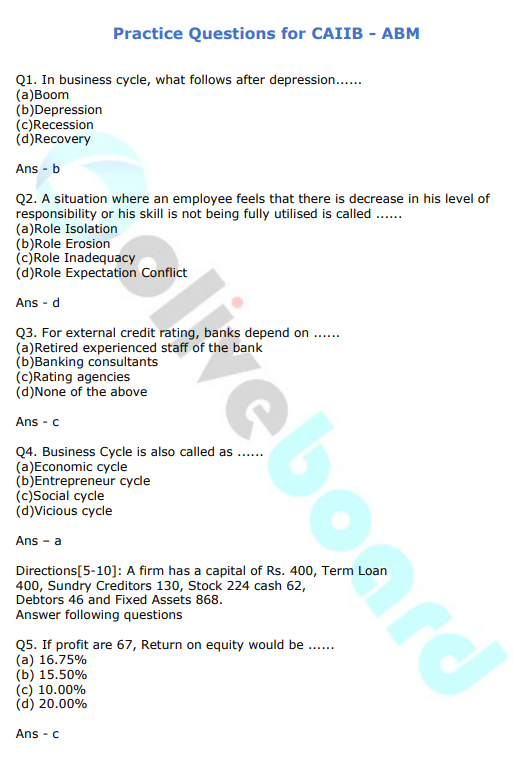

Q1. In business cycle, what follows after depression……

(a)Boom

(b)Depression

(c)Recession

(d)Recovery

Ans – b

Q2. A situation where an employee feels that there is decrease in his level of

responsibility or his skill is not being fully utilised is called ……

(a)Role Isolation

(b)Role Erosion

(c)Role Inadequacy

(d)Role Expectation Conflict

Ans – d

Q3. For external credit rating, banks depend on ……

(a)Retired experienced staff of the bank

(b)Banking consultants

(c)Rating agencies

(d)None of the above

Ans – c

Q4. Business Cycle is also called as ……

(a)Economic cycle

(b)Entrepreneur cycle

(c)Social cycle

(d)Vicious cycle

Ans – a

Directions[5-10]: A firm has a capital of Rs. 400, Term Loan

400, Sundry Creditors 130, Stock 224 cash 62,

Debtors 46 and Fixed Assets 868.

Answer following questions

Q5. If profit are 67, Return on equity would be ……

(a) 16.75%

(b) 15.50%

(c) 10.00%

(d) 20.00%

Ans – c

Q6. If Sales are 920 the Debt turnover ratio would be ……

(a)10 times

(b)20 times

(c)0.5 month

(d) 1 month

Ans – b

Q.7 Its Debt Equity Ratio

(a) 0.6:1

(b) 0.9:1

(c) 1.1:1

(d) 2:1

Ans – a

Q8. Net worth and tangible net worth is ……

(a) 270, 400

(b) 270, 624

(c) 670, 670

(d) 624, 670

Ans – c

Q9. The quick ratio would be ……

(a) 1:1

(b) 0.83:1

(c) 0.65:1

(d) 0.44:1

Ans – b

Q10. Current ratio is ……

(a) 1.25:1

(b) 1.85:1

(c) 2.1:1

(d) 2.55:1

Ans – d

Directions[11-16]: As on end of previous financial year 2020-21, XYZ Bank has:

Total Advances = Rs. 160000 Cr

ANBC (Adjusted Net Bank Credit) = Rs. 150000 Cr

Agriculture Advances = Rs. 27000 Cr

MSE Advances = Rs. 10000 Cr

Weaker Section Advances = Rs. 17000 Cr

Total Priority Sector Advances = Rs. 58000 Cr

Q11. Whether the Bank has achieved the target for Agriculture

Advances?

(a)Yes. The Bank has just achieved the target

(b)Yes. the Bank has exceeded the target

(c)No. The Bank has defaulted in achieving the target

(d)No such target for Agriculture Advances

Ans – a

Q12. Whether the Bank has achieved the target for MSE Advances?

(a)Yes. The Bank has just achieved the target

(b)Yes. the Bank has exceeded the target

(c)No. The Bank has defaulted in achieving the target

(d)No such target for Agriculture Advances

Ans – d

Q13. Whether the Bank has achieved the target for Weaker Section Advances?

(a)Yes. The Bank has just achieved the target

(b)Yes. the Bank has exceeded the target

(c)No. The Bank has defaulted in achieving the target

(d)No such target for Agriculture Advances

Ans – b

Q14. Whether the Bank has achieved the target for Priority Sector Advances?

(a)Yes. The Bank has just achieved the target

(b)Yes. the Bank has exceeded the target

(c)No. The Bank has defaulted in achieving the target

(d)No such target for Agriculture Advances

Ans – c

Q15. Which of the following is also known as Gearing Ratio?

(a)Current ratio

(b)Debt Equity Ratio

(c)Debt Service Coverage Ratio

(d)Turnover Ratio

Ans – b

Q16. Purchase of goods on credit _____ DE ratio

(a)Increase

(b)Decrease

(c)No change

(d)None of the above

Ans – c

Directions[17-29]: The debt equity ratio of X Ltd. is 0.5: 1. Which of the following would increase/decrease or not change the debt equity ratio?

Q17. Redemption of debentures

(a)Increase

(b)Decrease

(c)No change

(d)None of the above

Ans – b

Q18. Sale of goods on cash basis

(a)Increase

(b)Decrease

(c)No change

(d)None of the above

Ans – c

Q19.Further issue of equity shares DE ratio

(a)Increase

(b)Decrease

(c)No change

(d)None of the above

Ans – b

Q20.Cash received fromdebtors__ DE ratio

(a)Increase

(b)Decrease

(c)No change

(d)None of the above

Ans – c

Take a peek at Top 150 CAIIB Practice Questions ABM E-book

Conclusion

We hope this Ebook helps you in your CAIIB Preparation. Happy Preparation and Happy Learning from Oliveboard.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!