The Capital Adequacy Ratio (CAR) is one of the most important topics in banking and financial awareness for exams like IBPS PO, IBPS RRB, SBI PO, RBI Grade B, NABARD, LIC AAO and other regulatory exams. It measures the ability of a bank to absorb risks and remain solvent. A higher CAR indicates that the bank is financially strong and can withstand unexpected losses. Regulators like the Reserve Bank of India (RBI) and the Basel Committee on Banking Supervision (BCBS) set minimum CAR requirements to ensure banks maintain stability and protect depositors’ money.

What is Capital Adequacy Ratio?

The Capital Adequacy Ratio (CAR), also called the Capital to Risk (Weighted) Assets Ratio (CRAR), is the ratio of a bank’s capital to its risk-weighted assets. It ensures that banks have enough capital cushion to absorb a reasonable amount of losses and prevents insolvency.

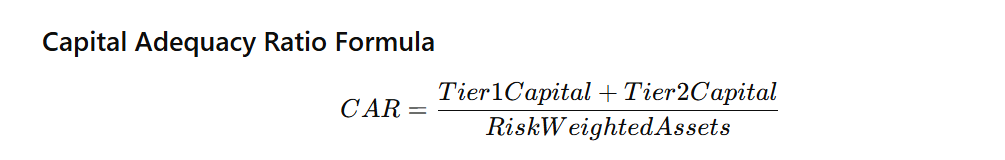

Here:

- Tier 1 Capital = Core capital (equity, reserves, retained earnings).

- Tier 2 Capital = Supplementary capital (subordinated debt, hybrid instruments).

- Risk-Weighted Assets (RWA) = Assets weighted according to their credit, market, and operational risks.

Why Is the Capital Adequacy Ratio Useful for Bank Exam Aspirants?

For exam preparation, CAR is a repeatedly asked concept in both objective MCQs and descriptive finance-related questions. Understanding CAR helps aspirants:

- Link it with Basel Norms (Basel I, II, and III).

- Understand RBI’s role in financial stability.

- Prepare for questions on banking regulations, NPAs, and financial risks.

- Write better descriptive answers in exams like RBI Grade B.

So, mastering CAR not only improves your conceptual clarity but also boosts your scoring ability in GA & Terms in Banking Awareness.

Components of Capital Adequacy Ratio

CAR is calculated using two major types of capital. Let’s break them down:

Tier 1 Capital – Core Capital

This is the most reliable form of capital available to absorb losses without stopping operations.

Examples of Tier 1 Capital:

- Paid-up equity capital

- Statutory reserves

- Retained earnings

- Free reserves disclosed in the balance sheet

Tier 2 Capital – Supplementary Capital

This is less reliable than Tier 1 but still supports the bank in crisis situations.

Examples of Tier 2 Capital:

- Subordinated debt

- Hybrid instruments

- Revaluation reserves

- General loan-loss reserves

Risk-Weighted Assets (RWA)

Not all assets carry the same level of risk. To calculate CAR, assets are adjusted using risk weights.

For example:

- Loans to Government → 0% risk weight (safe)

- Loans to Public Sector Undertakings → 100% risk weight

- Housing Loans (secured by property) → 50% risk weight

This risk-based classification ensures that banks maintain capital according to the riskiness of their lending portfolio.

Minimum CAR Requirements under Basel Norms

The Basel Committee has set international standards for banks. RBI follows these guidelines while regulating Indian banks.

Here’s a summary:

| Requirement | Basel Norms (Minimum) | RBI (India – Basel III) |

| CET 1 (Common Equity Tier 1) | 4.5% | 5.5% |

| Tier 1 Capital | 6% | 7% |

| Total Capital (CAR) | 8% | 9% |

Why Does CAR Matter in Banking?

Before moving to examples, let’s understand why CAR is significant:

- Protects Depositors → Ensures customer deposits remain safe even if the bank suffers losses.

- Financial Stability → A strong CAR prevents banking failures and systemic crises.

- Regulatory Compliance → RBI checks CAR to decide if a bank is healthy.

- Encourages Responsible Lending → Banks cannot lend excessively without keeping adequate capital.

Example Calculation of CAR

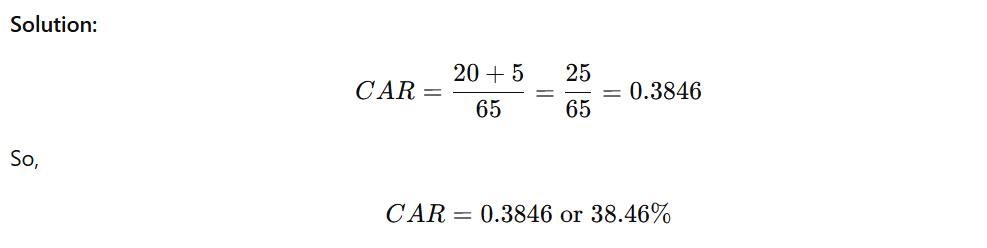

Suppose a bank has the following:

- Tier 1 Capital = ₹20 crore

- Tier 2 Capital = ₹5 crore

- Risk-Weighted Assets (RWA) = ₹65 crore

CAR vs Solvency Ratio

Students often confuse CAR with Solvency Ratio. Here’s the difference:

| Basis | Capital Adequacy Ratio (CAR/CRAR) | Solvency Ratio |

| Meaning | Measures a bank’s capital vs. risk-weighted assets | Measures a company’s ability to meet long-term debts |

| Applicability | Banks & financial institutions | All industries & companies |

| Formula | (Tier 1 + Tier 2) ÷ RWA × 100 | (Net Profit + Depreciation) ÷ Total Liabilities × 100 |

| Regulated by | RBI, Basel norms | No fixed regulator |

| Focus | Banking stability & depositor safety | Corporate financial health |

10 Practice Questions on CAR (with Answers)

Q1. CAR stands for?

Ans: Capital Adequacy Ratio

Q2. CAR is also called?

Ans: Capital to Risk (Weighted) Assets Ratio (CRAR)

Q3. Who sets global standards for CAR?

Ans: Basel Committee on Banking Supervision (BCBS)

Q4. Minimum CAR required under Basel III norms globally?

Ans: 8%

Q5. Minimum CAR required in India (RBI)?

Ans: 9%

Q6. Which capital is considered more reliable in CAR?

Ans: Tier 1 Capital (Core Capital)

Q7. Which assets are considered 0% risk weight?

Ans: Government securities/loans to Government

Q8. What is the formula of CAR?

Ans: (Tier 1 Capital + Tier 2 Capital) ÷ Risk Weighted Assets × 100

Q9. If Tier 1 = ₹50 cr, Tier 2 = ₹10 cr, RWA = ₹400 cr, find CAR.

Ans: (50+10)/400 × 100 = 15%

Q10. Why does RBI keep stricter CAR norms (9%) than Basel (8%)?

Ans: To ensure extra financial stability and depositor protection in India.

FAQs

The Capital Adequacy Ratio (CAR), also called the Capital to Risk (Weighted) Assets Ratio (CRAR), is a measure of a bank’s financial strength. It shows how much capital a bank has in relation to its risk-weighted assets and ensures that banks can absorb potential losses while protecting depositors.

As per RBI’s Basel III guidelines, Indian banks must maintain a minimum CAR of 9%, which is higher than the global Basel requirement of 8%. This stricter rule ensures financial stability and depositor protection in India.

Tier 1 Capital (Core Capital) includes equity capital, reserves, and retained earnings; it is the most reliable source to absorb losses. Tier 2 Capital (Supplementary Capital) includes subordinated debt, hybrid instruments, and revaluation reserves; it supports the bank during financial stress but is less reliable than Tier 1.

CAR is a repeatedly asked topic in IBPS, SBI, RBI, NABARD, and LIC AAO exams. It helps candidates understand Basel norms, RBI regulations, banking risk management, and financial stability, making it crucial for both objective and descriptive exam sections.

CAR (CRAR): Specific to banks, measures capital vs. risk-weighted assets to ensure depositor safety.

Solvency Ratio: Used for companies across industries, measures ability to meet long-term debts.

- Assam Cooperative Apex Bank Assistant Salary 2026, Pay Scale

- Assam Cooperative Apex Bank Recruitment 2026, 150 Assistant Posts

- SBI Clerk Document Verification, List of Documents Required

- SBI CBO General Awareness FREE QUIZ, Get FREE PDF

- SBI CBO General Economy FREE QUIZ, Get FREE PDF

- NABARD DA vs IDBI JAM 2026: Eligibility, Salary & Career

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.