India, is a land of contradictions and the best example of this would be the existence of two different worlds in the same nation: India and Bharat.

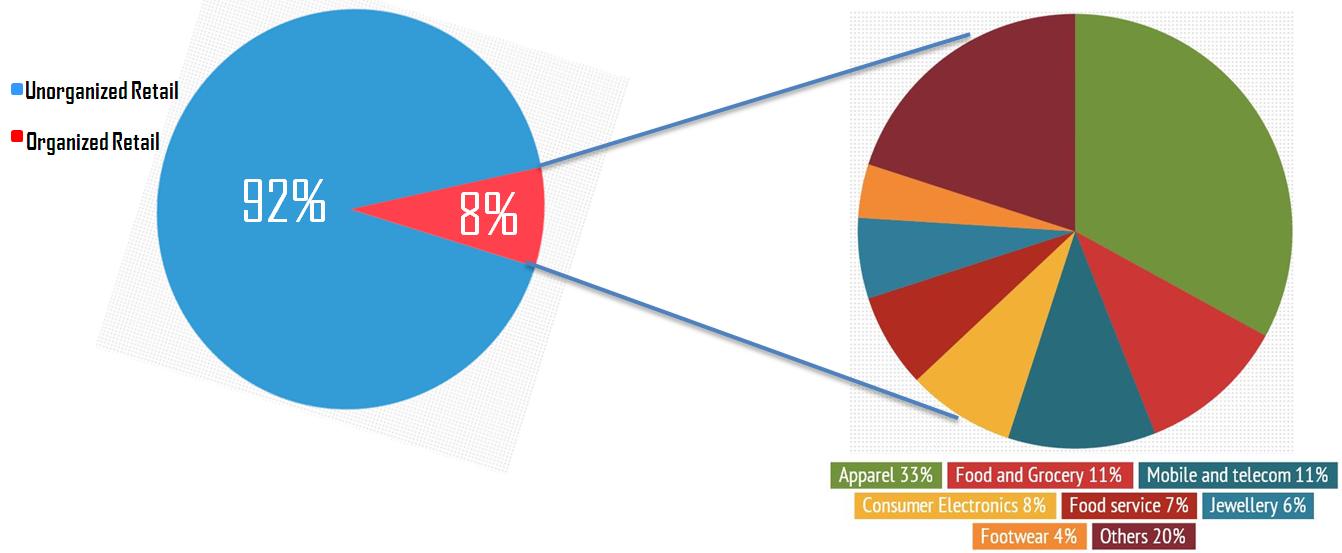

While, India is tech and Internet savvy, our Bharat is far behind. It even lacks the basic amenities. While India is talking about bullet trains and hyper-loops, one can still find people earning their livelihood from cycle-rickshaws in ‘Bharat’. Given such a wide spectrum of disparity, the fact that 90% of our workforce is in the unorganized sector, comes as no shock.

And amidst all these disparities, Prime Minister Modi announced the demonetization of Rs. 500 and Rs. 1000 notes. The demonetization step has had both positive and negative impacts on the economy. While many see ‘curbing black money’ as the main goal of the demonetization process, they miss out on the most obvious result, which is – financial inclusion and shift towards a cashless economy.

How Did Demonetization Give India A Nudge Towards Being A Cashless Economy?

Let’s just say that the following data speaks for itself.

India Is A Cash Obsessed Economy

The Indian economy is cash based. So much, that, MNCs like Amazon had to incorporate ‘cash on delivery’, just to be able to tap into the Indian market.

Why Is Moving Towards A Cashless Economy Important?

To put it in a straight forward manner – cashless economies tend to be less corrupt, and have lesser black money. Let’s examine these reasons in detail.

1. Cash is costly.

2. Cash drives a shadow economy.

In 2007, currency in circulation was almost equal to bank deposits. But in the last three years, currency with Indians was more than the bank deposits by 50%. As per government data, the size of black money in India is Rs.15-16 lakh crores. This is the unaccounted money and was being used to finance a shadow economy, almost running a parallel government that finances all illegal transactions. Most of it is used for financing terrorist activities, illicit funding for elections, purchasing political decisions, betting, trafficking, and for hijacking democracy.

3. Future rewards : Financial inclusion + Increased tax revenues.

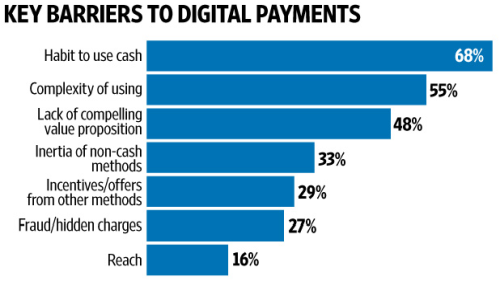

Moving Towards A Cashless Economy Is Not A Cakewalk!

1. Inadequate infrastructure

- For a vast country like India, having only 2.3 lakh ATMs and 14 lakh point of sale (PoS) terminals is too low. Countries like Brazil, Australia, France and the UK have PoS terminals three or four times that of India. Also, the ATMs are concentrated in metros, but the number is scarce in the suburban and rural areas.

- Another challenge is to improve activation of cards on all the channels. While it is natural that a PMJDY ( Jan Dhan Yojana) customer new to card payment system would initially use the cards on ATMs, a mainstream customer not using any other channel for a long period should be a matter of introspection.

Ideally, on a user base of 750 million cards in the country, the usage on point of sale should be at least 375 million transactions in a month, assuming that the customers, on an average, use the card at least once in two months on a PoS terminal. But data published by the RBI indicates the volume of PoS and e-commerce transactions together for all banks is about 130 million (as against 765 million on ATM channel) as on August 2016.

2. Mobile internet penetration is weak in rural India.

For settling transactions digitally, internet connection is needed. But ‘Bharat’ lacks proper connectivity to the Internet in rural areas. In addition to this, low literacy levels make it problematic to push the use of plastic money on a wider scale.

A Glimmer of Hope

A report by Google India and the Boston Consulting Group states that by the year 2020, $500 billion worth of transaction would happen online which means, it will increase by 10 folds. Also, cash based payments are expected to fall by 40% in the coming years.

Online transactions have become 20 times in the last 6 years. And this data was prior to the demonetization drive. Going by the recent trends, it is safe to say that that India and Bharat, both are doing quite well in this regard.

While, a ‘CASHLESS’ India may seem a tad too ambitious at this point, a ‘LESS-CASH’ India is certainly around the corner.

(Data Source : The Hindu)

Click here to know more about Digital Payments: Types, Advantages and Statistics.

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in