Pradhan Mantri Mudra Yojana 2024

The Pradhan Mantri Mudra Yojana (PMMY) is a major government initiative launched on April 8, 2015, offering loans up to Rs. 10 lakhs to small businesses in various sectors like manufacturing, trading, and services, including allied agricultural activities. It aims to support millions of micro and small enterprises, including proprietorship and partnership firms, across India. Let’s check the details of Pradhan Mantri Mudra Yojana.

Overview Table Of Pradhan Mantri Mudra Yojana

| Aspects | Details |

| Scheme Name | Pradhan Mantri Mudra Yojana (PMMY) |

| Launch Date | April 8, 2015 |

| Objective | To offer loans up to Rs. 10 lakhs to non-corporate, non-farm small/micro enterprises |

| Loan Categories | Shishu (up to Rs. 50,000) Kishore (Rs. 50,000 to Rs. 5 lakhs) Tarun (Rs. 5 lakhs to Rs. 10 lakhs) |

| Eligible Entities | Individuals, Sole proprietorships, Partnership firms, Private limited companies, Public companies, Other legal entities |

| Lending Institutions | Commercial Banks, RRBs, Small Finance Banks, MFIs, NBFCs |

| Documents Required | Proof of Identity Proof of Residence Business Identity/Address Bank Statements Project Reports, etc. |

| Progress Highlights (2024) | Over 2.1 million loans sanctioned totaling Rs. 20,426.48 crore, with Rs. 18,680.60 crore disbursed |

प्रधानमंत्री मुद्रा योजना (पीएमएमवाई)

प्रधानमंत्री मुद्रा योजना (पीएमएमवाई) एक योजना है जो 8 अप्रैल, 2015 को माननीय प्रधानमंत्री द्वारा शुरू की गई है, जिसके तहत गैर-कॉर्पोरेट, गैर-कृषि छोटे/माइक्रो उद्यमों को 10 लाख तक के ऋण प्रदान किए जाते हैं। ये ऋण पीएमएमवाई के तहत मुद्रा ऋण के रूप में वर्गीकृत होते हैं। ये ऋण कॉमर्शियल बैंकों, आरआरबी, छोटे वित्त बैंक, एमएफआई और एनबीएफसी द्वारा प्रदान किए जाते हैं।

उधारकर्ता किसी भी उपरोक्त ऋण प्रदान करने वाले संस्थान से संपर्क कर सकते हैं या इस पोर्टल www.udyamimitra.in के माध्यम से ऑनलाइन आवेदन कर सकते हैं। पीएमएमवाई के अधिकार में, मुद्रा ने तीन उत्पाद बनाए हैं – ‘शिशु’, ‘किशोर’, और ‘तारुण’ – जो माइक्रो यूनिट/उद्यमियों की विकास और वित्त परिस्थितियों के लिए विभिन्न विकास चरण दर्शाते हैं और उनके भविष्य के विकास के लिए एक संदर्भ बिंदु के रूप में कार्य करते हैं।

What Is Pradhan Mantri Mudra Scheme?

The Pradhan Mantri MUDRA Scheme, launched on April 8, 2015 by the Hon’ble Prime Minister, offers loans up to 10 lakh to non-corporate, non-farm small/micro enterprises. These loans, known as MUDRA loans, are provided by Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs.

Borrowers can approach any of these lending institutions or apply online through www.udyamimitra.in. Under Pradhan Mantri MUDRA Scheme, MUDRA has introduced three products – ‘Shishu’, ‘Kishore’, and ‘Tarun’ – representing different stages of growth and funding needs for micro units/entrepreneurs and serving as a reference point for their future growth.

Pradhan Mantri Mudra Yojana Features

- Financial Support: Offers loans to small businesses, initiated on April 8, 2015.

- Three-tiered Structure: Categorized into ‘Shishu’, ‘Kishore’, and ‘Tarun’, addressing different business stages.

- Wide Accessibility: Aims to support micro-enterprises across various sectors.

- Government Initiative: Launched by the Prime Minister to promote entrepreneurship and economic growth.

- Tailored Assistance: Loans tailored to meet the specific needs of micro-entrepreneurs.

- Empowerment: Focuses on empowering individuals and small businesses across India.

- Simplified Process: Provides an accessible and straightforward application process for loan seekers.

Pradhan Mantri Mudra Yojana Benefits

The Pradhan Mantri MUDRA Yojana (PMMY) is divided into three categories: ‘SHISHU’, ‘KISHORE’, and ‘TARUN’. These categories represent different stages of growth and financial needs for micro units and entrepreneurs.

- SHISHU: Loans up to Rs. 50,000.

- KISHORE: Loans above Rs. 50,000 up to Rs. 5 lakhs.

- TARUN: Loans above Rs. 5 lakhs up to Rs. 10 lakhs.

This classification helps micro-businesses and entrepreneurs choose the right level of financial support for their specific needs and stage of development.

Pradhan Mantri Mudra Yojana Eligibility

Qualified applicants may include:

- Individuals

- Sole proprietorships

- Partnership firms

- Private limited companies

- Public companies

- Other legal entities.

Please note:

- Applicants must not have defaulted on any bank or financial institution and should maintain a satisfactory credit history.

- Individual borrowers might need relevant skills, experience, or knowledge for the proposed venture.

- Educational qualifications, if necessary, are evaluated based on the nature and requirements of the proposed business activity.

Loans Under Pradhan Mantri Mudra Yojana

Loans offered through Pradhan Mantri Mudra Yojana are accessible via approved Member Lending Institutions (MLIs), which are:

- Public Sector Banks

- Private Sector Banks

- State-operated cooperative banks

- Regional rural banks

- Micro Finance Institutions (MFIs)

- Non-Banking Finance Companies (NBFCs)

- Small Finance Banks (SFBs)

- Other financial intermediaries endorsed by Mudra Ltd. as member financial institutions

Interest Rates:

Interest rates are determined by Member Lending Institutions periodically in accordance with Reserve Bank of India guidelines.

Upfront Fees/Processing Charges:

Banks might charge upfront fees depending on their rules. However, many banks don’t charge upfront fees for Shishu loans (up to Rs. 50,000/-).

Note:

MUDRA doesn’t use agents for loan applications. Borrowers should avoid anyone claiming to be MUDRA/PMMY agents.

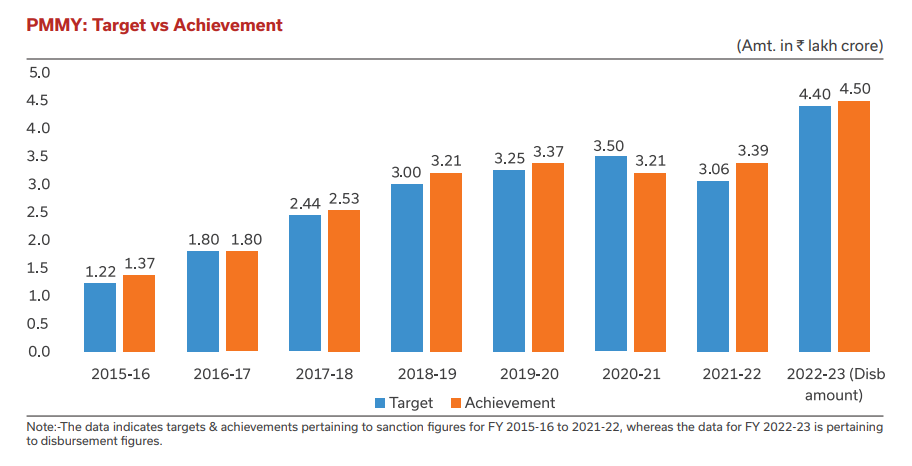

Pradhan Mantri Mudra Yojana Progress Highlights

In the financial year 2024-2025, as of May 3, 2024, the PMMY sanctioned over 2.1 million loans, totaling 20,426.48 crore. Of this amount, 18,680.60 crore was disbursed, highlighting its impactful support for entrepreneurs and micro-enterprises.

As per the latest Annual Report 2022-2023, the scheme has successfully completed 8 years of operation. During this time, it has disbursed a cumulative amount of ₹22.89 lakh crore across 41.16 crore loan accounts, primarily benefiting borrowers from weaker sections of society.

The participating lending institutions, including Public Sector Banks, Private Sector Banks, Regional Rural Banks, Small Finance Banks, Micro-Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs), have consistently surpassed the annual targets set by the Government of India under PMMY.

- Cumulative Outreach: Over 41 crore MSE borrower accounts have received credit support totaling ₹22.89 lakh crore.

- Empowering Women: Nearly 69% of the loan accounts belong to women beneficiaries, promoting gender empowerment.

- Addressing Credit Needs: About 51% of the loan accounts cater to individuals from SC/ST/OBC categories, ensuring financial inclusion for marginalized communities.

| Category | No. of Accounts (2022-2023) | Amount Sanctioned (2022-2023) | Amount Disbursed (2022-2023) | No. of Accounts (Cumulative) | Amount Sanctioned (Cumulative) | Amount Disbursed (Cumulative) |

| Shishu | 43,07,7851 | ₹1,42,766 crore | ₹1,41,610 crore | 34,25,36,204 | ₹9,37,338 crore | ₹9,26,798 crore |

| Kishore | 17,91,5912 | ₹2,04,007 crore | ₹2,00,937 crore | 6,09,54,997 | ₹8,57,463 crore | ₹8,28,194 crore |

| Tarun | 13,16,835 | ₹1,09,765 crore | ₹1,07,877 crore | 81,70,832 | ₹5,53,450 crore | ₹5,34,788 crore |

| TOTAL | 6,23,10,598 | ₹4,56,538 crore | ₹4,50,424 crore | 41,16,62,033 | ₹23,48,250 crore | ₹22,89,781 crore |

| Out of the above | ||||||

| Women | 4,42,56,813 | ₹2,16,954 crore | ₹2,15,035 crore | 28,24,88,984 | ₹10,58,623 crore | ₹10,21,457 crore |

| New Entrepreneur Accounts | 1,00,66,770 | ₹1,32,693 crore | ₹1,29,423 crore | 8,46,68,872 | ₹7,26,070 crore | ₹6,96,287 crore |

| SC/ST/OBC | 3,14,53,998 | ₹1,65,955 crore | ₹1,63,978 crore | 20,91,35,349 | ₹8,16,714 crore | ₹8,00,056 crore |

Pradhan Mantri Mudra Yojana Apply Online

Step01: Visit the official PM MUDRA website at https://www.mudra.org.in/ and navigate to the Udyamimitra portal.

Step02: Click on “Apply Now” for Mudra loan.

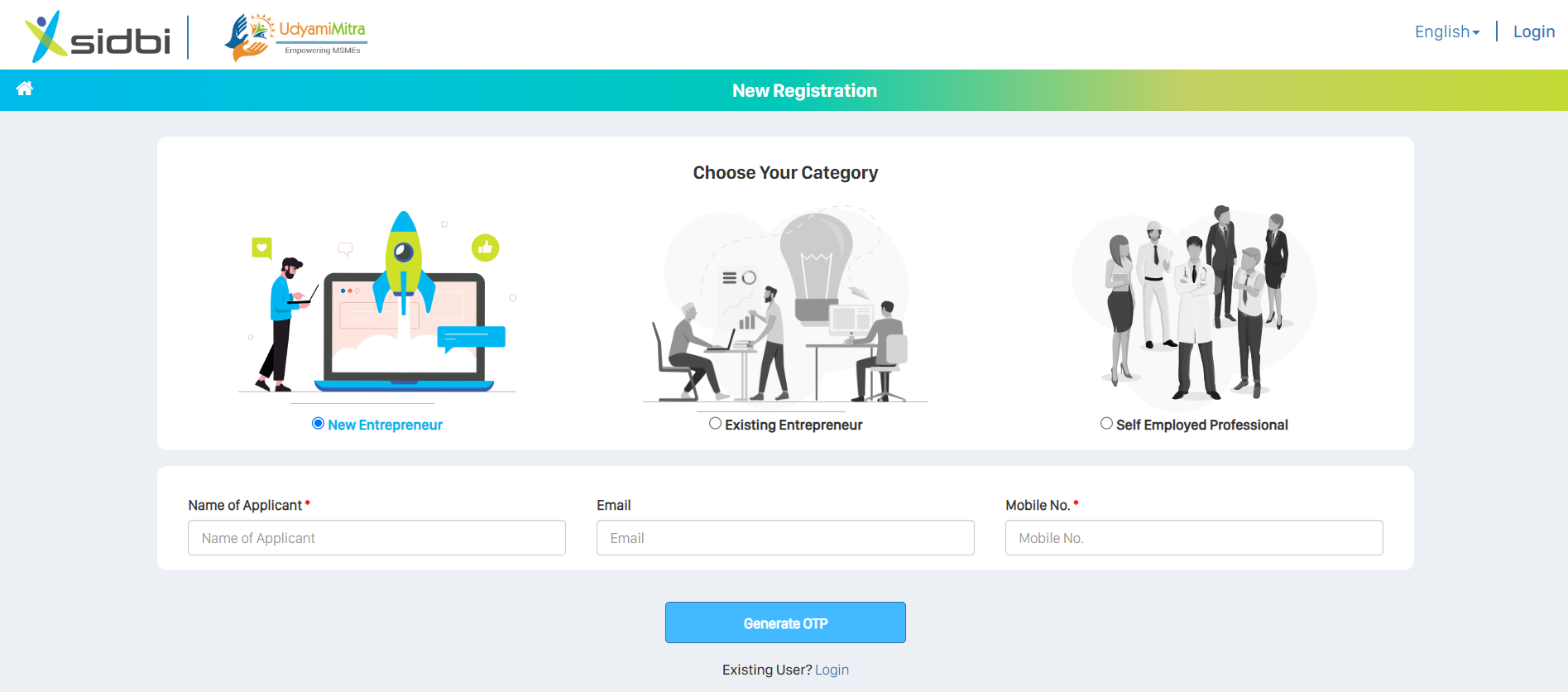

Step03: Choose one of the following options: New entrepreneur, Existing Entrepreneur, or Self-employed professional.

Step04: Enter the applicant’s name, email, and mobile number, then generate an OTP.

After successful registration:

Step01: Provide personal and professional details.

Step02: If needed, select hand-holding agencies for assistance in preparing project proposals; otherwise, proceed to the “Loan Application Center” and apply.

Step03: Select the loan category required: Mudra Shishu, Mudra Kishore, or Mudra Tarun.

Step04: Fill in business information such as business name, activity, and industry type (Manufacturing, Service, Trading, or agriculture-related).

Step05: Provide other details including owner information, existing and proposed credit facilities, future estimates, and preferred lender.

Step06: Attach all necessary documents, such as ID proof, address proof, applicant photo, signature, and business identity/address proof.

Step07: Once submitted, an Application Number will be generated for future reference.

Pradhan Mantri Mudra Yojana Documents Required

For Shishu Loan

- Proof of Identity: Self-attested copy of Voter’s ID Card, Driving Licence, PAN Card, Aadhaar Card, Passport, or any photo ID issued by a Government authority.

- Proof of Residence: Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID Card, Aadhar Card, Passport, or bank passbook/latest account statement duly attested by Bank Officials. Also accepted are Domicile Certificate or certificates issued by Government Authorities, Local Panchayat, or Municipality.

- Recent colored Photographs of the applicant (2 copies), not older than 6 months.

- Quotation of Machinery or other items to be purchased, including details of the supplier, machinery, and price.

- Proof of Identity/Address of the Business Enterprise: Copies of relevant licenses, registration certificates, or other documents related to the ownership and address of the business unit.

For Kishore and Tarun Loan

- Proof of Identity: Self-attested copy of Voter’s ID card, Driving License, PAN Card, Aadhar Card, or Passport.

- Proof of Residence: Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card, or Passport of Proprietor, Partners, or Directors.

- Recent colored Photographs of the applicant (2 copies), not older than 6 months.

- Proof of Identity/Address of the Business Enterprise: Copies of relevant licenses, registration certificates, or other documents pertaining to the ownership, identity, and address of the business unit.

- Applicant should not be a defaulter in any Bank/Financial institution.

- Statement of accounts from the existing banker for the last six months, if applicable.

- Last two years’ balance sheets of the units along with income tax/sales tax return, applicable for all cases from Rs.2 Lacs and above.

- Projected balance sheets for one year in case of working capital limits and for the loan period in case of a term loan, applicable for all cases from Rs.2 Lacs and above.

- Sales achieved during the current financial year up to the date of application submission.

- Project report for the proposed project containing details of technical and economic viability.

- Memorandum and Articles of Association of the company/Partnership Deed of Partners, etc.

- In the absence of third-party guarantee, an Asset & Liability statement from the borrower, including Directors & Partners, may be required to determine net worth.

Conclusion

In summary, the Pradhan Mantri Mudra Yojana (PMMY) launched on April 8, 2015, by the Prime Minister, offers financial help to small businesses. It has three categories – ‘Shishu’, ‘Kishore’, and ‘Tarun’ – supporting different stages of growth. PMMY boosts entrepreneurship and economic development across India.

Frequently Asked Questions

Ans: The Pradhan Mantri MUDRA Scheme offers loans up to Rs. 10 lakh to non-corporate, non-farm small/micro enterprises. These loans, known as MUDRA loans, are provided by Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs.

Ans: The loan categories under PMMY are ‘Shishu’ (up to Rs. 50,000), ‘Kishore’ (Rs. 50,000 to Rs. 5 lakhs), and ‘Tarun’ (Rs. 5 lakhs to Rs. 10 lakhs).

Ans: Loans are provided by commercial banks, regional rural banks (RRBs), small finance banks, microfinance institutions (MFIs), and non-banking financial companies (NBFCs).

Ans: Applicants are expected to have maintained a satisfactory credit history and not defaulted on any bank or financial institution to be eligible for loans under PMMY. However, specific criteria may vary among lending institutions.

Ans: PMMY aims to support micro-enterprises across various sectors, including manufacturing, trading, services, and allied agricultural activities.

- GA Questions Asked In SBI PO Mains 2025, 5th May Analysis

- Pradhan Mantri Suraksha Bima Yojana 2024 Overview & Benefits

- Central Government Schemes 2024, List of Schemes under Every Ministries

- Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) 2024

- Pradhan Mantri Gramodaya Yojana 2024 Features & Benefits

- Pradhan Mantri Van Dhan Yojana 2024, Features, Components & Stages