On 09 October 2024, the Reserve Bank of India (RBI) concluded its fourth bi-monthly Monetary Policy Meeting for the financial year 2024-25. The meeting aimed to evaluate the current economic landscape and determine strategies to manage inflation, growth, and liquidity within the Indian economy. Given ongoing global economic uncertainties, this meeting was particularly significant as inflationary pressures remained a concern.

Chaired by RBI Governor Shaktikanta Das, the Monetary Policy Committee (MPC) engaged in extensive discussions on various factors affecting the economy, including inflation, foreign portfolio investments (FPI), and foreign direct investments (FDI). The committee ultimately decided to maintain the policy interest rates unchanged, keeping the benchmark interest rate at 6.5%, with a majority vote of 5:1.

RBI Monetary Policy 2024

The Monetary Policy Meeting 2024 took place over three days, from 07 to 09 October 2024, with crucial discussions centered on inflation control and economic stability. A unanimous decision was reached to keep the repo rate unchanged at 6.50%, marking the ninth consecutive meeting without alterations. Governor Das emphasized the need for caution, stating, “It is with a lot of effort that the inflation horse has been brought to the stable. We must be careful about opening the gate lest the horse bolts.”

Focus on Inflation Control and Economic Stability

The core topic of inflation control dominated the discussions. While the RBI has managed to stabilize inflation levels, Governor Das reiterated the importance of vigilance to avoid triggering renewed inflationary pressures. The RBI is actively monitoring both domestic and international factors, particularly as global commodity prices remain volatile.

In a positive development for the Indian economy, Governor Das reported a rebound in Foreign Portfolio Investment (FPI) flows, recovering from earlier outflows of $4.2 billion seen in April and May. Foreign Direct Investment (FDI) flows have also remained robust, contributing to liquidity and supporting the rupee.

Enhancements for Consumer Protection

To improve consumer safety and reduce fraudulent activities, the RBI has introduced a new feature allowing individuals to verify beneficiary account details prior to initiating transfers. This enhancement will be applicable to NEFT and RTGS transactions, complementing existing measures in the UPI and IMPS systems.

Understanding Monetary Policy

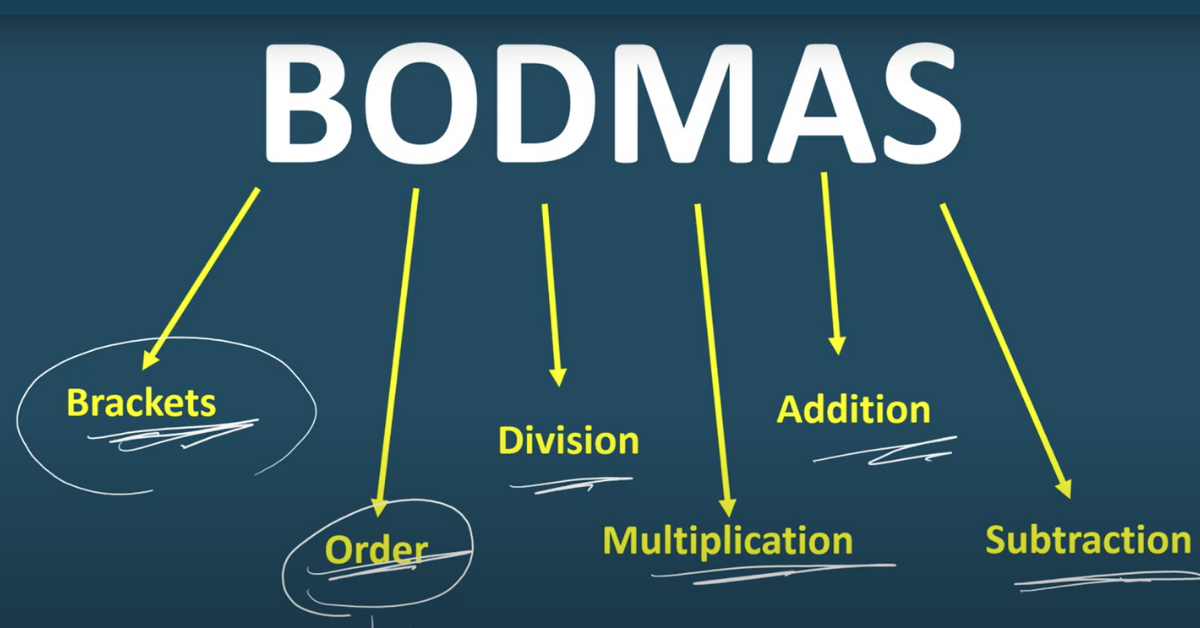

Monetary policy refers to the strategies employed by the central bank to utilize its monetary tools effectively to achieve its legislative goals. The primary aim of the RBI’s monetary policy is to maintain price stability while simultaneously fostering economic growth. Ensuring price stability is deemed essential for sustainable growth.

According to the amended RBI Act of 1934, the Government of India, in collaboration with the RBI, is responsible for setting the inflation target (currently at 4% ± 2%) every five years.

The Structure of the RBI Monetary Policy Committee

Established under Section 45ZB of the revised RBI Act, the Monetary Policy Committee (MPC) consists of six members tasked with determining the necessary policy interest rate to meet the inflation target. The first MPC convened on 29 September 2016. The current committee comprises:

| Role | Member |

| Chairperson (Governor of RBI) | Sri Shaktikanta Das |

| Deputy Governor (Monetary Policy) | Dr. Michael D. Patra |

| Nominated by Central Board | Dr. Rajiv Ranjan |

| Member 2 | Ram Singh |

| Member 3 | Dr. Nagesh Kumar |

| Member 4 | Saugata Bhattacharya |

Key Highlights of the MPC Meeting

The table below summarizes essential outcomes from the MPC meeting held on 08 August 2024:

| Parameter | Rate |

| Repo Rate | 6.50% |

| Reverse Repo Rate | 3.35% |

| Standing Deposit Facility (SDF) | 6.25% |

| Marginal Standing Facility (MSF) | 6.75% |

| Bank Rate | 6.75% |

| Cash Reserve Ratio (CRR) | 4.50% |

| Statutory Liquidity Ratio (SLR) | 18.0% |

Additional Highlights

- Real GDP Growth: Increased by 6.7% in Q1 of FY 2024-25.

- Projected GDP Growth: Estimated at 7.2% for FY 2024-25 and 7.3% for FY 2025-26.

- Inflation Forecast: Maintained at 4.5%, with Q3 FY25 expected to be at 4.8%.

Quarterly GDP Growth Estimates

| Quarter | Estimated Growth Rate |

| Q2 FY25 | 7.00% |

| Q3 FY25 | 7.40% |

| Q4 FY25 | 7.40% |

| Q1 FY26 | 7.30% |

Key Takeaways from the RBI Monetary Policy Meeting 2024

- Repo Rate Unchanged at 6.50%: The RBI has chosen to maintain the repo rate, reflecting its commitment to inflation management while supporting growth.

- Focus on Inflation: The RBI has successfully kept inflation stable but remains watchful of potential risks associated with global commodity price fluctuations.

- Positive Trends in Capital Flows: The resurgence of FPI inflows signifies renewed investor confidence, while strong FDI flows support ongoing economic growth.

- Core Inflation Stability: Core inflation levels remain stable, but the RBI emphasizes continued vigilance to prevent potential shocks.

Important Terms Related to Monetary Policy

Here are definitions of key monetary policy terms:

| Term | Definition |

| Repo Rate | The interest rate at which the RBI lends funds to banks, using government securities as collateral. |

| Reverse Repo Rate | The interest rate at which the RBI absorbs excess liquidity from banks overnight. |

| Marginal Standing Facility (MSF) | The rate at which banks can borrow overnight funds from the RBI against government securities. |

| Statutory Liquidity Ratio (SLR) | The percentage of a bank’s NDTL that must be held in secure assets like cash and government securities. |

| Bank Rate | The rate at which the RBI is willing to purchase or rediscount bills of exchange and other commercial papers. |

| Cash Reserve Ratio (CRR) | The average daily balance that banks must maintain with the RBI, is expressed as a percentage of their NDTL. |

- SBI PO vs. IBPS PO vs. IBPS RRB PO: Which Exam is Better?

- RBI Assistant Reasoning Preparation 2026: Complete Strategy

- OICL AO Mains Result 2026, Check Your Result Here

- OICL AO Cut Off 2025-26: Check Expected Marks

- IBPS Clerk Reserve List 2025-26, CSA Provisional Allotment

- Simplification Questions For Bank Exams, Live Quiz, FREE PDF

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exam categories like Regulatory Bodies, Banking, SSC, State PSCs, and more. I am on a mission to provide you with all the details you need, conveniently in one place. When I am not writing and marketing, you will find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!