Reserve Bank of India being the central bank of the country is a great organisation to work for. Every year Lakhs of aspirants apply for the RBI Grade B posts as it offers great career opportunities as well as impressive perks & allowances to its officers. The Grade B recruitment notification is expected to be announced in the month of June-July 2020. It is highly advisable to start with your preparations from now on itself so that when you are suddenly notified of the recruitment notification, you have already covered a prominent portion of the syllabus. The Grade B Exam is conducted in three stages namely Phase I, Phase 2 and the Interview round.

Toppers of the exam have always suggested carrying on the preparations and study for both Phase 1 and Phase 2 simultaneously because the syllabus of Phase 2 of RBI Grade B is vast and requires thorough knowledge and persistence in studies. The subjects asked in the Phase 2 Exam are Economics & Social Issues, Finance & Management and Descriptive English. So to give you a helping hand in your studies for the Grade B Exam, we at Oliveboard would be providing you with study notes on important topics from the syllabus of Phase 2. In this blog, we will cover the topic of “Risk Management in Banking Sector – RBI Grade B Notes”.

Risk Management in Banking Sector – RBI Grade B Notes

Risk Management is a very important topic that has both theory and numerical-related questions being asked in the RBI Grade B Exam. We have tried to elaborate on different types of risks faced by the banking sector and also the difference between different types of Risks with examples in this blog. All these years questions on this topic have been asked in the examination.

Risk – Definition

- Risk takes on many forms but is broadly categorized as a chance wherein an outcome or investment’s actual return will differ from the expected outcome or return.

- Risk includes the possibility of losing some or all of the original investment.

- Different versions of risks are usually measured by calculating the standard deviation of the historical returns or average returns of a specific investment.

- A fundamental idea in finance is the relationship between risk and return.

- As risk is directly proportional to return, the more risk a bank takes, the it can expect to make more money.

Types of Risks in the Banking Sector

Banking Sector is associated with the following Risks

- Liquidity Risk

- Interest Rate Risk

- Market Risk

- Credit or Default Risk

- Operational Risk

1. Liquidity Risk

It is a risk when a bank fails to honour the commitment of payment of deposits to the customers due to the inability to meet cash flow obligations. This may be due to rumours like the closing of banks or assets turning into NPAs.

Based on the reason this is again divided into 3 types.

- Funding Risk

- Time Risk

- Call Risk

2. Interest Rate Risk

- The interest rate risk refers to the chance that investments in bonds will suffer as the result of unexpected interest rate changes.

- The interest rate is one of the primary drivers of a bond’s price.

- The current interest rate and the price of a bond demonstrate an inverse relationship. In other words, when the interest rate increases, the price of a bond decreases.

- This is associated with the opportunity cost of holding Bonds at a fixed rate of interest.

- Mitigation can be done by Hedging or diversifying of Portfolio.

3. Market Risk

- Market risk is the risk that the value of an investment will decrease due to changes in market factors.

- These factors will have an impact on the overall performance of the financial markets and can only be reduced by diversification into assets that are not correlated with the market such as certain alternative asset classes.

- Market risk is sometimes called “systematic risk” because it relates to factors, such as a recession, that impact the entire market.

- Banks generally invest in products which are related to the price of Commodities, Shares, and Currency movement and this can lead to market risk.

4. Default or Credit Risk

- It is the risk of loss that may occur from the failure of any party to abide by the terms and conditions of any financial contract, principally the failure to make required payments on loans due to an entity.

- There are two risks associated with it – Counterpart risk and Country Risk.

- The major goal of a project finance firm in risk management is to ensure that it understands, measures, and monitors the various risks that arise, and that the organization adheres strictly to the policies and procedures established to address these risks.

- After analyzing the specific borrower’s risk, the credit risk management group assigns a credit rating to the borrower.

5. Operational Risk

- Operational risk is the risk not inherent in financial, systematic or market-wide risk. It is the risk remaining after determining financing and systematic risk and includes risks resulting from breakdowns in internal procedures, people and systems.

- Operational loss has mainly three exposure classes namely people, processes and systems.

- It has two sub-components. Transaction Risk & Compliance Risk.

- Transaction risk is the risk arising from fraud, both internal and external, failed business processes and the inability to maintain business continuity and manage information.

- Compliance risk is the risk of legal or regulatory sanction, financial loss or reputation loss that a bank may suffer as a result of its failure to comply with any or all of the applicable laws, and regulations.

Other risks include Strategic Risk, Reputation Risk, Systematic Risk and unsystematic Risk.

Risk Management in Banking Sector – Role of RBI

1. CAMELS

The financial Stability of the banks is evaluated by the banks using the framework of CAMELS

C- Capital Adequacy

A- Asset Quality

M- Management

E- Earnings Quality

L- Liquidity

S- Sensitivity to Market Risk

- This framework was recommended by the Basel Committee on Banking Supervision by the Bank for International Settlements (BIS).

- The board for Financial Supervision (BFS) works under the control of RBI and supervises all the financial institutions except Stock Markets and Insurance.

- Basel norms (Basel 1, Basel 2 and Basel 3) are being implemented for Risk Management.

- PCA (Prompt Corrective Action) to take corrective actions.

2. PCA (Prompt Corrective Action) Framework

PCA Framework consists of the following three parameters

- Capital to risk-weighted assets ratio (CRAR),

- Net non-performing assets (NPA) and

- Return on Assets (RoA)

The Reserve Bank takes some actions and puts some restrictions on the bank as soon as the value for any one of these parameters goes beyond a certain limit.

3. Risk-Return Tradeoff

- The risk-return trade-off is the principle that potential return rises with an increase in risk.

- Low levels of uncertainty or risk are associated with low potential returns, whereas high levels of uncertainty or risk are associated with high potential returns.

- According to the risk-return tradeoff, invested money can render higher profits only if the investor is.

- Willing to accept the possibility of losses.

Sample Questions

Q. Risk Management includes all of the following processes except?

- Risk Monitoring and Control

- Risk Identification

- Risk Avoidance

- Risk Response Planning

- Risk Management Planning

Answer: (3)

Q. The three factors that characterize project risk are _________?

- The severity of impact, duration of impact, and cost of impact

- Identification, Type of risk category, and Probability of impact

- Risk event, Risk probability, and the Amount at stake

- Occurrence, Frequency, and Cost

- Cost, Schedule, and Quality

Answer: (3)

Q. There are two general categories of risk areas, internal and external. Examples of external risk areas are __________?

- Schedule delays, Cost overruns, and Changes in technology

- Regulatory, Project completion, and Taxation

- Natural disasters, Regulatory, and Design

- Currency rates, Design, and Social Impact

- Inflation rates, Performance, and Schedule delays

Answer: (2)

An overview of the topic along with some important terms has been defined in this blog of Risk Management in Banking Sector – RBI Grade B Notes. We hope that you find the information given in the blog “Risk Management in Banking Sector – RBI Grade B Notes” useful and informative. Practice more MCQs to get conceptual clarity. RBI Grade B Exam 2020 Notification is soon to be expected, it is advisable to study regularly if you are an aspirant.

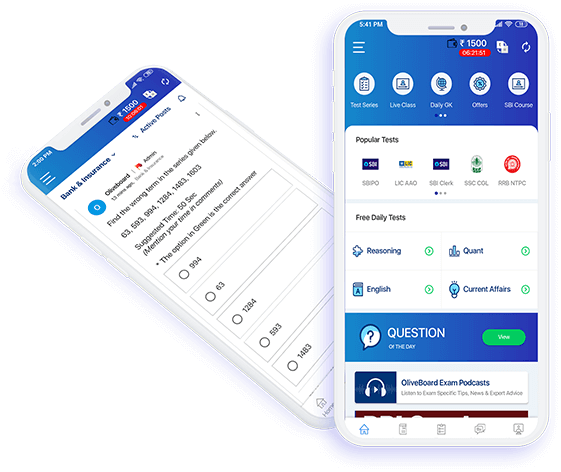

DOWNLOAD THE RBI, NABARD, SEBI Prep App FOR ON-THE-GO EXAM PREPARATION

The app provides comprehensive study material in form of online courses to ace these examinations.

The study material ranges from online LIVE classes, video lectures, study notes, revision sessions, past year papers, topic tests, the objective plus descriptive mock tests, mock interviews and much more.

List of Exams

1) RBI Grade B Generalist Posts

2) SEBI Grade A Generalist Posts

3) SEBI Grade A IT Officer Posts

4) NABARD Grade A Generalist Posts

5) NABARD Grade A IT Officer Posts

6) NABARD Grade A Agriculture Officer Posts

7) NABARD Grade B Posts

8) SIDBI Grade A Officer Posts

9) FSSAI Recruitment – For Technical officers, Food Safety Officers and Assistants

Get free video lessons, mock tests and GK tests to evaluate course content before signing up!

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!