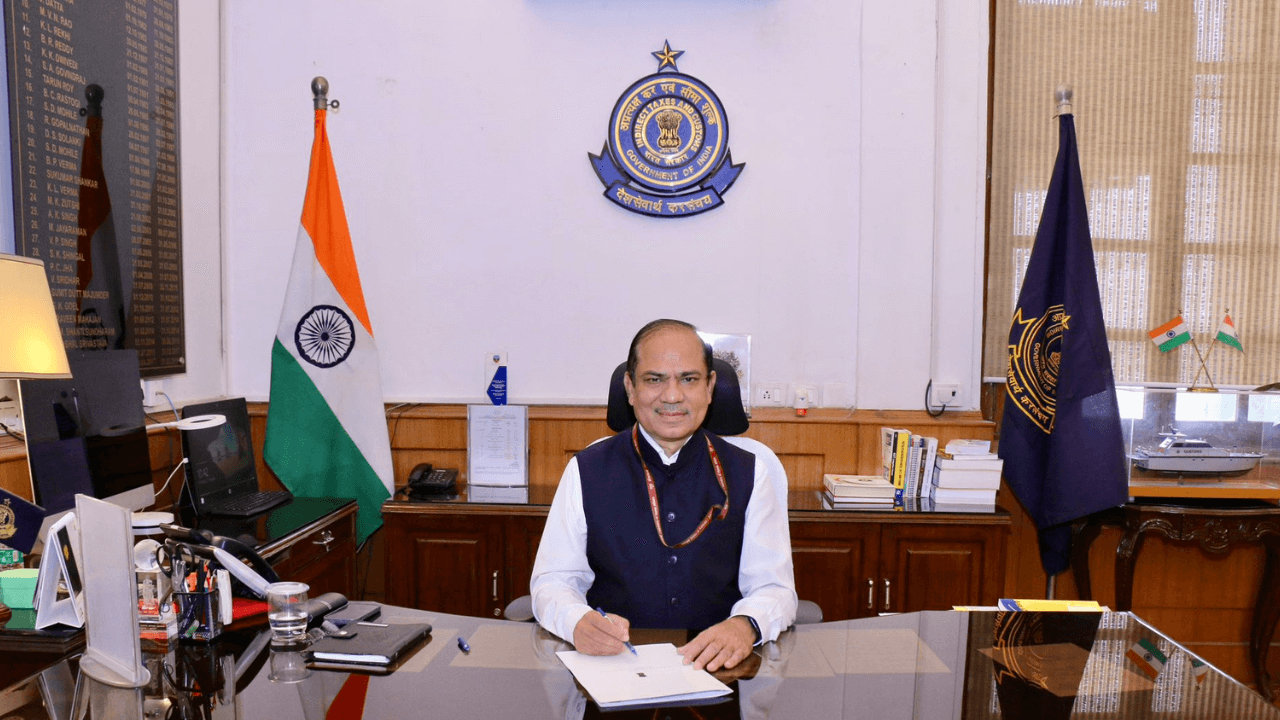

On August 5, 2023, Sh. Sanjay Kumar Agarwal, an officer of the Indian Revenue Service (Customs and Indirect Taxes) of the 1988 batch, assumed the role of Chairman of the Central Board of Indirect Taxes and Customs (CBIC).

He succeeds Vivek Johri, who retired as the head of CBIC on May 31. Sh. Agarwal, who was previously overseeing CBIC member compliance management and investigations, has been appointed to this significant position by the finance ministry in an order issued on August 5.

About the Central Board of Indirect Taxes and Customs (CBIC)

The Central Board of Indirect Taxes and Customs (CBIC) is a statutory body under the Ministry of Finance, Government of India. It is responsible for the administration of indirect taxes in India, which includes customs, central excise, service tax, and GST.

- The CBIC was formed on January 1, 1964, by merging the Central Board of Excise and the Central Board of Customs.

- The board is headed by a chairman, who is a senior Indian Revenue Service officer.

- The board has a number of members, who are also senior Indian Revenue Service officers.

- The CBIC has its headquarters in New Delhi, and it has regional offices in all major cities in India.

- The board also has a number of specialized units, such as the Directorate of Revenue Intelligence, the Directorate of Goods and Services Tax Intelligence, and the Directorate of Customs Intelligence.

Key Functions

- Levying and collecting indirect taxes

- Enforcing the laws related to indirect taxes

- Investigating cases of tax evasion

- Promoting trade and commerce

- Facilitating compliance with indirect tax laws

The CBIC plays a vital role in the Indian economy. It collects billions of rupees in indirect taxes every year, which helps to fund the government’s expenditures. The board also plays a role in promoting trade and commerce by ensuring that the indirect tax regime is fair and transparent.

Initiatives

The CBIC is committed to providing high-quality services to taxpayers. The board has a number of initiatives in place to make it easier for taxpayers to comply with indirect tax laws. These initiatives include:

- Online filing of returns

- Electronic payment of taxes

- Telephonic assistance

- Face-to-face counseling

The CBIC is also working to simplify the indirect tax laws. The board has introduced a number of simplification measures in recent years, and it is committed to further simplifying the laws in the future.

- Weekly Current Affairs 2025 PDF For Bank, SSC, UPSC Exams

- Unsung Heroes of India: 10 Unknown Freedom Fighters You Should Know

- 26 December Current Affairs 2023 in English

- Daily Current Affairs 2025, Check Today’s Current Affairs

- April Month Current Affairs 2024, Download PDF

- June Month Current Affairs 2024, Download PDF

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.