Banking Ombudsman and Consumer JAIIB Topper’s Notes: A banking ombudsman is an important figure in banking. RBI appoints a Banking Ombudsman to redress consumer complaints about banking services. Here we will learn in detail about the Banking Ombudsman and how they help in the banking industry. This is a topic for JAIIB IEIFS

Banking Ombudsman

- Expeditious and inexpensive forum for quick redressal of consumer grievances and protection of consumer interests

- Section 35A in Banking Regulations Act with effect from 1995 —-revamped in 2006

Banking Ombudsman Definition

There are a number of ways to define the position of banking ombudsman:

- A senior Officer appointed by RBI to redress consumer complaints against deficiency of certain banking services.

- Basically, a person appointed by RBI to resolve customer complaints on a Fast Track basis so that customers can get solutions hassle-free- all SCBs, RRBs, and Scheduled primary cooperative banks included

Banking Ombudsman Scheme

- Non-observance of Reserve Bank Directives on interest rates

- Delays in sanction, disbursement, or non-observance of prescribed time of loan disbursals

- Non- acceptance of loan applications without any valid reasons

- Non-adherence to the provisions of the fair practices code for lenders as per the Code of Bank’s Commitment to Customers

- Before reaching out to the Banking Ombudsman a customer has to approach the bank for resolution.If the respondent fails to respond within 30 days from the date of complaint or provides an unsatisfactory response, the complainant can file a detailed complaint regarding the matter.

Compensation

Any loss that the complainant suffers will be equal to the amount arising directly out of the act or omission of the bank or 20 lakhs, whichever is lower

In case of complaints relating to credit card operations for mental agony and harassment- compensation will not exceed 1 lakh

Appeal against the order passed by the banking ombudsman

If a person is dissatisfied with the solutions that the Banking Ombudsman provides, they can approach the appellate authority within 30 days of receiving the award. A Deputy Governor of the RBI is vested with the appellate authority.

When will the Ombudsman not consider a person’s complaint?

The banking ombudsman will not consider a person’s complaint if:

- They haven’t approached his bank for the redressal of his grievance first.

- The person has not made the complaint within one year from the date of receipt of the reply from the bank or,

- if the bank didn’t reply, and the person makes the complaint to Banking Ombudsman after the lapse of more than one year and one month from the date of the complaint made to the bank.

- Any forum such as a court of law, consumer court, etc. may have already dealt with or currently be handling the subject matter of the complaint.

- Frivolous or vexatious complaints.

- The scheme doesn’t cover the institution the complaint is about.

- The subject matter of the complaint is not pertaining to the grounds of complaint specified under Clause 8 of the Banking Ombudsman Scheme. If the complaint is for the same subject matter that was settled through the office of the Banking Ombudsman in any previous proceedings.

Can the Banking Ombudsman reject a complaint at any stage?

Yes. The Banking Ombudsman may reject a complaint at any stage if it appears to him that a complaint made to him is:

- not on the grounds of the complaint referred to above

- compensation sought from the Banking Ombudsman is beyond ₹ 20 lahks (₹ Two Million).

- requires consideration of elaborate documentary and oral evidence and the proceedings before the Banking Ombudsman are not appropriate for adjudication of such complaint

- the complaint is without any sufficient cause

- the complaint that it is not pursued by the complainant with reasonable diligence

- in the opinion of the Banking Ombudsman, there is no loss or damage, or inconvenience caused to the complainant.

Consumer Protection Act

- The consumer protection act came into effect in 1986 to protect the interests of consumers.

- It was repealed with the Consumer protection act 2019.

- It extends to the whole of Jammu and Kashmir

- The act covers all goods and services, except as otherwise provided by the central government.

- Enables speedy disposal of the redressal of consumer disputes.

Central Consumer Protection Authority:

- The Act proposes the establishment of the Central Consumer Protection Authority (CCPA) as a regulatory authority.

- The CCPA will protect, promote and enforce the rights of consumers and regulate cases related to unfair trade practices, misleading advertisements, and violation of consumer rights.

- CCPA would have wide-ranging powers.

- The CCPA will have the right to take suo-moto actions, recall products, order reimbursement of the price of goods/services, cancel licenses, impose penalties, and file class-action suits.

- The CCPA will have an investigation wing to conduct independent inquiries or investigations into consumer law violations.

Submission of complaints

- Any allegation should be in writing made by the complainant to obtain any relief

- The complaint must include a consumer or any voluntary consumer association registered under the Companies act 1956 or any other law or the Central or State govt, or one or more consumers having the same interest

- Complaints must be in a prescribed manner along with complete details and the applicable fee Supporting affidavit is compulsory.

- Admissibility of the complaint is decided within 21 days

Consumer Forums and The Commission

- Consumer councils- promote and protect the rights of consumers

- Central council- Jurisdiction for the entire country, state council- for each state, district council – for each district

- Council of state- minister in charge of consumer affairs in state government

- District forum has powers to deal with cases upto1 Crore

- State commission deals with cases exceeding the value of 1 Crore and below 10 crore

- Above 10 crores- Central Commission

E-Filing of Complaints:

The new Act provides flexibility to the consumer to file complaints with the jurisdictional consumer forum located at the place of residence or work of the consumer. This is unlike the earlier condition where the consumer had to file a complaint at the place of purchase or where the seller has its registered office address.

The new Act also contains enabling provisions for consumers to file complaints electronically and for hearing and/or examining parties through video-conferencing.

Consumers will also not need to hire a lawyer to represent their cases.

Banking Ombudsman and Consumer JAIIB Topper’s Notes: Summary

- Speedy redressal of customers is taken by the Banking Ombudsman over complaints relating to certain services rendered by banks.

- The Banking Ombudsman has the power to award compensation in genuine cases. One can approach the Appellate authority if not satisfied.

- To protect the interests of the consumers, the consumer protection act is in practice. The councils at different levels like district, state, and central protect the interests of the consumers.

JAIIB Banking Ombudsman and Consumer Topper’s Notes: Free E-Book Download for JAIIB

Step 1: Click on the download link. You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the Impact of Globalization on India PDF.

Step 3: After Logging in, you will be able to download the free e-book by clicking on “click here” as shown in the snap below.

JAIIB Handwritten Topper’s Notes by Sambita Mitra

Banking Ombudsman and Consumer JAIIB Topper’s Notes: Frequently Asked Questions

The Banking Ombudsman Scheme is an alternative dispute resolution mechanism provided by the Reserve Bank of India (RBI) for resolving customer complaints against banks.

Complaints should be filed with the Banking Ombudsman within one year from the date of the cause of action.

No, there is no fee for filing a complaint with the Banking Ombudsman.

The RBI appoints the Banking Ombudsman.

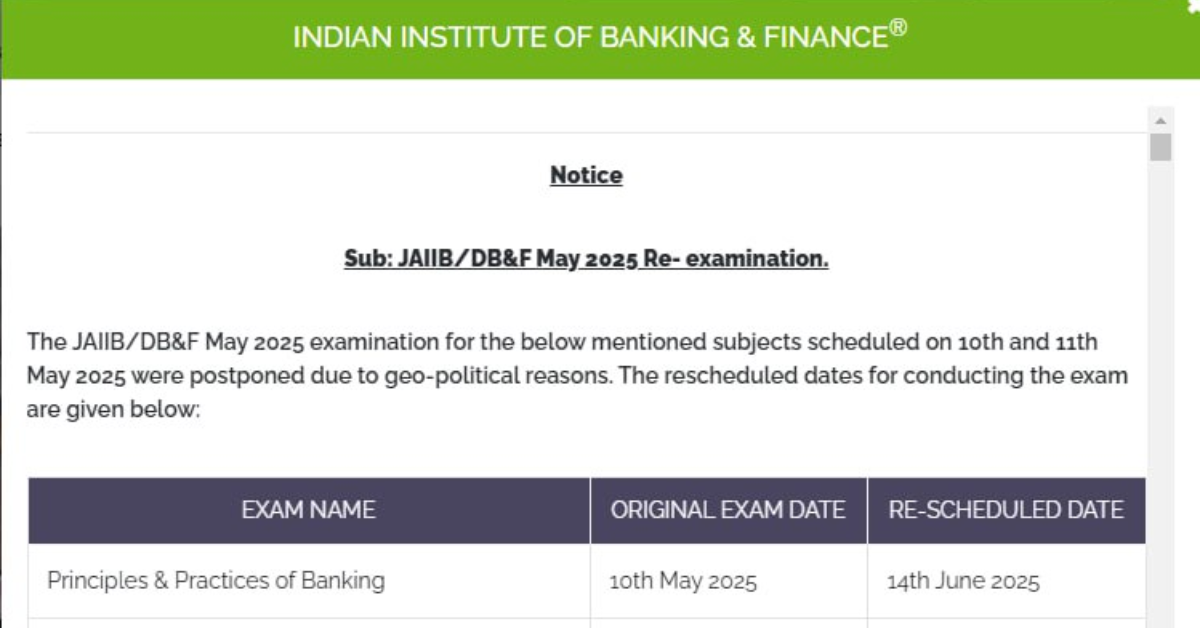

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis