Is Pursuing a Career in Banking Worth It in 2025? India’s banking sector is one of the most structured and evolving financial ecosystems in the world. As the country transitions rapidly toward a digital and financially inclusive economy, the demand for skilled banking professionals is at an all-time high. Whether you’re a fresh graduate or a mid-career professional, banking offers a wide array of roles with strong job security, competitive pay, and a clear growth path.

Banking Industry in India

India’s banking system has seen major developments in the past decade. The government’s push for a cashless economy, 100% financial inclusion, and digital transformation has expanded the sector significantly. From traditional public sector banks to fintech-led digital banks, the ecosystem is growing both in size and complexity, creating new career avenues for professionals across disciplines.

Is Pursuing a Career in Banking Worth It in 2025?

Banking is one of the safest and most rewarding career options in India today. Whether you’re looking for stability, growth, or a respectable job with a steady income, banking offers it all. With thousands of job openings expected in 2025, now is the perfect time to start preparing. If you have good communication skills, enjoy working with people, and want a strong, long-term career, banking might be the perfect fit for you.

Future Prospects of the Banking Sector in 2025

The banking sector in India is witnessing a major shift in workforce requirements. A large portion of current employees in public sector banks (over 7 lakh in total) are nearing retirement. This opens up thousands of vacancies over the next few years, especially in officer and clerical roles.

Additionally, private banks, digital banks, and fintechs are expanding aggressively, further increasing the demand for skilled professionals in areas such as risk management, digital banking, cybersecurity, data analytics, and financial advisory.

Emerging Roles and Career in Banking Sector

Modern banking goes far beyond just teller or clerk positions. The rise of digital products, customer experience models, and specialized services has opened doors to a variety of professional roles. Some key positions in the banking sector include:

- Probationary Officers (POs), like – SBI PO, IBPS PO

- Clerks and Customer Support Executives, like – SBI Clerk and IBPS Clerk

- Management Trainees (MTs)

- Loan and Credit Officers

- Investment Bankers and Financial Analysts

- Risk Managers and Compliance Officers

- IT Officers and Cybersecurity Analysts

- Relationship Managers and Sales Executives

You don’t need to be from a commerce or finance background to apply — banks welcome candidates from engineering, arts, science, law, and even design, depending on the role.

International Exposure and Transfers in Bank Jobs

Several Indian banks have foreign branches or operations in global financial hubs. As you grow in your role, there’s potential for international postings, exposure to global financial systems, and cross-cultural experience. In addition, the transferable nature of banking jobs gives professionals a chance to live and work in different regions of India — adding to their personal and professional development.

Real Success Stories in Banking Industry

These examples show that banking offers a level playing field for ambitious professionals, regardless of academic background.

- Arundhati Bhattacharya – Literature graduate who joined SBI as a PO and became the first woman Chairperson of SBI.

- Arun Tiwari – B.Sc. Chemistry graduate who rose to become CMD of Union Bank of India.

- KR Kamath – Started as an officer trainee and led Punjab National Bank as CMD.

Salary and Compensation in 2025 (Example: SBI PO)

Banking salaries vary based on position, experience, and bank type. Private banks may offer higher pay for tech and sales roles, but public sector jobs offer greater stability and perks. Below is a typical starting SBI PO Salary:

| Component | Amount (₹) |

| Initial Basic Pay (with 4 increments) | 56,480.00 |

| Dearness Allowance @ 19.83% | 15,327.01 |

| HRA (House Rent Allowance) | 4,518.40 |

| Location Allowance | 1,200.00 |

| Learning Allowance | 850.00 |

| Special Allowance | 14,967.20 |

| Gross Salary | 93,342.61 |

| Deductions | 12,993.00 |

| Net (In-hand) Salary | 80,350.00 |

FAQs

Yes, banking is a great career option in India in 2025. It offers job security, good salary, and many opportunities for growth in both public and private banks.

Yes, any graduate from any stream (Arts, Science, or Commerce) can apply for bank jobs like IBPS PO, SBI PO, and clerical posts.

Banking jobs offer benefits like fixed working hours, promotions, housing allowance, medical cover, and a pension after retirement.

Some top banking exams in 2025 are IBPS PO, SBI PO, IBPS Clerk, RBI Grade B, NABARD Grade A, and Specialist Officer exams.

In 2025, a Probationary Officer (PO) in SBI earns a basic pay of ₹41,960 and a total monthly salary of around ₹65,000–₹75,000, including allowances.

- SBI PO vs. IBPS PO vs. IBPS RRB PO: Which Exam is Better?

- RBI Assistant Reasoning Preparation 2026: Complete Strategy

- OICL AO Mains Result 2026, Check Your Result Here

- OICL AO Cut Off 2025-26: Check Expected Marks

- IBPS Clerk Reserve List 2025-26, CSA Provisional Allotment

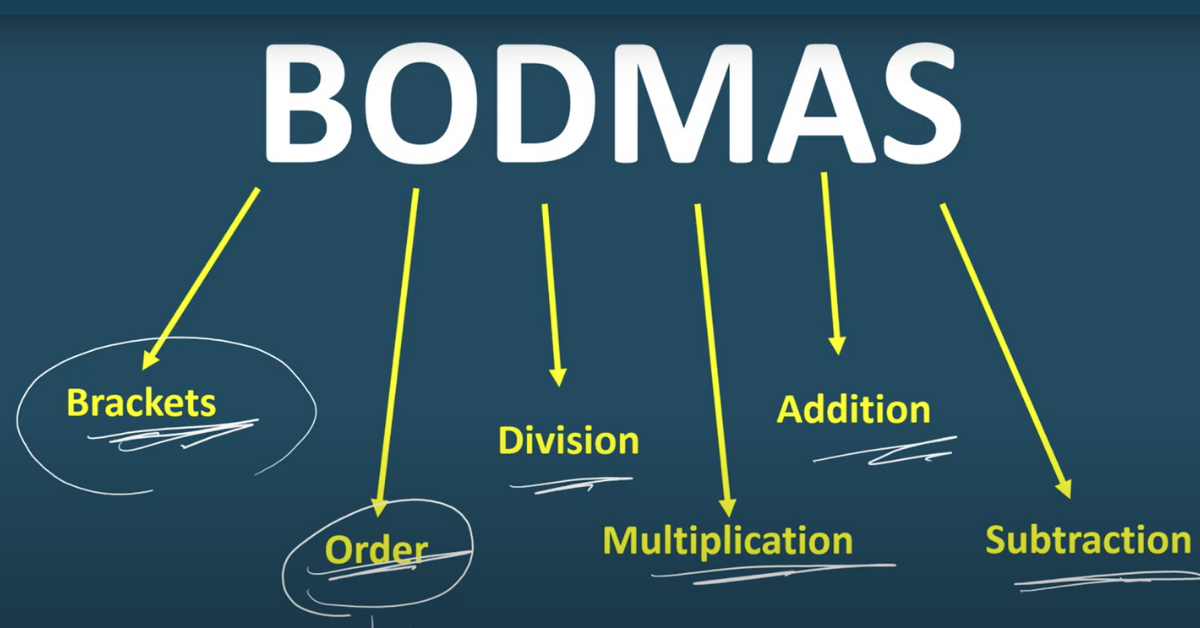

- Simplification Questions For Bank Exams, Live Quiz, FREE PDF

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railway, and state exams.