Reserve Bank of India being the central bank of the country is a great organisation to work for. Every year Lakhs of aspirants apply for the RBI Grade B posts as it offers great career opportunities as well as impressive perks & allowances to its officers. The Grade B recruitment notification is expected to be announced in the month of June-July 2020. It is highly advisable to start with your preparations from now on itself so that when you are suddenly notified of the recruitment notification, you have already covered a prominent portion of the syllabus. The Grade B Exam is conducted in three stages namely Phase I, Phase 2 and the Interview round.

Toppers of the exam have always suggested carrying on the preparations and study for both Phase 1 and Phase 2 simultaneously because the syllabus of Phase 2 of RBI Grade B is vast and requires thorough knowledge and persistence in studies. The subjects asked in the Phase 2 Exam are Economics & Social Issues, Finance & Management and Descriptive English. So to give you a helping hand in your studies for the Grade B Exam, we at Oliveboard would be providing you with study notes on important topics from the syllabus of Phase 2. In this blog, we will cover the topic of “Risk Management in Banking Sector – RBI Grade B Notes”.

Corporate Governance in Banking Sector – RBI Grade B Study Notes

What is Corporate Governance in Banking Sector?

Governance refers specifically to the set of rules, controls, policies, and resolutions put in place to dictate corporate behaviour. Corporate Governance essentially involves balancing the interests of a company’s many stakeholders, such as shareholders, senior management executives, customers, suppliers, financiers, the Government, and the community.

Corporate Governance can be discussed in 3 parts:

- General,

- Public Sector and

- Private Sector

Corporate Governance in Banking Sector – General features:

- Indian Legal system provides a very high level of protection to Indian Investors and India has a very high ranking with a score of 5 in the shareholders’ rights index and a maximum score of 4 in the creditor’s rights index.

- But these scores only remain on paper as the effectiveness of implementation lacks due to huge corruption and a variety of other reasons.

- Institutions like SEBI, NSDL, and NSCL have improved investors’ rights on many fronts.

- Annual reports now feature a certificate from the CEO and the CEO in which they affirm that financial statements do not contain any misleading statements.

- The corporate governance landscape in India has seen positive developments in the last decade, particularly with the enactment of clause 49 of the listing agreement and the legal changes in enforcing creditors’ rights.

Corporate Governance in Banking Sector – Private Sector:

There are 3 types of stakeholders in a company: Promoters, Financial Institutions and Individual or retail Investors. Initially, all three categories were equally important but now at the expense of retail investors other two have gained more stake.

- Promoters in India, in general, take a longer view and provide a more solid foundation for developing the companies.

- In electing the directors, the majority rule voting system is typically followed.

- Company Boards generally comprise three types of directors: Promoter Directors (or functional directors in the case of professionally managed companies), Professional Directors, and Institutionally Nominated Directors.

- Promoter Directors belong to the promoter group.

- Professional Directors are persons of eminence who are invited by the promoters mainly on the basis of favourable personal equations.

- Institutionally Nominated Directors are either senior executives of the institutions or persons of repute.

- The corporate governance system in the private sector may, therefore, be characterised as the “entrenched system”, given the firm hold of the promoters over the companies managed by them.

Tunnelling

The dominant shareholder may exploit minority shareholders. This phenomenon is referred to as tunnelling – the dominant shareholder may tunnel into the firm and benefit at the expense of minority shareholders.

Example: Companies Owned by families.

Corporate Governance in Banking Sector – Public Sector:

Public Sector – Shares owned by the Government are more than 51 per cent or wholly owned.

Boards appointed by the ministry have 3 categories of Directors:

- Functional Director – full-time employees of the organization

- Government Directors – Bureaucrats from the Ministry

- Outside directors

Public Sector Enterprises (PSEs) are constrained by various regulations and administrative guidelines. Further, they are subject to the CAG audit and are accountable to parliament. This leads to an excessive emphasis on observing rules, regulations, and guidelines. Efficiency and performance are often sacrificed at the altar of propriety.

Chief Executives have short tenures below five years and the development of conditions or long-term outlook is not possible because of this.

Legal Provisions:

- Strength: A public limited company must have at least three directors.

- Meetings: The board of directors must meet at least once in a quarter.

- Composition: There is no fixed number of non-executive directors. No person can be a director of more than twenty companies.

- Powers: The board of directors has the powers to (a) borrow, lend, and invest funds, (b) recommend dividends, and (c) appoint the managing director.

- Remuneration: The total remuneration of the directors is subject to a ceiling of 11 per cent of net profits. In addition, board members can be paid a sitting fee of up to Rs.20000 per meeting.

- Duties: The board has the duty to present the annual report to the members.

- Liabilities: The board is punishable for breach of trust, dishonesty, and fraud.

Clause 49 of the Listing Agreement

Clause 49 of the Listing Agreement was introduced on the recommendations of the Kumaramangalam Birla committee set up by SEBI and spells out the corporate governance provisions applicable to listed companies.

- Where the chairman of the board is a non-executive director, at least one-third of the board should comprise of independent directors. In case the chairman is an executive director, at least half of the board should comprise of independent directors.

- A qualified and independent audit committee shall be set up. The audit committee shall have a minimum of three directors as members. Two-thirds of the members of the audit committee shall be independent directors. The chairman of the audit committee shall be an independent director.

- Where the company deviates from a prescribed Accounting Standard, the same shall be disclosed in the financial statements, together with the management’s explanation for the same.

- The CEO and CFO shall certify to the Board that the financial statements present a true and fair view of the company’s affairs; that to the best of their knowledge and belief no transactions entered by the company are fraudulent.

Required Reforms in Corporate Governance

Some of the reforms required in Corporate Governance rules are listed below:

- Strengthen the Hands of Institutional Investors

- Separate Management from Control

- Expand the Role of Non-executive Directors

- Limit the Size of the Board

- Ensure that the Board Is informationally well-equipped

- Link Managerial Compensation to Performance

- Enhance Contestability

- Improve Corporate Accounting and Reporting Practices

Sample Questions:

Q. Which one of the following would not be described as an institutional investor?

- Banks

- Pension funds

- Insurance companies

- Employees holding shares through an employee share scheme

Answer: (4)

Q. What is meant by the ‘separation of ownership and control?

- That the owners of companies have become separated from those who control companies.

- That the law should seek to keep the owners and controllers of the company apart in order to avoid an over-concentration of power.

- That owners and controllers of companies should not act in concert to defeat resolutions.

- That those who control the company should be separated from those who own it.

Answer: (1)

Q. Which one of the following is not a valid difference between executive and non-executive directors?

- Executive directors work full-time, whereas non-executive directors work part-time.

- Executive directors tend to be paid considerably more than non-executive directors.

- Executive directors are involved in the management of the company, whereas non-executive directors are not expected to be involved in management.

- Non-executive directors should be independent, whereas the executives will usually not be.

Answer: (3)

Corporate Governance is in recent current affairs with many company loans turning into NPA’s and many others filing for Solvency under new IBC. Hence current affairs related to those companies are also to be studied along with the static part mentioned here.

This was all from us in this blog “Corporate Governance in Banking Sector – RBI Grade B Study Notes”. We hope that you find the information given above in the blog “Corporate Governance in Banking Sector – RBI Grade B Study Notes” useful. For more study notes for RBI Grade B, stay tuned to Oliveboard.

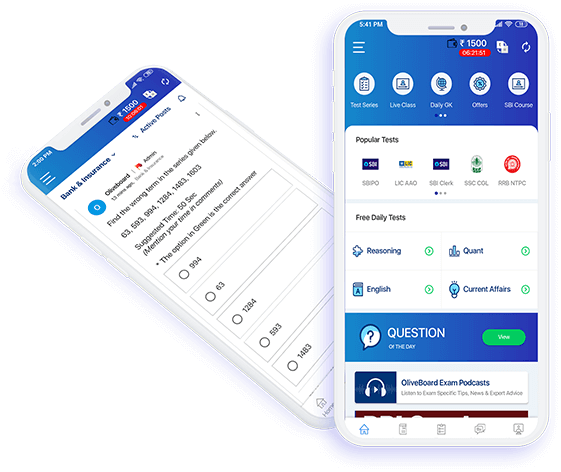

DOWNLOAD THE RBI, NABARD, SEBI Prep App FOR ON-THE-GO EXAM PREPARATION

The app provides comprehensive study material in form of online courses to ace these examinations.

The study material ranges from online LIVE classes, video lectures, study notes, revision sessions, past year papers, topic tests, the objective plus descriptive mock tests, mock interviews and much more.

List of Exams

1) RBI Grade B Generalist Posts

2) SEBI Grade A Generalist Posts

3) SEBI Grade A IT Officer Posts

4) NABARD Grade A Generalist Posts

5) NABARD Grade A IT Officer Posts

6) NABARD Grade A Agriculture Officer Posts

7) NABARD Grade B Posts

8) SIDBI Grade A Officer Posts

9) FSSAI Recruitment – For Technical officers, Food Safety Officers and Assistants

Get free video lessons, mock tests and GK tests to evaluate course content before signing up!

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!