Recently, there has been a lot of news around the GST Compensation to the states. Considering the importance of the topic and its impact on the Indian economy, it is expected that one may face questions based on this bill in interviews and group discussions. Let us learn all about it and know here about the history and the current scenario of GST Compensation to States.

GST Compensation to States

Goods & Services Tax (GST): What is it?

The goods and services tax (GST) is an indirect tax levied on most goods and services sold for domestic consumption.

The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

Goods & Services Tax Council

- It is a constitutional body under Article 279A for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- It was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

GST (Compensation to States) Act, 2017

- As per the GST (Compensation to States) Act, 2017, states are guaranteed compensation for revenue loss on account of implementation of GST for a transition period of five years (2017-2022).

- The compensation is calculated based on the difference between the current states’ GST revenue and the protected revenue after estimating an annualised 14% growth rate from the base year of 2015-16.

- If a state’s GST revenue grows slower than 14 per cent, such ‘loss of revenue’ will be taken care of by the Centre by providing GST compensation grants to the state.

- Any shortfall has to be compensated from the receipts of Compensation Cess imposed on selected commodities that attract a GST of 28 per cent.

- At present, the cess levied on sin and luxury goods such as tobacco and automobiles flow into the compensation fund.

Current Scenario:

- GST compensation payments to states have been pending since April, with the pending amount for April-July estimated at Rs 1.5 lakh crore.

- The GST compensation requirement is estimated to be around Rs 3 lakh crore this year, while the cess collection is expected to be around Rs 65,000 crore – an estimated compensation shortfall of Rs 2.35 lakh crore.

- To compensate for the loss, two options presented by the Centre for borrowing by States to meet the shortfall:

- The first was a special window to states, in consultation with the RBI, to borrow the projected GST shortfall of Rs 97,000 crore, and an amount that can be repaid after five years of GST, ending June 2022, from the compensation cess fund.

- A 0.5% relaxation in the borrowing limit under The Fiscal Responsibility and Budget Management (FRBM) Act would be provided, delinked from the conditions announced earlier as part of the pandemic package linked to the implementation of reform measures such as universalisation of ‘One Nation One Ration Card’, ease of doing business, power distribution, and augmentation of urban local body revenues.

- The second option was to borrow the entire projected shortfall of Rs 2.35 lakh crore – both on account of faltering GST collections and the expected shortfall due to the pandemic – facilitated by the RBI. No FRBM relaxation has been mentioned for this option so far.

Significance of GST for states:

- States no longer possess taxation rights after most taxes, barring those on petroleum, alcohol, and stamp duty were subsumed under GST.

- GST accounts for almost 42% of states’ own tax revenues, and tax revenues account for around 60% of states’ total revenues.

Source: The Hindu and Indian Express

What is India’s Goods and Services Tax (GST) Bill?

GST stands for Goods and Services Tax and is also known as Constitution (122 Amendment) Bill, 2014.

It is a single value-added tax levied at all points in the supply chain of goods and services. Credit is allowed for any tax paid on inputs. It would apply to both goods and services in a comprehensive manner. GST is best explained by this one line:

One Country, One Tax, One Market.

India has a federal structure. Accordingly, it has been proposed that GST will be levied by both, the Centre (CGST) and the states (SGST). It is expected that the essential design features would be common between CGST and SGST for individual states.

Some key features of GST Bill:

- exports would be zero-rated

- imports would be taxed in the same manner as domestic goods and services

- for inter-state supplies within India, an Integrated GST (aggregate of CGST and the SGST of the destination State) will be levied

- in addition to the IGST, an additional tax of up to 1% has been proposed to be levied by the Centre, the revenue from which will be assigned to origin states.

Goods and Services Tax Rate: According to Government there would be two slabs-

- a lower rate slab for essential items and,

- another effective rate for most items

Central Taxes Being Subsumed in GST Bill |

State Taxes Being Subsumed in GST Bill |

|

Central Excise Duty |

State Value Added Tax/Sales Tax |

|

Additional Excise Duty, |

Entertainment Tax |

| Service Tax |

Octroi and Entry tax |

|

Additional Customs Duty ( Countervailing Duty ) |

Purchase Tax, Taxes on lottery, betting and gambling |

| Special Additional Duty of Customs |

Luxury tax |

The Benefits of India’s GST Bill ( Sector-wise )

In GST, an efficient input tax credit system ensures that there is no cascading of taxes. GST is levied only on the value-added at every stage of production.

GST Bill Benefits: For business and industry

- Uniformity of tax rates and structures would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

- Goods and Services Tax Bill ensures that there is minimal cascading of taxes. This would reduce the hidden costs of doing business.

- Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

- GST would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give a boost to Indian exports.

GST Bill Benefits: For Central and State Governments

- GST would be simple and easy to administer as multiple indirect taxes at the Central and State levels are being replaced by one tax.

- GST is expected to decrease the cost of collection of tax revenues of the Government, and will, therefore, lead to higher revenue efficiency.

GST Bill Benefits: For the consumer

- Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

Concerns Regarding the Goods and Services Tax (GST) Bill

- The Tax on services would go up substantially from 14% to 20%

- Tax on retail would be almost double.

- Imported goods would be taxed at a higher rate.

- There will be dual control on every business by Central and State Government.

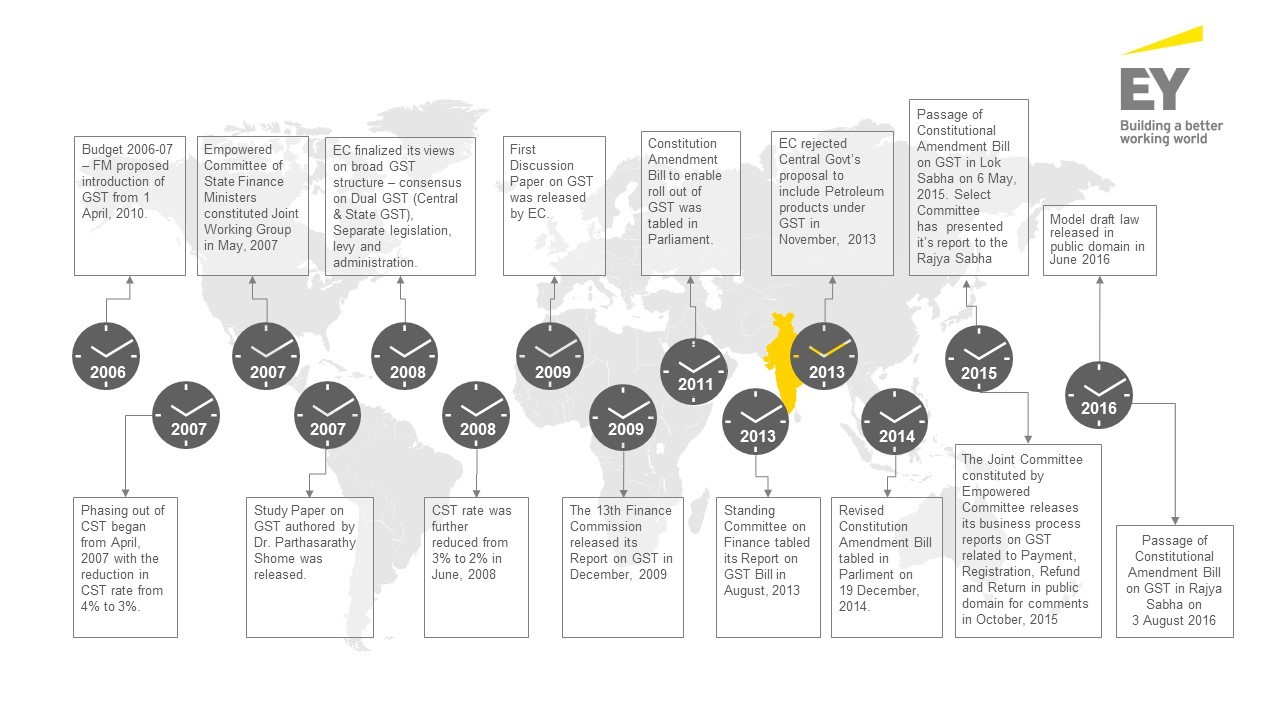

Timeline of events that have led to the GST Bill Amendment

Source: EY.com

RBI Grade B 2020 Online Course

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

What all the course offers you:

Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

Features:

Use Coupon Code ‘MY20’ to avail a 20% discount on RBI Courses!

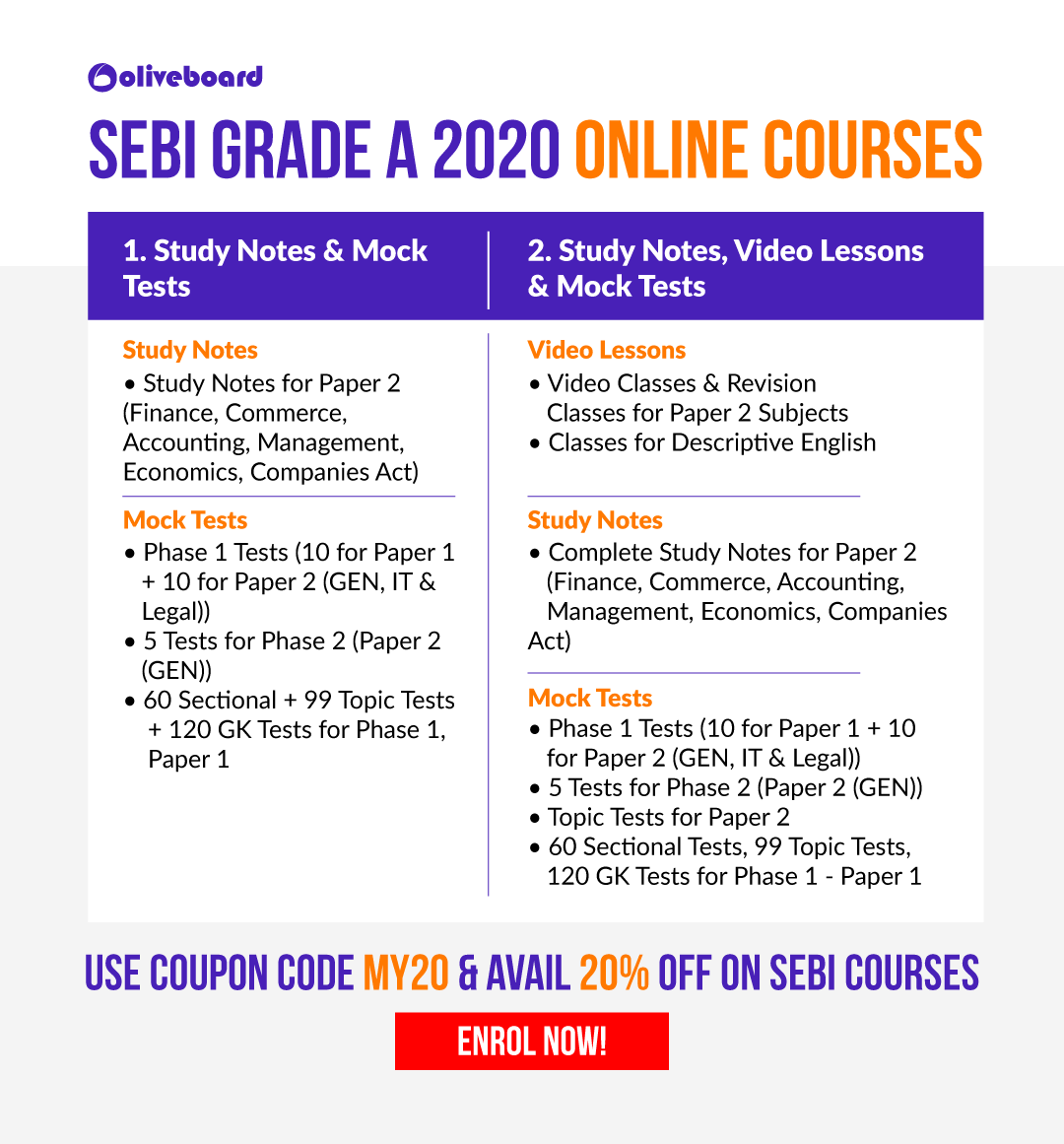

SEBI Grade A Online Course

For your Complete Phase 1 and Phase 2 Preparations

SEBI Grade A Cracker is a course designed to cover all the subjects under Phase I and Phase II exams.

- For Paper 1 of Phase I exam all essential subjects like Quantitative Aptitude, Reasoning, and English will be covered through video lectures.

- For Paper 2 of both Phase 1 and Phase 2, the complete syllabus will be covered through video lessons, and notes.

- The course will also have strategy sessions and past year paper discussions.

- This course has been designed in such a way that it can be covered well before the examination.

Enroll for SEBI Grade A 2020 Online Course Here

Course Features

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in