ECGC PO Vs SBI PO: The roles of SBI PO (State Bank of India Probationary Officer) and ECGC PO (Export Credit Guarantee Corporation Probationary Officer) are both coveted positions in the banking and financial sector. While both offer stability, growth, and attractive salaries, the job profiles, selection process, and salary structures differ significantly. In this article, we will break down the comparisons in various areas to help you make an informed decision if you are aiming for one of these positions.

ECGC PO Vs SBI PO

This table compares the general details, such as the organization and the nature of the job, for both positions. These roles cater to different sectors of banking, with ECGC PO focusing on export credit insurance and SBI PO handling customer services in general banking.

| Particulars | ECGC PO | SBI PO |

| Organization | Export Credit Guarantee Corporation of India | State Bank of India |

| Nature of Work | Provides export credit insurance to Indian exporters | Handles general banking operations and customer services |

| Exam Stages | Two stages: Objective Test & Descriptive Test | Three stages: Prelims, Mains, Group Discussion & Interview |

ECGC PO Selection Process Vs SBI PO Selection Process

Both exams have multiple stages, but the approach differs. SBI PO’s selection process is a bit longer, with three stages, whereas ECGC PO follows a simpler two-stage process. The detailed breakdown is provided below:

| Selection Process | ECGC PO | SBI PO |

| Stages | Objective Test, Descriptive Paper | Prelims, Mains, Group Discussion & Interview |

| Objective Test | Reasoning, Quant, English, General Awareness, Computer Knowledge | English, Quantitative Aptitude, Reasoning (Prelims); Reasoning & Computer Aptitude, Data Analysis, General Awareness, English (Mains) |

| Descriptive Test | Essay Writing, Precis Writing | Letter Writing, Essay Writing |

ECGC PO Exam Pattern Vs SBI PO Exam Pattern

Here is a side-by-side comparison of the exam pattern for both ECGC PO and SBI PO. While both exams assess a candidate’s reasoning, English, and quantitative aptitude, ECGC PO includes an additional test for computer knowledge, and the distribution of marks and time differs.

ECGC PO Exam Pattern

The ECGC PO Exam Pattern 2025 outlines the structure of the online examination for Probationary Officer recruitment. It consists of five sections with a total of 200 questions to be completed in 140 minutes.

| Name of the Test | No. of Questions | Maximum Marks | Duration |

| Reasoning Ability | 50 | 50 | 40 minutes |

| General Awareness | 40 | 40 | 20 minutes |

| Quantitative Aptitude | 50 | 50 | 40 minutes |

| English Language | 40 | 40 | 30 minutes |

| Computer Knowledge | 20 | 20 | 10 minutes |

| Total | 200 | 200 | 140 minutes |

SBI PO Exam Pattern

SBI PO follows a more intricate pattern with separate stages for Prelims and Mains exams, which are further divided into different sections.

SBI PO Prelims Exam Pattern

The SBI PO Prelims Exam Pattern 2025 outlines the structure of the preliminary examination for Probationary Officer recruitment.

| Subject | No. of Questions | Maximum Marks | Duration |

| English Language | 30 | 30 | 20 minutes |

| Quantitative Aptitude | 35 | 35 | 20 minutes |

| Reasoning Ability | 35 | 35 | 20 minutes |

| Total | 100 | 100 | 1 hour |

SBI PO Mains Exam Pattern

The SBI PO Mains Exam Pattern 2025 details the structure of the mains examination for Probationary Officer recruitment. It includes an objective test across four sections and a descriptive paper, with a total duration of 3 hours.

| Subject | No. of Questions | Maximum Marks | Duration |

| Reasoning & Computer Aptitude | 40 | 50 | 50 minutes |

| Data Analysis & Interpretation | 30 | 50 | 45 minutes |

| General/ Economy/ Banking Awareness | 50 | 60 | 45 minutes |

| English Language | 35 | 40 | 40 minutes |

| Descriptive Paper (Letter Writing & Essay) | 2 | 50 | 30 minutes |

ECGC PO Salary Vs SBI PO Salary

Salary is one of the key deciding factors for many candidates. Both SBI PO and ECGC PO offer attractive pay scales, but ECGC PO generally has a higher starting salary. Below is a detailed comparison of the salary structure for both positions.

ECGC PO Salary Structure

The ECGC PO Salary Structure 2025 offers a competitive pay scale with attractive allowances and career growth opportunities.

| Particulars | Details |

| Pay Scale | INR 53,600-2645(14)-90,630-2865(4)-1,02,090 |

| Basic Pay | INR 53,600 (Increment of INR 2645 provided for 14 years) |

| Basic Pay after 14 years | INR 90,630 |

| Maximum Basic Pay | INR 1,02,090 |

| Total CTC (Cost to Company) in Mumbai | INR 16 Lakhs per annum |

SBI PO Salary Structure

The SBI PO Salary Structure 2025 provides a competitive compensation package with additional benefits and allowances for Probationary Officers.

| Component | Amount |

| Basic Pay | INR 41,960 |

| Special Allowance | INR 6,881 |

| Dearness Allowance | INR 12,701 |

| Location Allowance | INR 700 |

| Learning Allowance | INR 600 |

| Gross Salary | INR 65,780 |

| Deductions | INR 12,960 |

| Net Salary | INR 52,820 |

ECGC PO Job Profile Vs SBI PO Job Profile

The job roles of an ECGC PO and SBI PO vary significantly in terms of responsibilities. An ECGC PO focuses on export credit and insurance-related tasks, while an SBI PO handles core banking operations and customer services. Here’s a quick comparison:

| Job Role | ECGC PO | SBI PO |

| Responsibilities | Providing export credit insurance to Indian exporters, managing export risks | Managing branch operations, handling customer queries, providing financial services |

| Nature of Work | More specialized, focuses on international trade and insurance | General banking and customer handling duties in domestic branches |

Which is Better? ECGC PO or SBI PO

Both positions have their pros and cons depending on your career aspirations. If you are interested in a specialized career with international exposure, ECGC PO might be a better choice due to its higher starting salary and niche focus. On the other hand, if you want to pursue a career in mainstream banking with a broader scope and more growth opportunities, SBI PO is a great option. Ultimately, the choice depends on your long-term career goals and interest in the specific banking sectors each job caters to.

ECGC PO vs SBI PO 2025 FAQs

Ans. ECGC PO focuses on export credit insurance, while SBI PO handles general banking and customer services.

Ans. SBI PO is generally considered tougher due to its three-stage process, including Prelims, Mains, and GD/Interview.

Ans. Yes, ECGC PO offers a higher starting salary with a basic pay of INR 53,600 compared to SBI PO’s INR 41,960.

Ans. Yes, computer knowledge is tested in the SBI PO Mains under Reasoning & Computer Aptitude.

Ans. Yes, you can apply for both if you meet the eligibility criteria for each exam.

Ans. An ECGC PO provides export credit insurance and manages risks related to international trade.

- SBI Clerk vs SBI PO, Major Differences & Similarities

- 7 Big Advantages of Becoming an SBI PO in 2025

- SBI PO Allotment Letter 2025 Out, Download Joining Letter

- SBI PO Document Verification and Joining Date 2025 Announced

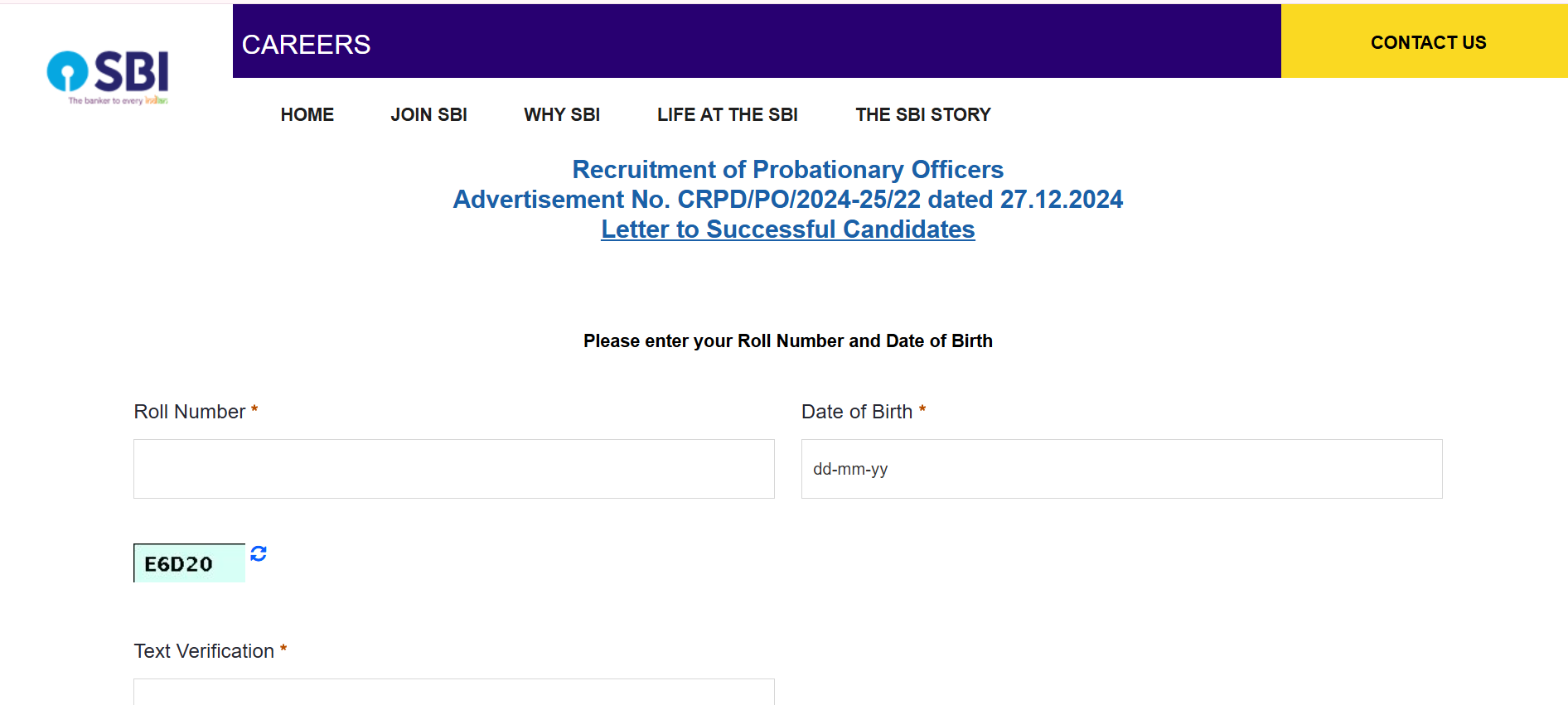

- SBI PO Final Scorecard 2025 Out, Final Result and Cut Off Marks

- ECGC PO Salary 2025, In Hand Salary, Pay Scale, and Allowances