The International Financial Services Centres Authority (IFSCA) has received a significant report from the ‘Committee of Experts on Onshoring the Indian Innovation to GIFT IFSC’. This committee, led by Shri G. Padmanabhan, Former Executive Director of RBI, and comprising representatives from various sectors, delved into the factors driving Indian startups to international shores. It also aimed to suggest solutions to prevent such outward shifts and encourage a return to Indian soil.

Fueling GIFT IFSC’s Fintech Excellence

The committee’s recommendations hold a special place in the evolution of GIFT IFSC into a global Fintech powerhouse. Their proposals aim to attract new Fintech players to establish a global presence in GIFT IFSC and tackle challenges to boost the International Innovation Hub there. The report offers a range of actionable steps for different stakeholders, including ministries and regulatory bodies, to realize the concept of onshoring Indian innovation to GIFT IFSC.

Boosting India’s Economic Vision: GIFT IFSC

An important aspect of the report is a detailed comparison of India’s approach to holding company setups with successful models in jurisdictions like Singapore, the Netherlands, and Luxembourg. By highlighting strengths and addressing challenges tied to holding company structures, the report underscores the potential of reverse flipping to drive India’s economic growth. The committee emphasizes aligning tax and regulatory laws in IFSC with global best practices to create a supportive environment for holding company structures.

Paving the Path to India’s Grand Vision

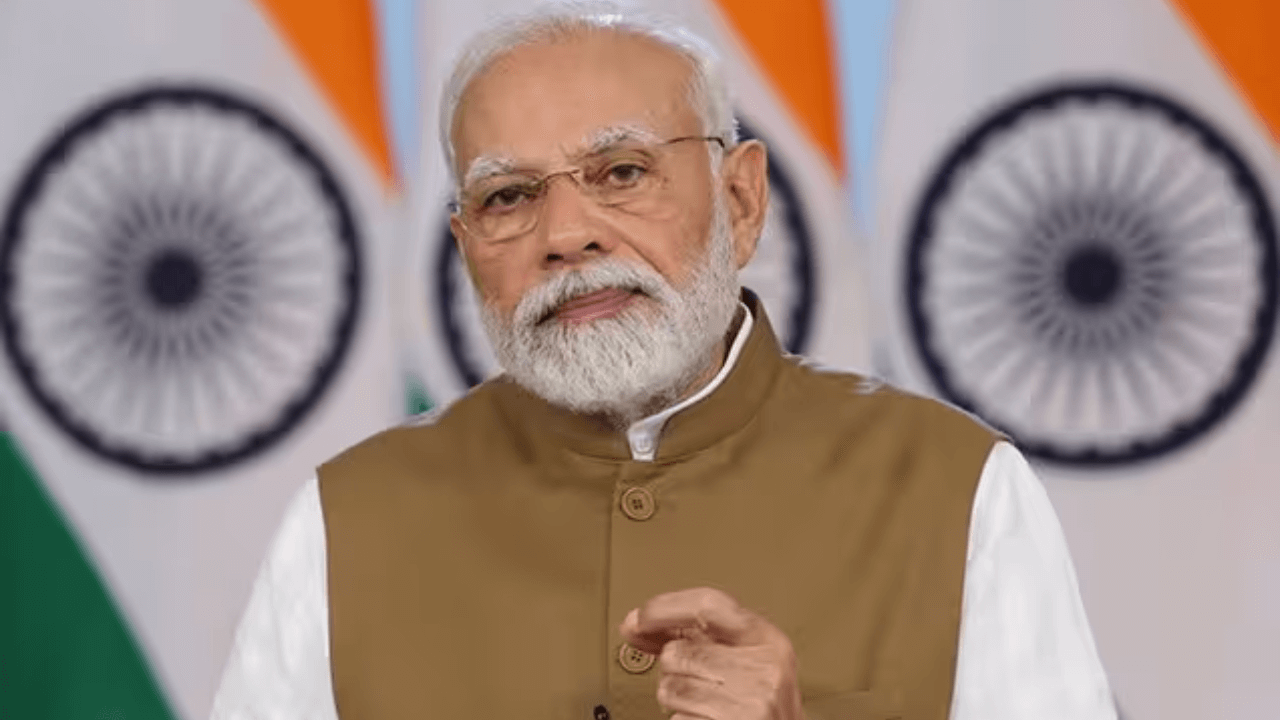

The committee believes that the insights shared in the report will spark productive conversations within the ministry, aligning with the goal of making India a 5 trillion-dollar economy and a global force by 2024-25, as envisioned by the Hon’ble Prime Minister. Shri G. Padmanabhan, the Committee Chair, expressed gratitude to IFSCA for entrusting them with this crucial task. The Chairperson of IFSCA extended appreciation to the committee of experts for their comprehensive recommendations, recognizing their role in shaping India’s financial landscape.

- Economic Survey 2026 Release, Key Highlights, and Significance

- RRB Group D Vacancy 2026, Know the Posts Available

- IBPS RRB Clerk Mains Exam Analysis 2026, 1st February Review

- RRB Group D Study Plan for 15 Days, Check Daily Schedule

- RRB Group D Books For Preparation, Check Subject Wise Books

Priti Palit, is an accomplished edtech writer with 4+ years of experience in Regulatory Exams and other multiple government exams. With a passion for education and a keen eye for detail, she has contributed significantly to the field of online learning. Priti’s expertise and dedication continue to empower aspiring individuals in their pursuit of success in government examinations.