Economic Survey Key Highlights – The Economic Survey is the central government’s flagship document, delving into the key details of the Indian economy and charting a course for the future. It also highlights potential threats to the economy.

Finance Minister Nirmala Sitharanam tabled the Economic Survey 2022-23 in parliament today(31-01-2023) before presenting budget 2023.

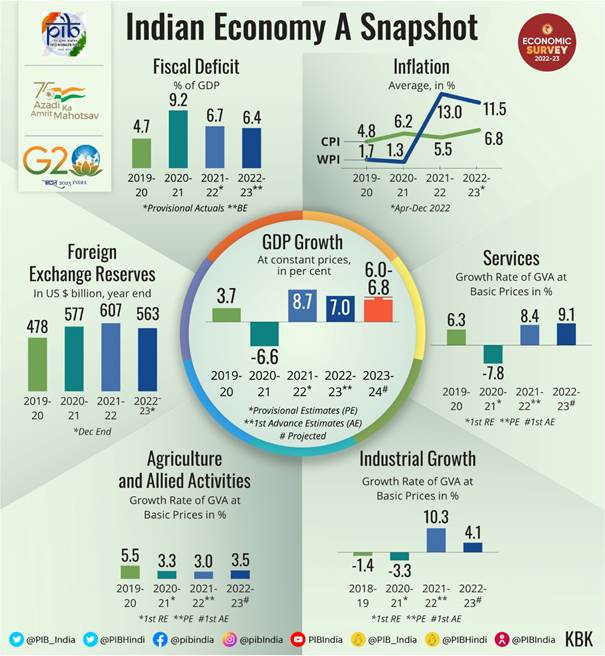

According to the Economic Survey for 2022-23, India’s GDP growth for the fiscal year 2023-24 will be in the 6-6.8 percent range. The baseline forecast for real GDP growth in the Survey is 6.5 percent. Finance Minister Nirmala Sitharaman introduced the survey in Parliament today. It is the Ministry of Finance’s flagship document, prepared under the direction of the Chief Economic Advisor. The document contains critical insights into India’s macroeconomic landscape and government policies, as well as reforms that can be implemented.

The Survey is being released this year at a time when India’s economy is being hailed as a bright spot amid recessionary fears in advanced economies. The survey is released just one day before Finance Minister Nirmala Sitharaman delivers the Budget 2023.

Prime Minister Narendra Modi stated ahead of the Budget Session of Parliament that the Union Budget will attempt to meet the hopes and aspirations of ordinary citizens. He stated that the Budget will provide a ray of hope to the world in the midst of global economic turmoil.

Modi acknowledged “credible voices from the world of economy” in an address to the media ahead of the Budget Session of Parliament. The prime minister stated that the Budget, which will be presented by Finance Minister Nirmala Sitharaman on February 1, will strive to fulfil people’s aspirations while also boosting the world’s hopes for India.

Download Economic Survey 2022-23 PDF:

Economic Survey 2022-2033 Key Highlights/Summary

Finance Minister Nirmala Sitharaman presented the Economic Survey report in the Lok Sabha. The survey projected a GDP growth rate in the range of 6-6.8% for the next fiscal 2023-24.

Economic Survey 2022-2023 presented in the parliament in two 2 volumes. The first looks at overall macroeconomic and sectoral developments, and the second is a revamped statistical appendix.

Key Highlights from the Economic Survey by the Finance Minister

- Challenge of the depreciating rupee, although better performing than most other currencies, persists with the likelihood of further increases in policy rates by the US Fed

- If inflation declines in FY24 and if real cost of credit does not rise, then credit growth is likely to be brisk in FY24. RBI has projected headline inflation at 6.8 per cent in FY23, which is outside its target range. At the same time, it is not high enough to deter private consumption and also not so low as to weaken the inducement to invest.

- It is expected that reaching the budget estimate for the fiscal deficit during FY23 will not be a concern for the Union Government. Union Government will be on track with the fiscal path outlined by the Medium-Term Fiscal Policy Statement.

- The widening of the CAD may also continue as global commodity prices

remain elevated and the growth momentum of the Indian economy remains strong. The loss of export stimulus is further possible as the slowing world growth and trade shrinks the global market size in the second half of the current year. - Sustained increase in private Capex is imminent with the strengthening of the balance sheets of the Corporates and the consequent increase in credit financing it has been able to generate.

- Financial health of the PSU banks has seen an improvement. This has positioned them for better credit supply. Consequently, the credit growth to the Micro, Small, and Medium Enterprises (MSME) sector has been remarkably high, over 30.6 per cent, on average during Jan-Nov 2022, supported by the extended Emergency Credit Linked Guarantee Scheme (ECLGS) of the Union government.

- Centre’s Capital expenditure for Road Transport and Highways in Apr-Nov FY23 stood at Rs 1.49 lakh crore rise of 102% YoY. Centre’s Capital expenditure for Railways in Apr-Nov FY23 stood at Rs 1.15 lakh crore, a rise of 76.65% YoY.

- Cumulative FDI in the pharma sector crossed the $20 billion mark in September 2022. Further, FDI inflows have increased four-fold over five years until September 2022, to $699 million. Growth in pharmaceutical output has slowed due to an unfavourable base effect and the waning of the pandemic.

- Government, along with private sector, has progressively worked towards increasing the share of renewables. This will ensure a gradual but calibrated energy transition, meeting the country’s sustainability targets and giving primacy to its national developmental requirements.

- The country is now a global force in steel production and the 2nd largest crude steel producer in the world. The steel sector’s performance in the current fiscal year has been robust, with cumulative production and consumption of finished steel at 88 MT and 86 MT, respectively.

- The performance of the agriculture and allied sector has been buoyant over the past several years, much of which is on account of the measures taken by the government to augment crop and livestock productivity, ensure certainty of returns to the farmers through price support, promote crop diversification, improve market infrastructure through the impetus provided for the setting up of farmer-producer organizations and promotion of investment in infrastructure facilities through the Agriculture Infrastructure Fund.

- The scenario of subdued global growth presents two silver linings – oil prices will stay low, and India’s CAD will be better than currently projected. The overall external situation will remain manageable.

Source: Moneycontrol

- Indian Bank Recruitment 2025 Out for 1500 Apprentice Posts

- Indian Bank Apprentice Salary 2025, Pay Scale, Salary Structure

- Indian Bank Apprentice Syllabus & Exam Pattern 2025, Check Details

- Railway RPF Syllabus 2024, Check Exam Pattern, Topic And Syllabus

- SSC JE vs RRB JE, Which Is Better? Know Detailed Comparison

Take a Look at Oliveboard’s Online Courses for your Comprehensive Preparation.

Connect with us on:

Frequently Asked Questions:

Yes, the economic survey is conducted every year

The economic survey is released on January 31st. It is prepared by the economic division of the department of Economic Division of the Department of Economic Affairs.

The four key economic concepts are scarcity, supply and demand, costs and benefits and incentives.

For UPSC preparation one must read Economic Survey of year 2022–2023 and Budget of 2023–2024.

Under the guidance of Cheif Economic Advisor V Anantha Nageswaran the Department of Economic Affairs (DEA) prepared Union Economic Survey 2022-2023.

The growth projection of union Economic Survey has predicted that India’s economy to grow at 8-8.5% in the fiscal beginning April 1, 2022.

For FY24 India’s GDP will grow between 6-6.8%.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!