The Indian Institute of Banking and Finance has released its Annual Report for 2024-25, citing details regarding the exams conducted by the institute, a comparison of the number of candidates appearing for the exams, updates in the courses, and more. In this blog, we will decode all the details provided in the PDF, along with information on the courses offered and the total number of registrations for those courses.

Indian Institute of Banking and Finance (IIBF)

The Indian Institute of Banking & Finance (IIBF) is a professional body dedicated to the banking and finance sector in India. Established in 1928, it has grown into the world’s largest institution of its kind, with over 11 lakh members, including employees from banks and financial institutions. Initially called The Indian Institute of Bankers (IIB), it was formed to create a strong platform for learning and development in banking.

Over the years, IIBF has introduced popular qualifications like JAIIB, CAIIB, and several diploma and certification courses that cover modern banking and finance topics. These programs are designed to enhance the skills of both existing employees and aspiring professionals, making IIBF a key driver of professional excellence in the sector.

What are the Main Objectives of IIBF?

The main objectives of IIBF are as follows:

- Vision: To be the premier institute for nurturing competent banking and finance professionals.

- Mission: To develop skilled bankers through education, training, exams, consultancy, and continuous development.

- Objectives:

- Promote study of banking and finance theory and practice.

- Certify competence in banking and finance.

- Collect and share professional knowledge.

- Encourage continuous learning and professional growth.

- Conduct research on banking products, instruments, and operations.

- Inspire innovation and creativity to face competition.

Who are the Key Members of the Governing Council of IIBF?

The Governing Council of the Indian Institute of Banking & Finance (IIBF) is led by senior leaders from India’s top banks and financial institutions.

- President: Shri M V Rao, Managing Director & CEO, Central Bank of India.

- Vice Presidents:

- Shri Debadatta Chand, Managing Director & CEO, Bank of Baroda.

- Shri Challa Sreenivasulu Setty, Chairman, State Bank of India.

- Members:

- Shri K Satyanarayana Raju, MD & CEO, Canara Bank.

- Shri Ashwani Kumar, MD & CEO, UCO Bank.

- Shri Ashok Chandra, MD & CEO, Punjab National Bank.

- Shri Binod Kumar, MD & CEO, Indian Bank.

- Shri B Ramesh Babu, MD & CEO, Karur Vysya Bank.

- Shri Deepak Kumar, Director, IDRBT.

- Shri Harideesh Kumar B, Director, IBPS.

- Shri Atul Kumar Goel, Chief Executive, Indian Banks’ Association.

- Shri Kishore Kumar Poludasu, DMD (HR) & CDO, State Bank of India.

- Shri Baskar Babu Ramachandran, MD & CEO, Suryoday Small Finance Bank.

- Prof. G Sivakumar, Professor, IIT Bombay.

- Shri Biswa Ketan Das, CEO, IIBF.

What are the Main Committees of IIBF and Who Chairs Them?

IIBF functions through several specialized committees, each focusing on a key area of its operations.

- Executive Committee – Chairman: Shri Debadatta Chand, MD & CEO, Bank of Baroda.

- Education & Training Committee – Chairman: Shri Ashwani Kumar, MD & CEO, UCO Bank.

- Examination Committee – Chairman: Shri K Satyanarayana Raju, MD & CEO, Canara Bank.

- CSR Committee – Chairman: Shri Harideesh Kumar B, Director, IBPS.

- IT Expert Committee – Chairman: Prof. G Siva Kumar, Professor, IIT Bombay.

- Research Advisory Committee – Chairman: Dr. Ajit Ranade, Trustee, Pune International Centre.

How did IIBF Perform Financially in FY 2024-25?

The Indian Institute of Banking & Finance (IIBF) has shown consistent and stable financial performance over the years. For the financial year ending 31st March 2025, the institute recorded steady growth in income and surplus, reflecting strong governance, efficient operations, and sustainable resource management.

| Particulars | FY 2024-25 | FY 2023-24 |

| Revenue and Other Income | 15,710.64 | 15,539.46 |

| Expenses | 7,240.04 | 7,208.45 |

| Surplus before Exceptional Items & Tax | 8,470.60 | 8,331.01 |

| Exceptional Items | 0.00 | 0.00 |

| Surplus before Tax | 8,470.60 | 8,331.01 |

| Tax Expenses | 1,284.03 | 1,307.03 |

| Net Surplus after Tax | 7,186.57 | 7,023.98 |

| Other Comprehensive Income / (Loss) | (28.16) | (0.38) |

| Total Comprehensive Income | 7,158.41 | 7,023.60 |

| Transfer to Staff Welfare Fund | 5.00 | – |

| Transfer to General Reserve | 7,181.57 | – |

What are the Membership Trends of IIBF as of 31st March 2025?

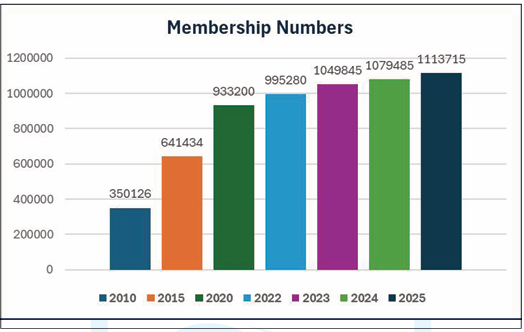

Membership at IIBF has been on a strong upward trend, crossing the 11-lakh mark in 2025.

- Ordinary Members: 11,13,715 (10,79,485 in 2024).

- Associate Members: 552.

- Fellow Members: 355.

- Institutional Members: 687.

- New Enrolments (FY 2024-25): 34,230 ordinary members.

- Growth Trend in Membership (Individual):

- 2010 – 3,50,126

- 2015 – 6,41,434

- 2020 – 9,33,200

- 2022 – 9,95,280

- 2023 – 10,48,945

- 2024 – 10,79,485

- 2025 – 11,13,715

What are the Different Types of Courses Offered by IIBF?

The Indian Institute of Banking & Finance (IIBF) offers a wide range of courses to support banking and finance professionals at different stages of their careers. These include flagship programs, diplomas, certificates, capacity-building courses, management programs, blended courses, and self-paced e-learning.

| Category | Course List |

| Flagship Courses | – JAIIB (Junior Associate of IIB) – CAIIB (Certified Associate of IIB) – Diploma in Banking & Finance |

| Diplomas | – Diploma in Treasury, Investment & Risk Management – Diploma in International Banking |

| Certificates | – AML/KYC – International Trade Finance – MSME – Micro Finance – NBFCs – Small Finance Banks – Urban Cooperative Banking – Foreign Exchange Facilities for Individuals – Strategic Management & Innovation in Banking – Insolvency & Bankruptcy Code – Certified Information Systems Banker – IT Security – Emerging Technologies – Prevention of Cyber Crime – Certified BFSI Professional – Business Correspondents/Facilitators – Debt Recovery Agents |

| Self-Paced E-Learning | – Digital Banking – Ethics in Banking – Climate Risk & Sustainable Finance – Project Finance |

| Capacity Building Courses (Mandated by RBI) | – Certified Treasury Professional – Certified Credit Professional – Risk in Financial Services – Certified Accounting & Audit Professional – Foreign Exchange Operations (FEDAI) |

| Management Programs | – MBA (IGNOU) – Advanced Management Programme (with IIM Calcutta) |

| Blended Courses | – Certified Banking Compliance Professional – Certified Wealth Management Professional |

| Courses Under Development | – Certificate in Customer Service – Certificate in Operational Risk Management – Certificate in Digital Banking & Cyber Security |

How do these Courses Help Banking and Finance Professionals?

These courses help banking professionals enhance their knowledge. The details are as follows:

- Career Advancement: JAIIB and CAIIB help employees get promotions and salary increments in banks.

- Specialization: Diplomas and certifications provide focused knowledge in areas like treasury, risk management, IT security, and trade finance.

- Compliance & Regulation: RBI-mandated capacity-building courses ensure bankers meet regulatory and operational standards.

- Global Relevance: Courses on digital banking, cyber security, and wealth management keep professionals updated with global trends.

- Flexible Learning: Self-paced e-learning allows professionals to learn anytime, anywhere.

| Syllabus | Syllabus |

| JAIIB Paper Wise Syllabus | CAIIB Paper Wise Syllabus |

Year-on-Year Comparison of JAIIB and CAIIB Enrolments

The Indian Institute of Banking & Finance (IIBF) has witnessed significant enrolments in its flagship courses JAIIB (Junior Associate of IIBF) and CAIIB (Certified Associate of IIBF). These courses are highly valued for career growth and professional development in the banking sector.

| Year | JAIIB Enrolments | CAIIB Enrolments |

| 2020-21 | 1,08,030 | 35,468 |

| 2021-22 | 1,87,974 | 1,01,136 |

| 2022-23 | 1,96,608 | 1,26,370 |

| 2023-24 | 1,17,396 | 74,059 |

| 2024-25 | 1,67,177 | 89,179 |

Check: The last date for the CAIIB 2025 registration process is 22nd September 2025.

How many candidates enrolled, appeared, and passed the flagship exams in 2024–25?

The details of the candidates appeared for the exam and the pass percentage details are as follows:

| Examination | Enrolled | Appeared | Passed | Pass % |

| JAIIB | 1,67,177 | 1,25,464 | 18,437 | 14.70 |

| CAIIB | 89,179 | 67,169 | 13,953 | 20.77 |

| DB&F | 3,639 | 3,044 | 594 | 19.51 |

What are the Most Preferred CAIIB Elective Subjects?

The details of the most preferred CAIIB elective subjects are as follows:

| Subject | Total Candidates | Percentage |

| Human Resources Management | 34,194 | 48% |

| Rural Banking | 17,079 | 23.98% |

| IT & Digital Banking | 13,740 | 19.29% |

| Central Banking | 3,514 | 4.93% |

| Risk Management | 2,708 | 3.80% |

How did Certificate Courses Perform in 2024–25?

The details of the certification course promotions are as follows:

| Course | Enrolled | Appeared | Pass % |

| Ethics in Banking (Self-paced) | 1,349 | 971 | 89.91% |

| Climate Risk & Sustainable Finance | 2,085 | 1,293 | 98.22% |

| Project Finance | 592 | 369 | 92.95% |

| BC/BF Certification (Hybrid/Remote/Physical) | – | – | 13.82–97.33% |

Note: Certificate enrolments grew 44% year-on-year; BC/BF mandatory training affected completion timelines.

Remote-Proctored Examinations Performance

The details of the remote proctored exam performance are as follows:

| Course | Enrolled | Appeared | Pass % |

| AML/KYC | 9,943 | 8,882 | 45.73% |

| Certified Treasury Professional | 1,152 | 1,048 | 57.92% |

| Digital Banking | 6,375 | 5,734 | 79.82% |

| Risk in Financial Services (Level 1) | 899 | 712 | 68.54% |

How Many Digital Certificates were Issued by IIBF?

Since October 2019, all successful candidates receive digitally signed e-certificates. As of 31 March 2025, 13,71,980 e-certificates were issued.

How have Enrolments in IIBF’s Capacity Building Courses changed Over the Years?

The Indian Institute of Banking & Finance (IIBF) offers several capacity building courses that are mandated by the Reserve Bank of India. These programs are designed to strengthen the professional capabilities of bankers by equipping them with specialized skills. Over the years, the enrolments in these courses have shown steady growth, reflecting the increasing importance of professional certifications.

| Course | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 |

| Certified Treasury Professional | ~1,000 | ~1,200 | ~1,400 | ~1,600 | ~1,800 |

| Certified Credit Professional | ~2,000 | ~2,500 | ~3,000 | ~3,500 | ~4,000 |

| Certified Accounting & Audit Professional | ~0 | ~0 | ~4,500 | ~0 | ~0 |

| Certificate in Risk in Financial Services | ~1,000 | ~1,200 | ~1,400 | ~1,600 | ~1,800 |

| Certificate in Foreign Exchange Operations | ~5,000 | ~6,000 | ~7,000 | ~8,000 | ~9,000 |

What is the ‘One Bank, One Course’ Initiative by IIBF?

The Indian Institute of Banking & Finance (IIBF) has introduced customised certification programmes based on the principle of “One Bank, One Course.”

The examinations for these certifications are conducted in a remote-proctored mode, on mutually decided dates. Successful candidates are awarded joint certificates endorsed by both IIBF and the participating bank, adding greater value to the qualification.

This initiative allows banks and NBFCs to train their workforce in areas most relevant to their operations, while also aligning with regulatory and compliance needs. It bridges the skill gap, ensures standardisation, and creates a stronger professional culture within banking institutions.

| Focus Area | Purpose |

| AML / KYC | Training to strengthen compliance with Anti-Money Laundering and Know Your Customer norms. |

| Compliance | Enhancing awareness of regulatory guidelines and internal compliance requirements. |

| MSME | Building knowledge on MSME financing and related government schemes. |

| Customer Service | Improving service quality and customer relationship management. |

| Cash & Currency Management | Training on safe handling, verification, and management of cash and currency. |

| Business Ethics | Fostering ethical practices and integrity in banking operations. |

| Risk Management | Equipping employees with the ability to identify, assess, and mitigate financial risks. |

What Are IIBF’s International Collaborations?

The Indian Institute of Banking & Finance (IIBF) works with top international and domestic educational organizations to bring global knowledge to India. These collaborations help banking professionals gain exposure to international standards, best practices, and specialized skills. By partnering with global institutions, IIBF enhances the quality of its courses and certifications.

| Memory Based Question Bank | Download Free PDF |

| JAIIB Memory Based Paper | Download Link |

| CAIIB Memory Based Paper | Download Link |

Which International Institutions Does IIBF Partner With?

IIBF collaborates with leading organizations worldwide to provide specialized courses and certifications:

| Institution | Course |

| GARP, USA | Financial Risk & Regulations |

| CISI, London | Risk Management |

| IFC | Climate Risk & Sustainable Finance |

| FPSB | Certified Financial Planner |

| UNEP-FI (with PRB Academy) | Training / Workshops on Sustainable Banking |

How Does IIBF Share Knowledge With International Associations?

IIBF actively participates in global forums to exchange ideas and learn from international best practices. Some key associations include:

| Association | Details |

| Asia Pacific Association of Banking Institutes (APABI) | Hosted the Biennial Conference in Mumbai in 2024 |

| Global Banking Education Standards Board (GBEStB) | IIBF CEO serves as Chairman. Next AGM will be in Edinburgh, June 2026, organized by Chartered Banker Institute. IIBF will also chair the World Conference of Banking Institutes |

| EBTN – European Banking & Financial Services Training Association | IIBF is an Associate Member, promoting knowledge sharing and networking with European banking education professionals |

What Is the Impact of These Collaborations and Associations?

Through these collaborations and knowledge exchanges, IIBF positions itself as a global leader in banking education. Indian professionals benefit by gaining cutting-edge knowledge, international certifications, and exposure to global best practices, which strengthens India’s banking sector overall.

Download IIBF Annual Report 2024-25 PDF

Interested candidates can download the Indian Institute of Banking & Finance (IIBF) Annual Report for the financial year 2024-25 in PDF format through the direct link provided below.

Key Takeaways from IIBF Annual Report 2024-25

The key takeaways of the IIBF annual report are as follows:

| Particulars | Details |

| About IIBF | India’s leading banking institute offering JAIIB, CAIIB, diplomas, and certificates. |

| Objectives of IIBF | Develop skilled bankers, certify competence, promote learning, research, and innovation. |

| Governing Council | Senior bank leaders manage IIBF, led by President Shri M V Rao. |

| Committees of IIBF | Specialized committees handle education, exams, IT, CSR, and research. |

| Financial Performance | FY 2024-25: Revenue ₹15,710.64 lakh; Net surplus ₹7,186.57 lakh. |

| Membership Trends | Total members 11 lakh+, steady growth in ordinary, associate, and fellow members. |

| Courses Offered | Flagship, diplomas, certificates, e-learning, management, and blended programs. |

| Benefits of Courses | Career growth, specialization, RBI compliance, global exposure, and flexible learning. |

| JAIIB & CAIIB Enrolments | 2024-25: JAIIB 1.67 lakh (Pass 14.7%), CAIIB 89k (Pass 20.77%). |

| Certificate & Remote Exams | High pass rates; popular courses include Ethics, Climate Risk, Digital Banking. |

| Digital Certificates | 13.7 lakh e-certificates issued since Oct 2019. |

| Capacity Building Courses | Steady enrolment growth; courses on treasury, credit, risk, accounting, and audit. |

| ‘One Bank, One Course’ Initiative | Customized training for banks/NBFCs with joint certificates. |

| International Collaborations | Global partnerships provide exposure, certifications, and best practices. |

| Download Annual Report | IIBF Annual Report 2024-25 PDF available free online. |

FAQs

JAIIB, CAIIB, and Diploma in Banking & Finance.

Over 11 lakh members as of 31st March 2025.

Revenue ₹15,710.64 lakh with net surplus ₹7,186.57 lakh.

Human Resources Management, Rural Banking, IT & Digital Banking.

13,71,980 e-certificates as of 31 March 2025.

- Risks in Banking Business Notes for JAIIB 2026 Exam

- JAIIB Risk and Basic Risk Management Framework, Download PDF

- JAIIB Indian Economic Architecture Topper Notes by Sambita Mitra

- Economic Concepts of Banking JAIIB Handwritten Notes, Check Details

- Best Way to Score 50+ in JAIIB 2026, Check Details

- JAIIB Handwritten Topper Notes, Crack JAIIB 2026

Hi, I’m Aditi. I work as a Content Writer at Oliveboard, where I have been simplifying exam-related content for the past 4 years. I create clear and easy-to-understand guides for JAIIB, CAIIB, and UGC exams. My work includes breaking down notifications, admit cards, and exam updates, as well as preparing study plans and subject-wise strategies.

My goal is to support working professionals in managing their exam preparation alongside a full-time job and to help them achieve career growth.