The role of Foreign Exchange Reserves in Economic Stability

Foreign-exchange (FX) reserves are central-bank holdings of foreign currencies, gold, Special Drawing Rights (SDRs) and the IMF reserve position. They serve four main objectives:

- Liquidity/cushion against external shocks. Reserves allow a country to meet import bills, redeem external debt, and smooth balance-of-payments shocks without sudden exchange-rate collapses. India’s reserves rose sharply through 2020–21, giving it multi-month import cover and a buffer during the COVID shock (RBI statements show the reserves were around ~US$487.2bn in early March 2020 and crossed US$500bn in June 2020).

- Exchange-rate management & market confidence. Central banks intervene in FX markets from reserves to reduce disorderly moves in the currency. Active intervention uses reserves (or their derivative/short positions) to stabilize the exchange rate.

- Risk management and portfolio return. Reserves must be safe and liquid, but central banks also seek some yield. Hence portfolios are typically dominated by high-quality sovereign bonds (US Treasuries, gilts, JGBs), short-term deposits, and gold as a diversification/liquidity asset.

- Strategic & geopolitical uses. Reserves are also a geopolitical buffer, the ability to pay for essentials and withstand capital flight gives policy autonomy during crises.

Global Trends in Foreign Exchange Reserve diversification

Two big multi-decade trends matter:

- Scale expansion: Global official international reserves are large COFER/IMF aggregates put global FX reserves in the trillions (COFER quarterly releases). Central banks in emerging markets have accumulated reserves steadily since the 2000s as a self-insurance strategy.

- Gradual currency diversification away from a pure USD centricity. IMF COFER and central-bank analyses show the U.S. dollar remains dominant but its share has declined from peaks in earlier decades. Recent surveys and central-bank research estimate the dollar’s share in disclosed allocated reserves at roughly the high-50s percent in the most recent published data, down from higher levels a decade earlier. Reserve managers have added small allocations to other liquid currencies (euro, yen, pound), and selectively to the Chinese renminbi and other liquid markets as they deepen. This diversification is slow because liquidity and depth in non-USD sovereign markets are still limited compared with the US Treasury market.

Implication for reserve managers: diversification reduces single-currency (USD) risk but raises operational challenges (liquidity, market access, collateral rules). Many reserve managers pursue a “core-satellite” approach: a large core in ultra-liquid safe assets plus a smaller satellite sleeve for yield/diversification.

The impact of Geopolitical Risks on Reserve Management Strategies

Geopolitics shapes reserve policy in several ways:

- Sanctions/secondary restrictions drive de-risking. Events such as sanctions on a major economy can force reserve-holders to reassess exposures to certain sovereign debt markets or counterparties. After 2022 geopolitical shocks, some central banks accelerated shifts into gold and other non-restricted assets.

- Safe-haven flows during crises. In times of global uncertainty, demand for USD and high-quality sovereign assets surges; that raises valuation and liquidity concerns for non-USD holdings. Reserve managers must balance the ability to liquidate quickly against diversification aims.

- Operational risk & access. Political tensions can affect custody arrangements, repatriation speed, and settlement systems — all of which are central to operational resilience.

Practical adjustments reserve managers make:

- Increase holdings in ultra-liquid instruments (US Treasuries, short-term repo),

- Raise gold as a non-counterparty, non-credit-based hedge,

- Maintain multiple custody/settlement routes and diverse counterparties.

IMF guidelines & best practices for effective Reserve Management

The IMF’s Revised Guidelines for Foreign Exchange Reserve Management (2014/2016 consolidation of prior work) set the standard framework for practice. Key takeaways:

- Clear objectives & governance: Separate strategic objectives (liquidity, safety, return, cost) and ensure governance structures (board, investment committee) are formalized. The IMF recommends clear roles for ministry/central bank and oversight by boards/committees.

- Comprehensive risk framework: Identify and quantify currency risk, interest-rate risk, liquidity risk, credit/counterparty risk and operational risk. Use metrics like Value-at-Risk, stress testing, and liquidity ladders.

- Policy & operational docs: Maintain an investment policy statement (IPS), counterparty lists, authorization limits and contingency plans.

- Transparency & reporting: Periodic public reporting on reserve levels/structure (consistent with IMF/COFER reporting) helps build confidence; internal reporting must be timely and granular.

- Contingency planning: Pre-defined playbooks for intervention, capital flight episodes, and crisis liquidity management (including swap lines) are essential.

These are standard practice across advanced central banks and increasingly adopted by EMs the emphasis is on practical governance and robust risk controls rather than exotic investments.

Case studies on Reserve Management Approaches

Check few case studies around the World:

- India (RBI): Active accumulation since 2013, large purchases during 2020–21 (COVID period) and steady diversification. India’s reserve composition is dominated by Foreign Currency Assets (FCA) with gold + SDRs smaller but strategically significant; India also increased gold holdings in recent years as part of diversification. (RBI weekly stats & press releases give week-by-week totals.)

- Switzerland (SNB): Very large balance sheet; interventionist policy to keep franc competitive has resulted in huge international assets shows the tradeoff between FX market intervention and balance-sheet size.

- China: Official reserves and external assets remain large; China uses a mix of official reserves and sovereign investment vehicles, and has gradually increased internationalization of the renminbi while guarding capital controls.

- Small commodity exporters (e.g., Gulf states): Often rotate FX inflows to sovereign wealth funds (SWFs) for long-term returns while maintaining a liquid cushion for monetary stability.

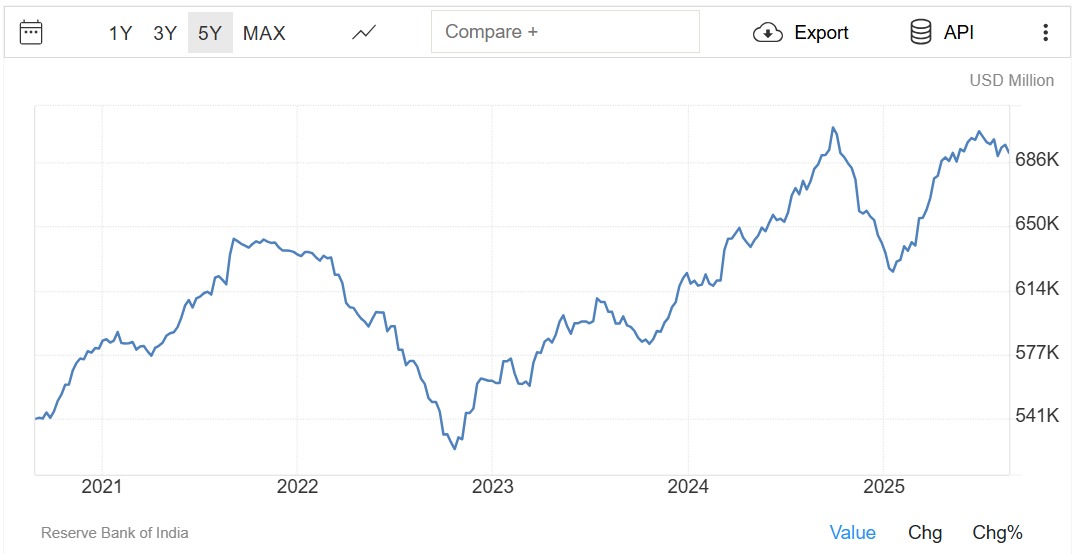

Analysing the fluctuations in India’s Foreign Exchange Reserves

Short timeline showing fluctuations in India’s Foreign Exchange Reserves:

- Early March 2020: RBI noted FX reserves at US$487.24bn (press release as of 6 March 2020).

- Week ended 5 June 2020: Reserves crossed US$500bn (weekly supplement media reported US$501.7bn). A combination of lower imports, valuation and capital inflows pushed reserves up.

- Late Sep 2020 (week ended Sep 18/25): Reserves around US$545.0bn in mid-late Sep 2020 (weekly statistical supplement).

- June 2021: Reserves above US$600bn a rapid build driven by inflows and subdued imports during COVID.

- March 2024: Trading Economics / RBI data show reserves ~US$642.6bn (March 2024).

- Sept 27, 2024: India recorded an all-time high of ~US$704.9bn (weekly RBI data reported in media).

Check out RBI’s official reports year-wise provided below:

| Year | Half | PDF Download |

| 2025 | Jan – Jun 2025 | Download PDF |

| 2024 | Jan – Jun 2024 | Download PDF |

| 2024 | Jul – Dec 2024 | Download PDF |

| 2023 | Jan – Jun 2023 | Download PDF |

| 2023 | Jul – Dec 2023 | Download PDF |

| 2022 | Jan – Jun 2022 | Download PDF |

| 2022 | Jul – Dec 2022 | Download PDF |

| 2021 | Jan – Jun 2021 | Download PDF |

| 2021 | Jul – Dec 2021 | Download PDF |

| 2020 | Jan – Jun 2020 | Download PDF |

| 2020 | Jul – Dec 2020 | Download PDF |

Major drivers of these fluctuations:

- Valuation effects: Changes in USD value vs. other currencies and mark-to-market on asset holdings.

- Capital flows: FDI/FPI, FX purchases (e.g., when exporters sell FX to banks), and RBI’s own market operations.

- Trade balance & imports: Lower imports (e.g., pandemic-related slowdown in 2020) reduced outflows and helped FX accumulation.

- Gold purchases: RBI made significant gold additions in 2018–21 that changed composition without destroying liquidity. (See RBI weekly supplement and World Gold Council commentary.)

What to watch when analysing reserves: week-by-week RBI weekly statistical supplement, foreign currency assets (FCA) trend, gold holdings, SDRs and IMF reserve position. These components explain both level and quality of reserves.

Future outlook evolving strategies in Reserve Management

Expect these continuing trends:

- Prudent diversification, but cautious use of non-USD assets. Reserve managers will continue modest diversification (euro, yen, pound, and selected liquid markets), but operational liquidity constraints slow radical shifts.

- More active liquidity management & stress testing. Central banks will expand stress scenarios (market closures, counterparty runs, valuation shocks) and maintain operational redundancy (multiple custodians, settlement rails).

- Gold and alternatives as insurance. Gold is likely to remain an insurance asset; some EMs may increase allocations if geopolitics intensifies.

- Digital/instrument innovation. As global financial plumbing evolves (CBDCs, tokenized assets), reserve managers will experiment first on the margin with operational/legal frameworks before large allocations.

- Sovereign coordination. Greater coordination across treasury, central bank and sovereign funds for holistic external asset/liability management.

If you are preparing for exams like RBI Grade B, you can check out the detailed RBI Grade B notification which is expected to be out between 8th to 14th September 2025.

FAQs

Foreign Exchange Reserves are assets held by a country’s central bank in foreign currencies, gold, Special Drawing Rights (SDRs), and the IMF reserve position.

They act as a buffer against external shocks, help in exchange-rate management, build investor confidence, and provide resources for emergencies.

As per RBI data, India’s forex reserves reached an all-time high of around US$704.9 billion in September 2024.

The main components are Foreign Currency Assets (FCA), gold reserves, Special Drawing Rights (SDRs), and the IMF reserve position.

During early 2020, reserves were about US$487 billion and crossed US$500 billion by June 2020, supported by reduced imports, capital inflows, and valuation effects.

- SEBI Grade A 2026 English Preparation Tips for Phase 1 & 2

- Economics Topics & Concepts You Cannot Miss for SEBI Grade A

- Management & Ethics Key Theories, Important for SEBI Grade A

- NABARD Grade A Question Papers, Section-Wise PYPs, Download PDFs

- SEBI IT Officer Syllabus 2026, Exam Pattern, Download PDF

- SEBI Law Officer Recruitment 2026, Download Notification PDF

Priti Palit, is an accomplished edtech writer with 4+ years of experience in Regulatory Exams and other multiple government exams. With a passion for education and a keen eye for detail, she has contributed significantly to the field of online learning. Priti’s expertise and dedication continue to empower aspiring individuals in their pursuit of success in government examinations.