Union Budget 2024

The Finance Minister, Smt. Nirmala Sitharaman delivered the Union Budget for the fiscal year 2024-25 in the new Parliament Building on July 23rd, 2024. Notably, this marked the first time the full budget was presented in the new Parliament Building. Sitharaman embraced a paperless approach, utilizing a ‘Made in India’ tablet computer for her address. This budget presentation represents her seventh consecutive budget, following those of 2019, 2020, 2021, 2022, 2023, and 2024. She had also presented an interim budget in the new parliament on 1st February 2024.

Union Budget of India 2024

For detailed insights and key highlights of the Union Budget 2024, you can refer to official documents or news sources for a comprehensive summary of the financial proposals and allocations presented by the Finance Minister.

The upcoming Union Budget in 2024 will mark Nirmala Sitharaman’s seventh consecutive budget presentation as the Finance Minister. Surpassing Morarji Desai, she became the only finance minister in India to present the Union Budget for seven consecutive years.

The current budget is the first one in the third term of the Narendra Modi government, as the Lok Sabha elections were held from April – June. This budget holds significance as it will outline the government’s financial priorities and initiatives for the new five-year term.

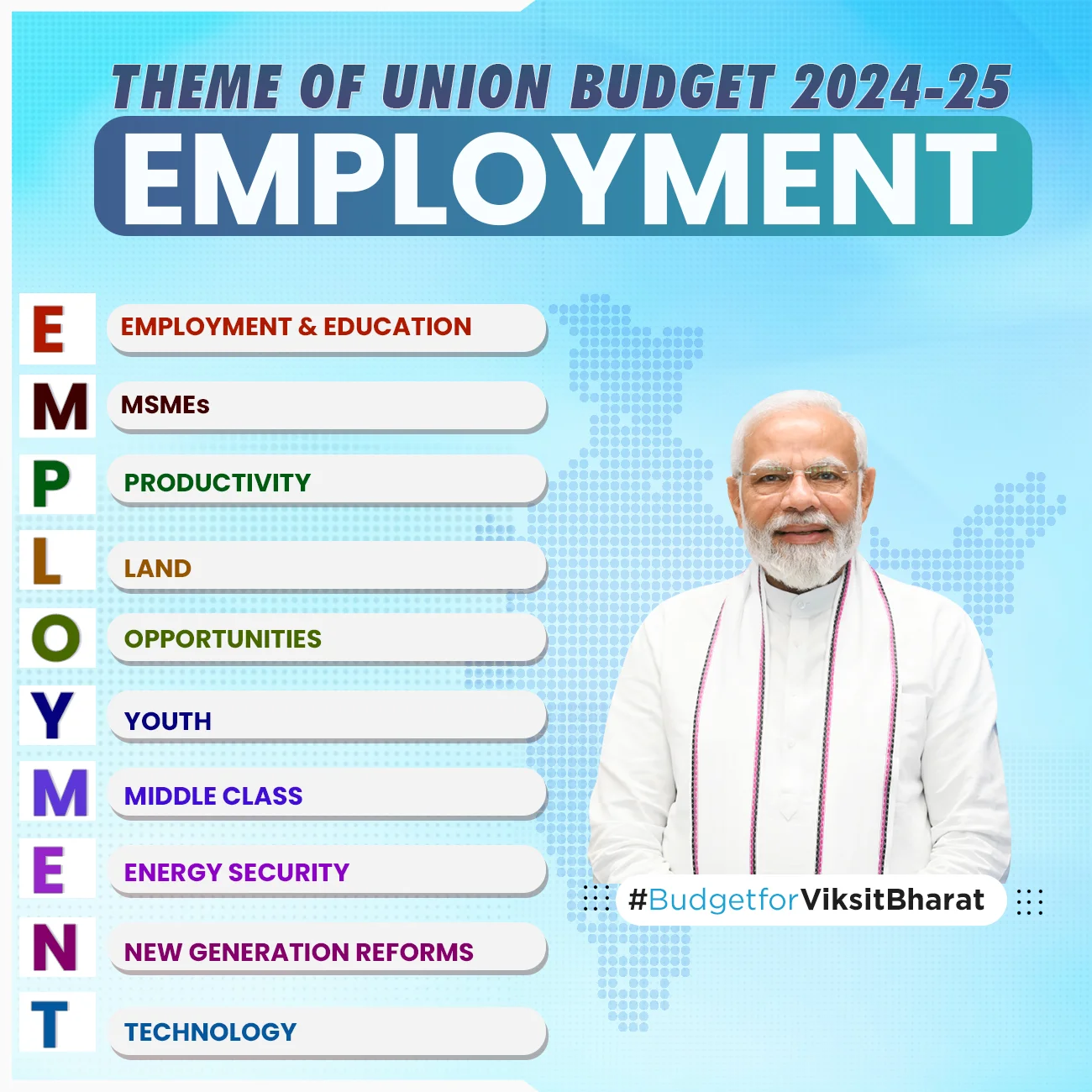

Theme of the Budget 2024

The Union Budget 2024-25, presented by Smt. Sitharaman focuses on boosting employment and skills, supporting MSMEs, and empowering the middle class.

Key highlights include:

- Introducing visionary policies for ‘Amrit Kaal’.

- Accelerating reforms to meet the people’s aspirations.

- Promoting competitive and cooperative federalism.

The Budget for Viksit Bharat 2024-25 is centered around the theme ‘EMPLOYMENT’ which stands for:

- E: Employment & Education

- M: MSME

- P: Productivity

- L: Land

- O: Opportunities

- Y: Youth

- M: Middle Class

- E: Energy Security

- N: New Generation Reforms

- T: Technology

Key Highlights of the Union Budget of India 2024

The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2024-25 in Parliament today. The highlights of the budget are as follows:

Budget Estimates 2024-25:

- Total Receipts (excluding borrowings): ₹32.07 lakh crore

- Total Expenditure: ₹48.21 lakh crore

- Net Tax Receipt: ₹25.83 lakh crore

- Fiscal Deficit: 4.9% of GDP

- The government aims to reduce the deficit to below 4.5% next year.

- Inflation: Low and stable, moving towards the 4% target

- Core Inflation (non-food, non-fuel): 3.1%

The focus of the budget is on EMPLOYMENT, SKILLING, MSMEs, and the MIDDLE CLASS.

Prime Minister’s Package of 5 Schemes for Employment and Skilling

Over 5 Years, Aimed at 4.1 Crore Youth.

Scheme A – First Timers:

- Benefit: One-month salary of up to ₹15,000

- Disbursement: In 3 installments

- Eligibility: First-time employees registered with EPFO

Scheme B – Job Creation in Manufacturing:

- Incentive: Direct incentive related to EPFO contributions for both employees and employers

- Duration: First 4 years of employment

Scheme C – Support to Employers:

- Reimbursement: Up to ₹3,000 per month for 2 years

- Purpose: Towards EPFO contribution for each additional employee

New Centrally Sponsored Scheme for Skilling:

- Target: Skill 20 lakh youth over 5 years

- Upgrades: 1,000 Industrial Training Institutes (ITIs) in hub-and-spoke arrangements

New Scheme for Internships:

- Coverage: 1 crore youth

- Placement: 500 top companies over 5 years

Nine Budget Priorities in Pursuit of ‘Viksit Bharat’

- Productivity and Resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development and

- Next Generation Reforms

Priority 1: Productivity and Resilience in Agriculture

- Allocation: ₹1.52 lakh crore for agriculture and allied sectors.

- High-Yielding Varieties: Release of 109 new climate-resilient varieties for 32 field and horticulture crops.

- Natural Farming: Introduction of 1 crore farmers to natural farming, including certification and branding within 2 years.

- Bio-Input Centres: Establishment of 10,000 need-based centres for natural farming resources.

- Digital Public Infrastructure (DPI): Implementation over 3 years for comprehensive coverage of farmers and their lands.

Priority 2: Employment & Skilling

Prime Minister’s Package:

- Employment Linked Incentive Schemes:

- Scheme A – First Timers

- Scheme B – Job Creation in Manufacturing

- Scheme C – Support to Employers

Women’s Workforce Participation:

- Hostels and Crèches: Establishment with industrial collaboration.

- Women-Specific Skilling Programs: Organization of targeted skilling initiatives.

- Market Access: Promotion of market access for women SHG enterprises.

Skill Development:

- New Centrally Sponsored Scheme: Skilling 20 lakh youth over 5 years.

- Revised Model Skill Loan Scheme: Facilitates loans up to ₹7.5 lakh.

- Financial Support for Higher Education: Loans up to ₹10 lakh for youth in domestic institutions not covered by existing government schemes.

Priority 3: Inclusive Human Resource Development and Social Justice

Purvodaya:

- Industrial Node Development: Establishing an industrial node at Gaya as part of the Amritsar-Kolkata Industrial Corridor.

- Power Projects: Initiating a new 2400 MW power plant at Pirpainti with an investment of ₹21,400 crore.

Andhra Pradesh Reorganization Act:

- Special Financial Support: ₹15,000 crore allocated through multilateral development agencies for the current financial year.

- Industrial Nodes: Development of nodes at Kopparthy along the Vishakhapatnam-Chennai Industrial Corridor and at Orvakal along the Hyderabad-Bengaluru Industrial Corridor.

Women-Led Development:

- Funding Allocation: Over ₹3 lakh crore designated for schemes benefiting women and girls.

Pradhan Mantri Janjatiya Unnat Gram Abhiyan:

- Socio-Economic Development: Targeting 63,000 villages and benefiting 5 crore tribal people in tribal-majority villages and aspirational districts.

Bank Branches in the North-Eastern Region:

- India Post Payment Bank: Establishing 100 new branches in the North East region.

Priority 4: Manufacturing & Services

Credit Guarantee Scheme for MSMEs:

- Collateral-Free Loans: Introduction of a credit guarantee scheme providing term loans to MSMEs for machinery and equipment without requiring collateral or third-party guarantees.

Credit Support to MSMEs During Stress Period:

- Continuity Mechanism: Establishing a new system to ensure continued bank credit for MSMEs during financial stress.

Mudra Loans:

- Increased Limit: Raising the Mudra loan limit under the ‘Tarun’ category from ₹10 lakh to ₹20 lakh for borrowers who have repaid previous loans successfully.

Enhanced Scope for TReDS:

- Lower Turnover Threshold: Reducing the mandatory turnover threshold for buyers on the TReDS platform from ₹500 crore to ₹250 crore.

MSME Units for Food Irradiation:

- Financial Support: Providing funds to establish 50 multi-product food irradiation units within the MSME sector.

E-Commerce Export Hubs:

- PPP Mode: Setting up E-Commerce Export Hubs through public-private partnerships to enable MSMEs and traditional artisans to access international markets.

Critical Mineral Mission:

- Domestic Production and Recycling: Launching a mission for domestic production and recycling of critical minerals, and acquiring overseas critical mineral assets.

Offshore Mining of Minerals:

- Auction of Offshore Blocks: Conducting the auction of the first tranche of offshore mining blocks, building on previous exploration efforts.

Digital Public Infrastructure (DPI) Applications:

- Development Focus: Creating DPI applications across various sectors including credit, e-commerce, education, health, law and justice, logistics, MSME, service delivery, and urban governance.

Priority 5: Urban Development

Transit Oriented Development:

- Plan Implementation: Developing Transit Oriented Development plans for 14 large cities with populations over 30 lakh to enhance transportation and urban planning.

Urban Housing:

- Investment in Housing: Allocating ₹10 lakh crore over the next 5 years, including ₹2.2 lakh crore in central assistance, under PM Awas Yojana Urban 2.0 to address the housing needs of 1 crore urban poor and middle-class families.

Street Markets:

- Support for Street Hubs: Launching a scheme to develop 100 weekly ‘haats’ or street food hubs annually for the next 5 years in selected cities.

Priority 6: Energy Security

Energy Transition:

- Policy Document: Introducing a policy on ‘Energy Transition Pathways’ to balance employment, growth, and environmental sustainability.

Pumped Storage Policy:

- Promotion of Storage Projects: Develop a policy to promote pumped storage projects for efficient electricity storage.

Research and Development of Small and Modular Nuclear Reactors:

- Partnership for R&D: Collaborating with the private sector for research and development of Bharat Small Modular Reactors (SMRs) and advancing nuclear energy technologies.

Advanced Ultra Super Critical Thermal Power Plants:

- Joint Venture: NTPC and BHEL to establish an 800 MW commercial plant using Advanced Ultra Super Critical (AUSC) technology.

Roadmap for ‘Hard to Abate’ Industries:

- Regulation Transition: Implementing regulations for transitioning ‘hard to abate’ industries from the ‘Perform, Achieve and Trade’ system to the ‘Indian Carbon Market’.

Priority 7: Infrastructure

Central Government Infrastructure Investment:

- Capital Expenditure: Allocation of ₹11.11 lakh crore (3.4% of GDP) for infrastructure investments.

State Government Infrastructure Investment:

- Long-Term Loans: Provision of ₹1.5 lakh crore in interest-free long-term loans to support state infrastructure projects.

Pradhan Mantri Gram Sadak Yojana (PMGSY):

- Phase IV Launch: Initiation of Phase IV to ensure all-weather connectivity to 25,000 rural habitations.

Irrigation and Flood Mitigation:

- Financial Support: ₹11,500 crore allocated for projects like the Kosi-Mechi intra-state link and other schemes in Bihar. Assistance was also provided to Assam, Himachal Pradesh, Uttarakhand, and Sikkim for flood and landslide management.

Tourism Development:

- Temple Corridor Projects: Comprehensive development of Vishnupad Temple Corridor, Mahabodhi Temple Corridor, and Rajgir.

- Support for Odisha: Development assistance for temples, monuments, craftsmanship, wildlife sanctuaries, natural landscapes, and pristine beaches.

Priority 8: Innovation, Research & Development

- Anusandhan National Research Fund: Operationalization of a fund to support basic research and prototype development.

- Financing Pool: Establishment of a ₹1 lakh crore pool to drive private sector-led research and innovation at a commercial scale.

- Space Economy: Creation of a ₹1,000 crore venture capital fund to expand the space economy fivefold over the next 10 years.

Priority 9: Next Generation Reforms

Rural Land Management:

- Unique Land Parcel Identification Number (ULPIN): Introduction of Bhu-Aadhaar for all land parcels.

- Cadastral Maps Digitization: Comprehensive digitization of land records.

- Survey and Mapping: Survey of land subdivisions according to current ownership.

- Land Registry: Establishment of a national land registry.

- Farmer Registry Integration: Linking land records with the farmers’ registry.

Urban Land Management:

- GIS Mapping: Digitization of urban land records with Geographic Information System (GIS) mapping.

Labour Services:

- E-shram Integration: Integration of the e-shram portal with other platforms to create a one-stop solution.

- Open Architecture Databases: Development of databases to address evolving labor market needs, skill requirements, and job roles.

- Job and Skill Connection: Mechanisms to connect job seekers with potential employers and skill providers.

NPS Vatsalya:

- Contribution Plan: NPS-Vatsalya plan for contributions by parents and guardians for minors.

Indirect Taxes

GST Reforms

- Simplification and Rationalization: Following the success of GST, the tax structure will be simplified and rationalized.

- Expansion: Efforts will be made to extend GST coverage to the remaining sectors.

Sector-Specific Customs Duty Proposals

Medicines and Medical Equipment:

- Full Exemption: Three cancer drugs—Trastuzumab Deruxtecan, Osimertinib, and Durvalumab—are fully exempt from customs duty.

- Phased Manufacturing Programme: Changes in Basic Customs Duty (BCD) on x-ray tubes and flat panel detectors for medical x-ray machines.

Mobile Phones and Related Parts:

- BCD Reduction: Duty on mobile phones, mobile PCBA, and chargers reduced to 15%.

Precious Metals:

- Gold and Silver: Customs duties reduced to 6% for gold and silver; platinum reduced to 6.4%.

Other Metals:

- BCD Removal: On ferro nickel, blister copper, ferrous scrap, and nickel cathode.

- Concessional BCD: 2.5% on copper scrap.

Electronics:

- BCD Removal: On oxygen-free copper for resistor manufacture, subject to conditions.

Chemicals and Petrochemicals:

- BCD Increase: On ammonium nitrate from 7.5% to 10%.

Plastics:

- BCD Increase: On PVC flex banners from 10% to 25%.

Telecommunication Equipment:

- BCD Increase: From 10% to 15% on PCBA for specified telecom equipment.

Trade Facilitation:

- Export Extension: The time for export of goods imported for repairs was extended from six months to one year.

- Re-import Extension: The limit for re-import of goods for repairs under warranty is extended from three to five years.

Critical Minerals:

- Full Exemption: 25 critical minerals fully exempt from customs duties.

- BCD Reduction: On two critical minerals.

Solar Energy:

- Duty Exemption: On capital goods for manufacturing solar cells and panels.

Marine Products:

- BCD Reduction: On broodstock, polychaete worms, shrimp, and fish feed reduced to 5%.

- Duty Exemption: For various inputs in shrimp and fish feed manufacture.

Leather and Textile:

- BCD Reduction: On real down filling material and MDI for spandex yarn from 7.5% to 5%, subject to conditions.

Direct Taxes

Efforts for Improvement:

- Simplify taxes and improve taxpayer services.

- Provide tax certainty and reduce litigation.

Revenue Enhancement:

- Focus on increasing revenues to fund development and welfare schemes.

Tax Regime Statistics:

- Corporate Tax: 58% of corporate tax revenue came from the simplified tax regime in FY23.

- Personal Income Tax: More than two-thirds of taxpayers opted for the simplified tax regime in FY24.

Tax Simplification and Reforms

Charities:

- Merge two tax exemption regimes for charities into one.

Tax Deducted at Source (TDS):

- General Payments: Reduce TDS from 5% to 2%.

- Mutual Funds/UTI: Withdraw 20% TDS on unit repurchase.

- E-commerce Operators: Reduce TDS from 1% to 0.1%.

- Payment Delay: Decriminalize delays in TDS payment until the due date of filing the statement.

Simplification of Reassessment:

- Time Limit: Reopen assessments beyond three years up to five years only if escaped income is ₹50 lakh or more.

- Search Cases: Reduce the time limit from ten to six years before the year of search.

Capital Gains:

- Short Term: Tax rate of 20% on short-term gains from certain financial assets.

- Long Term: Tax rate of 12.5% on long-term gains from all assets.

- Exemption Limit: Increase capital gains exemption limit on certain assets to ₹1.25 lakh per year.

Taxpayer Services:

- Digitalization: All remaining services of Customs and Income Tax, including rectifications and appellate orders, are to be digitalized in the next two years.

Litigation and Appeals:

- ‘Vivad Se Vishwas Scheme, 2024’: Resolve income tax disputes pending in appeal.

- Monetary Limits: Increase limits for filing appeals in Tax Tribunals, High Courts, and the Supreme Court to ₹60 lakh, ₹2 crore, and ₹5 crore, respectively.

- Safe Harbour Rules: Expand rules to reduce litigation and provide certainty in international taxation.

Employment and Investment:

- Angel Tax: Abolish angel tax to support start-ups.

- Foreign Shipping Companies: Introduce a simpler tax regime for companies operating domestic cruises.

- Foreign Mining Companies: Apply safe harbor rates for raw diamond sales.

- Corporate Tax: Reduce the rate for foreign companies from 40% to 35%.

Deepening Tax Base:

- Security Transactions Tax: Increase tax on futures and options to 0.02% and 0.1%, respectively.

- Buyback of Shares: Tax income received on share buybacks.

Social Security Benefits:

- NPS: Increase employer deduction from 10% to 14% of employee salary.

- Foreign Assets: De-penalize non-reporting of small movable foreign assets up to ₹20 lakh.

Other Major Proposal:

- Equalization Levy: Withdraw the 2% equalization levy.

Changes in Personal Income Tax Under New Tax Regime

- Standard Deduction: Increased from ₹50,000 to ₹75,000 for salaried employees.

- Family Pension Deduction: Enhanced from ₹15,000 to ₹25,000 for pensioners.

- Revised tax rate structure:

| Income | Tax Rate |

| 0-3 lakh rupees | Nil |

| 3-7 lakh rupees | 5% |

| 7-10 lakh rupees | 10% |

| 10-12 lakh rupees | 15% |

| 12-15 lakh rupees | 20% |

| Above 15 lakh rupees | 30% |

Prime Minister Narendra Modi’s Remarks on the Union Budget 2024-25

Prime Minister Narendra Modi lauded the Union Budget 2024-25, emphasizing its potential to empower all sections of society and drive national development. He highlighted the budget’s focus on uplifting the poor, farmers, and the emerging neo-middle class, while also introducing new schemes for education and skill development. Modi stressed the budget’s support for women’s economic partnerships and MSMEs, along with measures to boost employment through initiatives like the Employment Linked Incentive scheme. The Prime Minister noted the increased Mudra Loan limit and efforts to strengthen manufacturing and exports. He also praised the budget’s emphasis on startups, innovation, defense sector self-reliance, and tourism development. Modi mentioned tax relief measures, the ‘Purvodaya’ vision for eastern India, agricultural reforms, and various poverty alleviation initiatives.

Overall, he presented the budget as a catalyst for India’s economic growth and its journey towards becoming the world’s third-largest economy.

- RBI SO Syllabus and Exam Pattern 2025 for Grade A and B

- RBI SO Eligibility 2025, Check Qualification & Age Limit

- RBI SO Exam Date 2025, Check Phase 1 Schedule for Grade A/B

- RBI SO Apply Online 2025 Before 31st July for 28 Vacancies

- RBI SO Notification 2025 Out for 28 Vacancies of Grade A & B

- Free SSC CHSL Topic Wise Tests for English, Quant & More, Attempt Now

Frequently Asked Questions – Union Budget 2024-25

Ans. The Union Budget for 2023-24 was announced on 23rd July 2024.

Ans. The union budget mainly covers the major capital expenses and investments for one fiscal year.

Ans. The fiscal year in India spans from the 1st of April to the 31st of March of the next year.

Ans. The Union Budget is presented by the Finance Minister on the first day of February. However, due to general elections, an interim budget was presented on 1st February and the full union budget was presented on 23rd July after the elections.

Ans. Smt. Nirmala Sitharaman, India’s Finance Minister presented the Union Budget for 2024-25.

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.