The union budget is presented in the Parliament on the 1st of February every year but this year due to elections, the budget has been released on 23rd July 2024. Questions related to various schemes announced in the budget and allocations to these schemes by the government are mostly asked in various Banking and Government Exams like RBI Grade B, SBI PO, IBPS PO, NABARD, SEBI, etc.

Budget Terminology

But before you go on to read and learn about the Union Budget, it is very important to understand the basic budget terms and get acquainted with their definitions so that when you go on to read the budget, its terminology doesn’t seem unfamiliar to you. The Budget Terms should be very clear to you after reading this blog of Budget Terms and Definitions – A Glossary of Important Terms. Let us go on to learn the Budget terms and definitions below.

What is Union Budget?

Check out the following points to understand the union budget:

- The Union Budget is an annual financial report of India. It contains the Government’s revenue and expenditure for a fiscal year, which runs from April 1 to March 31.

- According to Article 112 of the Indian Constitution, the Union Budget, also referred to as the annual financial statement, is a statement of the estimated receipts and expenditures of the government in respect of every financial year.

- It is presented by the government every year before the start of the financial year. It is the most extensive account of the Government’s finances, in which revenues from all sources and expenditures on all activities undertaken are enumerated.

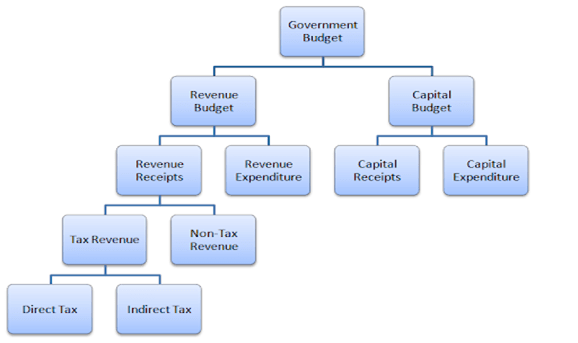

- It comprises of the revenue budget and the capital budget. It also contains estimates for the next fiscal year.

REVENUE BUDGET:

- Revenue Budget consists of the revenue receipts of the government (tax revenues and other revenues) and the expenditure met from these revenues.

REVENUE RECEIPTS:

- Those receipts which neither create any liability nor cause any reduction in the assets of the government.

- They are regular and recurring in nature and the government receives them in the normal course of activities.

- Revenue receipts include the proceeds from taxes and other duties levied by the Centre; the interest and dividend it receives on its investments; and the fees and charges the government receives for its services.

For the government, there are two sources of revenue receipts — tax revenues and non-tax revenues.

Tax Revenues:

- It gives a detailed report on revenue collected from different items like corporation tax, income tax, wealth tax, customs, union excise, service, taxes on Union Territories like land revenue, stamp registration, etc.

- Taxes collected from both direct and indirect tax are considered in Tax Revenue.

Non-tax Revenues:

- Non-Tax Revenue is the recurring income earned by the government from sources other than taxes.

Direct tax:

- A direct tax is a tax an individual or organization pays directly to the imposing entity.

- Direct taxes include income tax, property tax, corporate tax, estate tax, gift tax, value-added tax (VAT), sin tax, and taxes on assets.

Indirect tax:

- An indirect tax is collected by one entity in the supply chain and paid to the government, but it is passed on to the consumer as part of the purchase price of a good or service.

- The consumer is ultimately paying the tax by paying more for the product.

- Example: GST

Revenue Expenditure:

- Part of government expenditure that does not result in the creation of assets. Payment of salaries, wages, pensions, subsidies, and interest fall in this category as revenue expenditure examples.

Capital Budget:

- The capital budget consists of capital receipts and payments.

- It also incorporates transactions in the Public Account.

Capital Receipts:

- Those receipts that create liabilities or reduce financial assets. They also refer to incoming cash flows.

- Capital receipts can be both non-debt and debit receipts.

- Capital receipts are loans taken by the government from the public, borrowings from foreign countries and institutes, and borrowings from the RBI.

Non-debt capital receipts

- Non-debt receipts are those which do not incur any future repayment burden for the government.

- Examples of non-debt capital receipts: Recovery of loans and advances, disinvestment, issue of bonus shares, etc

Debt capital receipts

- Debt Receipts have to be repaid by the government. A reduction in debt receipt (or borrowing) can be a big leap for the economy’s financial health.

- Examples of debt capital receipts: Market loans, issuance of special securities to public-sector banks, issue of securities, short-term borrowings, etc. are all examples of debt capital receipts.

Capital Expenditure:

- It is the money spent by the government on the development of machinery, equipment, building, health facilities, education, etc.

- It also includes the expenditure incurred on acquiring fixed assets like land and investment by the government that gives profits or dividends in the future.

Capital expenditure includes money spent on the following:

- Acquiring fixed and intangible assets

- Upgrading an existing asset

- Repairing an existing asset

- Repayment of loan

Budget Terminology PDF

We have compiled all the Budget Terms and definitions in a PDF. Download the Budget Terminology PDF from the direct link given below:

Download Budget Terminology PDF

Budget Terms & Definitions

1. Annual Financial Statement

It is a statement of estimated receipts and expenditure of the government in respect of every financial year (April 1-March 31). It is divided into three parts, the Consolidated Fund, Contingency Fund, and Public Account. The government must present a statement of receipts and expenditure for each of these funds.

2. Appropriation Bill

It is a bill that gives power to the government to withdraw funds from the Consolidated Fund of India for meeting the expenditure during the financial year.

3. Bearish Trend

It is defined as a downward trend in the prices of an industry’s stocks or the overall fall in broad market indices in financial markets. The bearish trend is characterized by heavy investor pessimism about the declining market price scenario. A fall in the prices of about 20% is identified as a bearish trend.

4. Budgetary Deficit

It is the difference between all receipts and expenses in both revenue and capital accounts of the government. If revenue expenses of the government exceed revenue receipts, it results in a revenue account deficit. Similarly, if the capital disbursements of the government exceed capital receipts, it leads to a capital account deficit. Budgetary deficit is usually expressed as a percentage of GDP.

5. Bullish Trend

A trend in financial markets can be defined as a direction in which the market moves. ‘Bullish Trend’ is an upward trend in the prices of an industry’s stocks or the overall rise in broad market indices, characterized by high investor confidence. A bullish trend for a certain period of time indicates the recovery of an economy.

6. Capital Account

The capital account can be regarded as one of the primary components of the balance of payments of a nation. It gives a summary of the capital expenditure and income for a country. This account comprises foreign direct investments, portfolio investments, etc. It gives a summary of the net inflow of both private and public investment into an economy.

7. Capital Budget

It consists of capital receipts and payments. It also incorporates transactions in the Public Account. Capital receipts are loans raised by the government from the public, borrowings by the government from the Reserve Bank and other parties through the sale of treasury bills, loans received from foreign bodies and governments, and recoveries of loans granted by the Central government to state and Union Territory governments and other parties.

Capital payments consist of capital expenditure on acquisition of assets like land, buildings, machinery, and equipment, as also investments in shares, loans, and advances granted by the Central government to state and Union Territory governments, government companies, corporations, and other parties.

8. Capital Market

It is a market where buyers and sellers engage in the trade of financial securities like bonds, stocks, etc. The buying/selling is undertaken by participants such as individuals and institutions. The capital market consists of primary markets and secondary markets. Primary markets deal with the trade of new issues of stocks and other securities, whereas secondary market deals with the exchange of existing or previously-issued securities.

9. Consolidated Fund

Consolidated Fund of India is the most important of all government accounts. Revenues received by the government and expenses made by it, excluding the exceptional items, are part of the Consolidated Fund.

10. Consumer Price Index

It is a comprehensive measure used for the estimation of price changes in a basket of goods and services representative of consumption expenditure in an economy. Inflation is measured using CPI. The percentage change in this index over a period of time gives the amount of inflation over that specific period, i.e. the increase in prices of a representative basket of goods consumed.

11. Contingency Fund

It is created as an imprest account to meet some urgent or unforeseen expenditure of the government. This fund is at the disposal of the President.

12. Core Inflation

An inflation measure excludes transitory or temporary price volatility as in the case of some commodities such as food items, energy products etc. It reflects the inflation trend in an economy.

13. Corporation Tax

It is a tax imposed on the net income of the company.

14. Countervailing Duty

Duties that are imposed in order to counter the negative impact of import subsidies to protect domestic producers are called countervailing duties.

15. Credit Rating

It is an analysis of the credit risks associated with a financial instrument or a financial entity. It is a rating given to a particular entity based on the credentials and the extent to which the financial statements of the entity are sound, in terms of borrowing and lending that has been done in the past.

16. Customs Duty

It is a tax imposed on imports and exports of goods.

17. Deflation

When the overall price level decreases so that the inflation rate becomes negative, it is called deflation. It is the opposite of the often-encountered inflation. Deflation is different from disinflation as the latter implies a decrease in the level of inflation whereas on the other hand deflation implies negative inflation.

18. Demand for Grants

It is the form in which estimates of expenditure from the Consolidated Fund, included in the annual financial statement and required to be voted upon in the Lok Sabha, are submitted in pursuance of Article 113 of the Constitution.

The demand for grants includes provisions with respect to revenue expenditure, capital expenditure, grants to State and Union Territory governments together with loans and advances. Generally, one demand for a grant is presented in respect of each ministry or department. However, for large ministries and departments, more than one demand is presented.

19. Depreciation – The monetary value of an asset decreases over time due to use, wear and tear, or obsolescence. This decrease is measured as depreciation.

20. Direct Tax

It is a type of tax where the incidence and impact of taxation fall on the same entity. These are largely taxes on income or wealth. Income tax, corporation tax, property tax, inheritance tax, and gift tax are examples of direct tax.

21. Education Cess

It is an additional levy on the basic tax liability.

22. Excess Grants

It is the grant in excess of the approved grants for meeting the requisite expenses of the government. The Demand for Excess Grants is made after the actual expenditure is incurred and is presented to the Parliament after the end of the financial year in which the expenses were made.

23. Expenditure Budget

It shows the revenue and capital disbursements of various ministries/departments.

24. External Debt

It refers to money borrowed from a source outside the country. External debt has to be paid back in the currency in which it is borrowed.

25. Finance Bill

It is a Money Bill as defined in Article 110 of the Constitution. The proposals of the government for levy of new taxes, modification of the existing tax structure, or continuance of the existing tax structure beyond the period approved by Parliament are submitted to Parliament through this bill.

26. Fiscal Deficit

The difference between total revenue and total expenditure of the government is termed as fiscal deficit. It is an indication of the total borrowings needed by the government. While calculating the total revenue, borrowings are not included.

27. Gross Domestic Product

GDP is the final value of the goods and services produced within the geographic boundaries of a country during a specified period of time, normally a year. GDP growth rate is an important indicator of the economic performance of a country.

28. Index of Industrial Production

The Index of Industrial Production (IIP) is an index that shows the growth rates in different industry groups of the economy in a stipulated period of time. The IIP index is computed and published by the Central Statistical Organisation (CSO) on a monthly basis.

29. Indirect Tax

It is a type of tax where the incidence and impact of taxation do not fall on the same entity. Customs duty, central excise, service tax, and value-added tax, GST are examples of indirect tax.

30. Non-Tax Revenue

It is the recurring income earned by the government from sources other than taxes. The most important receipts under this head are interest receipts (received on loans given by the government to states, railways, and others) and dividends and profits received from public sector companies.

31. Primary deficit

Gross Primary Deficit is Gross Fiscal Deficit minus interest payments. Net Primary Deficit is Net Fiscal Deficit minus net interest payments. The net interest payment is interest paid minus interest receipt.

32. Privatization

The transfer of ownership, property, or business from the government to the private sector is termed privatization. The government ceases to be the owner of the entity or business.

33. Property Tax

It is the annual amount paid by a landowner to the local government or the municipal corporation of his area. The property includes all tangible real estate property, his house, office building, and the property he has rented to others.

34. Public Account

Public Account of India accounts for flows for those transactions where the government is merely acting as a banker.

35. Public Debt

Public debt receipts and public debt disbursals are borrowings and repayments during the year, respectively, by the government.

36. Purchasing Power Parity

The theory aims to determine the adjustments needed to be made in the exchange rates of two currencies to make them on par with the purchasing power of each other. The expenditure on a similar commodity must be the same in both currencies when accounted for the exchange rate. The purchasing power of each currency is determined in the process. Purchasing power parity is used worldwide to compare the income levels in different countries. PPP thus makes it easy to understand and interpret the data of each country.

37. Real Economic Growth Rate

It is the rate at which a nation’s Gross Domestic Product (GDP) changes/grows from one year to another. GDP is the market value of all the goods and services produced in a country in a particular time period. Real Economic Growth Rate takes into account the effects of inflation.

38. Receipts Budget

It shows a detailed summary of the revenue and capital receipts of the government. Receipts Budget forms a part of the Annual Financial Statement. It gives a summary of tax revenue, non-tax revenue, and capital receipts. It also gives a detailed analysis of tax and non-tax receipts together with the trends.

39. Regressive Tax

Under this system of taxation, the tax rate diminishes as the taxable amount increases. In other words, there is an inverse relationship between the tax rate and taxable income. The rate of taxation decreases as the income of taxpayers increases.

40. Securities Transaction Tax

It is a kind of turnover tax where the investor has to pay a small tax on the total consideration paid or received in a share transaction.

41. Subsidy

It is a transfer of money from the government to an entity. It leads to a fall in the price of the subsidized product. The objective of subsidy is to bolster the welfare of society.

42. Subvention

It refers to a grant of money in aid or support, mostly by the government. The term finds a mention in almost every Budget.

43. Supplementary Grants

The additional grant required to meet the required expenditure of the government is called Supplementary Grants. When grants, authorized by the Parliament, fall short of the required expenditure, an estimate is presented before the Parliament for Supplementary or Additional grants. These grants are presented and passed by the Parliament before the end of the financial year.

44. Surcharge

A surcharge is an additional charge or tax.

45. Tax Revenue – Tax Revenue forms part of the Receipt Budget, which in turn is a part of the Annual Financial Statement of the Union Budget. It gives a detailed report on revenue collected from different items like corporation tax, income tax, wealth tax, customs, union excise, service, taxes on Union Territories like land revenue, stamp registration, etc. Taxes collected from both direct and indirect tax are considered in Tax Revenue.

46. Union Excise Duty

It is a type of indirect tax on goods manufactured in India.

47. Ways and means advance (WMA)

One of RBI’s roles is to serve as banker to both central and state governments. In this capacity, RBI provides temporary support to tide over mismatches in their receipts and payments in the form of ways and means advances.

This was all from us in this blog of Budget Terms and Definitions. Budget terms should now be clear to you and you should be able to comprehend the upcoming Budget well. We hope that you like it and prove to be helpful in understanding and learning when you read the upcoming budgets.

- SIDBI Grade B Books 2025, Get Subject Wise List

- SIDBI Grade B Notification 2025 Out, Apply for 26 Vacancies

- SIDBI Grade B Syllabus & Exam Pattern 2025, Download PDF

- SIDBI Grade B Eligibility 2025, Age, Qualification, Nationality

- SIDBI Grade B Apply Online 2025, Link Active Till 11 August

- SIDBI Grade B Preparation Strategy & Previous Exam Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!