How to Prepare For Bank Exam

Preparing for a bank exam requires understanding the exam pattern and syllabus, creating a study plan, using quality study material, practicing regularly, focusing on weak areas, and staying consistent with your preparation. By following these steps diligently, you can increase your chances of success in the exam.

Effective Study Strategies for Banking Exam Preparation

Preparing for a banking exam in 2024 is simpler with this step-by-step guide:

- Utilize Online Resources: Make the most of online resources. They keep you updated with recent events and help you master tricks and methods for solving questions efficiently.

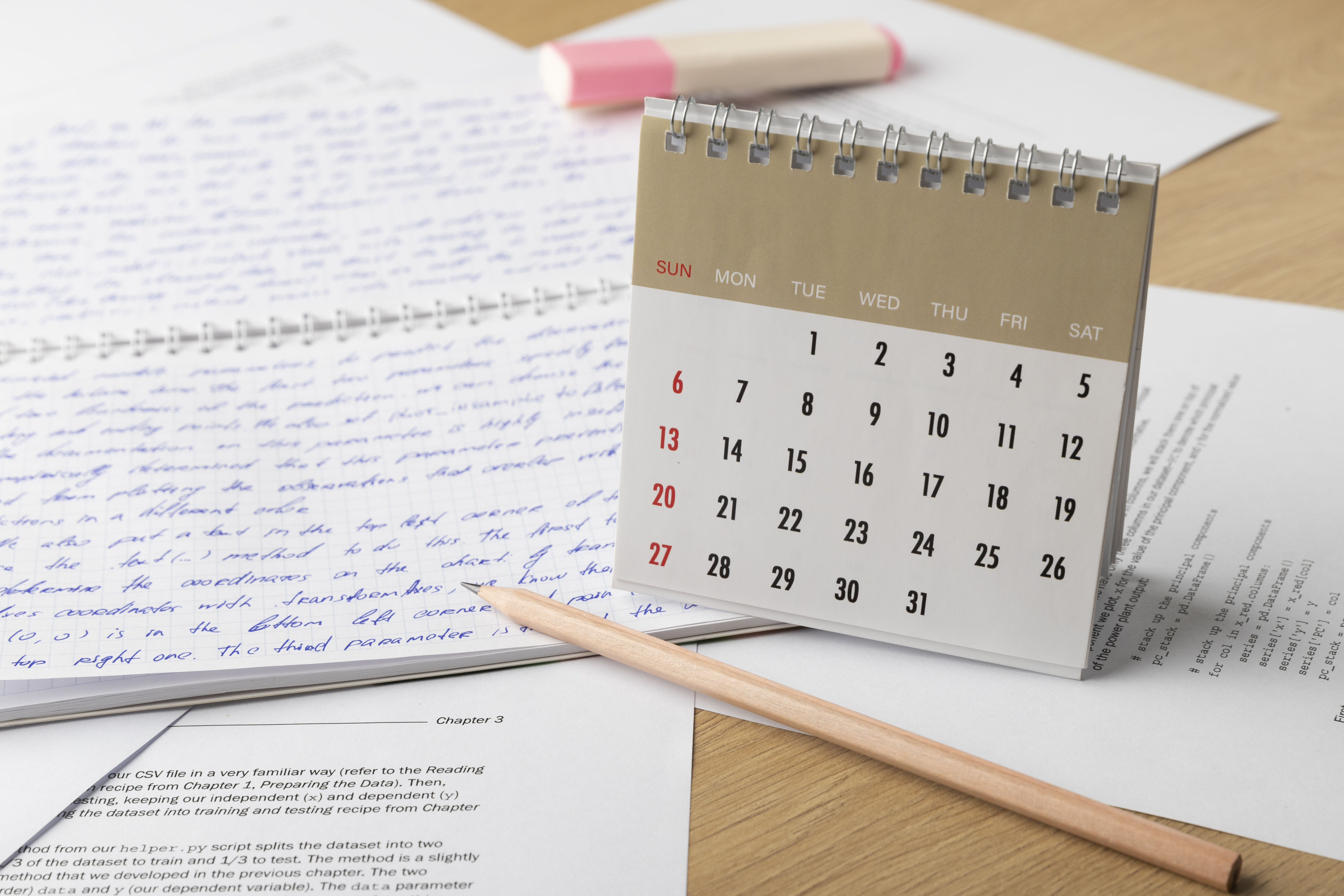

- Create a Timetable: Next, set up a timetable. This helps you manage your time effectively and cover multiple sections each day. Remember, scoring the cutoff marks in each section is essential for job eligibility.

- Plan Properly: The first step is to plan properly. Having a well thought out plan is crucial as it ensures no time is wasted. When creating the plan, be aware of the exam pattern, syllabus, and previous year’s cutoff. Knowing these aspects will help you prepare well by focusing on areas that need improvement.

- Thoroughly Revise: Once you complete your preparation, revise thoroughly. Don’t become complacent. Keep working hard on each section to ensure no gaps in your understanding.

- Cover the Entire Syllabus: Ensure you cover the entire syllabus when preparing for the exam. This ensures you can tackle any question that arises during the exam.

- Practice Regularly: Practice as much as possible. The more you practice, the better you become at solving questions. Try solving questions from mock tests within a specific time frame to track your progress and answer as many questions as possible during the exam.

Understanding the Exam Pattern and Syllabus 2024

Understanding the exam pattern and syllabus for effective preparation for any bank exam in 2024. It involves familiarizing yourself with the structure of the exam, including the number of sections, types of questions, and time allocation for each section. Additionally, gaining insights into the syllabus helps you identify the topics and concepts that need to be covered during your preparation process. By comprehensively understanding the exam pattern and syllabus, you can strategize your study plan and focus on areas that require more attention, ultimately increasing your chances of success in the bank exam.

Boost Your Confidence with Mock Tests

Mock tests also help simulate exam conditions, reducing anxiety on the actual exam day. By following these steps and staying consistent in your preparation, you can increase your chances of success in banking exams 2024.

What are bank recruitment exams in 2024?

In 2024, various agencies like SBI, RBI, IBPS, LIC, and PSBs conduct recruitment exams to fill vacancies in public sector banks across different posts including Clerks, PO/MT, SO, and RRB PO/Clerk. Here’s an overview:

- State Bank of India (SBI) conducts exams like SBI Clerk, SBI PO, and SBI SO.

- The Institute of Banking Personnel Selection (IBPS) administers exams such as IBPS PO, IBPS Clerk, IBPS RRB, and IBPS SO.

- The Reserve Bank of India (RBI) conducts RBI Grade B and RBI Assistant Recruitment exams.

- The Life Insurance Corporation of India (LIC) holds recruitment exams for posts like LIC AAO, LIC ADO, and LIC Assistant.

- Additionally, numerous other banks have their recruitment procedures to address staffing needs. Below is a comprehensive list of almost all banks in India participating in recruitment processes.

Selection Process for SBI Clerk, IBPS PO, IBPS Clerk, IBPS RRB, RBI, and LIC Exams:

When you start preparing for banking exams, it’s important to know the selection process, which usually has three stages. Understanding these stages is crucial for candidates:

- Preliminary Examination:

- The first stage is the preliminary exam. This is like a screening test to shortlist candidates for the main exam.

- In this exam, candidates are tested on basic subjects like English, Math, Reasoning, and General Knowledge.

- Main Examination:

- After passing the preliminary exam, candidates take the main exam. This is more detailed and covers a wider range of topics.

- The main exam may also include sections on banking and finance-related topics.

- Group Discussion/Interview:

- For some exams, candidates who pass the main exam go through a group discussion and/or interview.

- The group discussion tests communication and teamwork skills, while the interview assesses subject knowledge and problem-solving abilities.

Average Salaries in Various Banking Careers

In the banking sector, salaries vary depending on the role. Bank Managers and Certified Public Accountants (CPAs) earn around 7 Lakhs p.a., while Financial Risk Managers and Investment Bankers have higher average salaries of 11 Lakhs p.a. and 10 Lakhs p.a. respectively.

| Posts | Salary |

| Bank Manager | 7 Lakhs p.a. |

| Financial Accountant | 4 Lakhs p.a. |

| Financial Risk Manager | 11 Lakhs p.a. |

| Certified Public Accountant (CPA) | 7 Lakhs p.a. |

| Investment Banker | 10 Lakhs p.a. |

| Equity Analyst | 4 Lakhs p.a. |

Tips for Banking Exam Preparation

Here are the Simple Tips for Banking Exam Preparation:

- Know the Syllabus: Understand what topics are covered in the exam and focus on learning them well.

- Plan Your Study Time: Create a daily schedule that allows you to study each subject thoroughly.

- Practice with Previous years Papers: Solve previous year’s exam papers to get familiar with the types of questions asked.

- Practice Reasoning Daily: Spend time each day practicing reasoning questions, as they are important in banking exams.

- Understand, Don’t Just Memorize: Try to understand concepts rather than just memorizing them, although some things may need to be memorized.

- Brush Up on Math: Review basic math concepts and use shortcuts to solve problems quickly.

- Improve Your English: Read newspapers daily to build vocabulary and improve comprehension skills.

- Stay Updated: Keep up with current events and news related to banking and finance.

- Learn Basic Computer Skills: Familiarize yourself with common software and hardware terms, and practice using them.

- Focus on Weak Areas: Identify and work on improving areas where you struggle.

- Take Mock Tests: Practice with mock tests to get a feel for the exam and improve time management.

- Revise Regularly: Review what you’ve learned regularly rather than trying to cram at the last minute.

- Practice Descriptive Writing: Practice writing answers to descriptive questions within the time limit.

- Prepare for Interviews: Be ready to discuss exam-related topics confidently during interviews.

Most Popular Careers in Banking

Banking offers diverse career paths such as Asset Manager, Loan Officer, and Business Analyst, each providing unique opportunities for growth and development. Explore these popular roles to find your niche in the dynamic banking industry.

- Asset Manager: Manages investments and financial assets for individuals or organizations.

- Financial Risk Manager: Identifies and manages financial risks to ensure stability and profitability.

- Business Analyst: Analyzes business processes and data to improve efficiency and profitability.

- Internal Auditor: Reviews and evaluates internal controls and procedures to ensure compliance and reduce risk.

- Foreign Exchange Trader: Buys and sells foreign currencies to make profits based on market fluctuations.

- Credit Analyst: Assesses the creditworthiness of individuals or businesses applying for loans.

- Loan Officer: Evaluates loan applications and helps individuals or businesses secure financing.

- Bank Teller: Assists customers with routine banking transactions, such as deposits and withdrawals.

- Financial Manager: Oversees financial activities and prepares financial reports for organizations.

- Financial Service Representatives: Provides financial advice and assistance to clients regarding banking products and services.

- Book-Keeper: Records financial transactions and maintains accurate financial records for organizations.

- Audit Clerks: Assists auditors in reviewing financial records and ensuring compliance with regulations.

Developing Problem-Solving Skills and Exam Techniques

To succeed in bank exams in 2024, candidates need to develop problem-solving skills and exam techniques actively. This entails regularly practicing different types of questions and learning various problem-solving strategies. Additionally, mastering time-management techniques and exam tactics like quickly scanning through questions, eliminating incorrect options, and prioritizing easier questions can significantly improve exam performance. By practicing these skills and techniques consistently through mock tests and regular study, candidates can improve their ability to tackle challenging questions effectively and increase their chances of scoring higher in bank exams.

How Do I Prepare For Bank Exams – Best Tips to Remember

Here are some effective tips to help you get through bank exams with good marks –

1.1 Understanding the Exam Pattern – The first thing you need to understand is the pattern and syllabus of the exam – the number of sections in each paper, important topics to cover, sectional cut-off, and allotted time, etc. It is imperative that candidates be aware of the different topics from the syllabus. Questions may be asked from a particular topic or section of the syllabus. Therefore, you should be well prepared to attempt a variety of questions.

1.2 Create a Timetable – Preparing a timetable at home will help you with a study plan. Spending an entire day trying to solve similar questions or studying the same topic will not help you progress any further. Moreover, it becomes monotonous. Therefore, divide your day in a way so that you are able to study different sections of the paper. You can start your day with the ‘General Awareness’ section and then move on to practicing some Quantitative Aptitude problems. Later in the day, keep it light with English Grammar or studying about Computer programs. This way, you will be able to manage your time going through the topics that need to be covered. Focus on the section that you think you are weak in and make proper time-division accordingly.

Want to attempt a free mock test & test your preparations? CLICK HERE

1.3 Go Through Online Resources and Competitive Books – Besides textbooks, there are several resources and study materials – articles and blogs available online to help candidates prepare for banking exams. You can visit the various websites dedicated to competitive exam preparation and download these study materials, previous years’ question papers, and solved mock test papers. This will help you to derive a brief idea of the question pattern and important topics.

1.4 Keep Track of Time – Time management is the key to cracking banking exams. You should know that for each of the sections of your exam paper, you will be allotted a specific time. Therefore, you need to speed up in order to be able to attempt maximum questions in the least possible time. When solving papers, keep a stopwatch next to you. This way, you can analyze exactly how much time it is taking you to solve each question. This will help to improve the candidate’s speed and boost confidence in him/her in the course of time.

Register Here & Attempt Important GK Questions Here

1.5 Master the Methods and Tricks – Learning the shortcuts and tricks to solving questions particularly in Logical Reasoning and Quantitative Aptitude sections of the paper can help the candidates to obtain good marks. There are certain formulas for Speed Math and Reasoning Ability that are sure to save you time and spare the trouble of doing complicated calculations. You should memorize the formulas and practice as much as you can.

Therefore, the next time you ask yourself, how do I prepare for bank exams? glance through the above pointers. Regardless of these quick tips, the one thing that makes all the difference is rigorous practice.

Banking exams are hard to crack but if you work hard enough, you can surely get through with flying colors. In addition to the pointers mentioned here, it is very important to have a good source to prepare for the exam. Oliveboard gives you a surreal experience of the exam with its mock test designed according to the latest pattern. We also provide you the mock analytics which helps you capture your weak areas and a plan to help you overcome that.

Keep Yourself With Weekly Current Affairs Questions & Answers Here

In an attempt to answer, how do I prepare for bank exams? we have written this blog to help with the answers.

How to Prepare For Bank Exam – Ebooks

You can download 200+ ebooks important for SSC, Banking, Railway, Insurance, and other government exams here.

Oliveboard Bolt series E-books:

- Oliveboard Bolt – General Awareness

- Bolt – Monthly Current Affairs PDF

- Banking Bolt – Free E-book for Banking Awareness

- Economy Bolt – Free E-book for Economy

- RBI SO Syllabus and Exam Pattern 2025 for Grade A and B

- RBI SO Eligibility 2025, Check Qualification & Age Limit

- RBI SO Exam Date 2025, Check Phase 1 Schedule for Grade A/B

- RBI SO Apply Online 2025 Before 31st July for 28 Vacancies

- RBI SO Notification 2025 Out for 28 Vacancies of Grade A & B

- Free SSC CHSL Topic Wise Tests for English, Quant & More, Attempt Now

Prepare for Bank Exam 2024 – FAQs

Ans. Important ways include understanding the exam syllabus, creating a study plan, practicing regularly, and using resources like practice tests and old exam papers.

Ans. Effective time management involves making a study schedule that gives enough time for each subject, focusing on harder topics first, and taking short breaks to avoid getting tired.

Ans. Resources include books, online materials, videos, and classes. Practice tests and old exam papers are also helpful for practicing and improving.

Ans. Yes, practicing with practice tests is helpful because it helps you get used to the exam format, improves your time management, and helps you find areas you need to work on.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!