The Reserve Bank has released the 21st issue of the Financial Stability Report (FSR), which reflects the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC) on risks to financial stability, and the resilience of the financial system in the context of contemporaneous issues relating to development and regulation of the financial sector.

RBI Financial Stability Report – July 2020

Highlights

1. In response to COVID-19, a combination of fiscal, monetary and regulatory interventions on an unprecedented scale has ensured normal functioning of financial markets.

2. The overleveraged non-financial sector, simmering global geopolitical tensions, and economic losses on account of the pandemic are major downside risks to global economic prospects.

3. Actions undertaken by financial sector regulators and the Government to mitigate the impact of COVID-19 eased operational constraints and helped in maintaining market integrity and resilience in the face of severe risk aversion.

4. Bank credit, which had considerably weakened during the first half of 2019-20, slid down further in the subsequent period with the moderation becoming broad-based across bank groups.

5. The capital to risk-weighted assets ratio (CRAR) of Scheduled Commercial Banks (SCBs) edged down to 14.8 per cent in March 2020 from 15.0 per cent in September 2019 while their gross non-performing asset (GNPA) ratio declined to 8.5 per cent from 9.3 per cent and the provision coverage ratio (PCR) improved to 65.4 per cent from 61.6 per cent over this period.

6. Macro stress tests for credit risk indicate that the GNPA ratio of all SCBs may increase from 8.5 per cent in March 2020 to 12.5 per cent by March 2021 under the baseline scenario; the ratio may escalate to 14.7 per cent under a very severely stressed scenario.

7. Network analysis reveals that total bilateral exposures among entities in the financial system declined marginally during 2019-20; with the inter-bank market continuing to shrink and with a better capitalisation of public sector banks (PSBs), there would be a reduction in contagion losses to the banking system under various scenarios in relation to a year ago.

8. Going forward, the major challenges include pandemic-proofing large sections of society, especially those that tend to get excluded in formal financial intermediation.

Overview

1. Macro-Financial Risks

The global economy is facing a sharp and broad-based contraction as COVID-19 takes its toll on top of already sluggish and slowing macroeconomic conditions. Resolute and wide-ranging actions by central banks and governments have restored a semblance of normalcy in financial markets, but the recovery depends on a host of factors, and especially on the intensity and duration of the pandemic and the discovery of a vaccine. Global geopolitical tensions, overleveraged non-financial sectors – particularly elevated debt levels among governments, businesses, and households -, the ongoing losses of jobs and incomes impart heightened uncertainty to the outlook.

2. Domestic Economy and Markets

On the domestic front, the near-term economic prospects appear severely impacted by lockdown induced disruptions to both supply and demand-side factors, diminished consumer confidence and risk aversion. While financial sector regulators and the Government have taken policy measures to ensure financial intermediation functions normally, and distress faced by disadvantaged sections of society is mitigated, the downside risks to short term economic prospects are high. Policy measures have so far kept financial markets from freezing up and eased liquidity stress facing financial institutions and households. Consequently, borrowing costs have ebbed and illiquidity premia have shrunk. Nonetheless, risk aversion and lacklustre demand have impeded the fuller flow of finance from both banks and non-banks into the economy.

3. Financial Institutions: Soundness and Resilience

Credit growth (y-o-y) of scheduled commercial banks (SCBs)1, which had considerably weakened during the first half of 2019-20, slid down further to 5.9 per cent by March 2020 and remained muted up to early June 2020. This moderation was broad-based across all bank groups.

The capital to risk-weighted assets ratio (CRAR) of SCBs edged down to 14.8 per cent in March 2020 from 15.0 per cent in September 2019; the gross nonperforming assets (GNPA) ratio fell to 8.5 per cent from 9.3 per cent and the overall provision coverage ratio (PCR) improved to 65.4 per cent from 61.6 per cent over this period.

Macro stress tests for credit risk indicate that the GNPA ratio of all SCBs may increase from 8.5 per cent in March 2020 to 12.5 per cent by March 2021 under the baseline scenario. If the macroeconomic environment worsens further, the ratio may escalate to 14.7 per cent under very severe stress.

In terms of network analysis, the total outstanding bilateral exposures among constituents of the financial system narrowed during 2019-20. In terms of inter-sectoral exposures, asset management companies/mutual funds (AMC-MFs), followed by insurance companies, were the biggest fund providers in the system, while non-banking financial companies (NBFCs) were the biggest receiver of funds, followed by housing finance companies (HFCs). AMC-MFs recorded a sharp decline in their receivables from the financial system, while public sector banks (PSBs) and insurance companies experienced an increase. Payables of NBFCs and HFCs increased marginally.

The size of the inter-bank market continued to shrink which, along with the better capitalisation of PSBs, has led to a reduction in exposure to contagion losses that could result from a hypothetical idiosyncratic failure of a bank/ NBFC/ HFC and macroeconomic distress.

4. Regulatory Initiatives in the Financial Sector

In India, financial sector regulators have taken initiatives spanning monetary stimulus and regulatory reliefs to offset COVID-19’s impact. Significant regulatory actions have been put in place to ease operational constraints due to the lockdown as also for maintaining market integrity and resilience in the face of severe risk aversion by market participants. Looking ahead, as the focus shifts from pandemic-proofing large sections of society to a post-pandemic unwinding of stimulus and support packages in a calibrated manner, the challenge would be to establish normalcy without disrupting markets and the health of financial intermediaries.

5. Assessment of Systemic Risk

The Indian financial system remains stable, notwithstanding the significant downside risk to economic prospects. According to the latest systemic risk survey, all major risk groups, viz., global risks, risk perceptions on macroeconomic conditions, financial market risks and institutional positions were perceived as ‘high’, affecting the financial system. Among macroeconomic risks, risks to domestic growth and fiscal housekeeping were perceived to be ‘very high’, while risks on account of reversal/slowdown in capital flows, corporate sector vulnerabilities, real estate prices and household savings were perceived to be ‘high’.

Read the complete Financial Stability Report Here.

Free RBI Grade B Study Material 2020

Download PDF eBooks Here.

- RBI Grade B January 2020 GA

- Leadership Theories

- National Income Accounting

- Basics of Finance

- Basics of Economics

- Basics of Bonds

- Time Value of Money (TVM)

- Balance of Payments (BoP)

- Financial/Accounting Ratios

- Basics of Derivatives

- Introduction to Financial/Securities Markets

- Prompt Corrective Action Framework (PCA)

- Alternate Sources of Finance

- Banking Regulations & Basel Accords

- Credit Rating Agencies in India

Use Coupon Code ‘ZOOM20’ to avail 20% discount RBI Courses!

Study material for RBI Grade B 2020

If you are an RBI Grade B aspirant and also a working professional and find it difficult to find enough time for your RBI Grade B Preparations, do not worry at all.

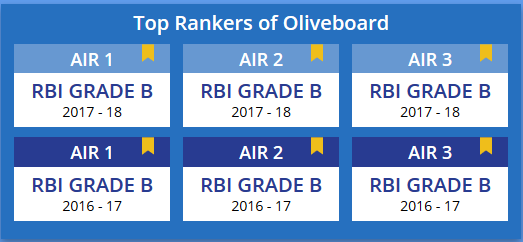

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

What all the course offers you:

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

1.1. Features:

| Phase I | Phase II |

|

|

1.2. How to enrol for the RBI Grade B Online Course 2020?

Step 1 – Login/Sign in RBI Grade B Exam Page.

Step 2 – After your login/sign in, click on “Edge (Live Class) on the top left corner.

Step 3 – As you click you will be redirected to the page where you would find the RBI Grade B Cracker Course 2020.

Now that you are aware of the RBI Grade B Online Classes, why wait?

Use Coupon Code ‘ZOOM20’ to avail 20% discount RBI Courses!

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!