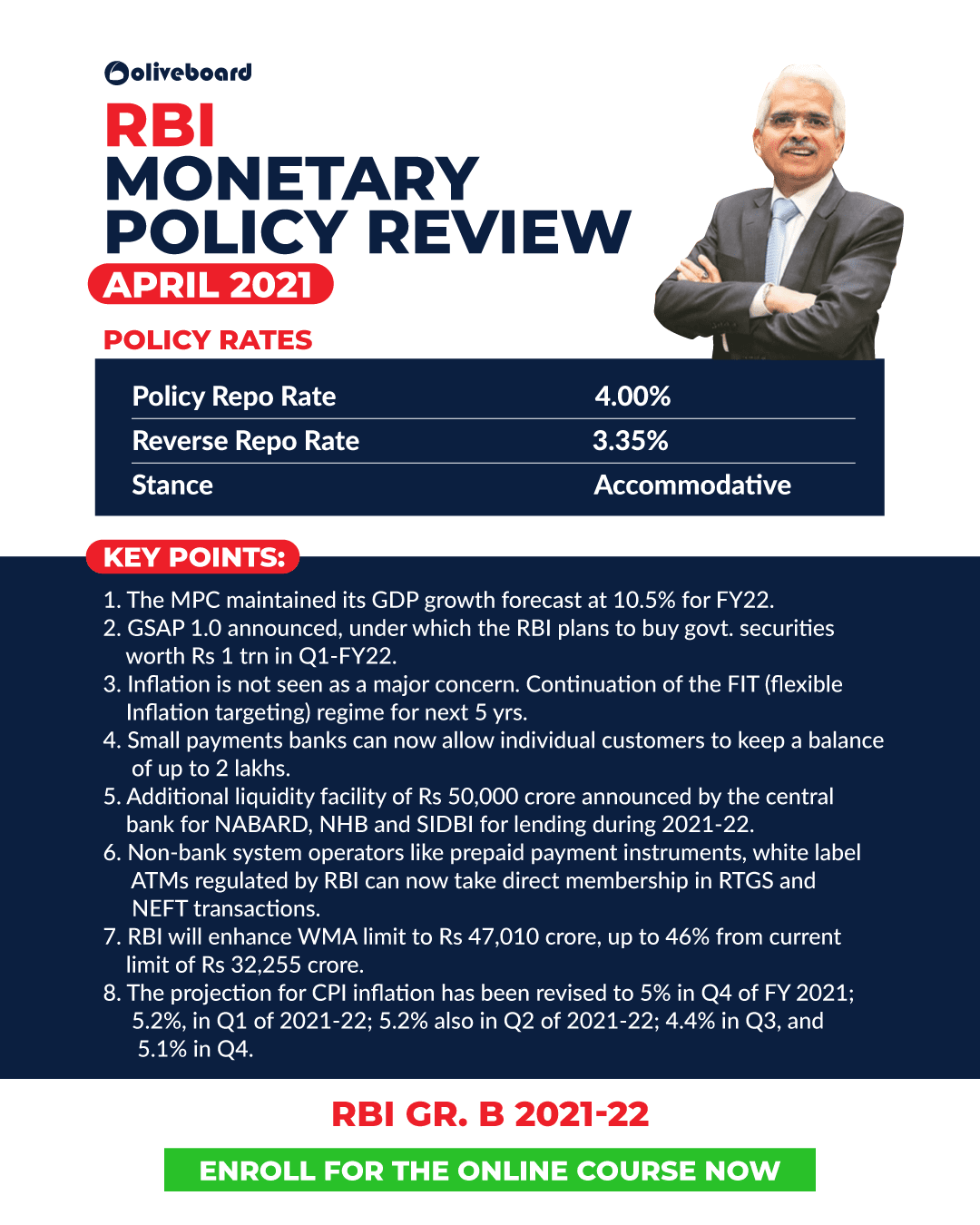

The Monetary Policy Committee of the Reserve Bank of India left the repo rate unchanged at 4% in its monetary policy committee meeting. The MPC maintains an accommodative stance. This was the first MPC meeting of the financial year 2021-22. MPC has kept the repo rate has remained at 4% since the August 2020 MPC meeting. Mr Shaktikanta Das, Governor of RBI, had said in his address that “The MPC also decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy while ensuring that inflation remains within the target going forward.” Let us have a look at RBI Monetary Policy Highlights – 7 April 2021.

Get RBI Grade B Free Study Notes & Mock Tests

RBI Monetary Policy Highlights – 7 April 2021

RBI Monetary Policy Review – April 2021

Policy Rates

Key Points

1. The MPC maintained its GDP growth forecast at 10.5% for FY22.

2. GSAP 1.0 announced, under which the RBI plans to buy govt. securities worth Rs 1 trillion in Q1-FY22.

3. Inflation is not seen as a major concern. Continuation of the FIT (flexible Inflation targeting) regime for the next 5 yrs.

4. Small payments banks can now allow individual customers to keep a balance of up to 2 lakhs.

5. Additional liquidity facility of Rs 50,000 crore announced by the central bank for NABARD, NHB and SIDBI for lending during 2021-22.

6. Non-bank system operators like prepaid payment instruments, white label ATMs regulated by RBI can now take direct membership in RTGS and NEFT transactions.

7. RBI will enhance the WMA limit to Rs 47,010 crore, up to 46% from the current limit of Rs 32,255 crore.

8. The projection for CPI inflation has been revised to 5% in Q4 of FY 2021; 5.2%, in Q1 of 2021-22; 5.2% also in Q2 of 2021-22; 4.4% in Q3, and 5.1% in Q4.

This is all from us this time for RBI Monetary Policy Highlights for the month of April 2021. We will update you about the decisions of the MPC in the upcoming bi-monthly monetary policy committee meeting. Till then stay tuned to Oliveboard.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!

THANK YOU