Retail Banking, Wholesale, and International Banking For JAIIB is an important topic when it comes to JAIIB and CAIIB exams conducted by IIBF. In this installment of Short Notes For JAIIB we will cover the details on types of banking and related concepts. Readers can find most of the concepts in the article below and can download the entire PDF notes using the link given below.

Retail Banking, Wholesale, and International Banking For JAIIB | Download PDF

Use the link and the steps below to download the PDF.

How To Download Ebooks On Oliveboard?

- Click on the link given

- You will be redirected to login/signup page

- Create an account or sign in if you already have an Olivebaord Account

- You’ll see a message – “Please click here to download the Free Ebook”

- Click on the link to get the PDF

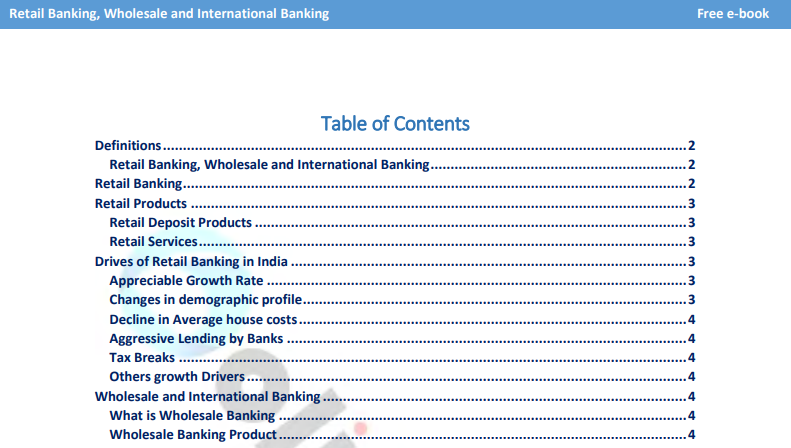

Sneak peek In To The Ebook

The term retail banking refers to how commercial banks deal with individual customers on both the asset and liability sides. Products offered are: SB, RD, CA, TDR, STDR, No Frill A/C, Home loan, auto loan, personal loan, education loan, crop loan, credit card, debit cards, lockers, bankassurance etc.

Business banking, also known as corporate banking or commercial banking, refers to doing banking business with businesses – mainly multinational corporations, domestic businesses, and public sector organizations. Products offered are: LC, BG, Collection of bills and documents, forex desk, tax collection, RTGS, term lending, etc.

International banking refers to dealing in cross-border transactions.

Besides offering mutual funds and capital market-related products, like share broking and commodity broking, universal banking offers all types of financial products, including shares, commodities, and more services under one roof, such as gold/bullion, government/corporate bonds, merchant banking, general banking, health insurance (both life and non-life), etc.

A depository receipt (DR) is a form of negotiable (transferable) financial instrument that is traded on a local stock exchange of a country but represents a security, usually in the form of equity that is issued by a foreign publicly listed company.

Participatory Notes are like contract notes. They are issued by FII to entities that want to invest in the Indian stock market but do not want to register themselves with the SEBI. FII is not allowed to issue Participatory notes to Indian national or overseas corporate bodies (because the majority are owned/controlled by NRIs).

Retail Banking

In retail banking, also known as consumer banking, banking services are provided to retail customers rather than institutional customers, such as companies, corporations, and/or financial institutions.

Today’s Retail banking sector is characterized by three basis features:

- Multiple products (deposits, credit cards, insurance, investments and securities)

- Multiple channels of distribution (call centre, branch, Internet and Kiosk)

- Multiple customer groups (Consumer, small business and corporate)

Retail Products

The Typical products offered in the Indian retail banking segment are:

Retail Deposit Products

- Saving Bank Account

- Recurring Deposit Account

- Current Deposit Account

- Term Deposit Account

- Zero Balance Account for salaried class people

- Basis Saving Bank Deposit Account (BSBDA) for the common man

- Senior Citizen Deposit Account, etc.

- Retail Loan Products

- Home loans to resident Indians for purchase of land and construction of residential

- house/purchase of ready built house/for repairs and renovation of an existing house.

- Home loans to Non- Resident Indians

- Auto loans- for purchase of new/used four-wheelers and two-wheelers

- Consumer loans- for purchase of white goods and durables

- Personal loans- for purchase of jewels, for meeting domestic consumption etc.

- Educational loans- for pursuing higher education both in India and abroad

- Trade related advances to individuals- for setting up business, retail trade etc.

- Crop loans to agricultural farmers

- Credit cards etc.

Retail Services

- Safe Deposit lockers

- Depository services

- Bancassurance Products etc.

Drives of Retail Banking in India

Appreciable Growth Rate

The economic boom and the ensuing increase in purchasing power have boosted the economic boom in consumer spending. Since 1992, India’s economy has grown at an average rate of 6.8% and the growth should continue at a comfortable pace.

Changes in demographic profile

Change in consumer demographics shows vast potential for growth in consumption both qualitatively and quantitatively. It has been forecasted that BRIC nations have a bright future, in which India’s demographic advantage will have a key role.

Today, the average age of borrowers has dropped from 40 years about five years ago too, now, an estimated 30 years. In the future, the average age is predicted to reduce further and hence it will indicate well for the housing finance market in terms of increased borrowers.

ADR vs GDR

| Parameter | ADR | GDR |

| Acronym | American Depository Receipt | Global Depository Receipt |

| Meaning | ADR is a negotiable instrument issued by a US bank, representing non-US company stock, trading in the US stock exchange. | GDR is a negotiable instrument issued by the international depository bank, representing foreign company’s stock trading globally. |

| Relevance | Foreign companies can trade in US stock market. | Foreign companies can trade in any country’s stock market other than the US stock market. |

| Issued in | United States domestic capital market. | European capital market. |

| Listed in | American Stock Exchange such as NYSE or NASDAQ | Non-US Stock Exchange such as London Stock Exchange or Luxemberg Stock Exchange. |

| Negotiation | In America only. | All over the world. |

| Disclosure Requirement | Onerous | Less onerous |

| Market | Retail investor market | Institutional market. |

Participatory Notes

Participatory notes also called P-Notes are offshore derivative instruments with Indian shares as underlying assets. These instruments are used for making investments in the stock markets.

However, they are not used within the country. They are used outside India for making investments in shares listed in the Indian stock market. That is why they are also called offshore derivative instruments.

Participatory notes are issued by brokers and FIIs registered with SEBI. The investment is made on behalf of these foreign investors by the already registered brokers in India. For example, Indian-based brokerages buy India-based securities and then issue participatory notes to foreign investors. Any dividends or capital gains collected from the underlying securities go back to the investors.

Why are participatory notes used?

P-Notes are very easy to invest in, which makes them very popular among FIIs. Prior to investing in Indian shares, foreign investors who are not registered with SEBI have to undergo a lot of scrutiny, such as know-your-customer rules. Foreign investors use this method to bypass these obstacles. In addition, since the beneficiaries of these notes are not disclosed, many anonymous investors opt to use them. Instruments like these allow investors to trade in the Indian market without registering with SEBI and revealing their identities.

Advantages of participatory notes

Anonymity: Participants in participatory notes do not have to register with SEBI, whereas all FIIs are forced to register. The system makes it possible for large hedge funds to operate anonymously.

Ease of trading: Trading through participatory notes is easy because they are like contract notes transferable by endorsement and delivery.

Tax saving: Some of the entities route their investment through participatory notes to take advantage of the tax laws of certain preferred countries.

Disadvantages of P-notes

Participatory notes are not very popular with Indian regulators because they have no way of knowing who owns the underlying securities. Several unaccounted funds are alleged to have entered the country through participatory notes.

- JAIIB Exam Syllabus & Pattern – List of Topics to Prepare

- JAIIB Exam Date – For May & Nov Exam Cycle

- JAIIB Exam – Eligibility, Schedule, Registration Details

- JAIIB Eligibility Criteria – Age Limit, No. of Attempts

- JAIIB Admit card – Steps to Download and Updates

- JAIIB Registration & Apply Online – Steps to Fill the Application Form

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in