Most Repetitive JAIIB RBWM MCQs

Most Repetitive JAIIB RBWM MCQs: The JAIIB (Junior Associate of Indian Institute of Bankers) exam is an important step for anyone looking to enhance their career in the banking industry. One of the key modules in this exam is RBWM (Risk and Banking Operations, Wealth Management), which focuses on understanding risk management, banking operations, and wealth management concepts. Practicing multiple-choice questions (MCQs) is an excellent way to prepare, especially those that are most frequently asked in previous exams.

Importance of JAIIB RBWM MCQs

The 50 Most Repetitive JAIIB RBWM MCQs cover the essential topics you need to know for the exam. These questions appear frequently in past exams and are likely to be repeated in future ones. Practicing them will help you understand the types of questions asked and the core concepts needed to pass the exam.

How to Approach JAIIB RBWM MCQs?

To successfully tackle the 50 Most Repetitive JAIIB RBWM MCQs, consider the following strategies:

- Understand the Concepts: Focus on mastering key topics like risk management, wealth management, and banking operations.

- Practice Regularly: The more you practice, the more confident you will be in answering the questions.

- Use JAIIB Mock Tests: Take mock exams to track your progress and identify areas where you need improvement.

- Revise Key Areas: Regular revision of important concepts will help reinforce your learning.

50 Most Repetitive JAIIB RBWM MCQs

- Which of the following is NOT a part of retail banking services?

a) Savings accounts

b) Corporate loans

c) Personal loans

d) Mortgages

Answer: b) Corporate loans - What does “internet banking” primarily allow customers to do?

a) Apply for loans

b) Open new accounts

c) Transfer funds

d) Purchase insurance

Answer: c) Transfer funds - What does the acronym ‘NEFT’ stand for in banking?

a) National Electronic Funds Transfer

b) National Economic Funds Transfer

c) National Emergency Funds Transfer

d) None of the above

Answer: a) National Electronic Funds Transfer - Which of the following is an example of electronic banking?

a) ATM transactions

b) Over-the-counter cash withdrawals

c) Direct deposits of checks

d) All of the above

Answer: d) All of the above - Which type of customer is eligible to open an internet banking account?

a) Only individual customers

b) Only corporate customers

c) Both individual and corporate customers

d) None of the above

Answer: c) Both individual and corporate customers - Which of the following is NOT an internet banking service?

a) Bill payments

b) Account balance checking

c) Account opening

d) Loan disbursement

Answer: d) Loan disbursement - Which mechanism is used for transferring funds between accounts in different banks?

a) RTGS

b) NEFT

c) IMPS

d) All of the above

Answer: d) All of the above - Which of the following is a disadvantage of internet banking?

a) Easy access to account information

b) Security risks like hacking

c) Faster transactions

d) 24/7 availability

Answer: b) Security risks like hacking - What is the full form of IMPS in banking?

a) Instant Money Payment System

b) Immediate Payment Service

c) Instant Mobile Payment System

d) International Money Payment Service

Answer: b) Immediate Payment Service - Which type of bank offers internet banking?

a) Commercial banks

b) Private banks

c) Public sector banks

d) All of the above

Answer: d) All of the above - What is a major security feature of internet banking?

a) PIN code

b) Password

c) Two-factor authentication

d) All of the above

Answer: d) All of the above - Which of the following is a key benefit of mobile banking?

a) Access to account details anytime, anywhere

b) Inability to access account details

c) Limited transaction options

d) None of the above

Answer: a) Access to account details anytime, anywhere - What does ‘RTGS’ stand for in banking?

a) Real-Time Gross Settlement

b) Real-Time General Settlement

c) Regional Transfer Gross Settlement

d) Real-Time General Service

Answer: a) Real-Time Gross Settlement - Which of the following is a method of transferring funds electronically?

a) Bank drafts

b) Demand drafts

c) Electronic funds transfer

d) Post-dated checks

Answer: c) Electronic funds transfer - Which service allows customers to access their account information 24/7 online?

a) Telephone banking

b) ATM banking

c) Internet banking

d) Branch banking

Answer: c) Internet banking - What is a benefit of electronic banking over traditional banking?

a) Less convenience

b) Faster transactions

c) Limited services

d) None of the above

Answer: b) Faster transactions - What does a user need to access internet banking?

a) A bank account number

b) A bank card

c) An internet connection

d) All of the above

Answer: d) All of the above - What type of transaction is typically faster, RTGS or NEFT?

a) RTGS

b) NEFT

c) Both are equally fast

d) Neither

Answer: a) RTGS - What is the primary use of ‘IFSC’ code in banking?

a) To identify the branch of a bank

b) To process bank loans

c) To verify account numbers

d) To transfer international funds

Answer: a) To identify the branch of a bank - Which of the following banks was the first to introduce internet banking in India?

a) ICICI Bank

b) State Bank of India

c) HDFC Bank

d) Axis Bank

Answer: a) ICICI Bank - Which of the following is NOT a type of electronic payment system?

a) UPI

b) NEFT

c) Demand Draft

d) IMPS

Answer: c) Demand Draft - Which service does NOT fall under electronic banking?

a) Direct deposit

b) Online payments

c) Bill payments via cheque

d) Bank account balance check

Answer: c) Bill payments via cheque - What type of banking allows customers to access their accounts and perform transactions using the internet?

a) Mobile banking

b) Internet banking

c) Telephone banking

d) None of the above

Answer: b) Internet banking - What does ‘KYC’ stand for in banking?

a) Know Your Customer

b) Know Your Credit

c) Keep Your Cash

d) Know Your Communication

Answer: a) Know Your Customer - Which of the following is an example of mobile banking?

a) Using a bank’s mobile app to transfer funds

b) Using a bank card to withdraw cash from an ATM

c) Calling customer service to request a checkbook

d) Visiting a branch for account balance

Answer: a) Using a bank’s mobile app to transfer funds - What is the typical limit for transactions via NEFT?

a) No limit

b) Up to Rs. 2 lakhs

c) Up to Rs. 5 lakhs

d) Rs. 10 lakhs

Answer: a) No limit - What is the role of RBI in internet banking?

a) Regulating the services offered by banks

b) Setting limits for online transactions

c) Ensuring security standards

d) All of the above

Answer: d) All of the above - Which of the following is true about internet banking security?

a) It’s completely risk-free

b) It can be accessed by anyone with an internet connection

c) It requires user authentication for access

d) It’s the same as visiting a physical bank

Answer: c) It requires user authentication for access - What type of bank account is commonly used for online transactions?

a) Savings account

b) Current account

c) Fixed deposit account

d) Recurring deposit account

Answer: a) Savings account - Which of the following does NOT require an internet connection?

a) ATM withdrawal

b) Mobile banking

c) Internet banking

d) None of the above

Answer: a) ATM withdrawal - Which payment platform allows customers to pay bills and transfer money using their smartphones?

a) Mobile banking

b) ATM

c) Branch banking

d) Post offices

Answer: a) Mobile banking - Which is a characteristic of electronic banking?

a) Limited accessibility

b) Transactions are done physically in branches

c) Provides 24/7 access to banking services

d) Restricted to cash transactions

Answer: c) Provides 24/7 access to banking services - Which of the following does NOT require authentication in internet banking?

a) Transfer of funds

b) Checking account balance

c) Requesting a cheque book

d) Setting up online bill payments

Answer: b) Checking account balance - Which type of transaction is typically NOT allowed in internet banking?

a) Fund transfer

b) Cash deposit

c) Bill payment

d) Account balance inquiry

Answer: b) Cash deposit - Which is a benefit of internet banking for banks?

a) Increased branch visits

b) Reduced operational costs

c) More paperwork

d) Limited customer engagement

Answer: b) Reduced operational costs - Which of the following is true for internet banking?

a) You need to visit the bank every time for transactions

b) You can only access your account during business hours

c) It allows 24/7 access to banking services

d) It requires physical signatures for all transactions

Answer: c) It allows 24/7 access to banking services - Which of the following is a mode of payment used in mobile banking?

a) UPI

b) IMPS

c) NEFT

d) All of the above

Answer: d) All of the above - What is the full form of UPI in banking?

a) Universal Payment Interface

b) Unified Payment Interface

c) United Payment Interface

d) Unified Postal Interface

Answer: b) Unified Payment Interface - Which of the following services allows a user to view their recent transactions?

a) Mobile banking

b) Telephone banking

c) Branch banking

d) ATM

Answer: a) Mobile banking - Which payment platform enables real-time transactions 24/7?

a) NEFT

b) IMPS

c) RTGS

d) SWIFT

Answer: b) IMPS - Which of the following is essential for opening an internet banking account?

a) A bank account

b) A credit card

c) A debit card

d) A loan account

Answer: a) A bank account - What does a mobile wallet allow customers to do?

a) Deposit money into an account

b) Send or receive payments via mobile

c) Apply for a loan

d) Open new bank accounts

Answer: b) Send or receive payments via mobile - What is the maximum transaction limit for IMPS in a day?

a) Rs. 50,000

b) Rs. 1,00,000

c) Rs. 2,00,000

d) Rs. 5,00,000

Answer: c) Rs. 2,00,000 - Which of the following is NOT a common feature of mobile banking apps?

a) Instant fund transfer

b) Bill payments

c) Cash deposit

d) Account balance check

Answer: c) Cash deposit - What is the main advantage of electronic funds transfer (EFT)?

a) Faster processing time

b) Requires physical visit to bank

c) Lower transaction costs

d) Limited transaction types

Answer: a) Faster processing time

- What does OTP stand for in internet banking?

a) Online Transaction Payment

b) One-Time Password

c) Official Transaction Passcode

d) Online Transfer Payment

Answer: b) One-Time Password - Which service allows you to transfer money to another bank account online?

a) RTGS

b) IMPS

c) NEFT

d) All of the above

Answer: d) All of the above - Which of the following can be done using internet banking?

a) Paying utility bills

b) Making international transfers

c) Checking transaction history

d) All of the above

Answer: d) All of the above - Which of the following is true about secure internet banking?

a) Bank accounts can be accessed by anyone

b) It involves strong encryption for data protection

c) It does not require user identification

d) It doesn’t need a password

Answer: b) It involves strong encryption for data protection - Which of the following is the most commonly used online payment gateway?

a) PayPal

b) UPI

c) NEFT

d) IMPS

Answer: b) UPI

Important Concepts for JAIIB RBWM

Here are some of the important topics that you should focus on while preparing for the exam:

| Topic | Key Points |

| Risk Management | Types of risks – market, credit, operational |

| Banking Operations | Functions of banks, role of central banks |

| Wealth Management | Investment strategies, asset classes |

| Credit Risk | Risk of borrower default |

| Market Risk | Risk due to market fluctuations |

Also Check,

| Related Topics | Link |

| 50 Most Repetitive JAIIB AFMB MCQs | Click here to Check |

| 50 Most Repetitive JAIIB PPB MCQs | Click here to Check |

| 50 Most Repetitive JAIIB IE & IFS MCQs | Click here to Check |

Conclusion

The 50 Most Repetitive JAIIB RBWM MCQs cover essential topics that will help you prepare for the JAIIB exam effectively. By practicing these questions and focusing on key concepts like risk management, banking operations, and wealth management, you will increase your chances of performing well. Remember, regular practice, understanding key concepts, and revising thoroughly are crucial to success.

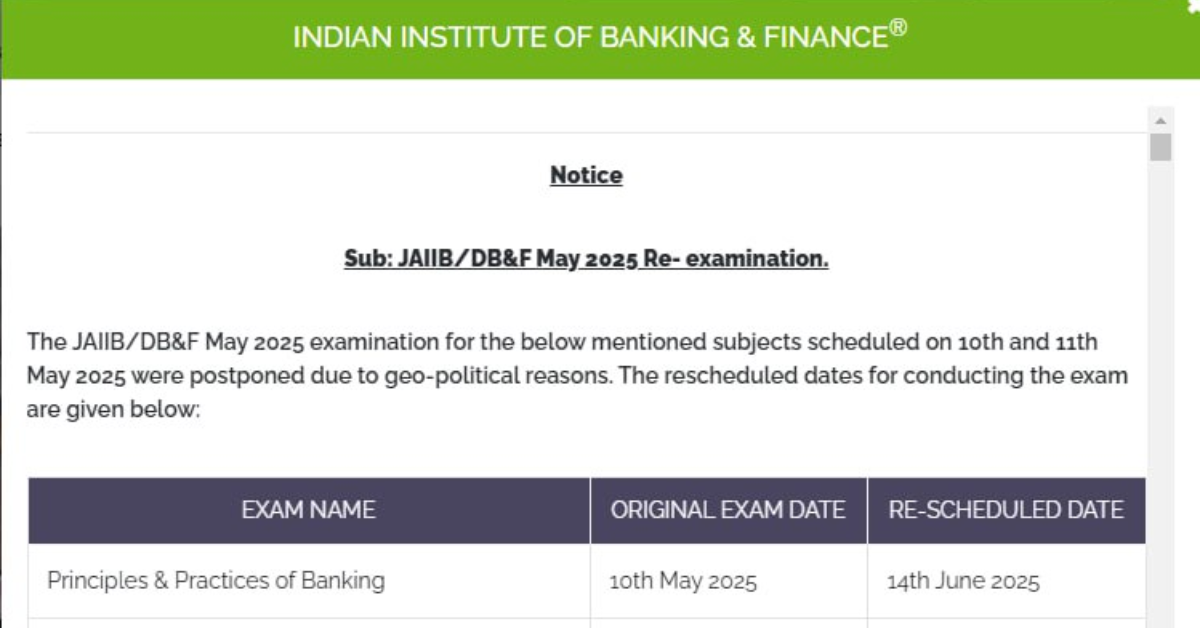

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!