Most Repetitive JAIIB AFMB MCQs

Most Repetitive JAIIB AFMB MCQs: The Junior Associate of Indian Institute of Bankers (JAIIB) exam is crucial for banking professionals seeking career advancement. Among the JAIIB modules, the Accounting and Finance for Bankers (AFMB) section plays a vital role. To help students prepare efficiently, we have curated the 50 Most Repetitive JAIIB AFMB MCQs, focusing on key topics and concepts that frequently appear in exams. This article is optimized to provide maximum value by covering essential MCQs, their answers, and explanations to strengthen your preparation.

Why Focus on Repetitive MCQs?

Focusing on repetitive MCQs helps identify commonly tested concepts, improving accuracy and efficiency during exams. It ensures targeted preparation by reinforcing high-frequency topics.

- High Scoring Potential: These questions often test core concepts, allowing you to secure marks easily.

- Exam Pattern Insight: Understanding repetitive questions helps identify trends and frequently tested areas.

- Effective Revision: Concentrating on these ensures you cover essential topics systematically.

Important Topics in JAIIB AFMB

The repetitive MCQs often revolve around the following areas:

- Accounting Standards (AS and Ind AS)

- Basic Accounting Principles

- Financial Statements

- Regulatory Framework

- Banking and Financial Terminologies

50 Most Repetitive JAIIB AFMB MCQs

- What is the full form of IASC?

- A) International Accounting Standards Company

- B) Indian Accounting Standards Committee

- C) International Accounting Standards Committee

- D) Indian Accounting Standards Company

Answer: C

- What organization replaced the IASC?

- A) IASB

- B) NAAC

- C) ICAI

- D) IFRS

Answer: A

- In which year was the IASC replaced by the IASB?

- A) 1999

- B) 2001

- C) 2003

- D) 2005

Answer: B

- What is the current name for the standards set by the IASB?

- A) IAS

- B) IFRS

- C) ICAI Standards

- D) IASC

Answer: B

- Under which Act was the Institute of Chartered Accountants of India (ICAI) established?

- A) Companies Act 1956

- B) Partnership Act

- C) Chartered Accountants Act 1949

- D) Accounting Act 1960

Answer: C

- What did NACA (National Advisory Committee on Accounting Standards) get replaced with in 2018?

- A) ICAI

- B) NAFFR

- C) NFRA

- D) IASB

Answer: C

- How many Indian Accounting Standards (Ind AS) exist in total?

- A) 29

- B) 32

- C) 41

- D) 27

Answer: C

- Why were Ind AS created in India?

- A) To align with the Companies Act

- B) To ensure compatibility with IFRS

- C) To replace local accounting standards

- D) To make financial statements simpler

Answer: B

- Which standard deals with agricultural accounting in India?

- A) AS 25

- B) Ind AS 41

- C) AS 21

- D) Ind AS 29

Answer: B

- How many accounting standards have been issued by the ICAI?

- A) 41

- B) 38

- C) 32

- D) 27

Answer: C

- How many accounting standards are currently applicable in India?

- A) 32

- B) 27

- C) 29

- D) 25

Answer: B

- Which accounting standard covers intangible assets?

- A) AS 26

- B) AS 8

- C) Ind AS 29

- D) AS 41

Answer: A

- Which accounting standard no longer exists?

- A) AS 6 and AS 8

- B) AS 1 and AS 21

- C) AS 7 and AS 29

- D) AS 25 and AS 26

Answer: A

- What does inflation accounting involve?

- A) Tracking inflation’s impact on consumer prices

- B) Adjusting financial statements for inflation effects

- C) Calculating GDP changes

- D) Preparing balance sheets without inflation considerations

Answer: B

- Which of the following is an example of an intangible asset?

- A) Land

- B) Equipment

- C) Goodwill

- D) Inventory

Answer: C

- What is the purpose of accounting standards?

- A) To regulate taxation

- B) To ensure uniformity in financial reporting

- C) To track company performance

- D) To assist in inventory valuation

Answer: B

- What is the focus of the MCQ Cracker Batch?

- A) Concept videos

- B) Mock interviews

- C) Multiple Choice Questions (MCQs)

- D) Essay writing

Answer: C

- How many MCQs are covered in the Cracker Batch?

- A) 100

- B) 200-300

- C) 300-400+

- D) 500-600

Answer: C

- What is the daily target for MCQs in the session?

- A) 10

- B) 15

- C) 20

- D) 25

Answer: B

- What code can be used to get maximum discounts on Olive Board?

- A) OB123

- B) PDY

- C) OLIVE20

- D) ELITE30

Answer: B

- Which organization prepares financial standards in India?

- A) NACA

- B) ICAI

- C) IASB

- D) NFRA

Answer: B

- What does NFRA stand for?

- A) National Financial Reporting Authority

- B) National Financial Regulatory Authority

- C) National Fiscal Reporting Agency

- D) National Financial Accounting Authority

Answer: A

- How many accounting standards were initially issued?

- A) 29

- B) 32

- C) 27

- D) 25

Answer: C

- Which year marked the replacement of NACA with NFRA?

- A) 2016

- B) 2018

- C) 2020

- D) 2022

Answer: B

- What is the key benefit of MCQ practice sessions?

- A) Time management improvement

- B) Enhanced descriptive skills

- C) Focus on theoretical learning

- D) Memorizing standards

Answer: A

- What type of questions does the MCQ Cracker Series include?

- A) Essay-based

- B) Theory-based

- C) Mixed and Sequence-based

- D) Project-based

Answer: C

- What is the relationship between Ind AS and IFRS?

- A) Ind AS simplifies IFRS

- B) Ind AS aligns with IFRS standards

- C) Ind AS is unrelated to IFRS

- D) Ind AS replaces IFRS globally

Answer: B

- D) Ind AS replaces IFRS globally

- Which standard deals with consolidation of financial statements?

- A) AS 15

- B) AS 21

- C) AS 26

- D) AS 6

Answer: B

- Which accounting concept is applied when revenue is recognized only when it is realized?

- A) Matching Principle

- B) Revenue Recognition Principle

- C) Prudence Principle

- D) Consistency Principle

Answer: B

- Which accounting principle ensures expenses are matched with the revenue of the same period?

- A) Prudence Principle

- B) Matching Principle

- C) Going Concern Principle

- D) Materiality Principle

Answer: B

- What is the main goal of International Financial Reporting Standards (IFRS)?

- A) Enhance comparability of financial statements globally

- B) Regulate taxation worldwide

- C) Simplify audit processes

- D) Develop local accounting frameworks

Answer: A

- AS 7 deals with accounting for which of the following?

- A) Construction Contracts

- B) Employee Benefits

- C) Revenue Recognition

- D) Provisions and Contingencies

Answer: A

- Which standard specifies the preparation and presentation of cash flow statements?

- A) AS 1

- B) AS 3

- C) AS 6

- D) AS 26

Answer: B

- Which Ind AS corresponds to IFRS 9?

- A) Ind AS 32

- B) Ind AS 109

- C) Ind AS 101

- D) Ind AS 116

Answer: B

- How can candidates improve their performance in MCQs?

- A) Avoid mock tests

- B) Focus on theoretical notes

- C) Practice mock tests regularly

- D) Memorize all standards

Answer: C

- Which is the most effective strategy for time management during MCQ exams?

- A) Attempt questions sequentially

- B) Attempt easy questions first

- C) Skip all numerical questions

- D) Avoid reviewing answers

Answer: B

- What should students focus on to reduce errors in MCQ exams?

- A) Study the syllabus deeply

- B) Analyze mock test results

- C) Avoid all tough questions

- D) Memorize examples

Answer: B

- What is one of the critical outcomes of practicing with MCQs?

- A) Increased conceptual clarity

- B) Memorization of formulas

- C) Avoidance of numerical problems

- D) Focus on descriptive answers

Answer: A

- What is the primary role of the NFRA?

- A) Regulate banking standards

- B) Oversee financial reporting standards in India

- C) Conduct corporate audits

- D) Set global accounting policies

Answer: B

- Which accounting standard focuses on the treatment of leases?

- A) Ind AS 116

- B) Ind AS 32

- C) Ind AS 115

- D) Ind AS 41

Answer: A

- How many mandatory accounting standards were issued by IASC before its replacement?

- A) 29

- B) 31

- C) 41

- D) 42

Answer: C

- Which standard requires disclosures about related party transactions?

- A) AS 18

- B) AS 19

- C) AS 20

- D) AS 21

Answer: A

- What is the standard code used for Financial Instruments?

- A) Ind AS 109

- B) Ind AS 115

- C) Ind AS 32

- D) Ind AS 16

Answer: A

- Which organization develops accounting standards for the US?

- A) ICAI

- B) IASB

- C) FASB

- D) AICPA

Answer: C

- In India, what body is responsible for issuing Ind AS?

- A) NFRA

- B) ICAI

- C) IASB

- D) Ministry of Finance

Answer: B

- Which concept suggests that financial statements are prepared assuming the entity will continue operating?

- A) Prudence Principle

- B) Consistency Principle

- C) Going Concern Concept

- D) Materiality Principle

Answer: C

- AS 19 deals with which area of accounting?

- A) Leases

- B) Employee Benefits

- C) Segment Reporting

- D) Intangible Assets

Answer: A

- What is the primary feature of inflation-adjusted financial statements?

- A) Restatement of monetary values

- B) Removal of tax components

- C) Fixed nominal asset values

- D) Focus on revenue increases

Answer: A

- Which Ind AS deals with revenue from contracts with customers?

- A) Ind AS 101

- B) Ind AS 115

- C) Ind AS 116

- D) Ind AS 32

Answer: B

- What is the primary focus of AS 6?

- A) Depreciation accounting

- B) Valuation of inventory

- C) Accounting for leases

- D) Segment reporting

Answer: A

Important Accounting Standards and Ind AS

| Standard | Area of Focus | Indian Equivalent (Ind AS) | IFRS Equivalent |

| AS 7 | Construction Contracts | Ind AS 11 | IAS 11 |

| AS 3 | Cash Flow Statements | Ind AS 7 | IAS 7 |

| AS 9 | Revenue Recognition | Ind AS 115 | IFRS 15 |

| AS 6 | Depreciation Accounting | Ind AS 16 | IAS 16 |

| AS 18 | Related Party Disclosures | Ind AS 24 | IAS 24 |

Also Check,

| Related Topics | Link |

| 50 Most Repetitive JAIIB RBWM MCQs | Click here to Check |

| 50 Most Repetitive JAIIB PPB MCQs | Click here to Check |

| 50 Most Repetitive JAIIB IE & IFS MCQs | Click here to Check |

Conclusion

The 50 Most Repetitive JAIIB AFMB MCQs provide a strategic edge in exam preparation by highlighting high-priority topics. Focusing on these questions ensures effective time management and concept clarity, which are crucial for success. Use this guide to streamline your study plan and boost your confidence for the JAIIB AFMB exam.

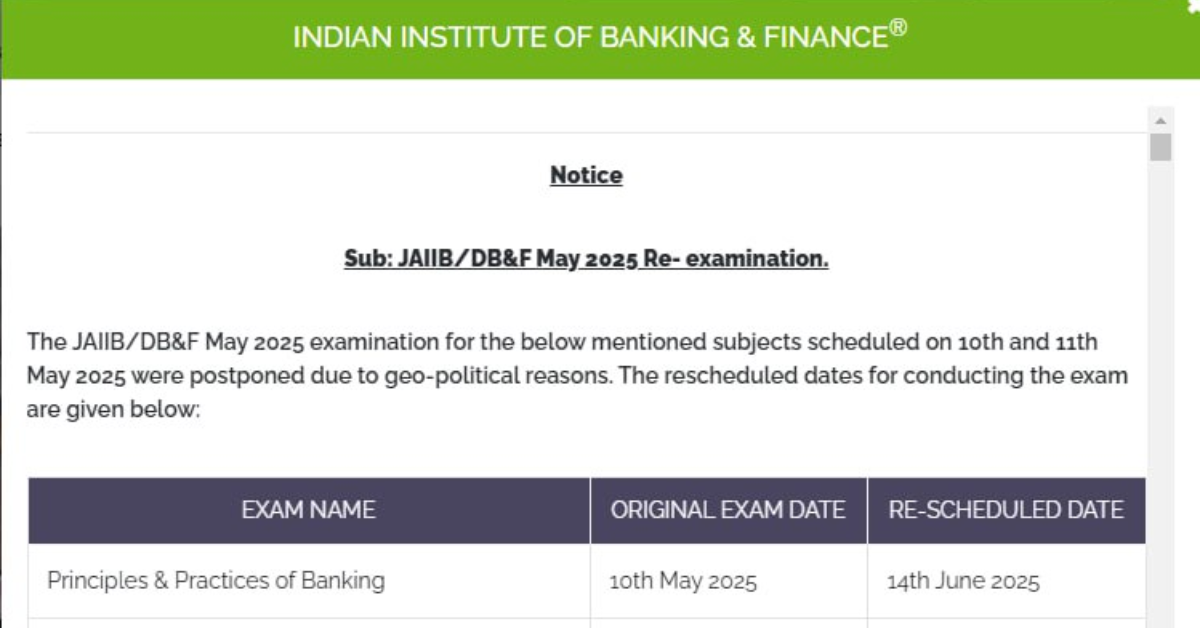

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!