8 February 2024 Current Affairs

8 February 2024 Current Affairs refers to the latest news and events happening worldwide and are relevant to our daily lives. Staying updated with the 8 February 2024 Current Affairs is essential for students who are preparing for exams, especially competitive exams, as it forms an important part of the syllabus. The importance of the 8 February 2024 Current Affairs lies in its ability to help students enhance their general knowledge, improve their reading and comprehension skills, and develop their critical thinking abilities.

8 Feb 2024 Daily Current Affairs

8 February 2024 Current Affairs also provides students with insights into issues such as politics, economics, and social issues that are important for their overall development as informed citizens. Regularly reading and analyzing the 8 February 2024 Current Affairs not only helps students ace their exams but also prepares them for their future roles as responsible and well-informed citizens of society.

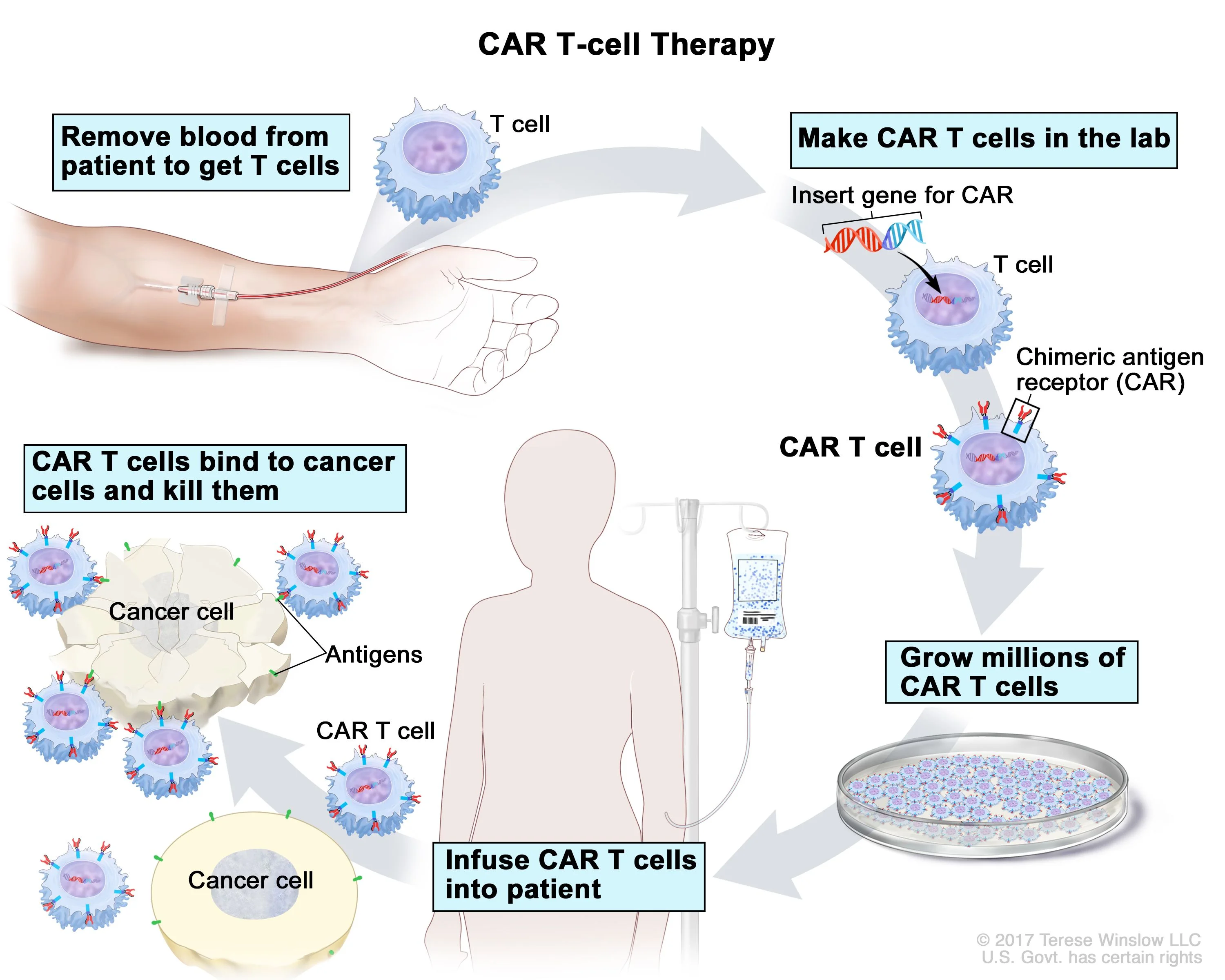

First patient declared ‘cancer-free’ using indigenous CAR-T Cell Therapy

CAR-T cell therapy, approved by India’s drug regulator in November 2023, has proven to be a life-saving treatment for patients battling cancer. Dr. (Col) V K Gupta, a Delhi-based gastroenterologist and former Indian Army officer, became the first patient to be declared “currently free of cancer cells” after undergoing the procedure at Tata Memorial Hospital on February 7. The therapy involves genetically reprogramming a patient’s immune system to target and fight cancer cells. This success marks a significant milestone in the application of advanced medical treatments in India. Read the complete article here.

Several startups get RBI approval to operate as payment aggregators

This month, two fintech startups Decentro and Juspay, and an enterprise software-as-a-service (SaaS) firm, Zoho, have received final authorization from the RBI for payment aggregator (PA) licenses. Food delivery major Zomato, and fintech firms Stripe and Tata Pay were among the companies to have bagged the license in January.

HDFC Bank raises $300 million through maiden sustainable finance bond issue

HDFC Bank has raised $300 million through its first-ever sustainable finance bond issue. The fundraiser is part of an overall raise of $750 million through Regulation S Bonds. The lender has raised $300 million for three years with a 95 bps spread over US Treasury, and another $450 million for 5 years with a 108 bps spread over US Treasury.

Tata AIA Life appoints Venkatachalam H as MD and CEO

The board of Tata AIA Life Insurance has approved the appointment of President and Chief Distribution Officer Venkatachalam H as MD and CEO, subject to regulatory approval. Venkatachalam will take over from incumbent Naveen Tahilyani, who moves to another role in Tata Group but will continue as a non-executive director of the insurance company.

RBI Repo Rate unchanged at 6.5%

Reserve Bank of India has kept the repo rate unchanged at 6.5 percent in its bi-monthly monetary policy announced. The six-member monetary policy committee (MPC) voted by 5:1 majority to keep the repo rate unchanged in its last meeting of the current financial year as retail inflation continues to be above its target of 4 percent.

ONGC, NTPC Green Energy Limited sign Joint Venture Agreement to focus on offshore wind energy projects

ONGC and NTPC Green Energy Limited (NGEL) have signed a Joint Venture Agreement (JVA) to focus on offshore wind energy projects. The agreement was signed at India Energy Week in Goa. Besides offshore wind projects, the agreement extends to ventures in storage, e-mobility, carbon credits, and green hydrogen business, including derivatives like Green Ammonia and Green Methanol.

Microsoft to train over 2 million people in India in Generative AI Skills by 2025

Microsoft announced an initiative to equip 2 million people in India with skills in artificial intelligence by 2025. Called ADVANTAG(I)GE INDIA, the program intends to push India’s AI transformation and empower its workforce for jobs in the future. The goal is to expand AI fluency nationwide for inclusive growth.

Prime Minister Shri Narendra Modi inaugurated the second edition of India Energy Week 2024 in Goa on 6-9 February

Prime Minister Shri Narendra Modi inaugurated the second edition of India Energy Week 2024 in Goa. PM Modi emphasized India’s commitment to unprecedented levels of investment in the energy sector while addressing the gathering of global energy leaders. The Prime Minister underlined that the massive government spending in the sector will create new avenues for investment.

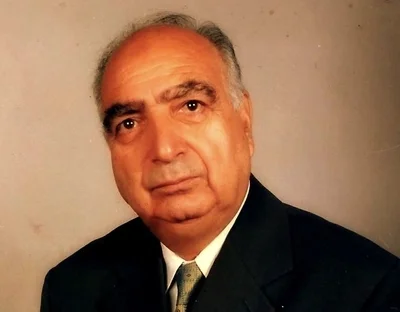

Farooq Nazki, Poet and Sahitya Akademi winner dies at 83

Mir Mohammad Farooq Nazki, veteran broadcaster, poet, and Sahitya Akademi winner, passed away. Nazki held several important positions in All India Radio Kashmir and Doordarshan and in 1995, Nazki was awarded the Sahitya Academi award in Kashmiri for his poetry book Naar Hyutun Kanzal Wanas (Fire in the eyelashes).

SBI partners with Flywire to modernize international education payments for students

State Bank of India (SBI) has teamed with Flywire Corporation to revolutionize the landscape of international education payments for Indian students. This strategic partnership aims to simplify the traditionally complex payment process, offering students a seamless and fully digital experience and completing their international education payments effortlessly in Indian rupees.

LIC launches new plan Index Plus

Life Insurance Corporation of India announced the launch of unit-linked, regular premium, individual life insurance plan Index Plus. The plan offers life insurance cover-cum-savings throughout the term of the policy.

LIC Index Plus policy: Key features

- Minimum age at entry: 90 days (completed).

- Maximum age at entry: 50 or 60 years depending on the basic sum assured.

- Minimum age at maturity: 18 years (completed)

- Maximum age at maturity: 75 or 85 years (nearer birthday) depending on the basic sum assured.

- Minimum policy term: 10 or 15 years depending on Annualized premium and Maximum Term is 25 years. The premium paying term is the same as the policy term.

- Minimum premium: Range from ₹30000/-(Yearly), ₹15000/-(Half- yearly).

HDFC Bank, group companies get RBI nod to acquire up to 9.5% stake in six banks

HDFC Bank and its group companies have received RBI approval to acquire stakes in ICICI, Axis, IndusInd Bank, YES Bank, Bandhan Bank, and Suryoday SFB. HDFC Bank, including group companies HDFC Mutual Fund, HDFC Life Insurance, and HDFC ERGO General Insurance, has received the Reserve Bank of India’s approval to acquire an aggregate stake of up to 9.5% in six banks

IIT Madras to spearhead development of India’s first Indigenous 155mm Smart Ammunition

The Indian Institute of Technology Madras (IIT Madras) has joined hands with Munitions India Limited, a key player in defense manufacturing, to create the nation’s first domestically designed 155 Smart Ammunition. This collaboration aims to enhance accuracy and lethality in defense operations, marking a crucial stride towards self-reliance in defense production.

- Why is The SSC CGL Called a Mini IAS?

- Important Number System Questions for SSC Exams, Practice Here

- Trigonometry Questions For SSC CGL 2025, Solve Important Questions

- How to Prepare for SSC CGL with Full Time Job? Get Complete Guide

- 40 Geometry Formulas PDF – Download Here

- RRB ALP Mock Test 2025 Official Link , Know How to Solve

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.