IIBF conducts one of its flagship courses- JAIIB Accounting And Finance For Bankers – twice a year, usually in May and November. One of the three disciplines in this course is PPB or Principles and Practices of Banking. The JAIIB Accounting and Finance for Bankers syllabus consists of four modules, each of which has different units. We will have a closer look into the Four modules of Paper Accounting and Finance for Banking are:

- Business Mathematics and Finance

- Final Accounts

- Banking Operations

- Principles of Bookkeeping and Accountancy

Accounting And Finance For Bankers | Download PDF

Use the link below to download the notes on Accounting and Finance For Bankers PDF

How To Download Ebooks On Oliveboard?

- Click on the link given

- You will be redirected to login/signup page

- Create an account or sign in if you already have an Olivebaord Account

- You’ll see a message – “Please click here to download the Free Ebook”

- Click on the link to get the PDF

Accounting And Finance For Bankers | Study Notes For JAIIB

Part 1: Accounting & Finance For Banking Short Notes

Module 1: Business Mathematics And Finance

Interest Calculation

Simple Interest: The amount of interest obtained each year in a fixed percentage of the borrowed or lent amount at the start is known as simple interest or flat rate interest.

Interest = Principal x Rate x Time (PRT) where,

Principal (P): Borrowed or Lent amount

Rate (R): percentage of the principal charged as interest (p.a.)

Time (T): Time of loan (in years)

Interest(I): Total interest amount paid

Compound Interest is the interest paid on both the original principal and the interest that has accumulated.

Compound Interest

It is paid on the original principal amount & accumulated part of interest.

where,

A: amount deposited

P: Principal amount

R: rate (expressed in terms of a fraction)

n: number of times per year that interest is compounded

t: number of years invested

The Rule of 72

Helps calculate the number of years it will take for money to double whether invested or owed. 72 divided by the rate equals (percent).

Formula: The time period for money to double= 72/r

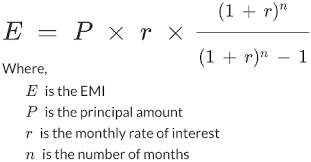

EMI is the monthly payment a borrower makes on his loan. It consists of both interest and principal repayment. The total monthly amount should stay the same throughout the repayment. In an EMI, the principal and interest on the loan are repaid in equal monthly installments during the loan’s predetermined term. The advantage of an EMI for borrowers is that they know exactly how much money they will need to pay toward their loan each month, making budgeting easier.

Part 2: Accounting & Finance For Banking Short Notes

Module 1: Business Mathematics And Finance

Present Value

It is the current value of a future sum of money. The three most important factors are 1. time, 2. The estimated rate of return, and 3. the size of future cash flows.

In the world of finance, one of the most fundamental and prevalent concepts is Present Value. It serves as the foundation for stock, bond, and financial modeling, as well as banking, insurance, and pension fund valuation. In other words, the temporal value of money is accounted for by the present value.

where,

C: Cash flow in the future period

r: the periodic rate of rate or interest (required rate of interest/ discount rate)

n: number of periods

Future Value

The value of an asset or cash at a specific future date that is equal to a certain amount now. It’s a method of assessing how much an asset or cash’s present value (PV) will be worth in the future.

One can calculate the FV of an asset in two ways:

- Simple Annual Interest :

Original Investment x (1 (interest rate x number of years))

2. Interest compounded annually :

Original Investment x ((1 interest rate) ^ no. of years)

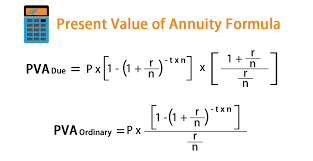

Annuities are a series of fixed payments that are either required of you or provided to you on a regular basis over a set period of time. Payments can be made on a yearly, semi-annual, quarterly, or monthly basis. Ordinary annuities and annuities due are two types of annuities.

Ordinary Annuity: Payments are due at the end of each period, e.g., straight bonds pay coupon payments every six months until maturity.

Payments are due at the beginning of each period, for example, rent. Rent is usually due when you initially move in (at the beginning of the month) and then on the first of every month after that.

The sum of the periodic payments (each) discounted at the set interest rate to represent the money’s time value is the present value of an annuity.

Where,

R: fixed periodic payment;

i: interest rate per compounding cycle;

n: number of compounding periods

Module B: Principles Of Bookkeeping And Accountancy

Accounting Standards, Definition, and Scope:

Nature and purpose of accounting, accounting principles origins and historical perspectives, accounting standards used in India, their definition and scope, US GAAP, Overview of International Financial Reporting Standards, GAAP and IFRS differences, Concept of Transfer Pricing.

Accounting Procedures for Beginners:

This section covers several accounting concepts, with a focus on the going concern concept, the double-entry system, the Principle of Conservatism, Revenue Recognition and Realization, and the Accrual and Cash Basis.

Cash/Subsidiary Books and Ledger Maintenance:

This section covers the fundamentals of record-keeping or bookkeeping, including the many types of accounts (real, nominal, and personal), debit and credit principles, accounting mechanics, and the journal, ledger, and subsidiary books.

Statement of Bank Reconciliation:

This section covers the basics of bank reconciliation, as well as the sources of discrepancies. Bank Reconciliation Statement Preparation When cash book and pass book extracts are provided, preparing a bank statement and modifying the cash book balance; advantages of bank reconciliation statement.

Trial Balance, Error Correction, and Adjusting and Closing Entries:

Trial Balance, its features, purpose, types, preparation of Trial Balance, categorization, location, correction of errors, rectification of errors when books are closed, different adjusting and closing entries.

Expenditure on Capital and Revenue:

Expenditure; Capital and Revenue Expenditure Distinction; Deferred Revenue Expenditure; Receipts; General Illustrations

Bills of Exchange:

The bill of exchange section covers several types of credit instruments, the period and due date of a bill, accounting entries for bills of exchange, accommodation bills, and other important words.

Module C: Final Accounts

Equation for a Balance Sheet:

This section covers topics such as the Balance Sheet Equation and the calculation of problems using the equation.

Final Accounts Preparation:

The section on final accounts deals with the preparation of various financial statements such as Trading A/C, Profit and Loss A/C, Profit & Loss Appropriation Account, and Profit & Loss Appropriation Account. Statements of Financial Position.

Analysis of Ratios:

The section on ratio analysis delves into the meaning and classification of accounting ratios, as well as their applications and limitations. Calculation and interpretation of various ratios. Many consumers also use accounting ratios.

Banking Companies’ Final Accounts:

This section discusses the definition and functions of a bank, as well as the accounting and auditing needs of banking organizations and the key aspects of bank accounting systems. Accountant’s Books of Accounts; Accountant’s Books of Accounts; Account Preparation and presentation of bank financial statements; CMA Format; Accounting Treatment of Specific Items; Preparation of Profit and Loss Accounts; Profit and Loss Account Comments; Important Balance Sheet Items; Bank Disclosure Requirements; RBI Additional Disclosures; Disclosures required under BASEL requirements

Company Accounts I & II:

The section under Company Accounts I & II deals with Companies: definition and type, What is the distinction between a partnership and a limited liability company? Various types of share capital, shares issued, Non-voting shares; Balance Sheet Form; Non-Voting Shares; Non-Voting Shares; Non-Voting Shares; Non-Voting Legal Requirements for Assets; Legal Requirements for Liabilities; Legal Requirements for Profit & Loss A/c; Legal Requirements for Profit & Loss A/c; Legal Requirements for Profit & Loss A/c; Legal Requirements for Profit & Loss Final Accounts Preparation.

Accounting in a Computerized Environment:

This section covers the definition, features, and vocabulary of computerized accounting. What is the difference between manual and computerized accounting? What are the benefits and drawbacks of computerized accounting? Computerized Accounting entails the use of commercially available software to conduct accounting functions. Computerization in Banking: Scope and Experiences; Core Banking Components; Information Security; Internet and World Wide Web: Banking Impacts.

Module D: Banking Operations

Banking Operations & Accounting Functions

Concepts discussed: Preparation of vouchers, cash receipt, and payment entries, clearing inward and outward entries, transfer debit and credit entries, KYC and documents required to satisfy KYC, verifying KYC and document authenticity, operational parameters for the opening of all types of accounts, loan application/document scrutiny, allowing withdrawals, and accounting entries. In banks, dealing with unreconciled entries and back-office processes.

Conclusion:

This brings us to the conclusion of this JAIIB Accounting and Finance for Bankers article. Please contact us at Oliveboard if you have any questions.

FREQUENTLY ASKED QUESTIONS

The most common accounting errors are:

Using personal and business accounts interchangeably

There is a lack of communication between the corporation and the accountant, and there is no backup.

Resources that were misallocated

Not keeping receipts

Carrying out accounting by hand

Keeping the accounting books up to date is a big no-no.

You can respond in a professional manner by saying that accounting specialists are accountable for providing a true and fair picture to the company’s management and shareholders. Documentation is crucial since it provides documentation of proper procedures followed and is required to be shown when audits are conducted.

Present Value: It is the current value of a future sum of money. The three most important factors are: 1. time, 2. estimated rate of return, and 3. the size of future cash flows.

Paper 1: PPB

Paper 2: Accounting and Finance for Bankers

Paper 3: Legal and Regulatory Aspects of Banking

In JAIIB Paper 2 there are four modules.

The JAIIB Exam Paper 2 is divided into four parts.

- JAIIB Exam Syllabus & Pattern – List of Topics to Prepare

- JAIIB Exam Date – For May & Nov Exam Cycle

- JAIIB Exam – Eligibility, Schedule, Registration Details

- JAIIB Eligibility Criteria – Age Limit, No. of Attempts

- JAIIB Admit card – Steps to Download and Updates

- JAIIB Registration & Apply Online – Steps to Fill the Application Form

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in