As per a recent update, the JKSSB Finance Account Assistant exam is going to be conducted from 1st June to 10th June 2021. With around 4 months left for the examination, it’s time for the preparation. To help you with your preparations we have brought you an ebook on A-Z Accounting Glossary terms for JK Finance Account Assistant Exam.

For JKSSB Finance Account Assistant Study Notes! Register Here For Free

How Much JKSSB Finance Account Assistant Earn? Check Here

Accounting Glossary of Terms | Ebook

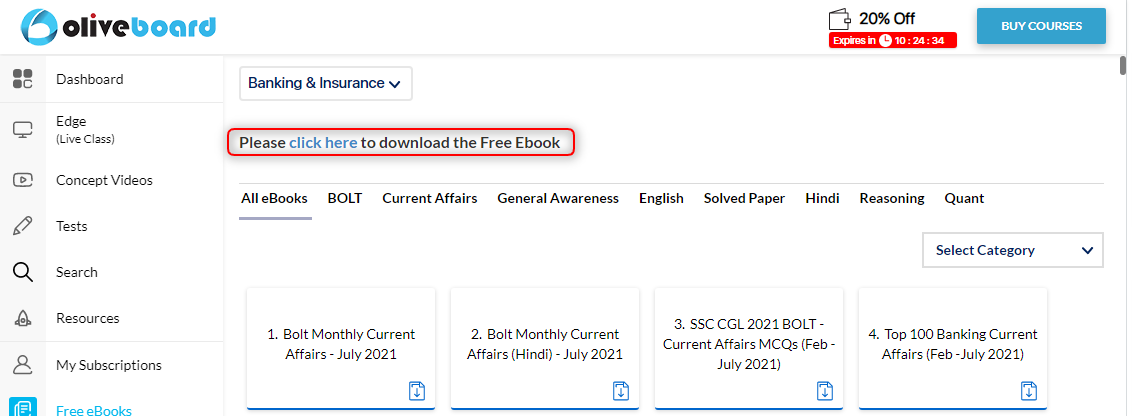

How To Download Accounting Glossary of Terms Free ebooks

- Click on the link given above

- Register or Login to your Oliveboard Dashboard

- Click on “click here” as shown in the image below to download file.

Here’s A Sneek Peek Into The Free ebook

A

accelerated depreciation method – method that charges larger depreciation charges in the early years of an asset’s life and smaller charges in later years.

account – a separate record for each type of asset, liability, equity, revenue, and expense used to show the beginning balance and to record the increases and decreases for a period and the resulting ending balance at the end of a period.

account balance – beginning account’s balance plus the increases less the decreases posted to the account with debits and credits.

accountant – a person formally trained to prepare, maintain, and analyze financial information.

accounting – is the art of analyzing, recording, summarizing, reporting, reviewing, and interpreting financial information.

accounting cycle – recurring procedures (steps) performed each accounting period.

B

bad debts – amounts owed a business that are unlikely to be collected.

balance sheet – the financial statement which shows the amount and nature of business assets, liabilities, and owner’s equity (capital) as of a specific point in time. It is also known as a Statement Of Financial Position or a Statement Of Financial Condition.

balance sheet account – a type of account that is included in the Balance Sheet; namely the Assets, Liabilities, and permanent Equity Accounts.

balance sheet-account form – horizontal balance sheet form that lists assets on the left side and liabilities and equity on the right side.

balance sheet-report form – The report form of the balance sheet provides information in a vertical format — essentially one column that goes the full width of the page. The report form starts with assets, providing a total value at the end of the assets section. It then lists liabilities and finishes with equity, with the final line of the report providing the total combined value of liabilities and equity.

bank reconciliation – the process of bringing the checkbook and bank statement balances into agreement.

bank statement – a copy of the bank’s record of the business’s account showing the balance of the account at the beginning of the month, the deposits and withdrawals (mostly checks) made during the month, service charges, and the balances at the end of the month.

For JKSSB Finance Account Assistant Study Notes! Register Here For Free

C

cancelled check – checks that have been processed (paid) by the bank and deducted from the bank’s customer’s account.

capital – capital is also called equity-see the terms owner’s equity and equity.

capital statement – the financial report that summarizes all the changes in owner’s equity (capital) that occurred during a specific period.

cash – asset accounts that record monetary items that are available to meet current obligations of the business. It includes bank deposits, currency, coins, checks, money orders, and traveler’s checks.

cash basis – accounting method that records revenues when cash is received and expenses when cash is paid.

cash disburements – (payments) journal a special journal used to record only cash payment transactions.

cash discount – deduction from the invoice amount allowed for early payment.

cash forecast – estimate of the timing and amounts of cash inflows and outflows over a specific period (usually one year).

D

debit – an entry (amount) entered on the left side (column) of a journal or general ledger account that increases an asset, draw or an expense or an entry that decreases a liability, owner’s equity (capital) or revenue.

debtor – customers that owe a business money.

deposits in transit – deposits recorded by the business but not yet recorded by the bank.

depreciation – expense account that records expenses related to the usage of plant and equipment allocated to periods in which they are used.

E

electronic funds transfer (EFT) – use of electronic communication to transfer cash from one part to another.

equipment – asset account used to record expenditures for physical goods used in a business, such as machinery or furniture. Equipment is used in a business during the production of income.

equity – owner’s claim to the assets of a business – also called net assets and capital-see related terms capital and owner’s equity

expense – decrease in owner’s equity (capital) resulting from the cost of goods, fixed assets, and services and supplies consumed in the operations of a business | The costs of doing business. The stuff we used and had to pay for or charge to run our business.

external users – users of accounting information who are not directly involved with a business such as governmental agencies, creditors, customers, and investors.

F

factory overhead – costs incurred during the manufacturing process, not including the costs of direct labor and materials. Factory overhead is normally aggregated into cost pools and allocated to units produced during the period.

FIFO -first in first out – cost flow assumption that assumes the oldest products are the first sold.

Financial Accounting Standards Board – independent group of full time members responsible for setting accounting rules.

financial statements – accounting reports prepared periodically to inform the owner, creditors, and other interested parties as to the financial condition and operating results of the business.

G

general journal – a journal used to record transactions not recorded in special journals.

general ledger – a record containing the accounts and balances for all of a business’s assets, liabilities, equity, revenue, and expense accounts.

Generally Accepted Accounting Principles – rules that specify acceptable accounting practices.

H

historical cost – original cost of an asset.

For JKSSB Finance Account Assistant Study Notes! Register Here For Free

I

income statement – the financial statement that summarizes revenues and expenses for a specific period of time, usually a month or a year. This statement is also called a Profit and Loss Statement or an Operating Statement.

income statement account – a type of account that is included in the Income Statement; namely the Revenue and Expense Accounts.

intangible assets – assets of a non-physical nature that have a value-patents-copyrights-trade names

interest expense – expense account that records money paid regularly at a particular rate for the use of money.

interest income – amounts earned from investments.

J

job costing – an order-specific costing technique, used in situations where each job is different and is performed to the customer’s specification. Also called job order costing

journals – a preliminary record where business transactions are first entered into the accounting system. The journal is commonly referred to as the book of original entry.

L

land – asset account that records expenditures for parcels of the earth such as building sites, yards, and parking areas.

liability – Claims by creditors to the property (assets) of a business.

– Other’s claims to a business’s good stuff. Amounts the business owes to others.

LIFO -last in first out – cost flow assumption that assumes the newest products are the first sold.

limited liability company (LLC) – relatively new type of business structure that combines the benefits of a partnership and corporation.

loss – amount a business’s expenses exceed (greater than) revenues. In other words, we earned less than we spent.

M

maintenance & repairs – expense account that records expenditures paid to repair and or maintain buildings and/or equipment.

mark up – amount added to the cost of products to determine selling prices.

merchandising business – a business that buys and sells products to consumers.

For JKSSB Finance Account Assistant Mock Test! Register Here For Free

N

net income – amount earned after subtracting all expenses from revenue (sales) for a period – also called net profit.

net loss – excess of expenses over revenues for a period -expenses are greater than revenues.

net pay – employee’s earnings after all deductions.

O

office supplies – asset or expense account that records expenditures for maintaining a supply of on hand supplies such as typewriter, copier, and computer paper, pens, pencils, and special forms.

organization costs – expenditures incurred in order to start a business.

outstanding checks – checks written but not yet paid by the bank at the bank statement date.

owner drawings (withdrawals) – assets taken out of a business for the owner?s personal use.

P

partnership – two or more people who share the ownership of a single business.

payroll taxes – expenditures for taxes based on wages paid to employees.

periodic inventory method – inventory determined by performing a physical inventory -counting, weighing, and measuring products on hand.

permanent or real account – another term used to refer to the balance sheet accounts.

perpetual inventory – a book inventory determined by maintaining detailed records of increases and decreases.

Q

quick assets – cash and other assets that can quickly be converted into cash.

R

real property – land and anything attached to the land.

receiving report – a document originated by the buying business listing the quantities and condition of the goods and/or services received from a supplier.

rental income – revenue account that records amounts earned from renting properties.

S

salaries – expense accounts that record expenditures for work performed by employees.

sale of products – amounts earned from the sale of merchandise.

sale of services – amounts earned from performing services.

sale on account – sale where the customer is allowed to pay at a future date.

sales journal – a special journal used to record all of the company sales on credit.

sales order – a documented originated by the seller listing the goods and/or services ordered by a customer and other information such as prices and delivery dates.

For JKSSB Finance Account Assistant Study Notes! Register Here For Free

T

T-Account – a skeleton outline of an account which provides the same basic data as a formal ledger account. Used as a teaching aid.

temporary account – another term used to refer to the income statement accounts. The accounts are called temporary due to the fact that their balances are set to zero when the books are closed.

transaction – any event or condition that must be recorded in the books of a business because of its effect on the financial condition of the business, such as buying and selling. A business deal or agreement.

trial balance – a worksheet listing of all the accounts appearing in the general ledger with the dollar amount of the debit or credit balance of each account. Used to make sure the books are in balance -total debits and credits are equal.

U

unearned revenue – a liability created when customers pay in advance for products or services that have not been delivered or rendered.

utilities – expenditures for basic services needed to function in the modern world, such as water, sewer, gas, electricity and telephone. Most businesses track the amount spent for each type of utility service

V

variable costs – are costs that varies in relation to changes in the volume of activity.

vendor – seller of goods and/or services-also called supplier.

W

wholesaler – a business that buys and sells large quantities of products to others for resale.

work in process – unfinished products being manufactured.

working capital – net difference between current assets and current liabilities.

Working Capital = Current Assets – Current Liabilities

worksheets – forms which are used to summarize all the information necessary to complete the end-of-period financial reports and prepare other financial analysis

Y

yield – return on investment an investor receives from dividends or interest expressed as a percentage of the security

yield curve – graph showing the term structure of interest rates by plotting the yields of all bonds of the same quality with maturities ranging from the shortest to the longest available.

yield to call – Yield on a bond assuming the bond will be redeemed by the issuer at the first call date specified in the indenture agreement.

yield to maturity – rate of return on a security to its maturity, giving effect to the stated interest rete, accural of discount, or amortization of premium.

Z

zero-coupon bond – bond on which the holder receives only one payment at maturity which includes both principal and interest from issuance to maturity.

zero-coupon convertible security – zero-coupon bond convertible into the common stock of the issuing company when the stock reaches a predetermined price.

What Do We Have In Cart For You?

-

- 10 JKSSB Finance Account Assistant Mock Tests

- 60 JK Finance Account Assistant Sectional Tests

- JKSSB Finance Account Assistant Complete Study Notes

All of this is curated by experts. So what are you waiting for? Enroll Now

Related Posts

Jammu & Kashmir Current Affairs Qs (Jan-Dec)

Weekly Current Affairs Questions.

The most comprehensive online preparation portal for MBA, Banking and Government exams. Explore a range of mock tests and study material at www.oliveboard.in