Balance of Payments is one of the important topics in Economics for RBI Grade B, SEBI Grade A & NABARD Exams. Let us dig deep into this topic and try to learn about it and its various components. We would also know why is it important for a nation to keep its Balance of Payments in check. We have compiled an eBook for this topic. Please download the eBook from the link given below.

Balance of Payment PDF Notes & MCQs

Download the eBook using the download button given below:

Get Free RBI Grade B & SEBI Grade A eBooks Here

Balance of Payment Notes PDF – Contents of the eBook

1. What is Balance of Payments – Definition

2. Components of Balance of Payments

3. Types of Balance of Payment

4. Balance of Payment Formula

5. Effects of Balance of Payment

Balance of Payment MCQs PDF – Download Here

Get Free RBI Grade B & SEBI Grade A eBooks Here

Study Notes of Balance of Payments

In the olden days, the economy was closed— which means, all the trade that occurred was happening within the country.

In the current scenario, most of the economies are open and this has benefitted all the stakeholders in ways like Opportunity to choose – Consumers and firms can decide between domestic and foreign goods, assets, location, labourers, workers, etc.

(An open economy is one in which trade occurs on a global level i.e., with different countries in terms of goods and services, financial assets, etc.)

Now, in order for the trade transaction to occur, the payment has to be done in a form of currency that is globally accepted and stable. So, when the payment is made it has to made in a currency that has to be accepted mutually by the parties involved. So, when there is a transaction it can be a surplus or a deficit.

I. What is the Balance of Payment?

- Balance of Payment (BoP) is a statement that records all the monetary transactions made between residents of a country and the rest of the world during any given period.

- This statement includes all the transactions made by/to individuals, corporates, and the government and helps in monitoring the flow of funds to develop the economy.

- When all the elements are correctly included in the BOP, it should sum up to zero in a perfect scenario.

- This means the inflows and outflows of funds should balance out. However, this does not ideally happen in most cases.

- BOP statement of a country indicates whether the country has a surplus or a deficit of funds i.e. when a country’s export is more than its import, its BOP is said to be in surplus.

- On the other hand, the BOP deficit indicates that a country’s imports are more than its exports.

- Tracking the transactions under BOP is something similar to the double-entry system of accounting. This means, all the transactions will have a debit entry and a corresponding credit entry.

II. Why Balance of Payment (BoP) is Important?

The Balance of Payment is important for any country due to the following reasons :

- The boP of a country reveals its financial and economic status.

- BoP statement can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating.

- BoP statement helps the Government to decide on fiscal and trade policies.

- It provides important information to analyse and understand the economic dealings of a country with other countries.

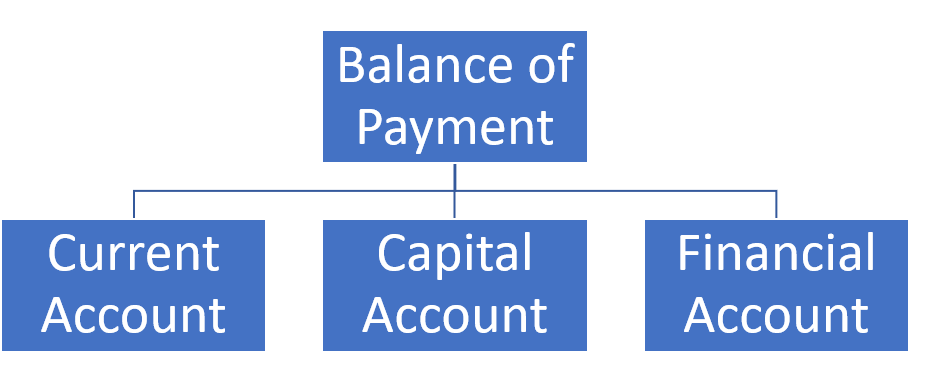

III. Components of Balance of Payment

There are mainly three components of the balance of payment viz.

1.Current Account

2.Capital Account

3. Financial Account

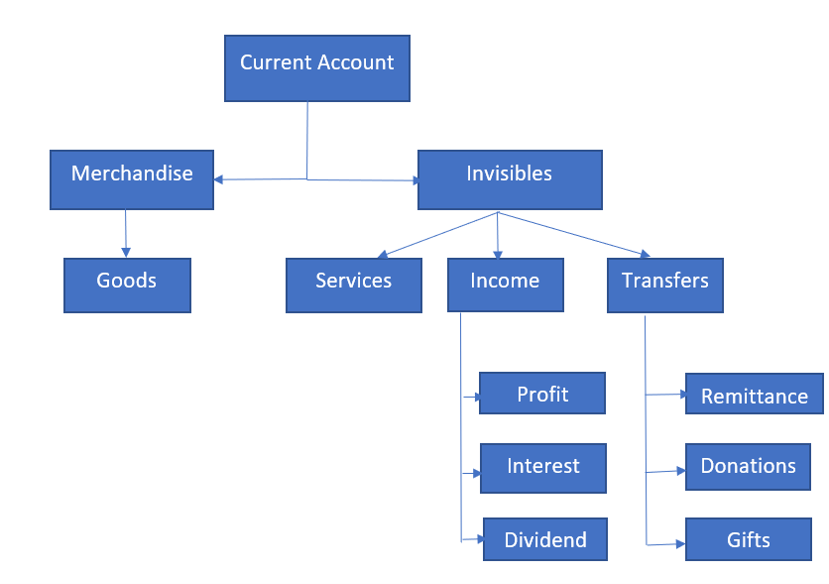

1. Current Account

The transactions related to goods, services, and income, constituting the current account on the balance of payments.

- The current account is functionally classified into two broad categories:

- Merchandise

- Invisibles

- The current account is used to monitor the inflow and outflow of goods and services between countries.

- This account covers all the receipts and payments made with respect to raw materials and manufactured goods.

- It also includes receipts from engineering, tourism, transportation, business services, stocks, and royalties from patents and copyrights.

- When all the goods and services are combined, together they make up a country’s Balance of Trade (BoT).

- There are various categories of trade and transfers which happen across countries.

- It could be merchandise or invisible trading, unilateral transfers, or other payments/receipts.

- Trading in goods between countries are referred to as merchandise and import/export of services (banking, information technology, etc) are referred to as invisible items.

- Unilateral transfers refer to money sent as gifts or donations to residents of foreign countries.

- This can also be personal transfers like – money sent by relatives to their family located in another country.

Balance of Trade (BoT)

- The BoT is the difference between the monetary value of a nation’s exports and imports over a certain time period.

- If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance.

Current Account Deficit (CAD)

- A current account deficit means the value of imports of goods/services /investment incomes /transfers is greater than the value of exports.

- It indicates the net outflow of foreign exchange.

Current Account Surplus

- A current account surplus means the value of imports of goods/services /investment incomes /transfers is less than the value of exports.

- It indicates the net inflow of foreign exchange.

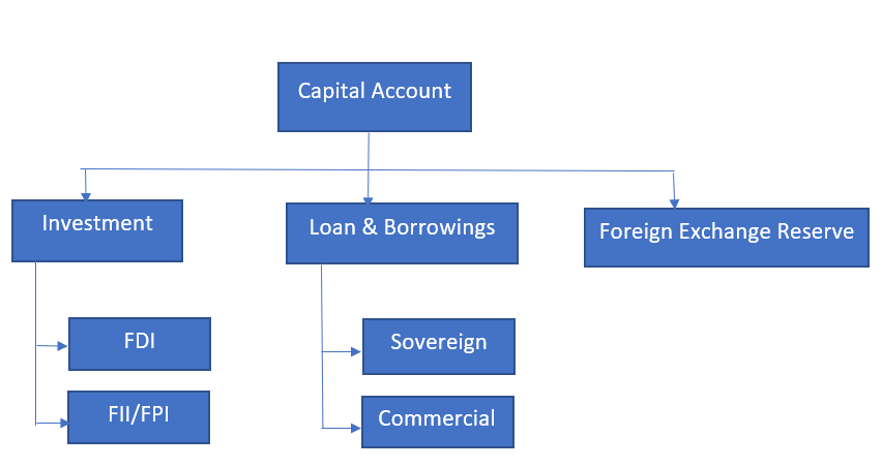

2. Capital Account

- All capital transactions between the countries are monitored through the capital account.

- Capital transactions include the purchase and sale of assets (non-financial) like land and properties.

- The capital account also includes the flow of taxes, purchase, and sale of fixed assets, etc by migrants moving out/into a different country.

- The deficit or surplus in the current account is managed through finance from a capital account and vice versa.

- There are three major elements of capital account –

- Investment

- Loans & Borrowings

- Foreign Exchange Reserve

3. Financial Account

- In the financial account, international monetary flows related to investment in a business, real estate, bonds, and stocks are documented.

- Also included are government-owned assets such as foreign reserves, gold, special drawing rights (SDRs) held with the International Monetary Fund, private assets held abroad, and direct foreign investment.

- Assets owned by foreigners, private and official, are also recorded in the financial account.

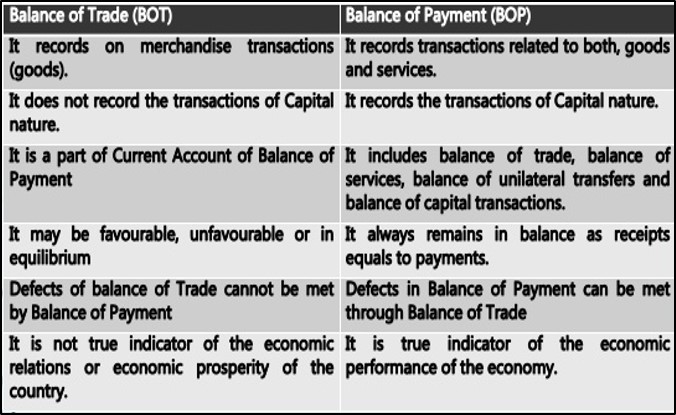

IV. Difference between Balance of Payment (BoP) and Balance of Trade (BoT)

V. Why BoP should be zero?

The sum of all transactions recorded in the balance of payments must be zero, as long as the capital account is defined broadly. The reason is that every credit appearing in the current account has a corresponding debit in the capital account, and vice-versa. If a country exports an item (a current account transaction), it effectively imports foreign capital when that item is paid for (a capital account transaction).

VI. BoP Surplus and Deficit

In a general scenario as we are aware when an individual spends more than her income then he has to finance the difference by selling assets or by borrowing. The same applies to a country that has a deficit in its current account (spending more abroad than it receives from sales to the rest of the world) that must finance it by selling assets or by borrowing abroad. Thus, any current account deficit necessarily has to be financed by a net capital inflow.

- So, the available options to a country are, engaging in official reserve transactions, by selling in the case of a deficit by selling foreign currency in the foreign exchange market. The decrease (increase) in official reserves is called the overall balance of payments deficit (surplus).

- The basic principle is that the monetary authorities are the ultimate financiers of any deficit in the balance of payments (or the recipients of any surplus).

- The balance of payments deficit or surplus is obtained after adding the current and capital account balances.

- A country is said to be in balance of payments equilibrium when the sum of its current account and its non-reserve capital account equals zero so that the current account balance is financed entirely by international lending without reserve movements.

VII. Balance of Payment (BoP) Crisis

- A weak trade deficit could often trigger a BoP crisis.

- This is also referred to as a currency crisis, which occurs when the total imports of an economy far exceed the total exports.

- Consequently, the economy fails to maintain its debt payments.

- Further, the BoP crisis is a kind of financial crisis that impacts the foreign exchange market considerably.

- The value of the affected nation’s currency witnesses rapid change, as a result, the currency’s ability to function as a medium of exchange is undermined.

- More often, the value of the currency depreciates driven by huge outbound capital flows.

- The occurrence of the BoP crisis can be attributed to several reasons.

- Among them, the budget crisis, which is the deficit in the budget is one of them.

- BoP crisis is also an indication of a real-time economic crisis.

- The crisis could prove to be destructive for small open economies as well as larger economies.

- However, the extent of destruction experienced by stable economies on account of the BoP crisis is likely to be far low.

VIII. India’s Balance of Payment (BoP) Crisis of 1991

- 1991 BoP crisis was one of the worst crises that India had to face.

- The then government was close to default, as RBI had refused new credit and foreign exchange reserves had been reduced to such a point that India could barely finance three weeks’ worth of imports.

- This necessitated the Indian government to keep national gold reserves as a pledge to the International Monetary Fund (IMF) in exchange for a loan to cover the balance of payment debts.

Factors responsible for the BoP crisis in 1991

- The first important factor responsible for this growing crisis in BOP was the policy of import liberalisation introduced by the Congress (I) Government headed by Late Rajiv Gandhi resulting in a huge inflow of imports particularly after the announcement of Exim Policy in 1985.

- The second factor responsible for the crisis was the existing heavy import base of the country. In spite of attaining an encouraging 18.7 percent annual growth rate of exports during the Seventh Plan, which was even higher than the annual growth rate of imports (16.8 percent), the BOP position deteriorates to a serious point as the country started with larger volume imports.

- The third factor responsible for this BOP crisis is the higher import intensity in the industrial development resulting from import intensive industrialization process followed in the country for meeting the requirements of elitist consumption (viz., colour TVs, VCRs, refrigerators, motorcycles, cars), etc.

- The steep depreciation of the rupee with the dollar and other currencies during 1987-91 had resulted in a considerable increase- in the value of imports.

- The worsening of the current account deficit in the BOP in 1990-91 and therefore was partly on account of Gulf war and the higher price of petroleum imports and higher volume of petroleum imports continuously.

- The current account deficit in 1990-91 weakened the ability to finance the deficit massively. Political uncertainty at home, copied with rising inflation and widening fiscal deficits, led to a loss of international confidence. This had resulted in the drying up of commercial borrowing and an outflow of NRI deposits.

IX. Currency Convertibility

- Currency convertibility refers to the freedom to convert the domestic currency into other internationally accepted currencies and vice versa at the market-determined exchange rate.

- The Indian rupee is partially convertible.

- It is fully convertible only in the current account and not in the capital account.

- This means one can import and export goods or receive or make payments for services rendered. However, investments and borrowings are restricted.

Current Account Convertibility

- Current account convertibility means freedom to convert domestic currency into foreign currency and vice versa for trade in goods and Invisibles (services, transfers, or income from investment).

- Individuals and entities can convert currencies in the foreign exchange market.

- Current account convertibility is one part of currency convertibility. The other part is the capital account convertibility.

- Current account and capital account convertibility indicate the purpose for which currency is converted.

- For example: When there is current account convertibility for the rupee, an exporter can sell the US Dollars (or other foreign currency) he obtained from exporting a commodity at the market-determined exchange rate in India. This means that there are no exchange controls (foreign exchange controls). Similarly, when an importer buys foreign currency from India’s foreign exchange market by exchanging rupees, it is current account convertibility.

Introduction of full Current Account Convertibility in India

- In India, there is full current account convertibility since August 20, 1993.

- A series of measures were launched then to liberalise exchange controls and the exchange rate system was shifted to market-determined exchange rates since March 1993.

- After that, on August 20, 1993, the RBI announced that that the rupee became fully convertible on the current account.

- This was after India accepted the status and obligations of Article VIII with the IMF.

Capital Account Convertibility

- Capital Account Convertibility is not just the currency convertibility freedom, but more than that, it involves the freedom to invest in financial assets of other countries.

- The Committee on Capital Account Convertibility (1997, Chairman Dr. S S Tarapore) in its report has given a working definition for the CAC which is as follows.

- “CAC refers to the freedom to convert local financial assets into foreign financial assets and vice versa at market-determined rates of exchange. It is associated with changes of ownership in foreign/domestic financial assets and liabilities and embodies the creation and liquidation of claims on, or by, the rest of the world.”

- Capital account convertibility is thus the freedom of foreign investors to purchase Indian financial assets (shares, bonds, etc.) and that of the domestic citizens to purchase foreign financial assets.

- It provides rights for firms and residents to freely buy into overseas assets such as equity, bonds, property and acquire ownership of overseas firms besides free repatriation of proceeds by foreign investors.

- In the case of capital account India still has certain restrictions where it has not made it fully convertible. (40:60) and is in the process of implementing the recommendations made by the S.S. Tarapore Committee, 2007. (Second Committee).

X. Foreign Exchange Reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Foreign exchange reserves are assets denominated in a foreign currency that is held by a central bank.

These may include foreign currencies, bonds, treasury bills, and other government securities. Most foreign exchange reserves are held in U.S. dollars, with China being the largest foreign currency reserve holder in the world.

Foreign Exchange Reserves

- Foreign exchange reserves indicate the reserves of the RBI kept in the form of foreign currency assets, gold, SDR, and reserve tranche position with the IMF. The forex reserve is kept as a cushion against any potential balanced of payment-related crisis.

India’s foreign exchange reserves comprise of:

- Foreign currency assets (FCA)

- Gold

- Special Drawing Rights (SDRs) with IMF and

- Reserve tranche position (RTP) in the International Monetary Fund

XI. Foreign Exchange Market

The market where different currencies can be purchased and sold.

Fixed Exchange Rates

In this system, the exchange rate of a currency was fixed by the IMF in comparison to the basket of important world currencies like the US dollar, Japanese Dollar, German Mark, and the French Franc. They were expected to maintain that particular rate in the future as well and the rate was modified by IMF periodically.

- Countries have had flexible exchange rate systems ever since the breakdown of the Bretton Woods system in the early 1970s. Prior to that, most countries had fixed or what is called the pegged exchange rate system, in which the exchange rate is pegged at a particular level.

The Bretton Woods System:

- In 1944 at the Bretton Woods Conference International Monetary Fund (IMF) and the World Bank were set up and re-established a system of fixed exchange rates.

- This was different from the international gold standard in the choice of the asset in which national currencies would be convertible.

- A two-tier system of convertibility was established at the center of which was the main currency was the dollar.

- It laid down certain guidelines where the commitment of the monetary authority of each IMF member participating in the system was mandatory to convert their currency into dollars at a fixed price.

- Only when there is a mismatch in a member’s BOP the change in exchange rates was permitted.

- Otherwise, it had to follow the rates as prescribed by the IMF from time to time.

Flexible Exchange Rates

In a Flexible exchange rate system also known as floating exchange rates, the exchange rate is determined by the forces of market demand and supply.

Managed Exchange Rates

In this, a country follows a mix of both fixed and flexible exchange rate systems wherein the government attempts to manipulate the exchange rate directly by buying/selling foreign currency or indirectly by monetary policy. Most of the economies these days follow a managed exchange rate system.

Interest Rates and the Exchange Rate

- The interest rate and the exchange rate go in tandem. For instance, let us consider two countries A and B. Normally the wealthy nations go in search of the nations which offer higher interest rates when compared to their domestic rates. This is called an Interest rate differential.

- So, if we assume that government bonds in country A pay an 8 percent rate of interest whereas equally safe bonds in country B yield 10 percent, the interest rate differential is 2 percent. Investors from country A will be attracted by the high-interest rates in country B and will buy the currency of country B selling their own currency. At the same time, investors in country B will also find investing in their own country more attractive and will therefore demand less of country A’s currency.

- This will lead to the depreciation of country A’s currency and an appreciation of country B’s currency. Thus, a rise in the interest rates at home often leads to an appreciation of the domestic currency. Here, the implicit assumption is that no restrictions exist in buying bonds issued by foreign governments.

Income and the Exchange Rate:

When income increases, consumer spending increases. Spending on imported goods is also likely to increase. There is a depreciation of the domestic currency. If there is an increase in income abroad as well, domestic exports will rise. On balance, the domestic currency may or may not depreciate. What happens will depend on whether exports are growing faster than imports. In general, other things remaining equal, a country whose aggregate demand grows faster than the rest of the world normally finds its currency depreciating because its imports grow faster than its exports.

Exchange Rates in the Long Run

In order to make long-run predictions purchasing Power Parity (PPP) theory is used to calculate exchange rates in a flexible exchange rate system. According to this theory, as long as there are no barriers to trade like tariffs and quotas, exchange rates should ultimately adjust so that the same product costs the same whether measured in rupees in India, or dollars in the US, yen in Japan, and so on, except for differences in transportation which means equality of buying capacity.

India’s Exchange Rate:

- India’s exchange rate has evolved over time. Post-independence, over the prevailing Bretton Woods system, the Indian rupee was pegged to the pound sterling due to its historic links with Britain.

- In Sep 1975 when the Bretton Woods system collapsed coupled with the declining share of the UK in India’s trade, the rupee was delinked from the pound sterling.

- From 1975 to 1992, the exchange rate of the rupee was officially determined by the Reserve Bank within a nominal band of plus or minus 5 percent of the weighted basket of currencies of India’s major trading partners.

- The Reserve Bank intervened on a day-to-day basis which resulted in widespread changes in the size of reserves.

- The early 1990s saw a significant rise in oil prices and the suspension of remittances from the Gulf region in the wake of the Gulf crisis.

- This, and other domestic and international developments, led to a severe balance of payments problems in India.

- The drying up of access to commercial banks and short-term credit made financing the current account deficit difficult.

XII. SOME RELEVANT TERMS:

1 Depreciation:

When a domestic currency loses its value in front of a foreign currency in a market-driven situation then it is termed as “Depreciation”

2. Devaluation:

When the exchange rate of a domestic currency is cut down by its government against a foreign currency is called “Devaluation”. This is also called Official Depreciation.

3. Revaluation:

A situation wherein the government increases the exchange rate of its currency against any foreign currency. This is also called Official Appreciation.

4. Nominal Effective Exchange Rate (NEER):

It is the weighted average of the exchange rates before the currencies of India’s major partners in trading.

5. Real Effective Exchange Rate (REER):

When NEER is adjusted to inflation we arrive at REER.

6. Hard currency:

- It is that currency in which the most number of transactions take place globally in short which is the most liquid.

- Till the second world war, the UK pound sterling was the best hard currency which was replaced by the US dollar.

- Later on, when IMF came into force, it introduced a new basket of currencies called the “SDRs (Special drawing rights)” which had the US dollar, Euro, Japanese Yen, and the pound. Also, the Chinese Yuan was also added in 2016 making the hard currencies number to FIVE

7. Soft Currency:

A currency that is available very easily in any economy in its forex market.

8. Hot Currency:

This is a temporary name for Hard currency. If a hard currency is exiting at a faster pace from the economy, it is known as Hot Currency.

9. Heated currency:

When the hard currency is exiting an economy at a faster pace it is under enough pressure of depreciation. Also called currency under heat or under hammering.

10. Cheap Currency:

When the government starts repurchasing the bonds before their maturities the money which flows into the economy is known as the cheap currency/cheap money.

11. Dear Currency:

Dear money as it is also called when the government issues bonds and when the money starts flowing from the system to the government the currency would become dearer.

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3 years of experience in content and SEO optimization, I have led content for popular exams like SSC, Banking, Railways, and State Exams.