Reserve Bank of India being the central bank of the country is a great organisation to work for. Every year Lakhs of aspirants apply for the RBI Grade B posts as it offers great career opportunities as well as impressive perks & allowances to its officers. The Grade B recruitment notification is expected to be announced in the month of June 2019 most probably. It is highly advisable to start with your preparations from now on itself so that when you are suddenly notified of the recruitment notification, you have already covered a prominent portion of the syllabus. The Grade B Exam is conducted in three stages namely Phase I, Phase 2 and the Interview round.

Toppers of the exam have always suggested to carry on the preparations and study for both Phase 1 and Phase 2 simultaneously because the syllabus of Phase 2 of RBI Grade B is vast and requires thorough knowledge and persistence in studies. The subjects asked in the Phase 2 Exam are Economics & Social Issues, Finance & Management and Descriptive English. So to give you a helping hand in your studies for the Grade B Exam, we at Oliveboard would be providing you study notes on important topics of the syllabus of Phase 2. In this blog, we will cover the topic of Inflation – ESI Study Notes.

Take a Free Oliveboard Mock Test for RBI Grade B

Inflation – ESI Study Notes

Download the Free PDF Here

Inflation is one of the important topics for RBI Exams. RBI being the watchdog of Inflation through its Monetary Policy, quite a good number of questions on Inflation were asked in the previous years and can also be asked in the upcoming exam as well. Read the Inflation – ESI Study Notes given below to know fully about the topic.

1. Inflation

- Inflation is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time.

- It is the rise in the general level of prices in a period where the same money buys less than it did in previous periods.

- Usually shown as a percentage, inflation indicates a decrease in the purchasing power of a nation’s currency.

Rate of Inflation = (Price Level in year N – Price level in year N-1) * 100

Price level in year (N-1)

2. Deflation

- Deflation is the general decline in prices for goods and services occurring when the inflation rate falls below 0% i.e. inflation rate becomes negative. Deflation happens naturally when the money supply of an economy is fixed. In times of deflation, the purchasing power of currency and wages are higher than they otherwise would have been.

- Deflation is caused by a number of factors but is largely attributed to two:

- A decline in aggregate demand and increased productivity. A decline in aggregate demand typically results in subsequent lower prices of the goods & services.

- Causes of this shift include reduced government spending, stock market failure, consumer desire to increase savings, and tightening monetary policies (higher interest rates).

3. Reasons for inflation:

- Demand-pull inflation: It is caused by an increase in the demand for the goods and services which in turn increases their prices this is also known as too much money chasing too few goods. If demand grows faster than supply, prices will increase. This has been stated by the Keynesian school of economics.

- Measure: Import of goods is a short-term measure and as a long-term measure government should increase the production to match the demand.

- Cost-push inflation: This is caused when the cost of production goes up. The need to increase prices and maintain their profit margins results in the price increase. This includes things such as wages taxes and increased cost of natural resources or imports.

- Measure: Government should cut down taxes and reduce duties like excise and custom on inputs as a short-term measure and in the long-term measure better production process should be adopted.

- Monetary inflation: When there is an oversupply of money in the economy the value of the money reduces and fewer goods can be bought with the same money. So, if there is too much supply of the money price of the commodity increases and results in inflation. This is stated by the monetarist school of economics.

- Measure: In the short term a tighter monetary policy may be preferred and as a long-term measure better production practices can resolve the issue.

4. Types of inflation

Depending upon the range and severity there are several types of inflation.

- Low inflation is slow and unpredictable lines are also called creeping inflation it takes place in a longer. And the ranges limited to a single digit.

- Galloping inflation: it is a double-digit of triple-digit referring to a very high inflation Latin American countries such as Argentina Chile Brazil add saturates of inflation.

- Hyperinflation: it is large and accelerating which have the annual rates in a million or a trillion not only range is very large the increase happens in a very short span of time like overnight .some examples are Germany after first World War in the 1920s.Such a situation in Stu loss of confidence in the domestic currency and people opt for other forms of money like gold.

- Bottleneck inflation: play falls drastically well the demand remains the same this occurs reasons maybe supply-side accidents hazards or miss management. Also called structural inflation.

- Core inflation: It shows the price rise in all goods and services excluding energy and food articles .it was the first time used in the year 2001.

5. Effects of inflation:

Effects of inflation are both at the micro and macro levels. Various players the economy are affected in varied ways.

- Lenders suffer and borrowers benefit when the inflation rises and vice versa when the inflation falls.

- Higher price levels reduce the purchasing power of the money in the short run but in the long run income levels also increase.

- As money loses value with increase in inflation holding physical currency reduces its value. Rising inflation depletes the saving rate in an economy.

- With the rise in inflation consumption levels decreases (high prices) and investment expenditure increases (lower cost of finance).

- The taxpayer pays higher taxes because of increased income and crossing their respective slabs of Direct tax and increased prices in case of indirect tax.

- The currency of the economy depreciates and loses its exchange value.

- Exports increase due to currency depreciation and gain competitive prices in the world market.

- Import decrease as foreign goods become costlier.

- Employment increases in the short run but becomes neutral or negative in the long run.

- The nominal value of the wages increases while the real value decreases and there is a negative impact on purchasing power.

6. Indicators of inflation:

The two most common indicators to measure inflation are wholesale price index and consumer price index.

- Wholesale price index:

- It is the price of a representative basket (697 items) of wholesale goods of 3 categories. manufacturing primary articles fuel and power. services are not included in WPI.

- The data is released by the office of economic advisor, department of industrial policy and promotion, ministry of Commerce.

- The base year for measuring WPI is 2011-12. The current series is the 7th revision of the base year.

2. Consumer price index:

- CPI measures the changes in the price level of a basket of consumer goods and services or just by households

- It includes food and beverages housing fuel and light clothing and footwear pan, tobacco and intoxicants.

- CPI is released in 3 categories. CPI rural, CPI urban, CPI combined

- Central statistics office, ministry of statistics and program implementation release the data.

- Monetary policy takes note of CPI for inflation data.

3. Headline inflation

Headline inflation is a measure of the total inflation within an economy including commodities such as food and energy prices which are more volatile my core inflation is calculated from CPI minus the volatile food and energy components. headline inflation may not present an accurate picture of open economies inflationary trend.

7. Related terms

- Stagflation is high unemployment and economic stagnation along with high rates of inflation. When the inflation rate is high the economic growth rate slows down, and unemployment remains constantly high and results in stagflation.

- Reflation: To achieve higher levels of economic growth and reduce unemployment governments often go for stimulating the economy by increasing public expenditure, tax cuts, lower interest rate etc. Here fiscal deficit rises due to Stimulus, wages increase but there is no improvement in employment.

- Phillips curve: Phillips curve explains the relationship between inflation and unemployment in an economy according to the curve there is an inverse relationship between inflation and unemployment.

- Inflation targeting the announcement of an official target range by the central bank for inflation is known as inflation targeting. it started in 2015 after the agreement on monetary policy framework according to its CPI -C inflation to be below 6% by 2016 January and 4% plus or minus 2% going forward.

Sample Questions

Q. What is the Opposite of the term Deflation?

- Stagflation

- Inflation

- Reflation

- Disinflation

Answer: Inflation

Q. Who benefits from the increase in inflation?

- Borrowers

- Lenders

- None

- Importers

Answer: Borrowers (Real interest rates decrease)

Q. Phillips curve is a measure of?

- Stagnation and inflation

- Higher wages and inflation

- Unemployment and inflation

- Higher wages and stagnation

Answer: Unemployment and inflation (There is an inverse relationship between unemployment and inflation in a Phillips Curve)

Q. Fiscal Deficit is also known as?

- Deflationary Gap

- Inflationary Gap

- Reflation

- Primary Deficit

Answer: Inflationary Gap (Deflationary Gap is the Fiscal surplus)

Take a Free Oliveboard Mock Test for RBI Grade B Prelims

This was all from us in this blog of Inflation – ESI Study Notes. We hope that you find the information given above in the blog of Inflation – ESI Study Notes useful. For more study notes for RBI Grade B and NABARD Exams, stay tuned to Oliveboard.

If you are an RBI Grade B aspirant and also a working professional and find it difficult to find enough time for your RBI Grade B Preparations, do not worry at all.

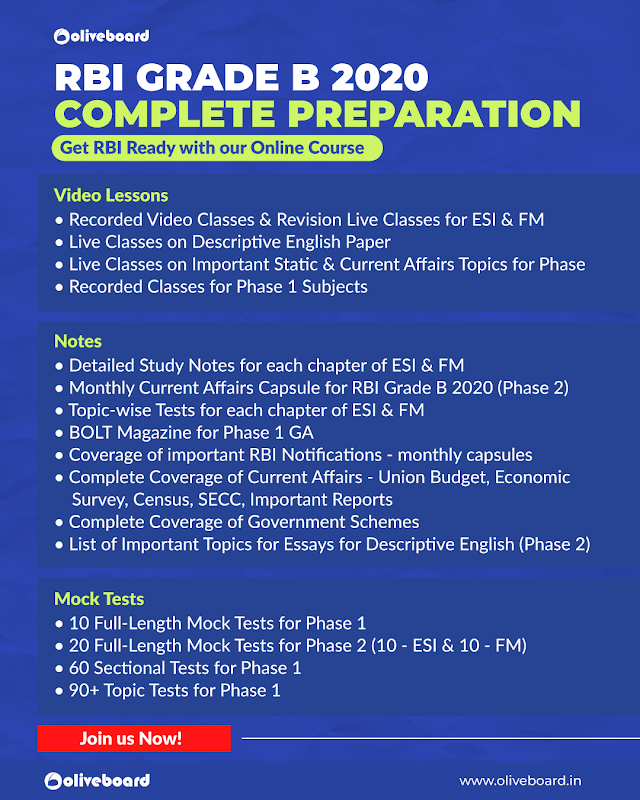

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. What all the course offers you

Study material for RBI Grade B 2020

If you are an RBI Grade B aspirant and also a working professional and find it difficult to find enough time for your RBI Grade B Preparations, do not worry at all.

Oliveboard has come up with RBI Grade B Online Cracker Course for RBI Grade B 2020 Exam. Oliveboard’s RBI Grade B Online Course 2020 will be your one-stop destination for all your preparation needs

What all the course offers you:

1. Course Details

RBI Grade B Cracker is designed to cover the complete syllabus for the 3 most important subjects: GA for Phase 1 and ESI + F&M for Phase 2 exam. Not just that, it also includes Mock Tests & Live Strategy Sessions for English, Quant & Reasoning for Phase 1. The course aims to complete your preparation in time for the release of the official notification.

Use Coupon Code ‘MY20’ to avail a 20% discount on RBI Courses!

1.1. Features:

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!