JAIIB 2024 Expected Questions

JAIIB 2024 Oct-Nov cycle will be starting from 8th June 2024 and only a few weeks have been left for the examination. Aspirants must be looking for practice sets and guides to strategize their preparation. So, we have come up with the JAIIB 2024 Expected Questions for the October-November Cycle curated by the JAIIB exam experts. This Ebook will provide you with more than 150 questions which includes questions from all four papers. This blog will provide you with the direct link to download the E-book and the detailed YT session for the same.

JAIIB 2024 Expected Questions Ebook – Download

The E-book will provide you with some of the most important questions that are expected in the upcoming JAIIB Oct-Nov Cycle 2024. More than 150+ questions with the answers will help aspirants strategize their preparation. The direct link to download the Free EBook is mentioned below.

How to download the Free E-book?

Step 1: Click on the download link.You will be taken to Oliveboard’s FREE E-Books Page.

Step 2: Register/Login to the Free E-Books Page of Oliveboard (It is 100% free, You just enter your valid email ID and a password to be able to download the pdfs.

Step 3: After Logging in, you will be able to download the free e-book by clicking on “click here” as shown in the snap below.

What’s There in the JAIIB 2024 Expected Questions Ebook?

IE&IFS Paper Expected Questions

Question 1. Which among the following statements is/are not correct in relation to the topic “Financial Instruments”?

1. These include instruments on the asset as well as on the liability side of the financial institution’s balance sheet.

2. They can also be in the form of intangible value-added services, which can facilitate financial development.

3. Financial instruments on the asset side of the balance sheet include loans and advances, investments, placements, derivatives, etc., whereas financial instruments on the liabilities side of the balance sheet include deposits, money accepted from customers for remittances, insurance policies and mutual funds units issued and contribution received for building up a corpus for payment of pension.

4. While financial institutions and financial instruments provide the base for capture and transfer of wealth from savers to investors, the process cannot be complete, without the presence of financial markets.

(a) (1) only

(b) (3) only

(c) (4) only

(d) None of these

Answer: D

Question 2. Under the recommendations of Narasimhan Committee 2, what is “Narrow Banking” all about?

(a) Transfer of bank’s NPAs to Asset Reconstruction Company for better management.

(b) The weak banks should place their funds only in short-term and risk-free assets.

(c) The bank’s NPAs should not exceed 20% of its total assets.

(d) All of the above

Answer: B

Question 3. The Depositories Act came into effect in the year:

(a) 1996

(b) 1999

(c) 1995

(d) 1899

Answer: A

Question 4. Which among the following is/are not a part of Sweeping Reforms?

1. Delicensing of Imports

2. Tightening of Foreign Exchange regulations

3. Abolishment of License Raj

4. Pegging of Exchange Rate

(a) (1) and (2)

(b) (3) only

(c) (2) only

(d) (2) and (4)

Answer: D

Question 5. P. J. Nayak Committee formed by RBI in 2014 served the purpose of:

(a) Giving guidelines for commercial banks who fund leasing companies

(b) Reviewing the governance of boards of banks in India

(c) Giving recommendations relating to credit institutions and credit information companies

(d) None of these

Answer: B

Question 6. Nationalization within the Indian Banking System commenced with the nationalization of:

(a) SBI

(b) RBI

(c) Both (A) and (B)

(d) None of the above

Answer: B

Question 7. RBI launched the Lead Bank Scheme in the year:

(a) 1970

(b) 1974

(c) 1966

(d) 1969

Answer: D

Question 8. In terms of the RBI Act, the bank’s paid-up capital and raised funds must be at least ________, in order to qualify as a scheduled bank.

(a) Rs. 20 Lakhs

(b) Rs. 15 Lakhs

(c) Rs. 10 Lakhs

(d) None of the above

Answer: D

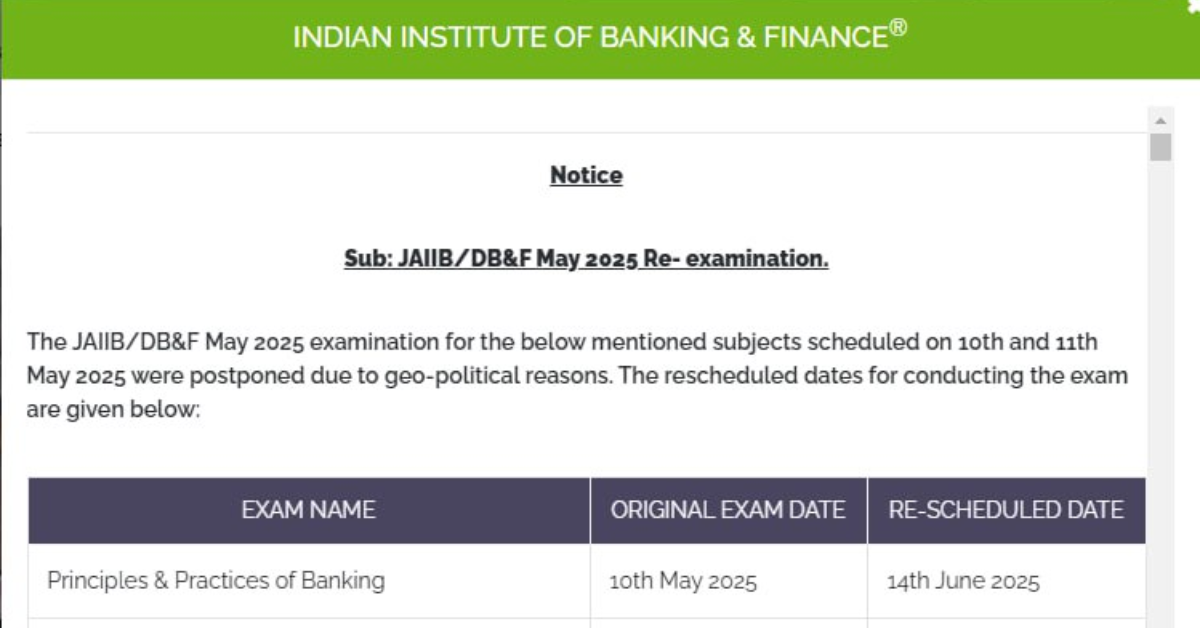

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

- JAIIB Memory Based Paper, Download IE&IFS, PPB, AFM, RBWM PDF

- JAIIB Result Calculator 2025, Calculate Your JAIIB Marks

- Types of Shares & Their Issue, Complete Details & Classification

Frequently Asked Questions

Ans. Candidates can download the E-book mentioned in the blog consisting of more than 150 expected questions.

Ans. Candidates can check the steps to download the ebook mentioned in the blog.

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!