The JAIIB (Junior Associate of Indian Institute of Bankers) exams for the Indian Economy (IE) and Indian Financial System (IFS) are fast approaching. With only a week left until the exam on October 19, 2024, it is essential to focus on the most important topics that can significantly increase your chances of qualifying. In this article, we will outline crucial areas of study across all modules, enabling you to prepare effectively and efficiently.

Importance of Effective Preparation

Effective preparation is critical to success in the JAIIB exams. With just seven days remaining, students must focus on high-yield topics that cover the syllabus comprehensively. Below are the key modules and important units to prioritize:

Key Modules and Important Topics

Module A: Indian Economy

- Sectors of the Indian Economy

- Role of the Private Sector and MSMEs in the Indian Economy

- Infrastructure

- Globalization

- Economic Reforms

- Foreign Trade Policy

- Climate Change and Sustainable Development

These units are essential for building a solid understanding of the Indian economy. Ensure you have a firm grasp of these topics, as they are frequently tested in the JAIIB exams.

Module B: Banking and Finance

- Demand and Supply

- Money Supply and Inflation

- Theory of Interest (Note: This topic is lengthy; focus on key concepts)

- Business Cycle

- System of National Accounts

- Union Budget

In this module, understanding the demand-supply dynamics and the impact of inflation on the economy is vital. Focus on units that are frequently highlighted in the exams.

Module C: Indian Financial System

- Overview of the Indian Financial System

- Microfinance Institutions

- Insurance Companies

- Reforms and Developments in the Banking Sector

A solid understanding of the Indian Financial System is crucial. Pay particular attention to reforms and developments that have shaped the current landscape.

Module D: Financial Markets

- Financial Markets

- Foreign Exchange Market

- Interconnectedness of Markets

- Market Dynamics

- Derivative Market

- Venture Capital

- Lease Financing

- Credit Rating and Scoring

- Mutual Funds

- Insurance Products

- Pension Products

- Parabanking

- Real Estate Investment Trusts (REITs)

This module encompasses a broad range of topics essential for understanding how financial markets operate. Ensure you have a comprehensive understanding of these topics, as they are critical for both theoretical and practical aspects of banking.

Summary of Key Topics

| Module | Key Topics | Importance |

|---|---|---|

| Module A | Sectors of the Indian Economy, Role of Private Sector, etc. | Foundation for understanding economy |

| Module B | Demand and Supply, Money Supply, Business Cycle | Core banking and financial concepts |

| Module C | Overview of Indian Financial System, Microfinance | Insight into banking operations |

| Module D | Financial Markets, Foreign Exchange, Credit Rating | Understanding market operations |

Study Strategies for Success

- Prioritize High-Weightage Topics: Focus on topics that carry more marks in the exam.

- Create a Study Schedule: Allocate specific time slots for each module based on your strengths and weaknesses.

- Utilize Study Materials: Leverage online courses, revision notes, and practice tests.

- Participate in Mock Tests: Taking mock exams helps familiarize you with the exam pattern and timing.

- Engage in Group Study: Discussing topics with peers can enhance understanding and retention.

Last-Minute Revision Tips

- Daily Revision: Dedicate the last days before the exam to review all key topics thoroughly.

- Focus on Weak Areas: Identify your weak points and concentrate on improving them.

- Practice Previous Year Papers: Solve past papers to understand the question patterns and difficulty levels.

Enroll in a Capsule Course

To aid your preparation, consider enrolling in a capsule course starting from October 13, 2024. This course offers:

- Last-Minute Revision Classes: Attend classes daily from 7 PM to 9 PM until October 19, 2024.

- Final Marathon Sessions: Participate in two final marathon classes on October 18 and 19 to cover last-minute queries.

- Discount Offers: Use code “HIMANSHU” to get a 50% discount on the course fee of ₹749.

Conclusion

With only a week left until the JAIIB IE & IFS exam, focusing on the essential topics outlined in this article can significantly improve your chances of success. By following effective study strategies and prioritizing high-yield topics, you can confidently approach the exam. Remember, dedication and hard work in these final days can make all the difference.

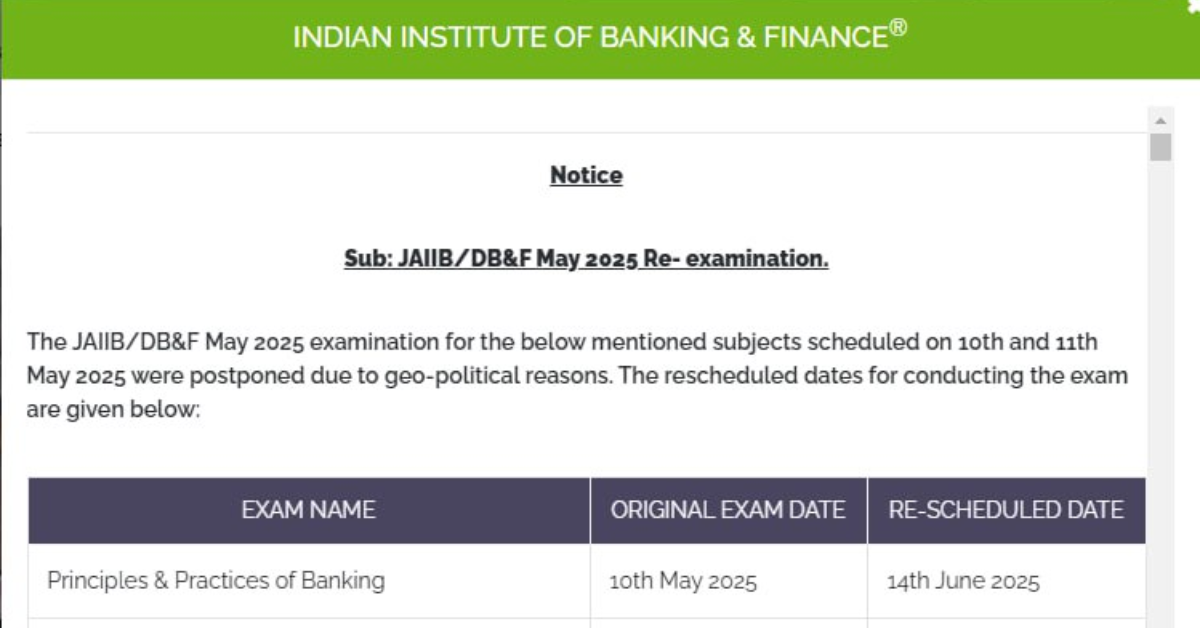

- JAIIB PPB and AFM New Exam Dates Out for Affected Areas, May Cycle

- JAIIB RBWM Exam 2025 Analysis for Shift 1, 2 & 3 – 18th May 2025

- JAIIB Exam Analysis 2025, May Cycle, All Shifts Covered

- JAIIB AFM Exam Analysis 2025, May All Shifts Review

- JAIIB PPB Exam Analysis 2025, May All Shifts Review

- JAIIB IE and IFS Exam Analysis 2025, 4th May 2025 Detailed Analysis

Hello there! I’m a dedicated Government Job aspirant turned passionate writer & content marketer. My blogs are a one-stop destination for accurate and comprehensive information on exams like Regulatory Bodies, Banking, SSC, State PSCs, and more. I’m on a mission to provide you with all the details you need, conveniently in one place. When I’m not writing and marketing, you’ll find me happily experimenting in the kitchen, cooking up delightful treats. Join me on this journey of knowledge and flavors!