The Retail Banking and Wealth Management (RBWM) paper is the fourth subject in the JAIIB examination conducted by the Indian Institute of Banking & Finance (IIBF). It is one of the most important and scoring papers for banking professionals.

In this blog we have provided the details of the key topics, their weightage, and an effective approach to prepare for the upcoming JAIIB exam.

Why RBWM is a Scoring Paper?

Among all four papers, Retail Banking & Wealth Management is known for its scoring potential. The paper combines conceptual understanding with practical banking applications.

However, since IIBF has made several updates in the syllabus, candidates must prepare strategically. A focused and smart approach can make this paper your strongest section.

Also Check: Important Topics of RBWM

Module-Wise Weightage and Importance

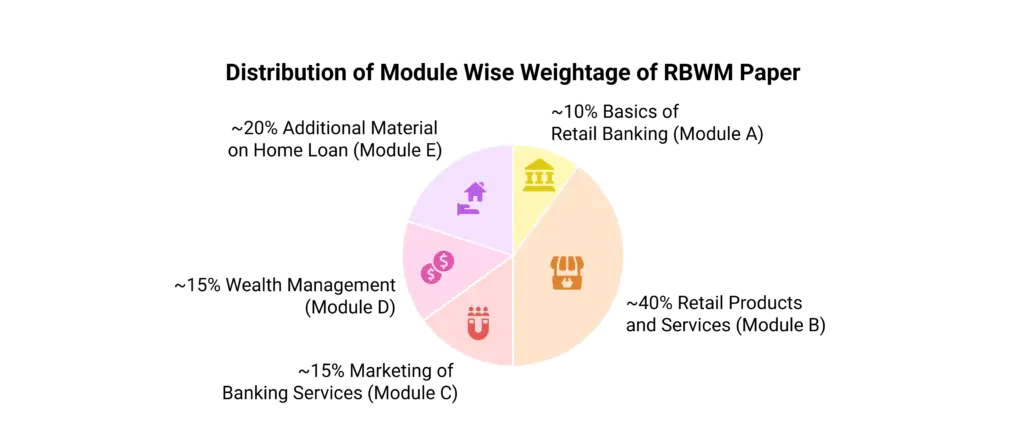

The RBWM paper is divided into multiple modules (A to E). Each module carries a different weightage, and some have a higher probability of repeated questions.

As per the May 2025 exam the module wise weightage details are as follows:

If you prepare Module B, and E thoroughly, you can easily score 50-60 marks, as most high-weightage questions come from these sections.

Most Important Topics for RBWM 2025

Some of the important topics that are repeatedly asked in recent JAIIB RBWM paper and must not be ignored are as follows:

Module A – Basics of Retail Banking

- Concept and meaning of Retail Banking

- Difference between Retail and Corporate Banking

- Branch profitability: Gross Profit, Net Profit, ROE, ROA, Leverage Ratio

Module B – Retail Products and Services

- Customer requirement and Maslow’s Hierarchy of Needs

- Product Life Cycle (PLC) – Introduction, Growth, Maturity, Decline

- Types of bank accounts – Savings, Current, RD, FD

- Loans and advances – Types of retail loans

- Credit, Debit, and Prepaid Cards

- Remittance and fund transfer services

- Credit Scoring & Securitization (Unit 16) – highly important

Also Check: Common Mistakes to Avoid Preparing for JAIIB

Module C – Marketing of Banking Services

- Marketing introduction and stages

- Delivery channels in India (ATMs, Internet, Mobile Banking)

- CRM (Customer Relationship Management)

- Service standards and quality

- Marketing Information System (read at the end – low frequency topic)

Module D – Wealth Management

- Investment planning and financial goals

- Tax planning and investment products

- Mutual funds and insurance basics

- Retirement and estate planning

Module E – Additional Material on Home Loan

- Lender appraisal and mortgage process

- Mortgage advice and valuation of property

- Reverse mortgage loan

- Sinking fund and related numerical questions

Key Changes Introduced in RBWM Syllabus 2025

IIBF has made several updates in the May and November 2025 cycles, especially for RBWM. The major changes include:

- Increased focus on Module E (Home Loan section) with more numerical questions.

- Revised study material covering updated banking products and financial terms.

- Greater weightage on Wealth Management and Securitization.

Preparation Strategy for the JAIIB RBWM Exam

To prepare effectively for RBWM, focus on concept clarity and practical understanding.

Here’s a simple plan for working professionals:

- Start with Module B: It carries maximum marks and is easy to grasp with real-life examples.

- Move to Module D: Practice numericals related to tax, investment, and valuation.

- Cover Module C next: Focus on marketing concepts and CRM.

- Finally, revise Module A and E: These add-on topics can fetch extra marks.

Also, practice previous year papers (PYPs) and model-wise tests to identify repeated question trends.

FAQs

Module B (Retail Products) and Module D (Wealth Management) carry the highest weightage.

Yes, with smart preparation, RBWM can be one of the most scoring papers in JAIIB.

Topics like customer needs, credit scoring, PLC, loans, CRM, and wealth management numericals are repeatedly asked.

Module E is important, especially numericals on valuation, mortgage advice, and reverse mortgage.

Yes, Module D and Module E contain most of the numerical questions.

- Depreciation & its Accounting Notes, Important for JAIIB AFM

- Ratio Analysis Notes, Important for JAIIB AFM 2026

- Balance Sheet Equation Notes, Important for JAIIB AFM 2026

- Consumer Protection Act COPRA, Important for JAIIB PPB 2026

- Foreign Exchange, Forex Market, Important for JAIIB IE & IFS 2026

- Security Considerations, IT Security & IT Audit for JAIIB PPB 2026

Hi, I’m Aditi. I work as a Content Writer at Oliveboard, where I have been simplifying exam-related content for the past 4 years. I create clear and easy-to-understand guides for JAIIB, CAIIB, and UGC exams. My work includes breaking down notifications, admit cards, and exam updates, as well as preparing study plans and subject-wise strategies.

My goal is to support working professionals in managing their exam preparation alongside a full-time job and to help them achieve career growth.