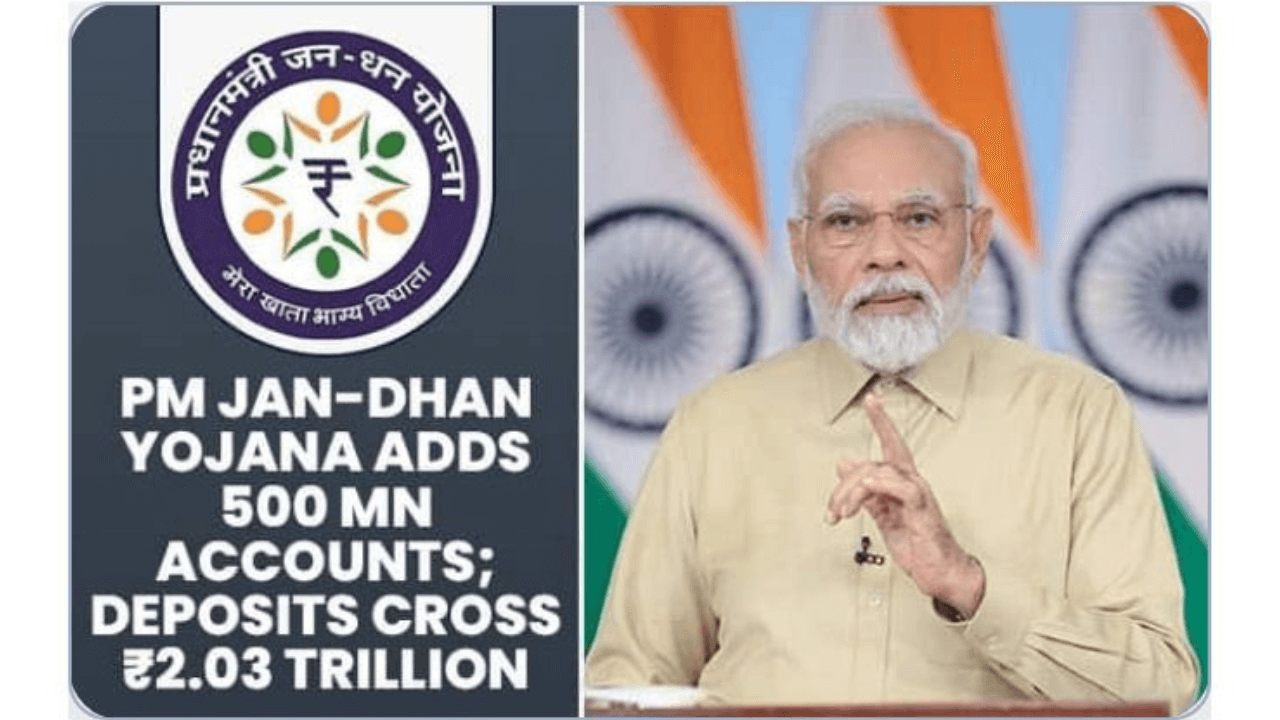

Launched on August 28, 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY), also recognized as the National Mission on Financial Inclusion, has reached nearly 9 years of existence. In the latest update from banks, it’s been revealed that the total count of Jan Dhan accounts has surged past a remarkable 50 crore mark as of August 9, 2023. This initiative has undeniably played a significant role in expanding financial access and inclusion nationwide.

More About the News

- Among these accounts, an impressive 56% are owned by women, highlighting the significant empowerment brought about by the Pradhan Mantri Jan Dhan Yojana (PMJDY).

- Additionally, a substantial 67% of these accounts have been established in rural and semi-urban regions, showcasing the program’s reach into areas that often lacked access to financial services.

- The cumulative deposits in these accounts have exceeded an impressive ₹2.03 lakh crore, and a commendable 34 crore RuPay cards have been provided without any charge.

- On average, the balance held in PMJDY accounts stands at ₹4,076, with over 5.5 crore accounts benefiting from Direct Benefit Transfer (DBT) advantages.

Undoubtedly, the PMJDY initiative has transformed the financial landscape of the nation, achieving near full coverage of bank accounts for adults. This success is rooted in the all-encompassing approach of the scheme, which aims to bridge the gap to the formal banking system, especially in remote areas, through the intelligent use of technology, collaboration, and innovation.

About the Pradhan Mantri Jan Dhan Yojana (PMJDY)

The Pradhan Mantri Jan Dhan Yojana (PMJDY) stands as a National Mission on Financial Inclusion, presenting a comprehensive approach aimed at ensuring that every household in the nation is part of the financial mainstream. This initiative encompasses a holistic strategy, striving to provide every household with inclusive financial services.

The core vision of this plan is to offer widespread access to banking services, ensuring that every household possesses at least one fundamental banking account. The plan’s objectives encompass not only the establishment of these accounts but also extend to promoting financial literacy, granting access to credit, facilitating insurance coverage, and enabling pension provisions.

Objectives

- Through the PMJDY scheme, individuals without existing accounts can open a basic savings bank deposit (BSBD) account at any bank branch or through designated Business Correspondent (Bank Mitra) outlets.

- The primary goal of the “Pradhan Mantri Jan-Dhan Yojana (PMJDY)” is to guarantee access to a range of financial services.

- These services encompass the availability of elementary savings bank accounts, tailored credit options, seamless remittance facilities, as well as insurance and pension provisions.

- The scheme’s focus is on including segments of the population that have traditionally been excluded, such as weaker sections and low-income groups.

- Achieving widespread financial penetration at an affordable cost necessitates the strategic and effective utilization of technology.

- This fusion of technology and comprehensive financial services holds the key to realizing the objectives of PMJDY.

Benefits

- The PMJDY initiative facilitates the opening of a basic savings bank account for individuals who were previously unbanked.

- Crucially, there’s no mandatory requirement to maintain a minimum balance in these PMJDY accounts. These accounts also accrue interest on the deposits held within them.

- Upon opening a PMJDY account, individuals are provided with a Rupay Debit card, granting them access to various financial services.

- This card comes with an added benefit of Accident Insurance Cover, initially set at ₹1 lakh and subsequently enhanced to ₹2 lakh for new PMJDY accounts opened after August 28, 2018.

- Eligible PMJDY account holders can also access an overdraft (OD) facility, allowing them to borrow up to ₹10,000, subject to certain conditions.

- PMJDY accounts are eligible for a range of government schemes, including Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), and the Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

This integration with these initiatives serves to enhance the financial security and well-being of individuals who are part of the PMJDY network.

- Weekly Current Affairs 2025 PDF For Bank, SSC, UPSC Exams

- Unsung Heroes of India: 10 Unknown Freedom Fighters You Should Know

- 26 December Current Affairs 2023 in English

- Daily Current Affairs 2025, Check Today’s Current Affairs

- April Month Current Affairs 2024, Download PDF

- June Month Current Affairs 2024, Download PDF

Hello, I’m Aditi, the creative mind behind the words at Oliveboard. As a content writer specializing in state-level exams, my mission is to unravel the complexities of exam information, ensuring aspiring candidates find clarity and confidence. Having walked the path of an aspirant myself, I bring a unique perspective to my work, crafting accessible content on Exam Notifications, Admit Cards, and Results.

At Oliveboard, I play a crucial role in empowering candidates throughout their exam journey. My dedication lies in making the seemingly daunting process not only understandable but also rewarding. Join me as I break down barriers in exam preparation, providing timely insights and valuable resources. Let’s navigate the path to success together, one well-informed step at a time.