Mumbai’s Real Estate Market

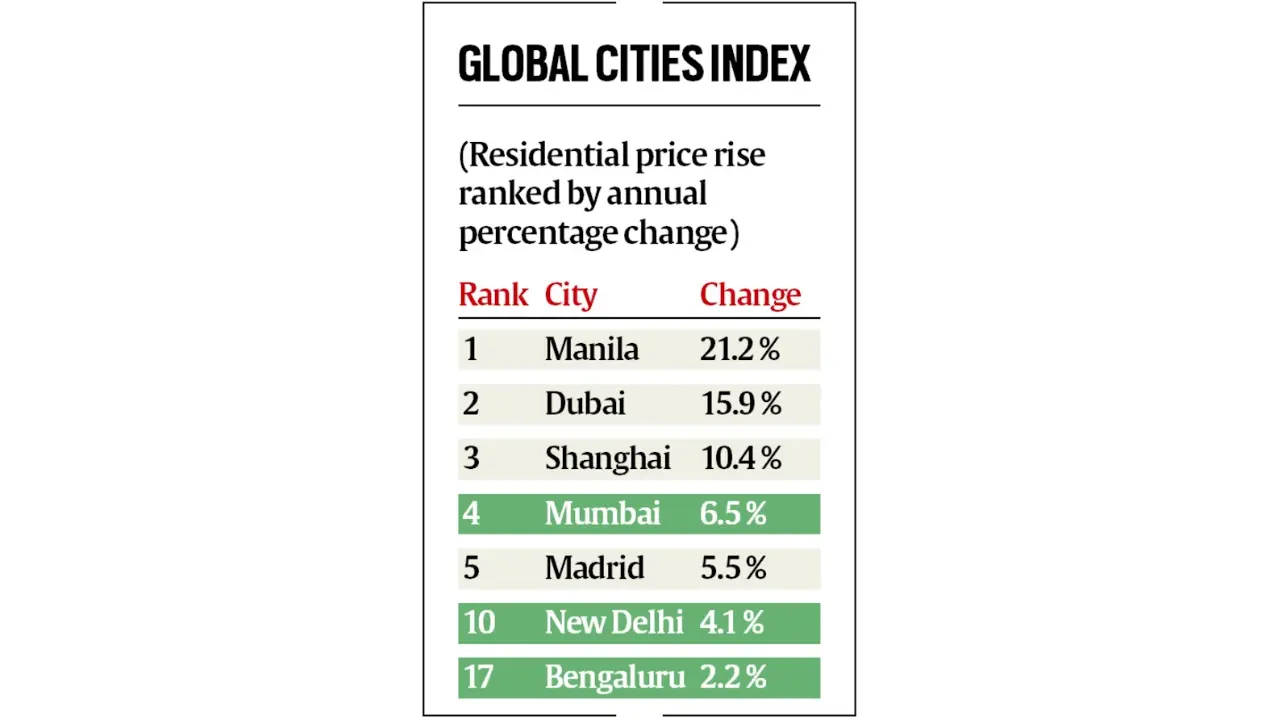

A recent report from Knight Frank’s Prime Global Cities Index has brought exciting news for Mumbai’s real estate market. Covering the third quarter of 2023, the report shows that Mumbai has experienced a remarkable surge in its prime residential property prices, securing the fourth-highest year-on-year increase among cities worldwide. This surge in prices has propelled Mumbai a remarkable 18 places higher in the rankings compared to its position in September 2022, fundamentally reshaping the city’s real estate landscape.

Impressive 6.5% Price Surge in Mumbai

Mumbai’s real estate market has witnessed an impressive 6.5% increase in prime residential property prices. This substantial surge underlines the enduring appeal of the city to homebuyers and investors alike. With this remarkable growth rate, Mumbai has now firmly established itself as a prime destination for real estate investment, capturing the attention and investments from around the globe.

New Delhi and Bengaluru Join the Upward Trend

The positive momentum isn’t limited to Mumbai alone; other Indian cities are also making waves in the global real estate market. New Delhi’s National Capital Region (NCR) has seen significant progress, climbing from its 36th position a year ago to secure the 10th spot in the September 2023 rankings. This progress is bolstered by a noteworthy 4.1% year-on-year increase in prime residential property prices, making New Delhi an increasingly attractive market for property seekers.

Bengaluru, often referred to as the “Silicon Valley of India,” has also experienced a commendable rise in global rankings. In 2022, the city was ranked 27th, but in 2023, it has jumped to the 17th spot, supported by a 2.2% growth in prime residential property prices. This growth highlights the promising potential of Bengaluru’s real estate market, further solidifying its reputation as a thriving technology hub.

An Overview of the Prime Global Cities Index

The Prime Global Cities Index, compiled by Knight Frank, is a valuation-based index tracking the movements of prime residential property prices across 46 cities worldwide. It offers a comprehensive perspective on the health and performance of real estate markets in these global hubs. Notably, the index tracks nominal prices in local currency, providing an in-depth understanding of local market dynamics.

Global Trends in Prime Residential Prices

The Prime Global Cities Index also reveals interesting global trends in prime residential property prices. The average increase in annual prime residential prices across the 46 markets for the 12-month period ending in September 2023 was 2.1%. This growth rate is the strongest recorded since the third quarter of 2022, reflecting the fact that 67% of the cities included in the index are experiencing growth on an annual basis, indicating a global trend of increasing prime residential property prices.

Manila Takes the Top Spot: Mumbai’s Real Estate Market

The top position in the Prime Global Cities Index is claimed by Manila. The city has experienced an impressive 21.2% rise in residential property prices, attributed to strong domestic and foreign investments in the city’s real estate sector. Manila’s real estate market is currently on an impressive upward trajectory.

Dubai’s Decline from the Top

For the first time in eight quarters, Dubai has been displaced from the top spot. This change is primarily due to a sharp decline in quarterly growth, dropping from 11.6% in the June quarter to a mere 0.7% in the September quarter. This shift in rankings highlights the dynamic nature of the global real estate market.

San Francisco: The Weakest Market

Conversely, San Francisco has emerged as the weakest market in the Prime Global Cities Index, with a noticeable decline of 9.7% on a year-on-year basis. This decline underscores the market dynamics in the city and emphasizes the varying performance of global real estate markets.

Conclusion: Mumbai’s Real Estate Market

In conclusion, Mumbai’s surge in prime residential property prices has significantly altered its real estate market, making it an attractive destination for investors. New Delhi and Bengaluru are also experiencing substantial growth, reflecting the overall positive trend in India’s real estate market. The global real estate landscape is continuously evolving, with cities like Manila rising to the top, while Dubai and San Francisco face unique challenges. These developments offer valuable insights for both investors and property enthusiasts worldwide.

- Indian Bank Recruitment 2025 Out for 1500 Apprentice Posts

- Indian Bank Apprentice Salary 2025, Pay Scale, Salary Structure

- Indian Bank Apprentice Syllabus & Exam Pattern 2025, Check Details

- Railway RPF Syllabus 2024, Check Exam Pattern, Topic And Syllabus

- SSC JE vs RRB JE, Which Is Better? Know Detailed Comparison